Retailers must leverage data to capitalize on lost sales

While approximately half of U.S. states plan to be partially reopened by mid-May, nearly two months of lockdown orders have had an inordinate impact on the alcohol industry. Shelter-in-place restrictions have muted on-premises sales, and overall economic impacts to consumers and supply chain issues present challenges to a healthy retail sales outlook. Despite booming in-store and online sales, the reality is that the alcohol industry has a long road ahead to get to where conditions were before COVID-19.

But what would it take to rebalance topline market performance for alcohol given shifts in where people can purchase alcohol? And how can current behavioral shifts toward take-out restaurant services and “off-premises”* alcohol sales be leveraged to offset the immense “on-premises” losses?

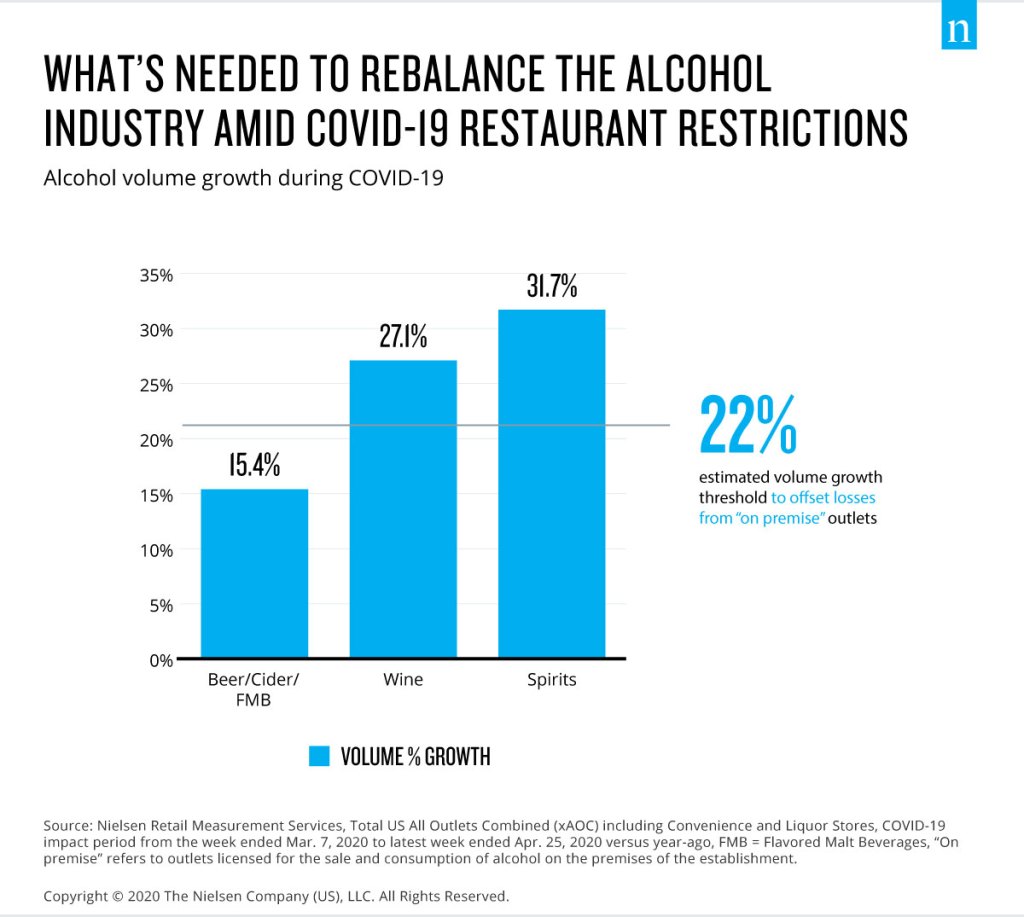

A NielsenIQ investigation of the latest trends estimates that the U.S. alcohol market needs to sustain 22% volume growth across all alcohol categories sold off-premises in order to merely level off from the impact of closed bars and restaurants. While this measure helps to size the magnitude of the current imbalance, the burden of rebound doesn’t fall squarely on the off-premises channel. On premises, the declines have now stabilized week to week, but NielsenIQ CGA reports that average sales per outlet remain 68% below rates of a year ago in the week ended April 25, and hovered between -67% to -75% throughout the rest of April. The path forward will require both an optimized off-premises strategy and support of a responsible return to on-premises alcohol consumption.

Adjusting to new thresholds for industry growth

“Meeting that volume threshold would mean total alcohol sales growth gets back to levels prior to COVID-19,” says Danny Brager, SVP of NielsenIQ’s Beverage Alcohol practice. “However, unquestionably, we expect the total dollar spending on alcohol will decline. Consumers are shifting the dollars they would have spent on alcohol in a restaurant, bar, or tasting room to alcoholic beverages they can buy at a lower markup from retailers, online merchants, and even directly from the supplier in the instances where it is legalized to do so.”

The fact that on-premises establishments are offering alcohol for sale alongside takeout food orders, albeit often at prices far below the norm of the price of these products pre-COVID-19 on the premises itself, is also influencing the industry’s threshold for reaching or surpassing total industry growth. Brager says that “alcohol is being heavily promoted by on-premises establishments trying to ignite their take-home food business. While this is helping encourage consumer adoption and sustaining on-premises operator’s businesses, it’s also contributing to the lower overall consumer spending on alcohol right now.”

Wine and spirits are pacing above this 22% volume growth threshold, but beer (including flavored malt beverages [FMB] and ciders) has fallen short of that benchmark to date. Within each of these categories, the individual impact to companies varies drastically, so understanding what’s turning the market today can help brands and on-premises operators harness the segments of alcohol consumption that offer opportunities for success. The below deep-dive analysis highlights three key ways in which the “COVID-19 effect” on alcohol has manifested in America.

Embracing omnichannel buying

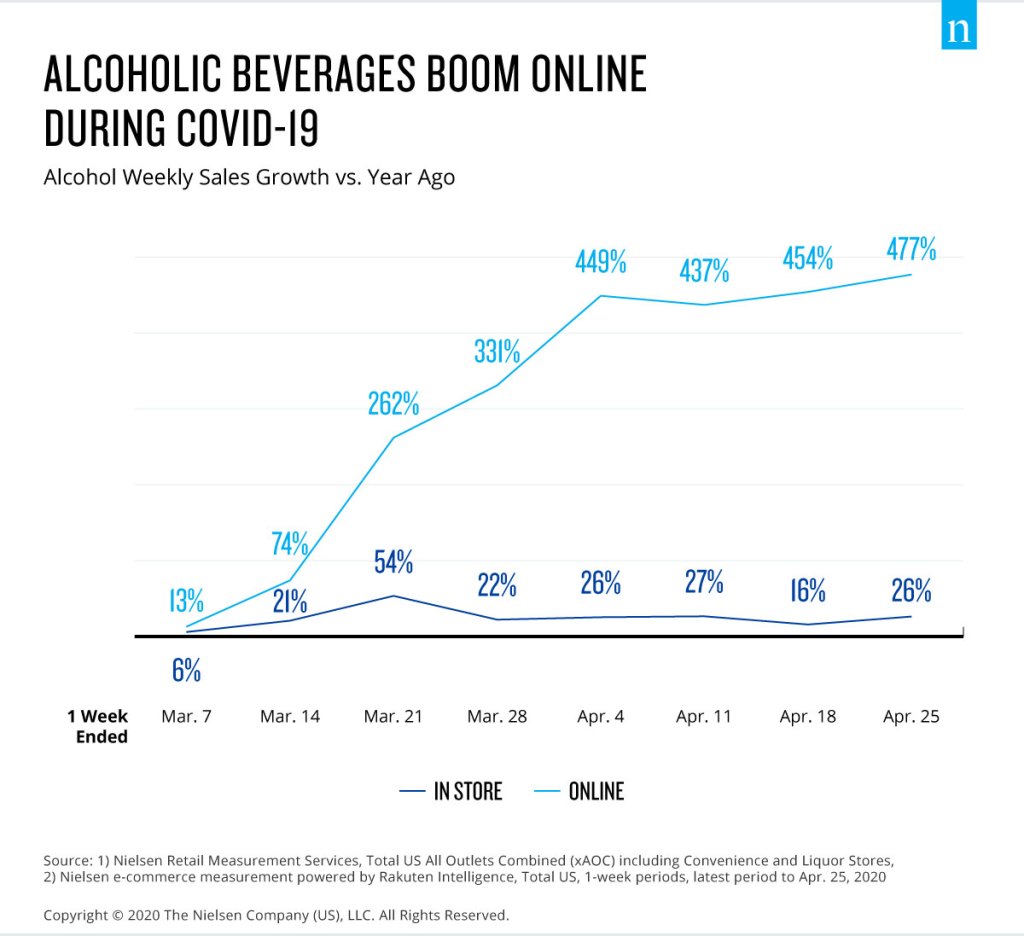

With bars and restaurants closed, it makes sense that recent sales trends depict the massive shift in where consumers buy and ultimately where they consume their adult beverages of choice. Compared with this time a year ago, during the seven-week COVID-19-impacted period ended April 18, brick-and-mortar alcohol dollar sales were up 21%, while online sales of alcohol have skyrocketed to over 2X that of a year ago, up 234%. In fact, alcohol is the fastest-growing e-commerce department among consumer packaged goods (CPG), and weekly growth has continued.

In addition to rising off-premises alcohol sales, COVID-19 has caused a massive influx in the number of active omnichannel off-premises buyers we’re used to seeing. In fact, during the week ended April 11, the number of off-premises buyers purchasing alcohol was up 27% compared with the same period a year ago. And it’s not just physical stores seeing this uptick. There were three times as many online buyers in the two weeks ended April 18 than in the two weeks ended Feb. 29.

Online sales represent an opportunity for the on-premises channel too. The last few weeks have seen retailers and operators become more sophisticated in their approach to restaurant takeout and delivery options. As a result, consumer adoption is rising. In fact, a growing number of consumers claim to be ordering alcohol with their takeout from restaurants (14% of U.S. consumers in the week ended April 25, up from 9% in the previous two weeks). And among consumers who have ordered alcohol with takeout/delivery or would consider doing so, about half would consider ordering a cocktail kit or pre-made cocktail.

Trading up to larger pack sizes

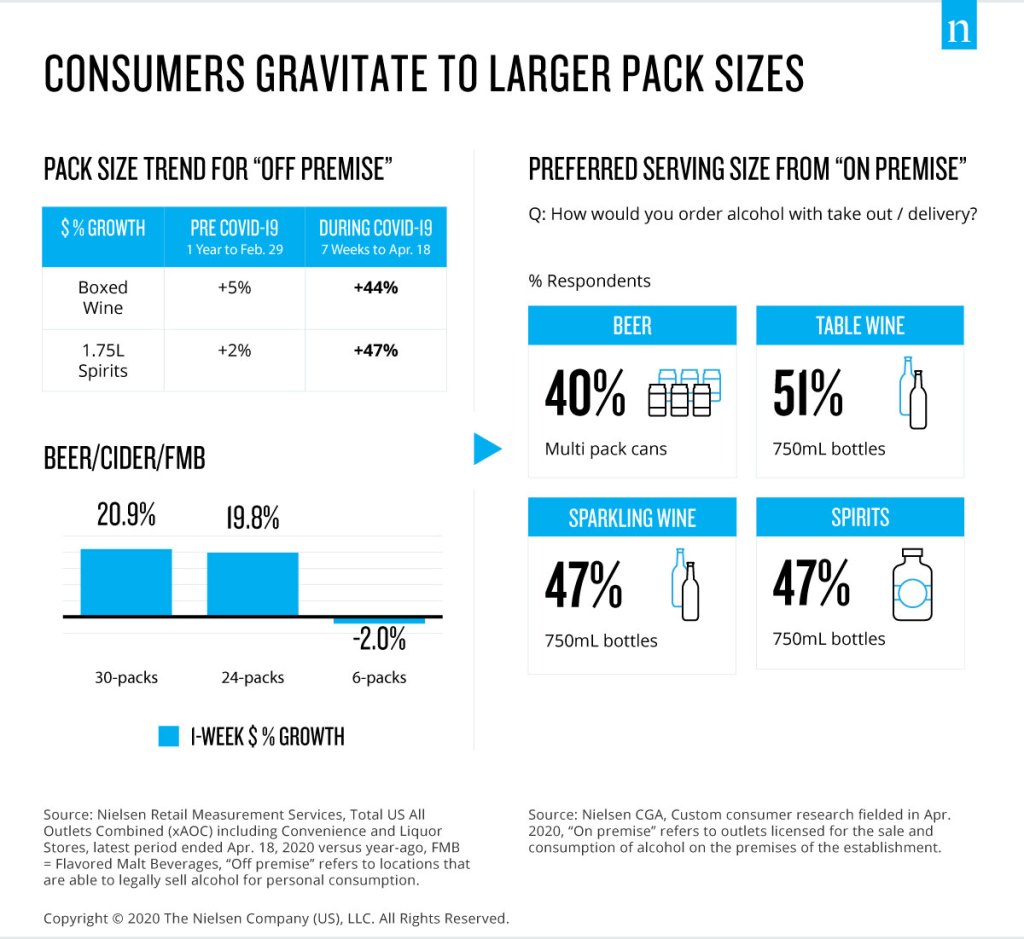

Beyond the influx of omnichannel buyers on the scene, many consumers are trading up to larger pack sizes in their off-premises purchases. For wine and spirits in particular, there has been unprecedented demand for larger pack sizes far beyond the norm. Comparing the year ended Feb. 29 to the seven-week COVID-19-impacted period ended April 18, sales growth in percentage points was nearly 10X higher for boxed wine and 23X higher for 1.75-liter spirits. The beer category has also seen consumers trading up to larger pack sizes, with double-digit sales growth among 30-packs (+21%) and 24-packs (+20%) in the week ended April 18.

While consumers buying alcohol on-premises to accompany their takeout orders still prefer larger serving options, such as multipacks of beer and 750ml wine and spirit bottles, a significant percentage of Americans prefer moderately sized packages. With many consumers opting for package sizes smaller than the norm of what they’d buy in the store, there are clear differences between the package size preferences of today’s on-premises alcohol buyers. For spirits purchased on-premises via takeout orders, 37% of Americans indicate a preference for 200ml bottles, while 36% prefer ready-to-drink (RTD) cans of spirits. For wine, 27% of Americans consider the 375ml bottle to be their serving size of choice.

Focusing on favorites

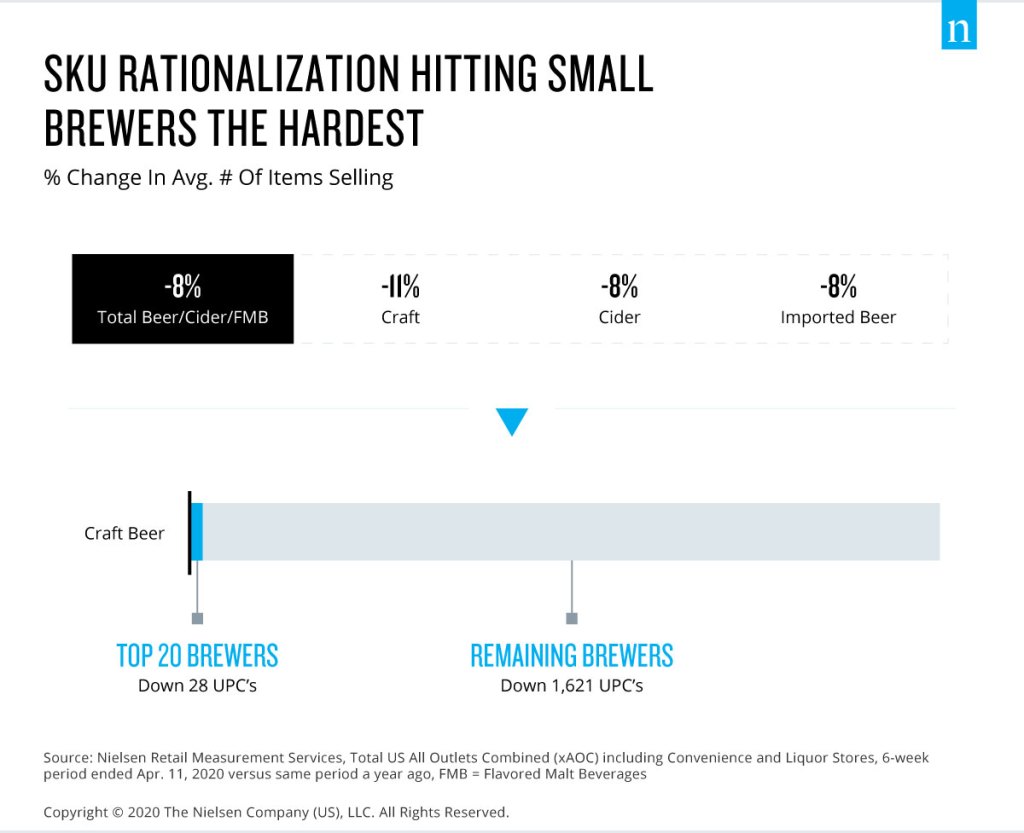

Under current conditions, many consumers seem less willing to experiment with a product or brand they don’t have a strong affinity toward. In fact, 69% of surveyed Americans say they’re purchasing alcohol brands they know and trust. This has played to the advantage of larger brands, and some retail outlets have pared down the number of items they carry in a given store, focusing on securing stock of a smaller set of key products. To date, this impact has been largely limited to the beer category as some supply chains are pressured under difficult conditions. With even more pressure on retail shelf space decisions, this also serves as a reminder for brands to highlight their unique differentiation, particularly where those align to emerging consumer needs.

As far back as the last year or more, U.S. retailers have been scaling back on the number of beer items they sell. But amid supply challenges brought on by virus concerns, sku rationalization is happening in a big way for the beer category as retailers attempt to reset the COVID-19 shelf sets. In the six weeks ended April 11, the total number of beer, FMB, and cider items selling across U.S. outlets had declined by 8.3% compared with the same period a year ago. This represents a drop of more than 1,900 items selling across the category, with declines affecting small craft brewers the most.

Strategies for the future

What opportunities do these key shifts present for the future? Consider the channel strategies right for you.

Given the significant restrictions imposed on the pre-COVID-19 ways of doing business, it’s only logical that alcohol companies consider all channel strategies. For some, that may very well be through the traditional routes to online or offline retail, and for others, it may include—where legalized and permissible—a direct-to-consumer (DTC) model, or a combination of the two. For instance, in the wine category, evidence from NielsenIQ partners Wines Vines Analytics and Sovos ShipCompliant shows that DTC shipments grew at strong double-digit rates in March 2020, led by small wineries (those selling between 5,000 and 50,000 cases annually). This was promising, as it followed a couple of years of decelerating growth in DTC shipments, with only single-digit increases witnessed during the first two months of 2020.

Engage with high-opportunity consumer targets

Knowing that there is currently a larger pool of active off-premises alcohol buyers to engage with, it’s essential to profile and identify your highest-opportunity consumers. Podcast listeners, for example, have a demonstrated interaction with various alcohol categories. Recent research from NielsenIQ Scarborough highlights that, compared with the overall American population, podcast listeners of legal drinking age are 101% more likely to purchase hard cider, 32% more likely to purchase spirits, 26% more likely to purchase beer, and 24% more likely to purchase wine. When it comes to reaching the right buyers with the right messages during the COVID-19 pandemic, this may be a key audience for alcohol brands to tap into.

Double down where sales growth is the highest

Large-format alcohol packages are growing in popularity, and consumers are driving strong growth among mixable accompaniments such as tonic water, lemon juice, and lime juice. But there is opportunity to harness this demand toward key premixed adult beverages, too. Already, sales of hard seltzers sold off-premises grew 288% during the week ended April 18, and contributed more than 50% of category dollar growth across beer, FMB, and ciders. RTD cocktails were also key to the growth of the spirits category. Doubling down on hard beverages can drive sustained growth in these challenging times.

Knowing which mixed drinks consumers are concocting at home can also help optimize in-store promotions among relevant hard beverages for in-home celebrations. This is especially relevant where they can align to holidays and events such as Cinco de Mayo and 4th of July. In fact, according to NielsenIQ CGA, 76% of consumers who usually celebrate occasions like these in bars or restaurants plan to celebrate them in other ways given restaurant closures.

On the flip side, this appetite for premixed cocktails could drive much-needed growth for on-premises establishments that can successfully tap into this demand. An April survey conducted by NielsenIQ CGA found that across all alcoholic beverages, consumers were the least price conscious when ordering cocktails with takeout food orders. Additionally, 28% say they would choose a more premium cocktail and 58% would opt for the cocktail favorites they know and love.

Support ‘on-premises’ like never before

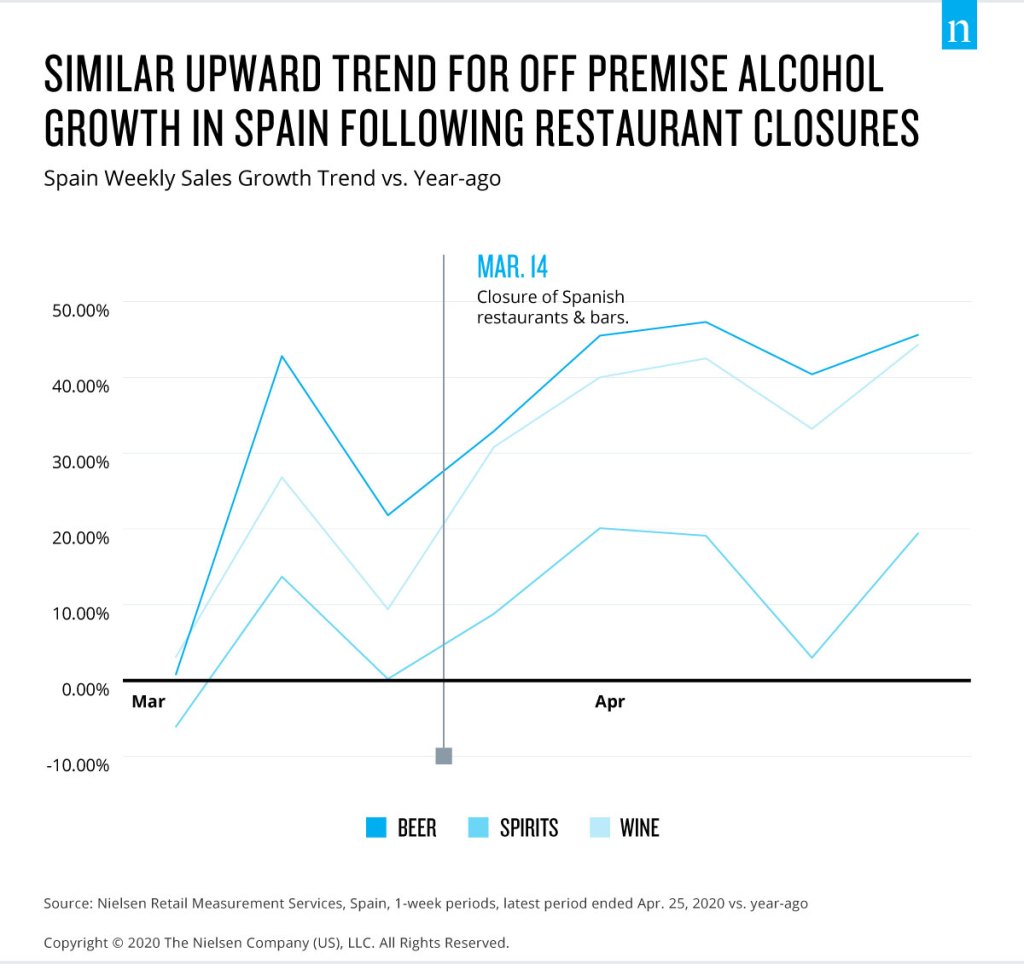

A leaner on-premises environment for alcohol is likely to emerge once the peak of COVID-19 passes. Before a “new normal” is established, the channel will transition into a phase with continued restrictions. Examples of this are manifesting across the globe. While still in lockdown, consumers in Spain, for instance, followed the suit of most countries after restaurant closures were implemented on March 14. There, consumers continue to flock to off-premises means for acquiring alcohol, with strong sales growth in beer (+45.6%), wine (+44.3%), and spirits (+19.4%) in the week ended April 25 compared with a year ago. But early plans indicate that it will be a slow return to any form of normalcy. When restaurants in Spain begin to reopen in phases, the government will impose restrictions to allow only a fraction of the typical dining space occupancy and limit dine-in service to restaurant terraces only.

With restrictions like these in place, at this transitory stage, on-premises retailers and operators will need more support than ever before from their manufacturer and retail partners. Knowing how to meet a priority set of consumer needs with a lean assortment of alcohol options will be essential to surviving through long-term dining restrictions in restaurants. Operators will be turning to the brands that can prove they’ve been essential to the COVID-19 need states of consumers. In fact, 57% of surveyed on-premises operators would value evidence-based recommendations on the optimal drink range/assortment for their bars.

Given the higher price markups traditionally present in on-premises alcohol offerings, there is clearly a lot of ground to make up as businesses remain closed for dine-in service across the nation and much of the globe. But as evidenced by the continued growth and demand for both off-premises sales and takeout orders on-premises, there is ample room to rebalance the alcohol industry even in the face of persistent COVID-19 restrictions.

Notes

*The term “on-premises” refers to establishments licensed for the sale and consumption of alcohol on the premises of the location. Conversely, “off-premises” retail outlets are locations that are able to legally sell alcohol for personal consumption.