Vast majority seeking new ways to save

The study, conducted across 16 countries by NielsenIQ’s Customized Intelligence team, identified four consumer groups whose spending intentions and circumstances have changed dramatically from last year.

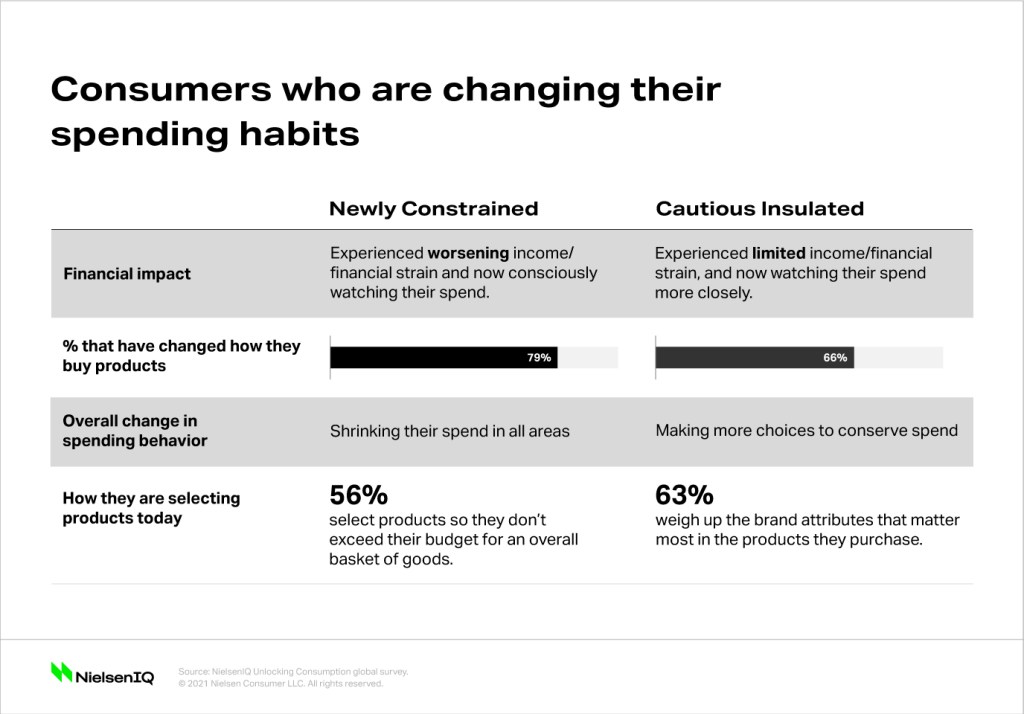

A majority of consumers now find themselves with less money to spend and an abundance of caution around spending it. In fact, the study highlights that 73% of consumers have experienced a recent shift in their personal financial situations, to varying degrees, since September of 2020. Dissecting this lot of cautious spenders, we have the Newly Constrained consumer group (46%) whose income or financial situations have declined, and the Cautious Insulated group (27%) who have had limited impact to their financial situation or income. Across both groups, recent events have driven these cohorts to become extra mindful of what they spend.

While nearly half of these consumers are buying whatever product is on promotion and opting for private label options to save money, 53% of newly constrained and 58% of cautious insulated consumers say they will stick to their regular brand preferences, with the vast majority opting for the lowest price option amongst their preferred brands.

“Spending abilities are polarized not just across the four new consumer groups but also within the groups themselves. Saving money at all costs is essential for many consumers, yet huge numbers say they will stick to their regular brand preferences—and that’s the rub. Brands need to help consumers do both,” said Scott McKenzie, Global Head of the NielsenIQ Intelligence Unit.

Consumers will trade up and down

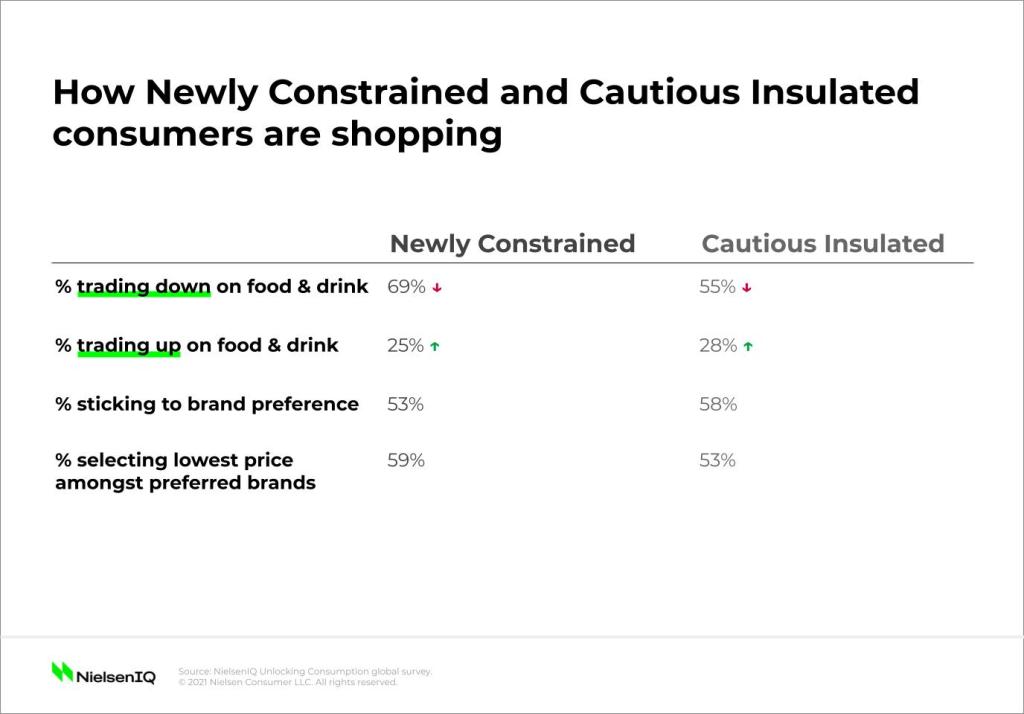

These two consumer groups are reevaluating what’s essential to them and their families. They are making tough decisions about what categories can be abandoned and what compromises can be made even within a category. 69% of Newly Constrained and 55% of Constrained Insulated consumers say they are trading down to manage household spending. Brands need to ensure their portfolios and assortment are optimized to capture this down trading, so consumers don’t trade out of a category altogether.

“Brands and retailers need to help consumers manage their overall basket spend by allowing them to flex their budgets. Downtrading will be a key component of this, but brands should also explore how they can help consumers trade up when budgets allow. This could include volume-based promos for cautious spenders, and for the more insulated consumers, innovative in-home occasions and relevant premium offers,” said McKenzie.

Brand loyalty comes at a price

More than half of Newly Constrained (53%) and Insulated Cautious consumers (58%) say they will stick to their regular brand preferences—but this loyalty comes with added scrutiny. Shifting financial situations necessitate extra caution when justifying what consumers will buy. Consumers are deliberately prioritizing the brand attributes that matter most to them. For 59% of Newly Constrained consumers and 53% of Insulated Cautious consumers, decisions are being driven by lowest price when it comes to their preferred brand options. Brand repertoires are expanding as a result. Companies need to double down on offering the lowest price options within familiar brand families in order to succeed with today’s cautious, brand-loyal buyers.

“There’s an interesting juxtaposition between loyal intentions and financial constraints. This year could look very different than the last, where even the most loyal of consumers are forced to shift away from familiar products due to necessary wallet adjustments. Brand price shifts need to be made with a tiered approach that considers consumer tradeoffs at both ends of the spending spectrum,” McKenzie said.