Eretail media transformation: what’s changing

There are a number of forces acting upon retailers and CPG manufacturers right now and they are perhaps most acutely reflected in online media. More media activations are being offered by retailers and brands are partnering with tech suppliers to streamline their product information management, synchronize distribution and sales, manage user generated content and track purchase data with Nielsen, IRI and retailer partners.

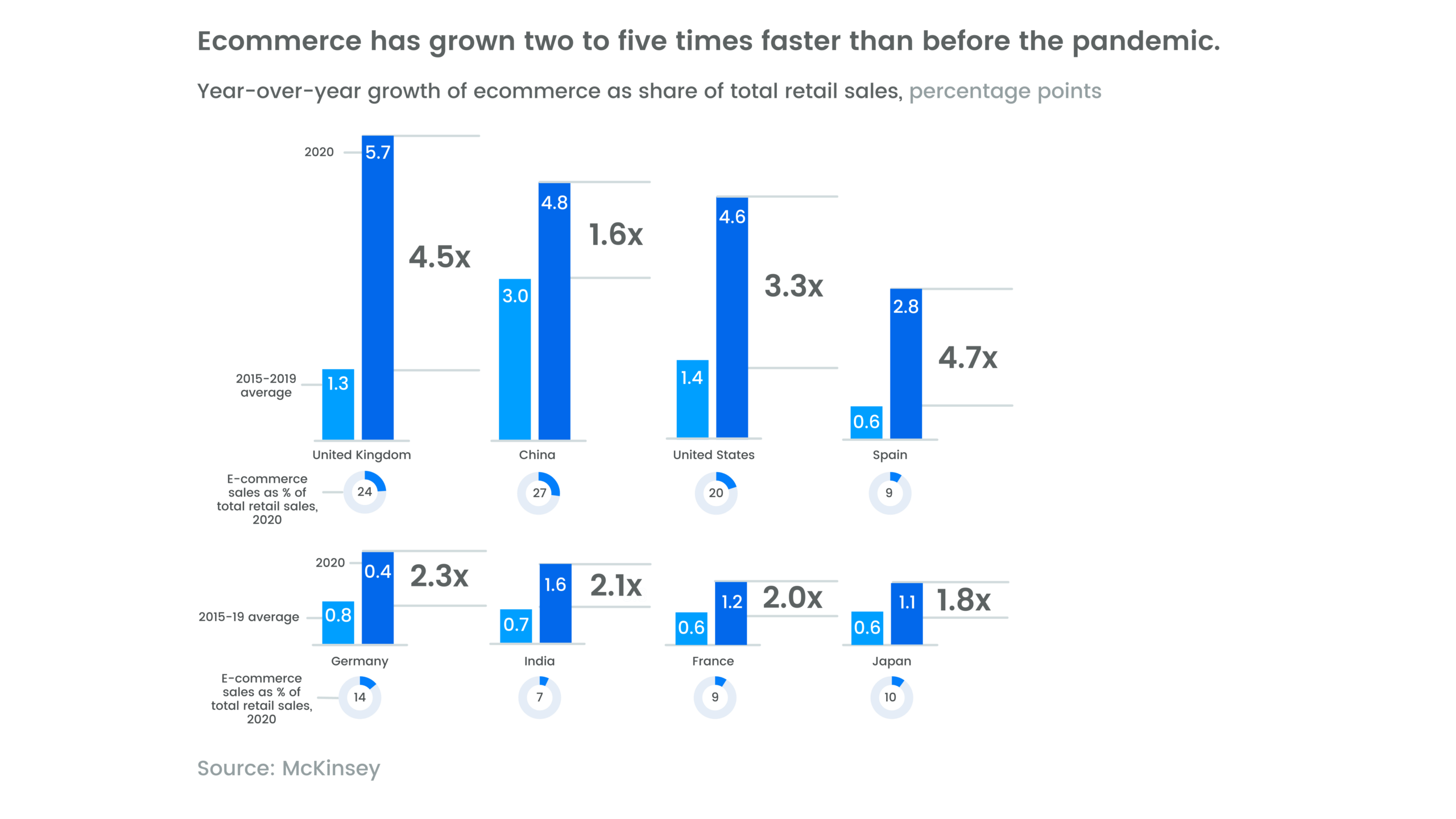

Due to this flurry of activity and the steady transition to omnichannel and ecommerce, shopper marketing budgets (such as in-store promos and displays and coupons) are now being partially re-allocated to online. Given the growth of ecommerce, this isn’t surprising.

With more shoppers doing their pre-purchase browsing online before purchasing in-store or digitally, more eyeballs than ever before are online and that means a larger audience to advertise to. Point of purchase and in-store advertising budgets are shifting to online from brick and mortar. Even though online is claiming increasing ground, physical stores are not being supplanted. Stores are being repurposed as multifunctional. They now serve as local fulfillment centers for online orders, traditional stores, as well as spaces that brands can use as experiential marketing, which is usually augmented with online media.

Ecommerce is a powerful retail media driver

According to BCG, 41% of US online grocery shoppers are first time users, due to Covid. As shoppers migrate to ecommerce–even if they wind up making their purchase in-store–online advertising is crucial at this moment as new shoppers discover egrocery.

The digital media ad spend in the US in 2020 was $336 billion. One reason that number is so big is because the measurement capabilities that come with digital media are attractive to CPGs. Specific-intent shoppers are going online, sometimes to retailer sites just to read reviews and gather information, but online is increasingly where people are shopping, so this constitutes a prime advertising opportunity for brands. When the deep purchase data possessed by retailers is coupled with the data a tech partner can provide on eretail media, it becomes quite powerful.

Retailers as media companies

Retailers such as Target and Walmart are creating teams and processes very much like media companies. They’re actually following the path beaten by Amazon which has been using it’s online retail store as a lucrative advertising platform for years.

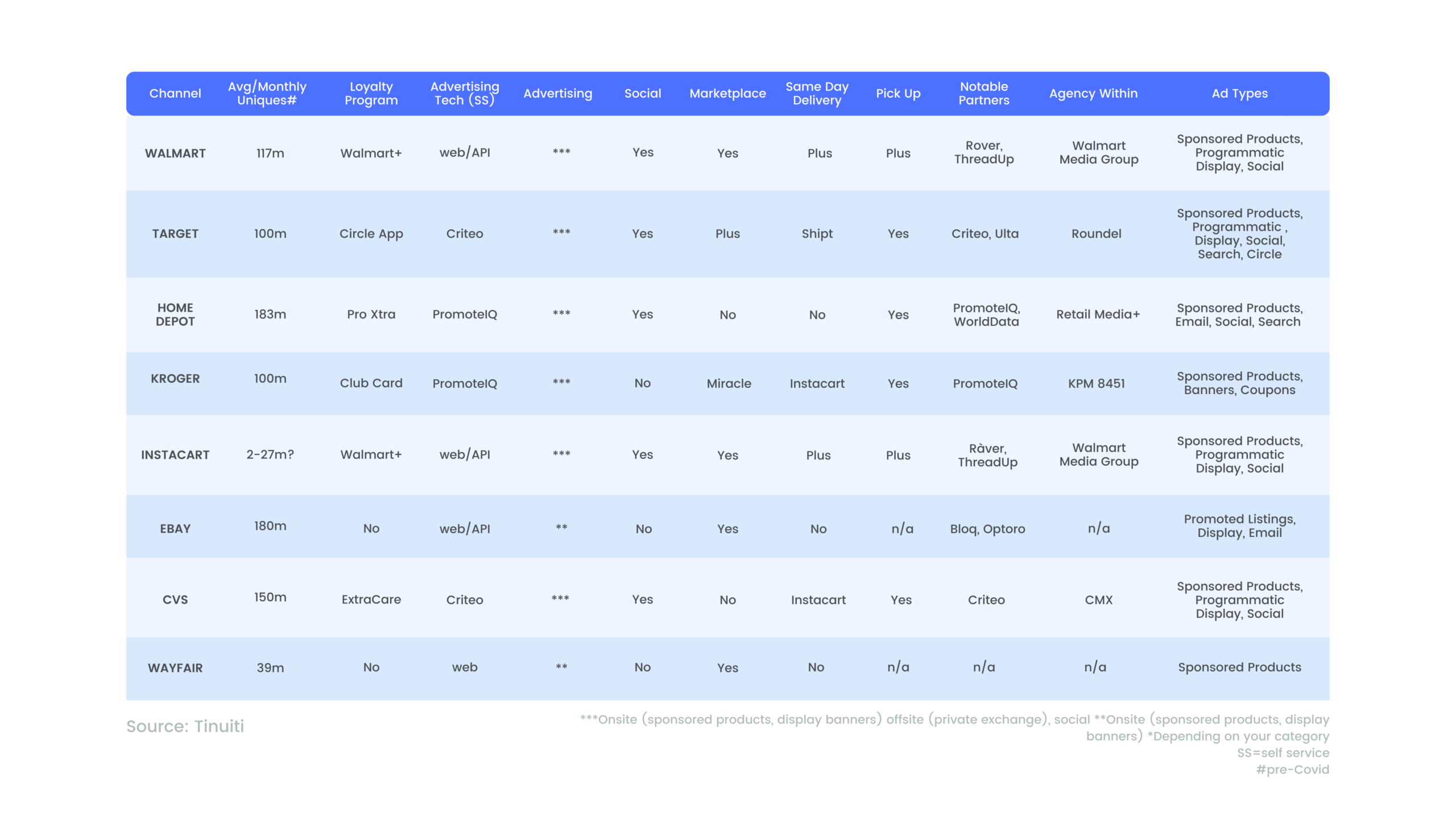

This chart outlines details of the online advertising, programs and offerings of the major US retailers. Advertising is becoming an important part of their business, as it has for Amazon.

Traditional retailers are uniquely positioned to sell media space due to the first-party customer data and sales information they collect. In fact, grocery retailers are better situated to capitalize on customer data than almost any other industry due to the frequent, repeat purchases CPG products entail.

Selling the media space–and the physical space retailers have–will provide ways for brands to engage with consumers in unique and powerful ways. There are many brands struggling to find their way in the new media world, and with new ways of personalizing ad targeting and using the physical stores to create brand experiences, eretail media is a crucial part of any CPG’s ecommerce strategy.