High growth ingredients to know

When identifying today’s industry-leading evolving health needs, it’s important to assess the maturity and relative presence of key ingredients found across the store (whether that store is in a physical retail outlet, or online). An analysis of the U.S. market shows 12 high-growth ingredients in a way that allows for deep assessments of future growth potential. From the small, but mighty sales of Maca, to the broad and growing spectrum of ayurvedic medicine, all the ingredients pictured below have seen double-digit sales growth, yet their proliferation of categories across the store hasn’t been the same for all.

Differentiate between growth drivers

Collagen

High category expansion:

Now found in 23 more categories across the store vs. Q3 2017 From soaps, cosmetics, etc, to nutrition bars, broth, etc.

Strong growth driver:

$814M in U.S. Sales Q2 2021.

+20% in $ growth vs. Q2. 2019

Collagen has been a great example of an ingredient with strong growth and expansion potential. Back in the third quarter of 2017, collagen was found in just 74 categories, primarily concentrated in beauty care products like cosmetics. Today, this rapidly growing ingredient can be found in over 97 categories, with strong growth in food categories like broth and nutrition bars.

Ginger

Low category expansion:

Found in the same # categories across the store vs. Q3 2017

Strong growth driver:

$1.2B in US Sales Q2 2021

+31% in $ growth vs. Q2. 2019

Ginger, on the other hand, is an ingredient that has stabilized in recent years. While growth has been strong, with quarterly sales in 2021 up 31% from 2019, this ingredient can be found in the same number of categories as measured in 2017.

Ancient Grains

Low category expansion:

Now found in 19 fewer categories across the store vs. Q3 2017

Strong growth driver:

$3.5 in U.S. Sales Q2 2021

+12% in $ growth vs. Q2. 2019

Ancient Grains represents a matured opportunity where it is now found among 19 fewer categories across the store compared to measures in 2017.

One to watch: Nootropic

Optimized mental and physical performance for peak health is important for 68% of consumers globally. Furthermore, 1 in 3 believe it will become even more important to them in the next two years. Aligned to this shift is the growth and popularity of nootropics, which are popular substances known for their ability to improve or enhance a range of cognitive functions. Previously only found in specialized supplements, nootropics are emerging from their niche market, now being incorporated into various food and drinks to aid in enhancing focus and memory among core users.

There is huge potential and growing opportunities to bring holistic health and wellness to mainstream brands. Unilever’s recent acquisition of Onnit serves as a perfect example of recent expansion. Onnit, a leading nootropics brand, offers a variety of different supplements touted for their ability to improve cognitive function, mood and relaxation, gut health and immunity support. They aren’t the only ones investing in new ranges of supplements to support aspirational health needs. Nestle has recently purchased the Bountiful Company, a nutritional supplement brand. This move helps to ensure their portfolios are adapting to match new consumer priorities.

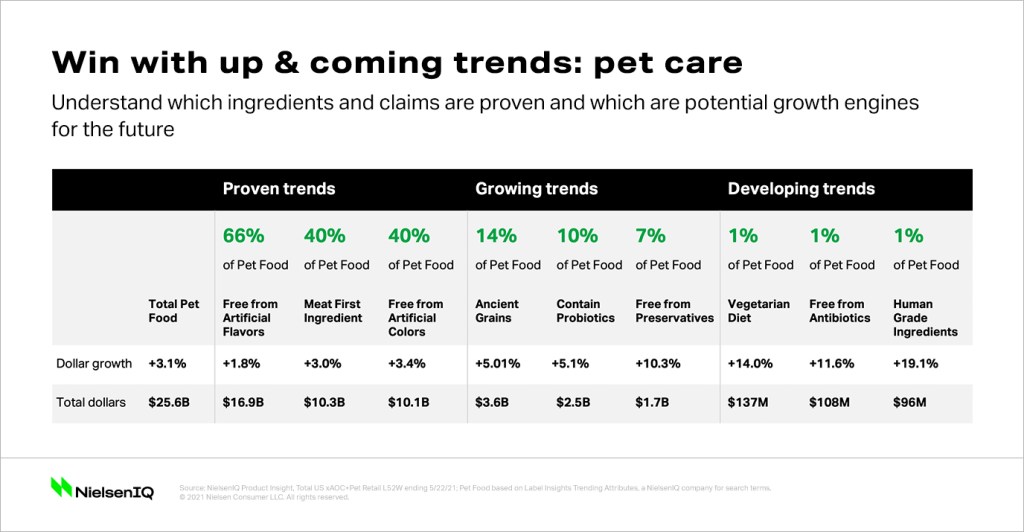

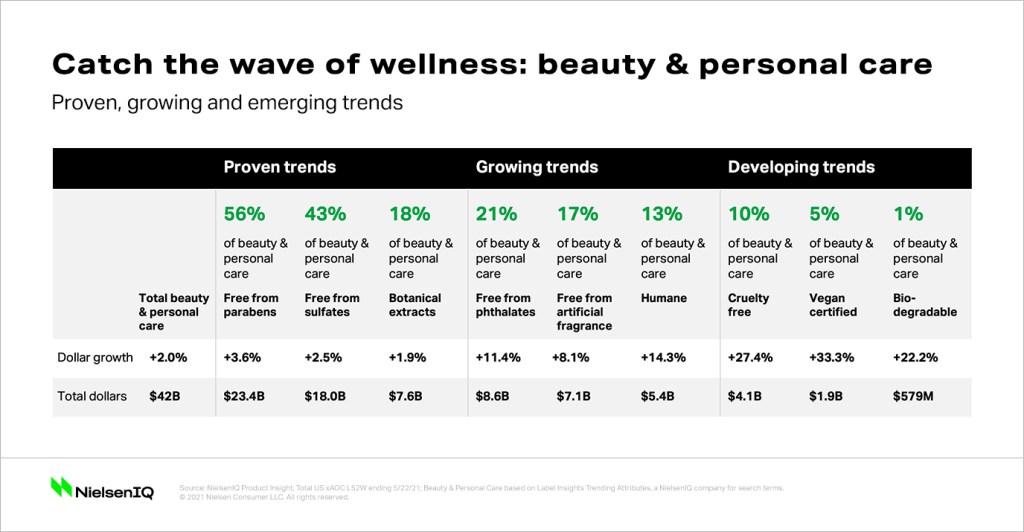

Catch the wave of wellness: proven, growing and developing trends in pet, beauty & personal care

Much has changed in the world of pet care and NielsenIQ measures of evolving U.S. attributes highlights what to look out for in terms of the proven, the growing and the emerging needs of consumers.

To win with pet care buyers, companies need to assess the maturity of the trends they are most aligned with. From the new developments in terms of humanizing pet dietary needs and regimes, to the proven demand for quality ingredients in pet foods, the various evolving needs in this space are quite diverse. But as with any evolving trend, particularly within the space of pet food, in order to secure longevity, it’s important to validate new diet-based innovation to ensure key criteria are met, such as whether something is truly healthy for pets.

Taking a similar lens within the beauty and personal care space, it’s clear that altruistic desires around ethical and environmental causes are among the less developed of emerging consumer health and wellness needs. Meanwhile, products without parabens and sulfates have become new table stakes for beauty buyers who are not only intrigued by these trends, but have come to expect them as proven requirements to their purchase.

When it comes to evolving consumer health and wellness needs, continuous measurement is a necessary means to making sure you resonate with your consumers. New and emerging trends will require nurturing as consumers overcome their fears of the unknown. Growing trends, on the other hand, will require skillful scaling of efforts in order to meet swift demand curves. Proven trends are the most established of “evolving” health needs, and the competition will be hot for who can meet key needs the best among a more populous playing field.

Take a deeper look into the global consumer health and wellness revolution

Understanding how consumers’ evolving health needs are being met is only part of the story. The opportunity for companies looking to meet and exceed the growing expectations of wellness-minded consumers is to figure out where your brand fits and sits along the entire hierarchy of health and wellness needs. Our Global Health and Wellness report takes a deep dive into how consumer needs have been reshaped around the world, what is trending, and what the budding opportunities are across the new, broadened spectrum of global well-being.

Stay ahead by staying in the loop

Don’t miss the latest NIQ intelligence—get The IQ Brief in your inbox.

By clicking on sign up, you agree to our privacy statement and terms of use.