Aspirations for health living manifest differently across the globe

61%

of global consumers say that aspirational needs have become more important to them in the last 2 years

Singapore

Regularly exercise

Thailand

Eat optimal portion sizes

South Korea

Boost health & dietary vitamins or supplements

India

Use natural products for preventative health (i.e. ginger, turmeric, etc.)

Source: NielsenIQ Global Health & Wellness Study of 17 markets, September 2021

How the world aspires to be healthy

From committing to the avoidance of key ingredients like sugar or sodium, to building a life around specialty lifestyles or diets, there are many ways in which consumers seek out their aspirational health needs. But missed business opportunities are plentiful today. From the desires for personalization, to the demands for additional transparency, there is a very granular world of specific aspirational health habits taking hold of the market today.

51%

of U.S. food products fail to claim their single most-searched attribute

Source: NielsenIQ Label Insight, 2021

62%

of global consumers are interested in products or services that can be customized to meet their specific health needs

Source: NielsenIQ Global Health & Wellness /Study of 17 markets, September 2021

77%

of surveyed global consumers feel that product labels need to be more specific and transparent to facilitate making healthier choices

European consumers looking to low calorie beverages

Limiting sugar and caloric intake has proven to be a popular means for long-term health management, particularly in European markets. Businesses are also contributing to this shift, through proactive or reactive efforts to market healthier alternatives in response to regulatory shifts. Retail measures from Europe confirm that across mainstream categories like soft drinks and sports drinks, consumers are looking to support their future health by opting for low-calorie versions of their favorite beverages. Swedish consumers have driven 17% sales growth in low calorie soft drinks this year, which far outpaces the 7% growth witnessed across the category. Companies should consider where else across the store to expand assortment of low calorie offerings to meet the aspirational needs of shoppers.

The thirst for low calorie beverages is not limited to just the European market. Across the globe, innovation in low calorie beverages is thriving. Last year, NielsenIQ Breakthrough Innovation winners included Gatorade Zero and BodyArmour Lyte in the U.S. and Linha Maguary Stevia in Brazil.

Aspirations to break booze habits are growing

While non-alcoholic beer has been available to consumers for many years, there are now more no/low alcoholic wines, spirits and beer options available than ever before. These new innovations better meet health and wellness desires of certain consumers such as lower ABV, lower sugar, lower calorie or sustainable sourcing practices.

Forbes reported earlier this year that the UK is ‘the most mature’ market for the no-alcohol category, citing CGA data. This year, the UK has seen established spirits brands launch innovations in no-proof to mirror regular ABV offerings. NielsenIQ data shows that sales of low and no-alcohol alternatives continue to soar with low and no-alcohol beer sales + 22%, low and no-alcohol spirit sales +111% and low and no-alcohol wine sales + 27% (NielsenIQ Scantrack WE 2.10.21 – Total Coverage).

Within the U.S., the market for no/low alcoholic beverages is still relatively small at less than 5% household penetration, but is an interesting area to watch, as it now represents $3.1B in sales and a 3.5% total alcohol market share.

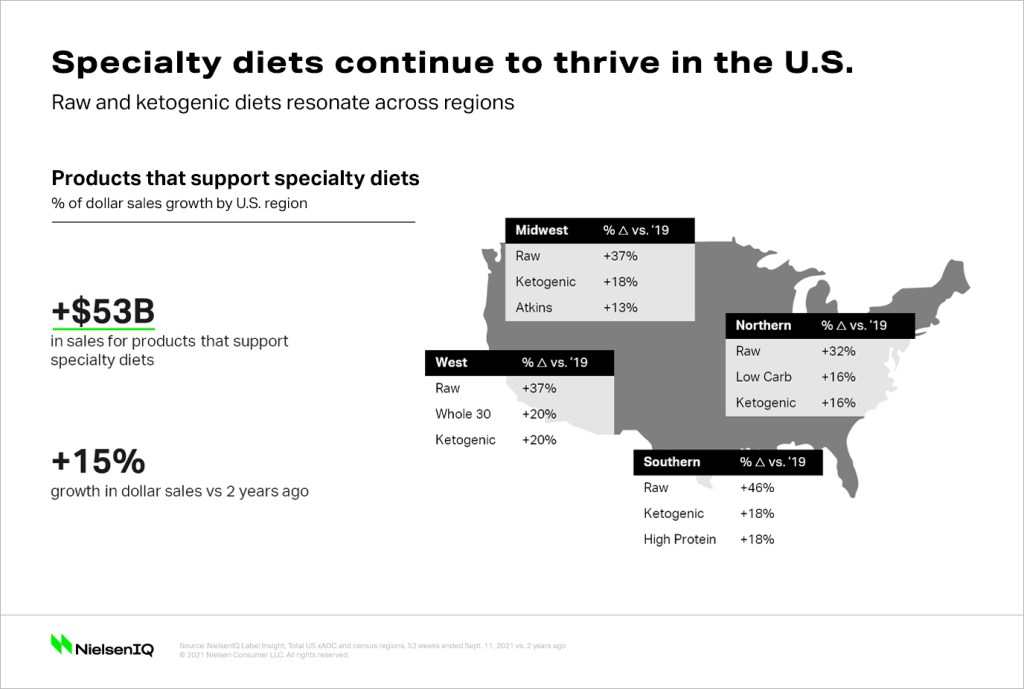

Specialty diets continue to thrive in the US

Diet and nutrition has a critical role to play for consumers seeking to meet a variety of long-term health goals. In the U.S. market, it’s interesting to see that despite regional differences, there are consumers across the country driving growth among products that support both raw and ketogenic diets.

Plant-based diets remain a global stronghold

While not new to the space of specialty diets, plant-based products have continued to grow and expand global awareness and adoption. Supported by campaigns like Veganuary, plant-based diets and their associated benefits have gained serious momentum across many markets worldwide. Over 6 in 10 surveyed consumers across the globe already buy or are more likely to buy plant-based products than they did 2 years ago. Further, 65% would pay more for plant-based products, and nearly 2 in 10 of these respondents say they would pay a lot more for them.

Aligned to the strong consumer sentiment towards embracing plant-based diets, it’s clear that these beliefs are being put into action as purchasing of meat and dairy alternatives thrives among Canadian and British households. In the chilled meat alternatives category, for example, the average U.K. household spends nearly £39 per buyer and sales are up by 33% in the last year. In Canada, plant-based dairy alternatives are also flying off shelves, having been purchased by 42% of Canadian households and growing by over 13% in category sales year-over-year.

In Asia, successful Hong Kong brand, Omnipork, a plant-based pork alternative, took the Asian market by storm in 2019. Broadly speaking, worldwide interest in plant-based alternatives has also been supported heavily in recent years by retailers and quick-serve restaurants that have expanded assortment of key offerings.

For the millions of households that have introduced plant-based diets into their lives for a variety of aspirational reasons (and also, altruistic reasons as outlined later on), purchase data shows no signs of this trend slowing down just yet.

It pays to be plant-based

64%

of global consumers would be willing to pay more for plant-based products. 18% of which would pay a lot more.

United Kingdom

2.4M

UK households have someone who follows a vegan or vegetarian diet

Chilled Meat Alternatives: +33%

in sales growth vs. 2020 Purchased by 29% of UK households, with 934k additional households buying the category.

Canada

$1.1B

in annual sales of plant-based products, up 17% vs. 2020

Plant-based Dairy Alternatives: +13% in sales growth vs., 2020 purchased by 42% of Canadian households, with 242k additional households buying the category

Source: NielsenIQ Global Health & Wellness Study of 17 markets, September 2021,

UK: NielsenIQ Homescan survey, Nov. 2020, and NielsenIQ Homescan Panel, Total UK, 52 weeks ended Jun. 19, 2021 vs. year-ago,

Canada: NielsenIQ MarketTrack and NielsenIQ Homescan Panel, Total Canada, 52 weeks ended May 15, 2021 vs. year-ago

Business expected to foster aspirational needs

According to surveyed consumers, the burden of healthy living, through food and nutrition, activity and ailment-preventing behaviors falls on companies as well. A majority of consumers (64%) feel in favor of taxing businesses who promote unhealthy choices, meanwhile, even more (68%) agree that governments should more closely regulate businesses to encourage healthier decision making.

The U.K. has been an early adopter of stricter governance and legislation to help consumers make healthier choices. But of all surveyed markets – British consumers are least enthusiastic towards these regulatory measures compared to others. Ahead of recent and forthcoming efforts to curb sugar and caloric intake in the U.K. and Europe-wide, governments are legislating to enforce change, whether local consumers may have the appetite for it or not. The cost of enabling unhealthy choices continues to rise and businesses will be held accountable to building a healthier future.

64%

of global consumers agree that companies should be taxed heavily if they continue to produce or promote unhealthy choices (vs. U.K. 57%)

Source: NielsenIQ Global Health & Wellness Study of 17 markets, September 2021

68%

of global consumers agree that governments should more closely regulate businesses to help consumers make better health choices (vs. U.K. 54%)

66%

of surveyed global consumers feel that advertising (on and offline) should be regulated so children are unable to see unhealthy product advertising (vs. U.K. 59%)

Take a deeper look into the global consumer health and wellness revolution

Understanding how consumers’ aspirational health needs are being met is only part of the story. The opportunity for companies looking to meet and exceed the growing expectations of wellness-minded consumers is to figure out where your brand fits and sits along the entire hierarchy of health and wellness needs. Our Global Health and Wellness report takes a deep dive into how consumer needs have been reshaped around the world, what is trending, and what the budding opportunities are across the new, broadened spectrum of global well-being.

Stay ahead by staying in the loop

Don’t miss the latest NIQ intelligence—get The IQ Brief in your inbox.

By clicking on sign up, you agree to our privacy statement and terms of use.