What trends are driving U.S. beauty and personal care growth?

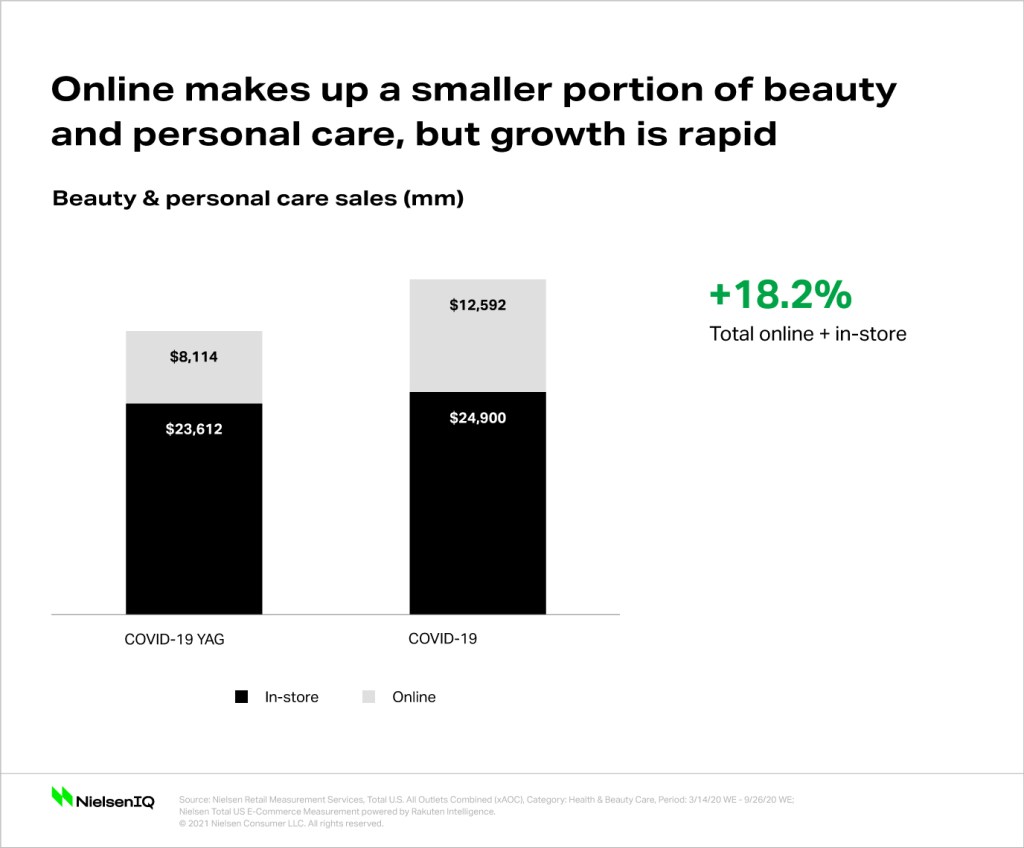

The onset of the COVID-19 outbreak smudged beauty and personal care sales, yet the industry remained resilient despite massive declines experienced this past spring. In fact, the U.S. experienced an 18.2% sales gain across all brick and mortar channels and online during the 29 weeks ending Sept. 26, 2020.

Living amid a pandemic has given beauty consumers far less need to purchase and wear cosmetic products on a regular basis. But with many categories being kissed goodbye for now—such as mask-unfriendly lipstick—where did this growth come from?

One key trend, namely, online beauty and personal care products, plumped category dollar sales by 55.18% while brick and mortar outlets experienced a comparative 5.45% dollar gain. Although the growth in brick-and-mortar sales seems to pale in comparison to online growth, this increase is still remarkable given steep declines in select beauty categories.

Currently, online sales account for one-third of beauty and personal care sales. However, growth has been astronomical throughout the pandemic and every major subcategory experienced double- to triple-digit sales increases.

Shoppers across most categories are focused on limiting their time in-store and developing a dependency for online shopping, and beauty and personal care is no exception. Over 60% of beauty and personal care shoppers are now making at least half of their purchases online—whether it be through home delivery or click and collect.

Within beauty and personal care, click and collect sales accelerated much faster than shipped sales between March 2020 and August 2020, which grew by 192% and 62% respectively. This momentum is expected to continue as pandemic-related concerns continue circulating across the U.S., which underscores that the key to unlocking beauty and personal care growth moving forward is through online shopping.

Low-Income shoppers are driving growth online

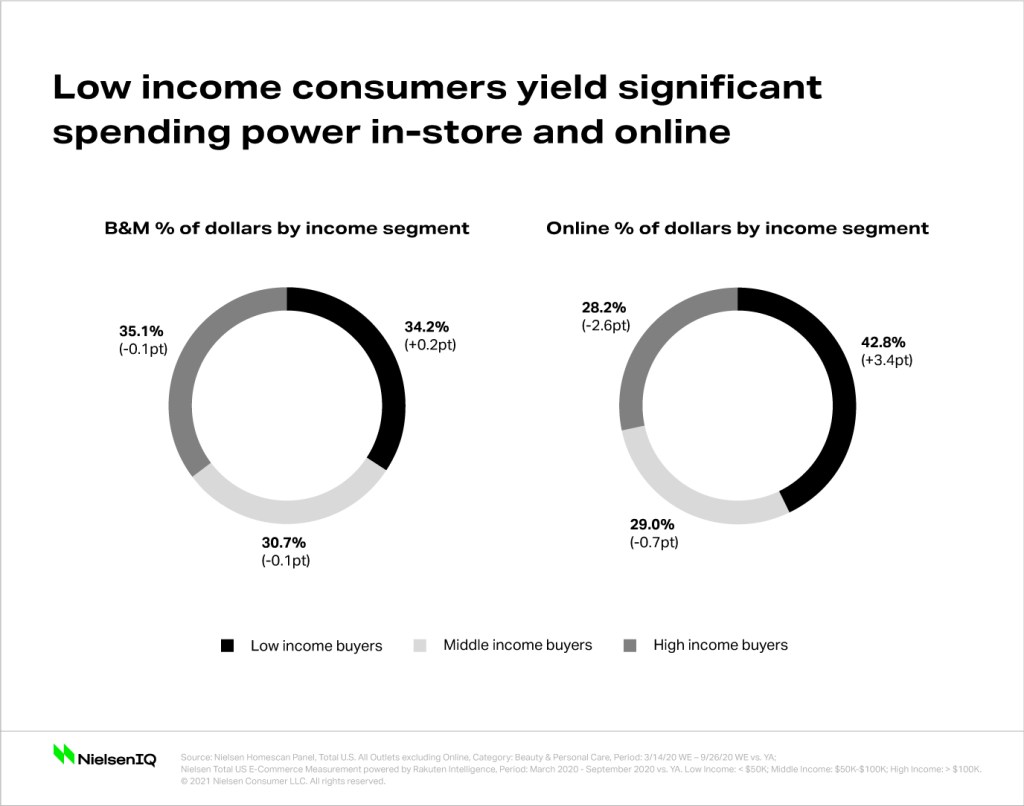

The real variable that beauty and personal care retailers need to pinpoint is which segments are driving online growth. During a time where economic stability has declined for millions and the near-term future outlook remains uncertain, low-income shoppers have been fueling online beauty and personal care sales. From a demographic standpoint, these consumers tend to be over the age of 65, multicultural, and live alone in economically challenged urban and rural areas.

With far less financial flexibility than their middle and high-income counterparts, it may seem surprising that low-income consumers are the all-star cohort when it comes to online beauty. However, this constrained shopper segment actually makes up the largest share of online beauty and personal care dollars, as witnessed between March 2020 and September 2020. And depending on whether unemployment rates rise again, the diffusion of more low-income consumers will follow suit and, in turn, position online beauty and personal care products to further flourish.

Uncover the truth behind the latest beauty insights

Rapidly changing customer needs are impacting business strategies around the globe. Find out how you can better understand evolving consumer interest in clean, sustainable, and cross-channel shopping habits within the beauty category—for today and tomorrow.

Brick and mortar remains important for low-income beauty

The low-income segment’s strong preference for online beauty and personal care in the new normal is revealed by household penetration share, which declined 5.4% in-store, while online penetration grew by 40.9%. Low-income shoppers increased their online beauty and personal care spend by an impressive 69%, which was as much as 27 percentage points more than the middle-income segment and 18 points higher than the high-income segment. Despite strong online growth, however, brick and mortar is still an important channel for these shoppers.

Overall, low-income shoppers continue spending more on beauty and personal care in-store, but online spending growth has been much more dramatic. To wit: online beauty and personal care purchases are about 2.5x larger than in-store purchases. In addition, trip frequency grew faster online versus in-store, but this group is still making over 3x as many beauty and personal care shopping trips within brick and mortar.

Low-income consumers turned to drug stores, wholesale clubs and some mass retailers more frequently than middle and high-income shoppers. And though low-income share of wallet is smaller in brick and mortar channels compared to online, this figure is considerably higher than middle-income shoppers—and less than one percentage point below high-income share of wallet. This means the low-income segment is highly valuable for both brick and mortar and online retailers.

Engage constrained wallets through impulse and value brands

Given restricted wallets, low-income shoppers have been sticking to purchasing essentials when shopping for groceries, but this doesn’t seem to be the case within online beauty and personal care. Low-income beauty and personal care shoppers present the highest opportunity to convert impulsivity. Rates of impulse purchasing grew across all income segments into the new normal, and while the low-income segment had the lowest impulse purchase rate pre-covid, they now possess the highest rate of impulse purchasing through the online channel. By September 2020, 17.8% of low income shoppers purchased online beauty and personal care products on impulse in the new normal, compared to 13.1% of middle-income shoppers and 11.4% of high-income shoppers.

Accordingly, retailers and manufacturers can convert impulsivity into additional dollars through targeted “buy more, save more” promotions, free product samples to encourage secondary purchases and offering last minute add-on products at a discounted price.

When making a beauty and personal care purchase, low-income consumers are focused on finding high-value, high-quality products, regardless of channel. Retailers and brands need to build engagement and trust among low-income shoppers by proactively recommending value-based product alternatives both in-store and online. Building off this, these shoppers show a strong preference for branded products over private label but still over-index for private label brands compared to other income groups. By touting value and effectiveness, private label brands will be able to capture beauty and personal care dollars from low-income consumers.

In order to unlock the true value of low-income beauty and personal care, retailers must enable a seamless and equal online and offline shopping experience that leaves shoppers with little room to question their purchases. As low-income consumers become even more invested in shopping online and searching for the best deal, retailers must provide easy search and discovery of prices and promotions, as well as capabilities that assist shoppers in comparing products. Manufacturers can appeal to low-income shoppers through strategic promotions and incentives. In addition, retailers need to balance their offline and online product assortments, offer the same promotions and incentives across channels and make online shopping an easy decision by offsetting delivery costs with prompt delivery timeframes or free pick-up locations to lock in consumers and build loyalty.