Holiday deal days fuel frugal sentiment

Frugality over festivity was the general sentiment that defined the October prelude to Black Friday. The early Black Friday push started with Target’s Deal Day on Thursday, October 6, continued with Walmart’s three-day Rollbacks and More event, and concluded with Amazon’s two-day, Prime Early Access Sale, which ended on October 13.

While this week of early discounts had the potential to take a sizeable piece of business away from the traditional Black Friday shopping holiday, consumers instead seized the moment and stocked up on groceries over gadgets.

In fact, a new NielsenIQ survey reports that 41% of consumers who shopped the early deals stated that they didn’t make a dent in their holiday shopping list during Amazon, Target or Walmart’s October deal days. As inflation continues to impose a cost-of-living crisis on consumers, recent deal day shopping holidays have become less about bargains on big ticket gifts and more about price hunting for everyday essentials and economic survival.

How consumers shopped for early Black Friday deals

Discounts are now a necessity for consumers. NielsenIQ data reports that more than 1 in 5 surveyed consumers surveyed are deal dependent and leaning on sales and discounts to help meet their holiday and general shopping needs.

While consumers came out to shop deals, many felt a bit deflated by the level of discounts with 32% of consumers stating that the deals fell a bit short in comparison to typical Black Friday holiday deals. As a result, most consumers prioritized smaller purchases and deals with 72% indicating they spent under $200 on a mixture of holiday gifting and everyday essentials.

The battle for bargains

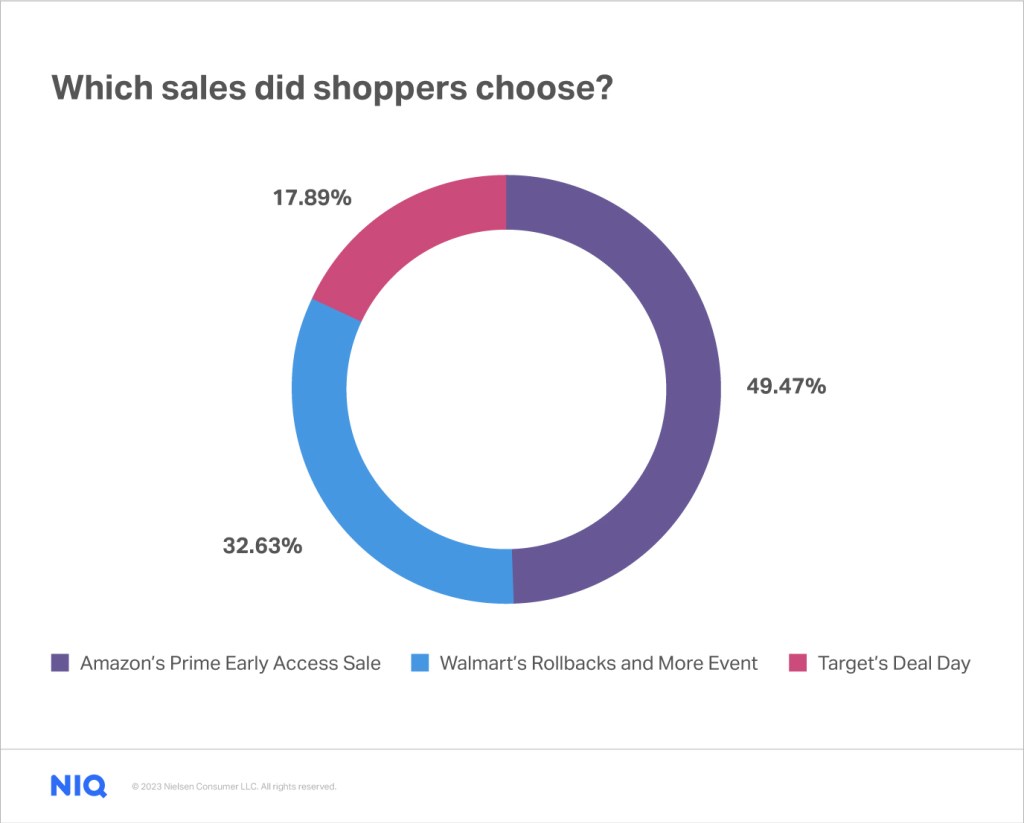

In the battle for bargains across the three retail holidays, the majority of consumers (47%) stated that they shopped online and gravitated toward Amazon’s Prime Early Access Sale.

Of those who stated that they shopped the deal day holiday events:

- 57% stated they shopped exclusively online

- 24% stated they shopped both in-store and online

- 20% stated they shopped exclusively in-store

Home cleaning, laundry care, and paper goods were popular private label purchases

Within the everyday essential categories, home cleaning products, laundry care, and paper products topped the list of categories where consumers opted to purchase store brand private label products versus branded.

Trending purchases

Everyday essentials

33%

Home cleaning supplies

32%

Laundry care

31%

Haircare

30%

Pet food

29%

Halloween Candy

Gifting

45%

Clothes

30%

Toys

23%

Tech

21%

Home décor

20%

Gift cards

Top reasons consumers shopped

- Find deals on gifts: 38% shopped for deals on holiday gifts

- Save on grocery + everyday essentials: 38% shopped for deals on groceries and everyday essentials

- Beat possible price hikes:32% shopped to get an early jump on deals in case prices increased due to inflation in the future

- Buy discounted goods for holiday hosting: 26% shopped to find discounted items on thanksgiving and other future holiday hosting events

- Prepare for winter/rising heating costs: 25% shopped to find deals on cold weather items (heated blankets, thermal clothing, thick socks, heavy sweaters, etc.) To prep for winter/save on heating bills

Practicality drove consumers to shop

Practicality was a strong force that drove early deal day shoppers, with many consumers making choiceful and practical purchases to prepare for future events.

While the main driver for deal seekers was to find discounts on gifts and groceries (38%), 25% of consumers surveyed stated that they shopped last week’s deal to find deals on cold weather items, such as heated blankets, thermal clothing, thick socks, and heavy sweaters, with the intension to find products that will help them stay warm and save on heating bills.

A recent forecast from the U.S. Energy Information Administration estimates that the average winter heating costs is expected to rise to $931 in the U.S., up 28% from last year.

Overall, consumers approached the week of early holiday deals with practicality, price consciousness, and an aim to proactively prepare for future events. While this week of early discounts had the potential to take a sizeable piece of business away from the traditional Black Friday shopping holiday, it did not. NielsenIQ’s survey shows that 85% of consumers stated that they will be checking out traditional Black Friday and Cyber Monday deals in November.

Source: NielsenIQ survey of 500 consumers to capture deal day holiday sentiment and habits during October’s week of retail deal days, October 2022