Asia Pacific FMCG growth still recovering positively

According to NielsenIQ’s Retail Measurement Services (RMS) data, the FMCG industry in Asia Pacific saw a value growth of 5.2% from April 2021 to March 2022 versus the previous period, while the overall growth in Q1 of 2022 was up 0.8% compared to the previous year. This is a slowdown driven predominantly by the lockdown in key cities in China and the impact of rising inflation. Despite the slowdown and price increases, consumers are still making purchases and we see a positive volume growth of 0.9% in the same 12 month period versus the previous.

While inflationary pressures are real, an understanding of how your brand and category is being impacted by inflation can help you find pockets of opportunities for your brand.

Here are 3 steps to help you better manage these inflationary pressures.

Step 1: Understand that inflationary dynamics are not universal

While most would see inflation resulting in price increases and a likely decline in volume, the actual dynamics of inflation is not universal. Each category and item is impacted with different intensities, and each category could be affected by a number of different external factors.

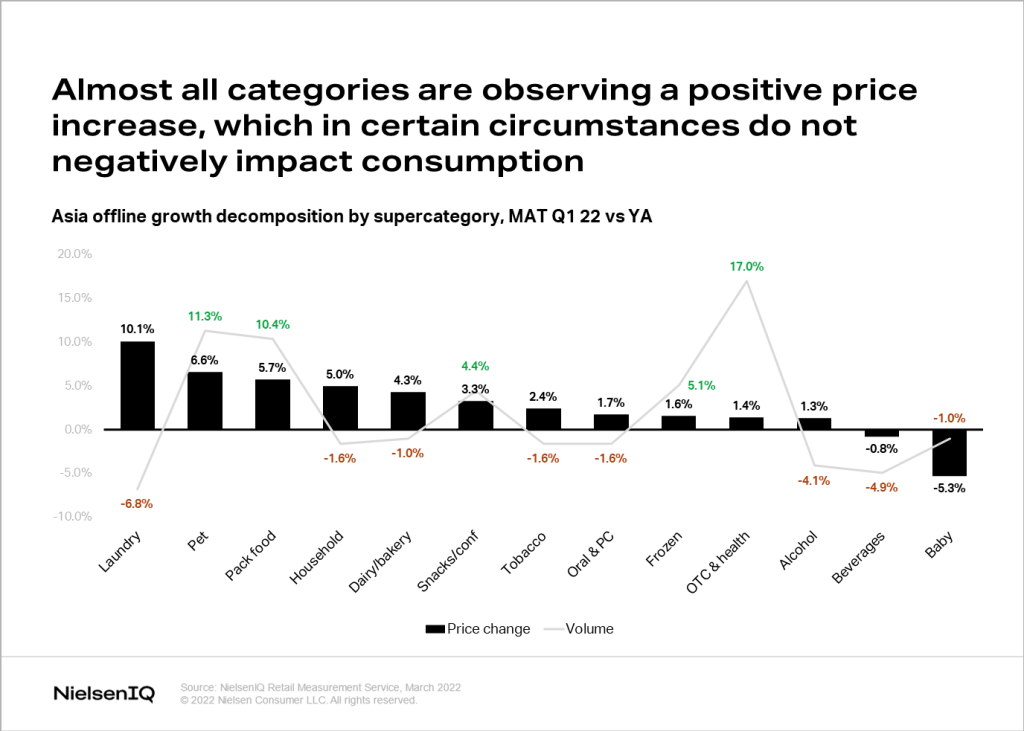

From the chart below, we can see how almost all super categories in Asia are seeing a rise in price due to inflation. However, volume decline is not a given, in fact some of the super categories are actually growing in volume despite the rise in price.

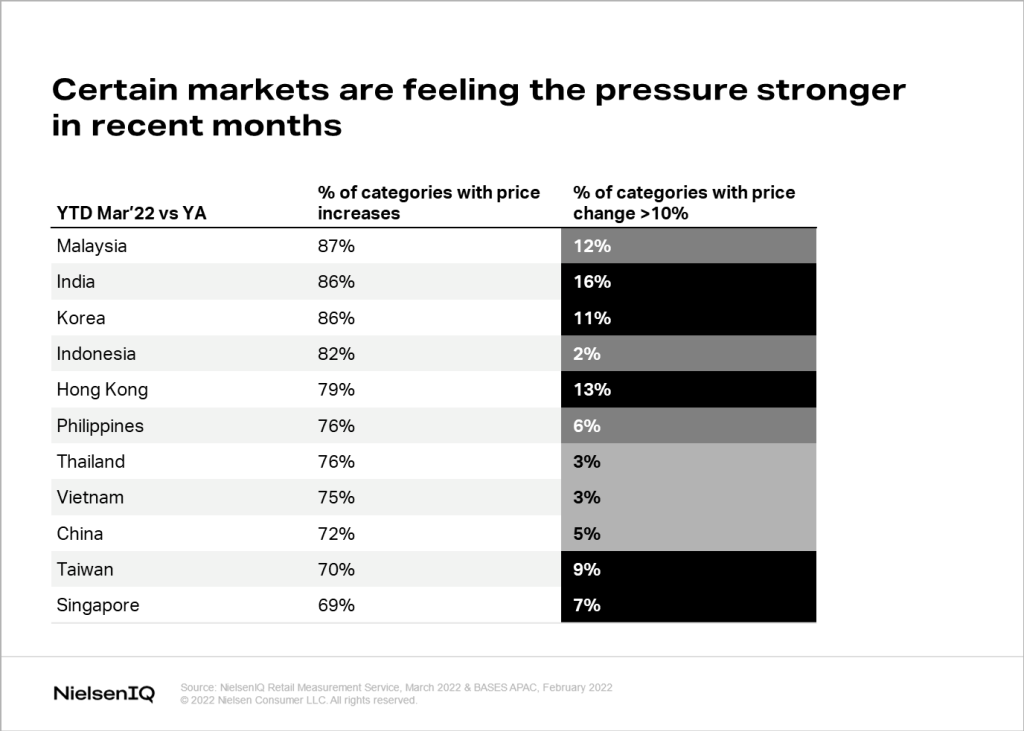

When we look at the effects of inflation across markets, we see differing levels of price increases, with some markets feeling more pressure than others. For example, in Malaysia, India, Korea, and Indonesia, over 80% of categories increased their prices, with many categories raising their prices by more than 10%.

Step 2: Understand the category’s price promotion landscape

In Asia Pacific, where shoppers are still considered strongly discount-driven, over 37% of sales in 2021 resulted from a price promotion. However, 52% of these sales would have happened anyway even without the use of a discount, rendering the pricing promotion irrelevant or a waste.

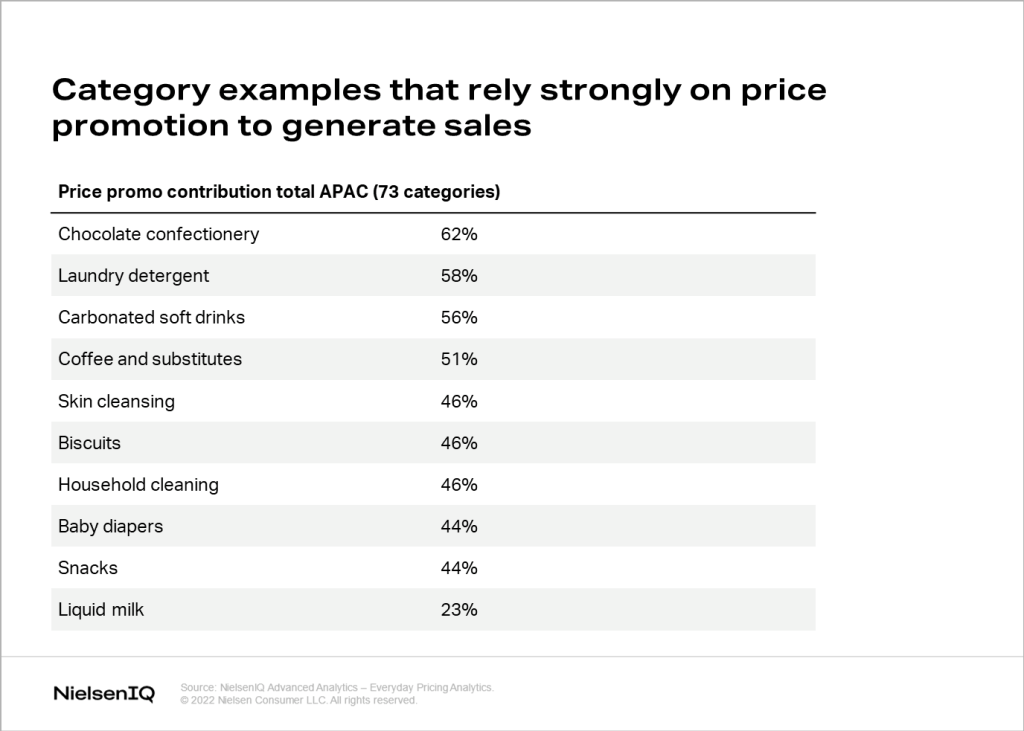

As inflation has caused consumers to seek better deals and discounts, manufacturers need to understand how to set their promotions correctly and efficiently in order to maximize their sales opportunity. Take, for example, the chocolate confectionary category in the table below which shows that 62% of the total sales in the Asia Pacific region involved a price promotion.

We also see that consumers within this category are very reactive to promotions and are brand disloyal, presenting an opportunity for manufacturers to apply their own competitive price promotion.

It is important to note, however, that despite a category being heavily reliant on promotions, not every brand has been able to apply promotions efficiently to optimize their ROI.

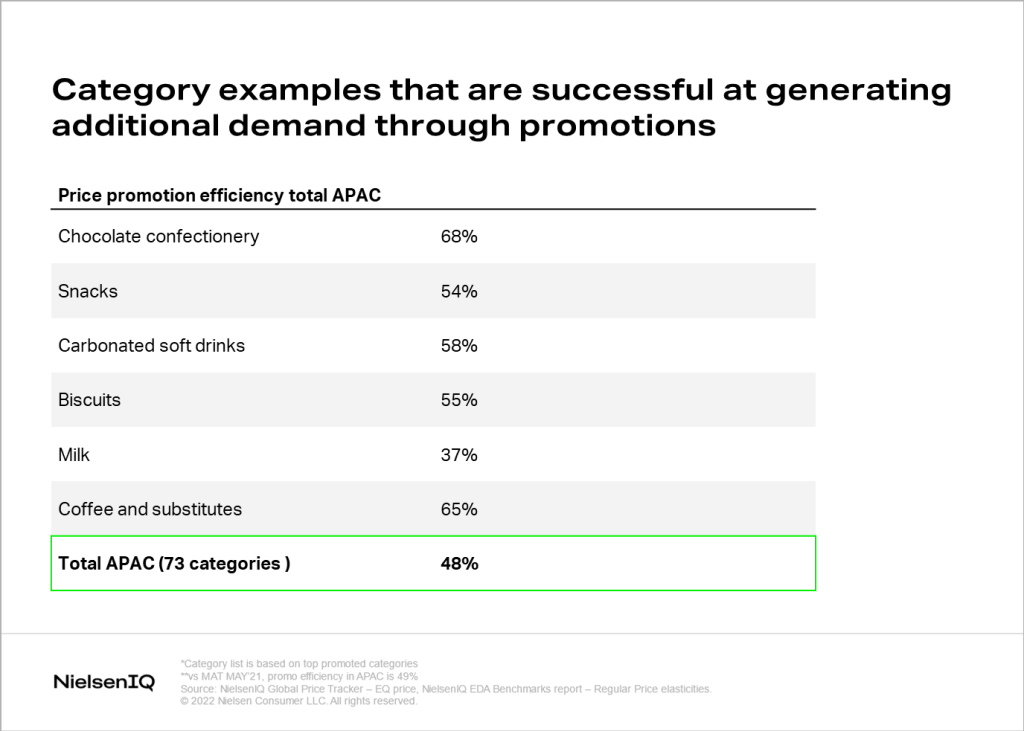

When we looked at the promo efficiency within the Asia Pacific region, we found the benchmark to be 48%. Promo efficiency is calculated based on the amount of incremental sales created from the promotional period in addition to the regular or baseline sales. Our analysis shows that only 55% of brands in the region have surpassed the promo efficiency benchmark.

We can see from the table below, for example, that the milk category is below the APAC benchmark, which indicates inefficiency in promotions.

Step 3: Always re-evaluate on potential market changes and re-adjust

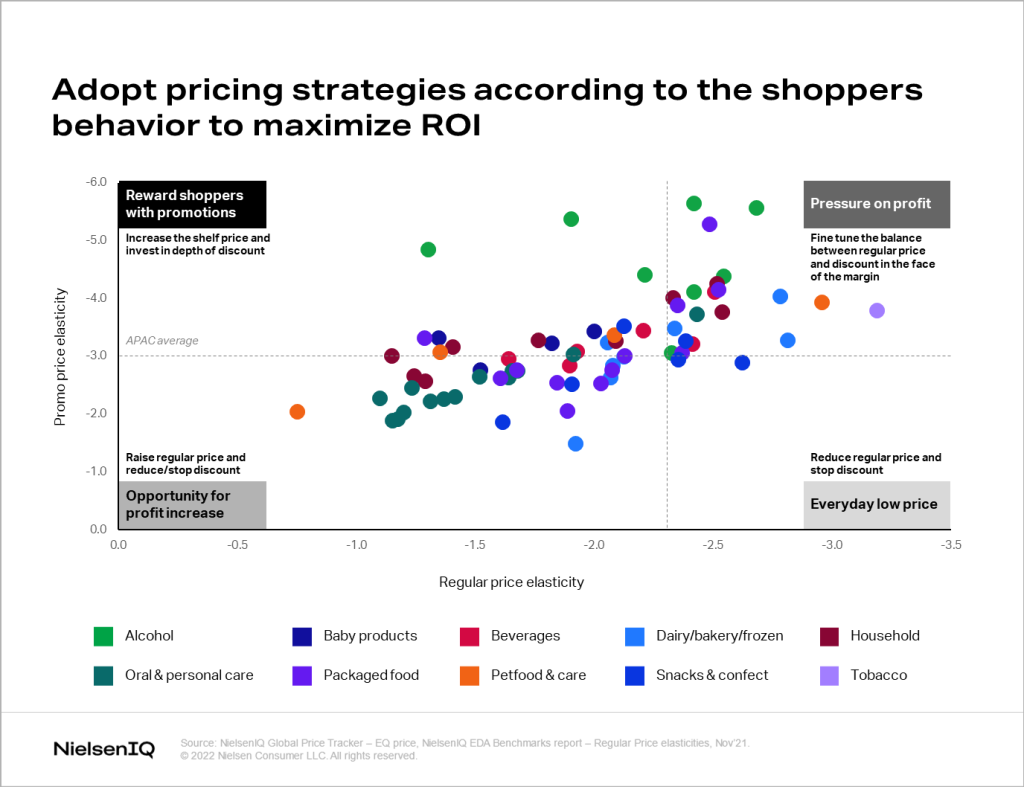

In the current market landscape, identifying the correct pricing strategy is key to maximize your ROI. Certain brands are more sensitive to price increases, while some may not be as sensitive, so a price increase on the less sensitive brands does not necessarily mean a volume loss.

The chart below highlights the price sensitivity of different categories. For example, Oral and Personal Care categories can adopt the opportunity for profit increase by increasing their regular price or reducing their discounts without negatively impacting the ROI.

In terms of Asia Pacific consumers and their reactivity to promotions, we observed that consumers have become more reactive to promotions in more than 60% of the categories. This aligns with how inflation has caused more consumers to watch their spend and seek better deals.

As inflation remains a dominant economic factor around the world, manufacturers must remain agile in facing the latest challenges. Using granular and accurate data and analysis, you can get an insight into the prevailing consumer behavior and the price sensitivity to different brands, to implement business decisions that are backed by solid information.