The ripe small brand opportunity in the U.S.

We know that manufacturers outside of the top 100 have contributed 52% of their region’s annual FMCG growth in North America, but there are specific opportunities within the United States that warrant a closer look. Though making inroads in some categories online, small and medium-sized businesses are dwarfed by large businesses in-store, according to NielsenIQ Discover, Total US Omnisales, Latest 52 weeks ended Apr. 30, 2022.

In order to understand how consumers in the U.S. view small and medium-sized businesses, it is important to identify the specific outlets that they seek these products in. According to NielsenIQ survey data, the top three outlets that show a small buying preference are street/farmers’ market vendors (38% of respondents), specialty stores (29%), and mini-markets, bodegas, and small/independent grocery stores (23%). While it should come as no surprise that small brands are sought in small retail channels, the role that these corner stores play in consumers’ lives are evolving in an interesting way.

Embracing the role of the extended pantry

Comparing NielsenIQ Omnishopper data against findings from National Retail Solutions (NRS) Insights, a US-based expert in the measurement of small-format, independent retailers, some interesting patterns emerge. Consumers in the U.S. are essentially utilizing their corner store as an extended pantry. In fact, small independent retailers are seeing 6% growth in average basket total, compared to 2.5% growth in basket size at the total U.S. level. They’re also seeing a high frequency of store visits, logging a visit an average of 3.8 times per week. The categories of products being shopped in these smaller stores reflect a broader pantry need, from soft shell tortillas to supplements, milk, and more.

“U.S. shoppers have come to think of the small-independent retail channel as natural extensions to their at-home pantries,” says Brandon Thurber, Director of Insights and Media Measurement at NRS Insights. “Often with reliable local supply networks and a unique assortment that differs from the norm, these stores are now trusted and familiar partners serving the needs of everyday American consumers.”

The corner store can revive struggling categories

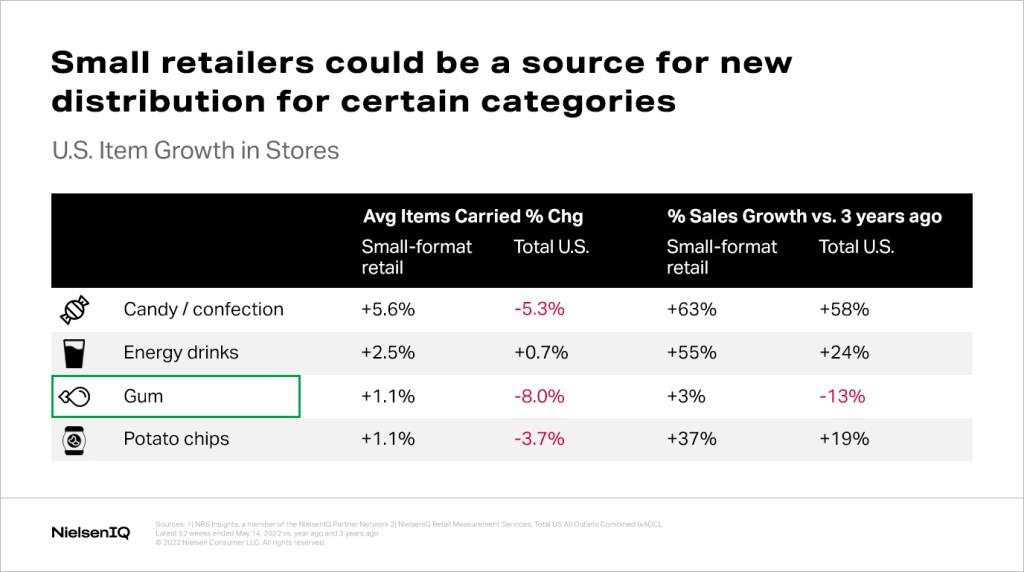

While keeping in mind the evolving ways that consumers view small retailers—and the unique products they seek when shopping there—there is reason to believe that certain categories could see a revitalized source of distribution.

For instance, gum sales in the U.S. have declined 13% over the last 3 years, resulting in companies narrowing their distribution of gum SKUs, with an average 8% reduction in items carried in major U.S. stores. In this same time span, however, the small-independent retailer space has seen a 3% increase in gum sales compared to 3 years ago, and the average number of items carried has remained steady at +1% year over year. Similar gaps in sales and offering can be found in categories like candy, energy drinks, and potato chips, which indicates that consumers arrive at the corner store with specific product needs that they don’t bring to larger retailers.

While small and medium-sized businesses may lack resources to easily lead the pace of global growth, future success lies in owning what’s different and embracing unique opportunities to drive growth. It boils down to understanding who their consumers are, how they prefer to utilize smaller shopping outlets, and what kinds of products they expect to be there when they shop. Smaller businesses have the potential to fill a profitable niche in the gaps that exist in today’s current small-independent retail marketplace.

Stay ahead by staying in the loop

Don’t miss the latest NIQ intelligence—get The IQ Brief in your inbox.

By clicking on sign up, you agree to our privacy statement and terms of use.