FMCG decline in India

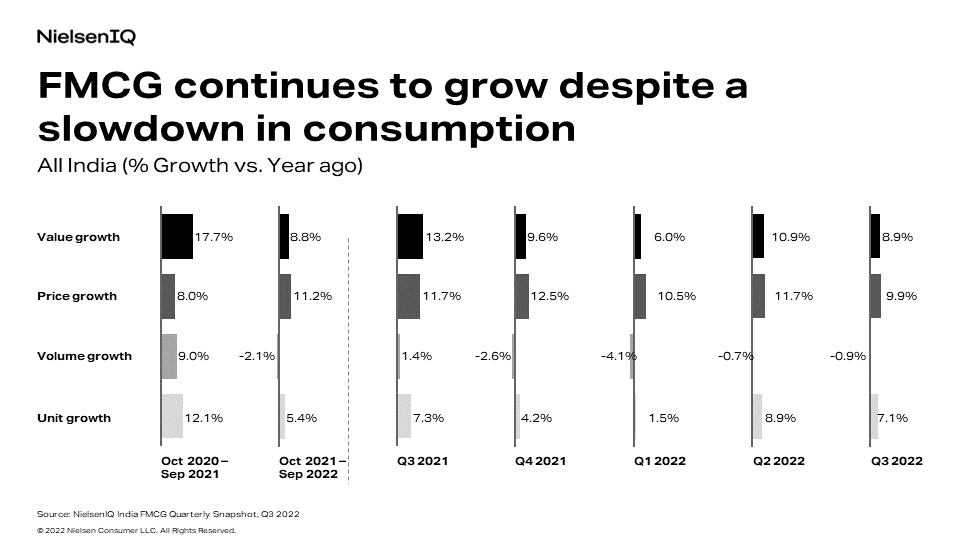

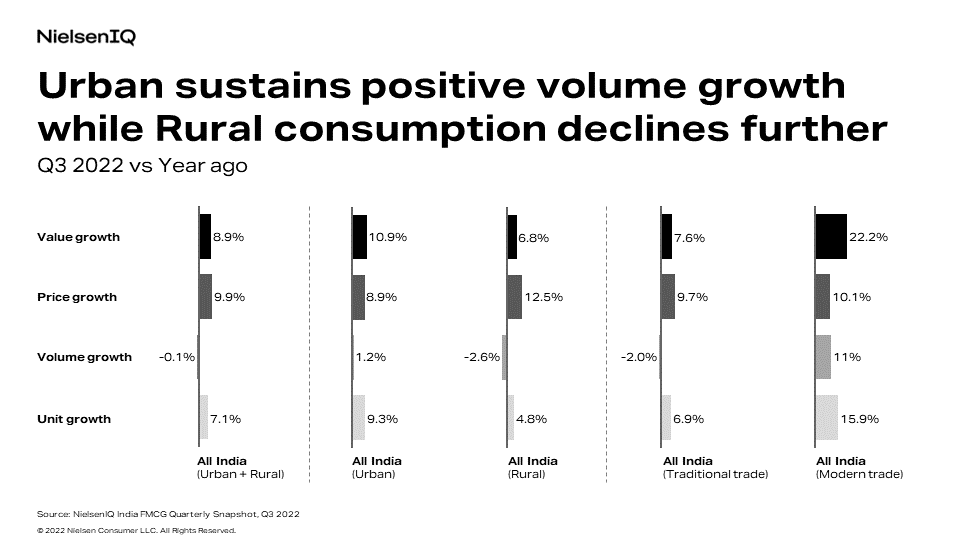

The FMCG industry in India grew by 8.9% in the third quarter of 2022—two percent lower than the previous quarter. The decline is being driven by rural markets, where consumption dropped to –3.6% in Q3 of ‘22. The consumption decline in rural markets continues to be led by double-digit price increases and lower unit growth. At the same time, urban markets are experiencing consumption growth, mainly driven by food categories, and showed a volume growth of 1.2% this quarter.

With apprehension surrounding this slowdown and continued inflation, the third quarter of 2022 experienced a slight dip in FMCG growth as consumers are staying cautious with their consumption. While markets have already opened up completely post-pandemic, volume and value sales of FMCG are above pre-covid levels (Q1 2020). However, the slow volume growth of -0.9% can be attributed to the double-digit price increase for the past six consecutive quarters.

Urban and rural consumptions vary

Overall in Q3 2022, traditional trade volume declined, while modern trade shows double digit value as well as volume growth. Pack size growth also remains negative in this quarter as consumers continue to prefer smaller pack sizes, but a slight uptrend was observed in Q3’22 compared to Q2’22 on the back of traditional channels. However, we see traction towards smaller packs in Modern Trade.

Food consumption in urban areas strengthens further

After being in the negative for the past three consecutive quarters, food categories that fall under staples, such as non-refined oil, atta, and rice, are experiencing an uptick. Impulse categories continue to show double digit growth, while edible oils has seen a sharp drop in price increases due to government tax reduction and manufacturers themselves dropping prices. This drop in price increases has resulted into volume growth for edible oils.

The food segment continues the uptick seen in the last quarter with a positive volume growth of 3.2% in Q3 2022. This growth is seen in urban markets, while rural areas see a marginal decline of -0.3%. The non-food segment on the other hand remains below pre-covid levels and deepens further with a volume decline of -6.8%, led by lower consumption in rural areas.

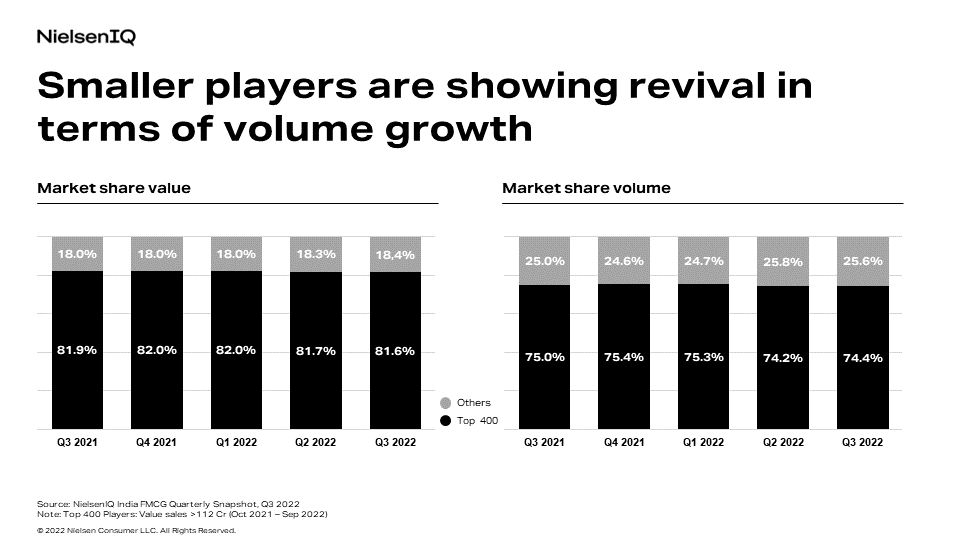

Small manufacturers are driving the consumption growth

Small manufacturers (apart from the top 400 or manufacturers with less than INR 112 crore offtake this year) are driving consumption with a positive volume growth of 0.5% in Q3 2022. This is a considerable turnaround as the growth in Q2 2022 was at -9.1%. Lower price increases by small manufacturers compared to medium/large manufacturers (Top 400 players) in Q3’22 have helped drive positive consumption growth for them. Small manufacturers are also gaining in both value and volume share over the last few quarters when looked at sequentially.

Manufacturers continue to bring new offerings to consumers in Q3 2022

Manufacturers across key FMCG categories are taking different measures to win back consumers. One of those measures is to change-up their pricing strategies to develop affordable price points for consumers.

We have also seen an increase in new product launches across key FMCG categories in Q3 2022 compared to a year ago, and most of these new product launches are in the form of new pack sizes. This could be the result of manufacturers working with smaller grammages as raw material prices are still high. While new product offerings contribute positively to consumption, assortment distribution decline are pulling down overall volumes within key FMCG categories.