The evolution of SMBs

Over the course of the last decade, countries around the world displayed a new economic attitude towards small and medium-sized businesses (SMBs), recognizing their contribution to economic growth and stability.

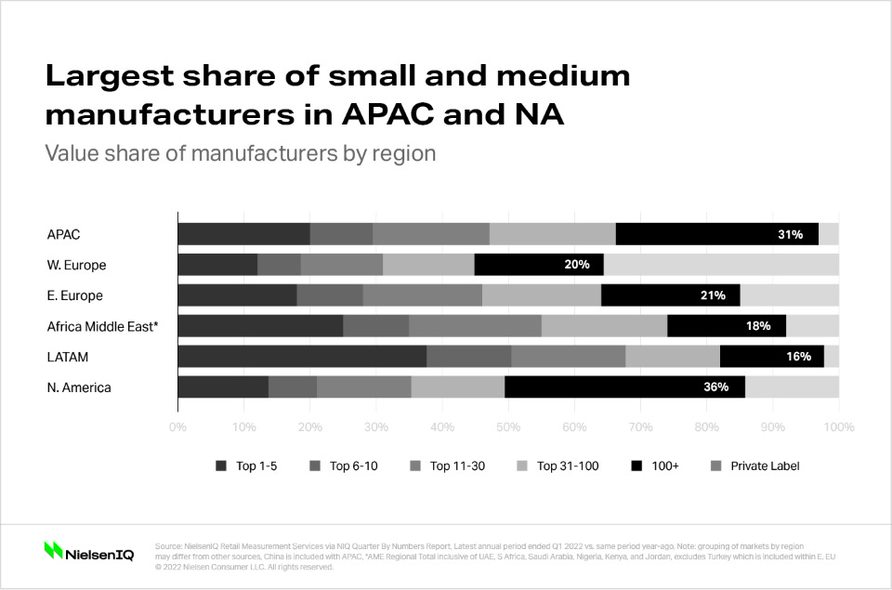

Consequently, smaller brands are taking up a growing piece of the pie, showing consistent growth across all regions.

While countries made major moves such as funding for start-ups, consumers are also showing a shift in attitude towards those brands.

Official definitions of SMBs are usually centered around the number of employees, total revenues, and contribution to GDP—but how do consumers themselves define them?

According to NielsenIQ data, among the leading traits according to global respondents are that smaller brands tend to be “local” (33%), “independent” (31%), and “unfamiliar” (27%). Large brands, on the other hand, are viewed as “very popular, recognizable, or world-renowned” by 46% of those surveyed.

These distinctions form a very compelling baseline for brand perception, where small and medium-sized businesses can strive to hone and create demand for their strengths as new, different, or locally affiliated options for consumer interest.

A quick look at SMBs in the E.U.

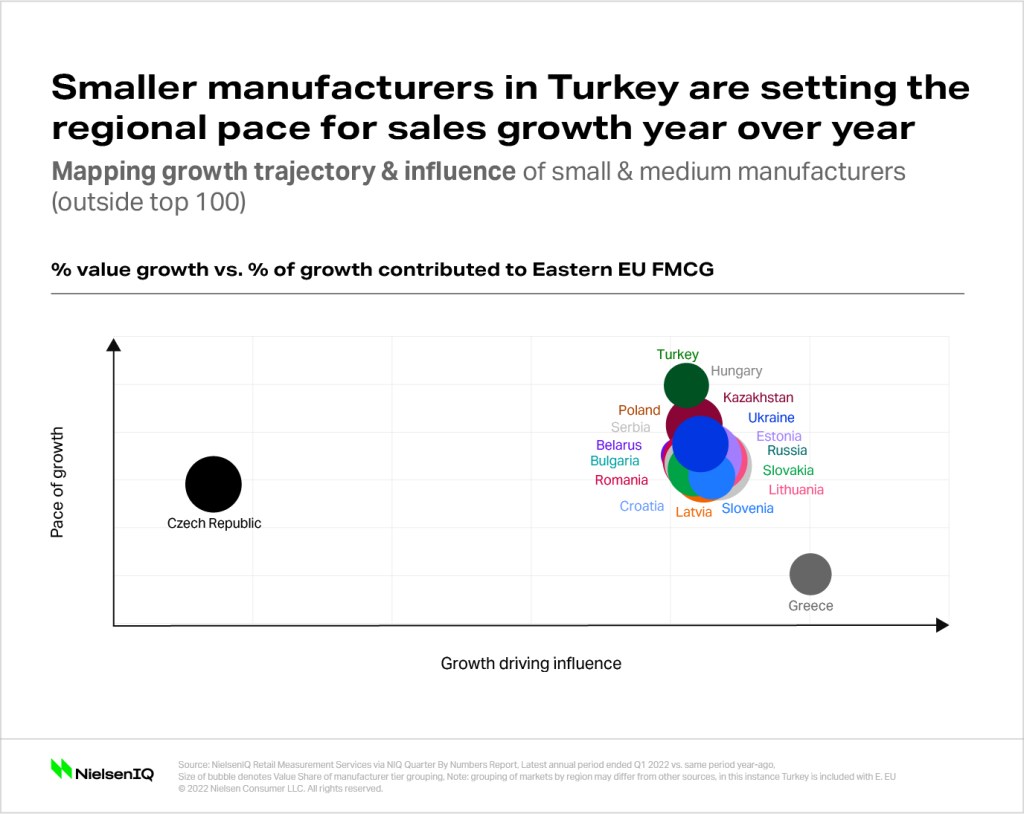

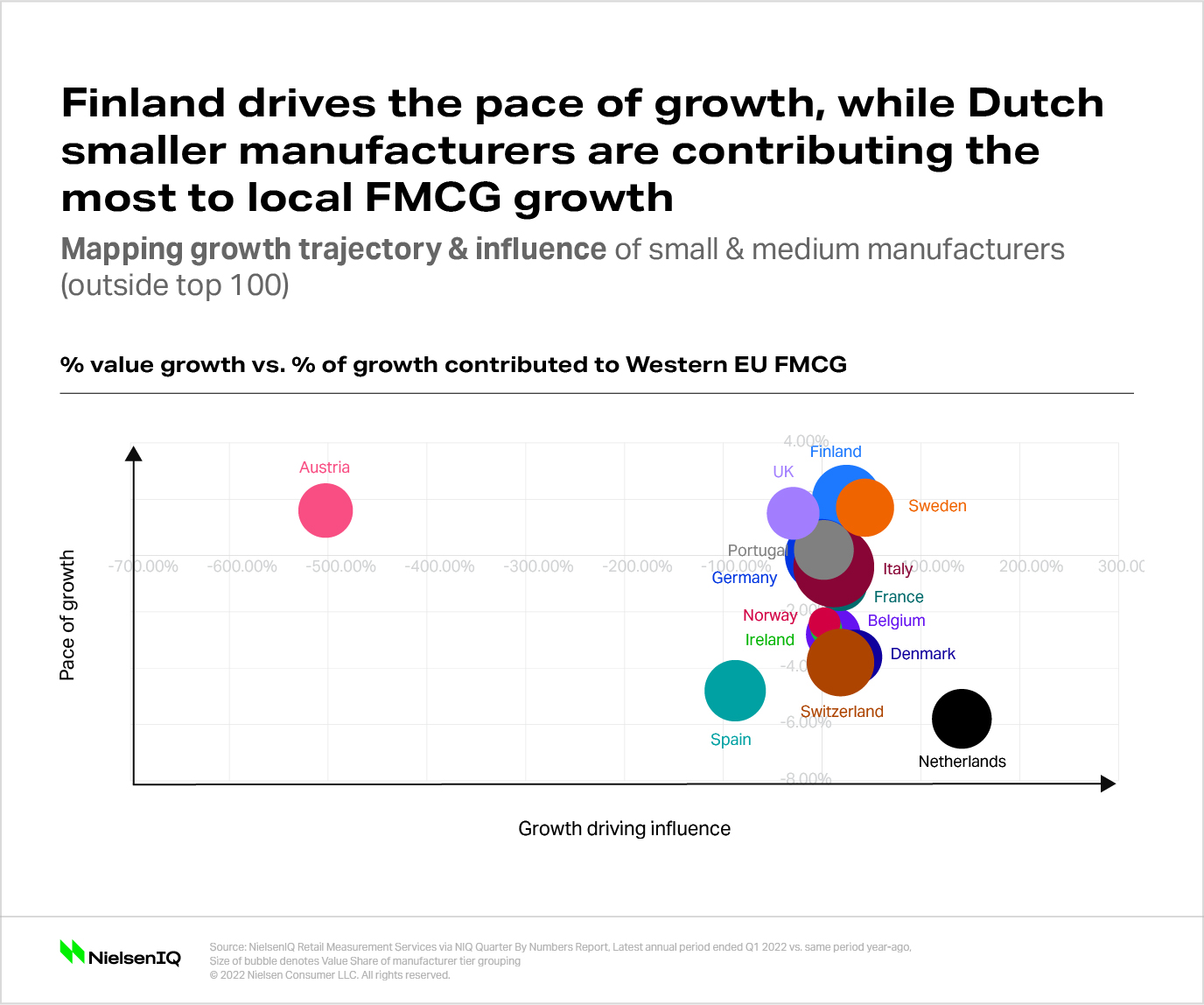

SMBs in the European Union take up a relatively average share of the market in comparison to other regions, with the Eastern region growing at a faster pace.

Further investigation into the region shows that most markets, with only minor exceptions, are close in both pace and influence. Turkey is growing exceptionally faster than the rest of the markets, while Greece takes the lead in terms of influencing growth for the FMCG market.

Consumers evolve toward smaller brands

The pandemic shifted consumer buying dynamics in more ways than one, and a preference toward smaller brands (versus well-known and popular brands) was one of them.

NielsenIQ’s global study, the 2022 Brand Balancing Act*, shows that more than half of the respondents in the E.U. (57%) have started buying a greater variety of brands across multiple categories.

By all current measures, consumers in France seem to be the readiest to embrace smaller brand consumption in comparison to the rest of the Western region. 61% of respondents said they prefer to buy locally made products from small businesses in their area. That sentiment is closely followed by Spain, with 59% of respondents claiming the same. Moreover, 55% of the respondents in France feel that small brands are more authentic and trustworthy than big brands; while respondents in Spain largely agreed at 53%.

In terms of pricing, however, it is important to note that the general perception across E.U. markets is that smaller brands are not as cost-efficient. That in itself could be a major barrier in purchasing decisions, especially with inflation being a primary deciding factor for many consumers currently.

What’s next for SMBs?

Market and consumer indicators show signs of an indisputable fact: the future belongs to SMBs. There are three pillars of success for you as a small business owner:

- Get others to believe your vision by highlighting growth potential and opportunities

- Understand your consumer

- Stay agile with the market changes

It is critical for entrepreneurs and key decision makers for small manufacturers to stay connected to the most accurate and up-to-date information. Be sure to take the necessary steps to ensure you are keeping up with the ever-changing SMB landscape.

*The NielsenIQ global study, the 2022 Brand Balancing Act, shines a light on core facets of brand choice with a particular focus on how consumers perceive and prioritize smaller brands. The results of this global data investigation have formed the backbone of a simple and essential framework to guide the strategy of small and medium-sized businesses in 2022 and beyond.