Inflation continues to fuel potential consumer recession

In early October, the U.S. government released the Consumer Price Index (CPI) for September. The report showed inflation was at 8.2%, an increase of 0.4% from August, which itself saw a 0.1% increase.

This is a worrying trend. Despite a drop in gas prices, inflation continues to stick for essentials like consumer package goods. With these essentials at high prices, pressure will continue to be put on consumer spending, pushing the U.S. and Canada ever closer to a consumer recession.

What is a consumer recession?

A consumer recession is when the core habits of traditional consumption have shifted, forcing shoppers to behave as though a recession is already here. They consume less, shift their spending to value retailers and brands, and buy more products on promotion. The degree of the overall shift will gauge whether we are in a consumer recession, where 100% denotes a full consumer recession.

U.S. moving closer to a consumer recession

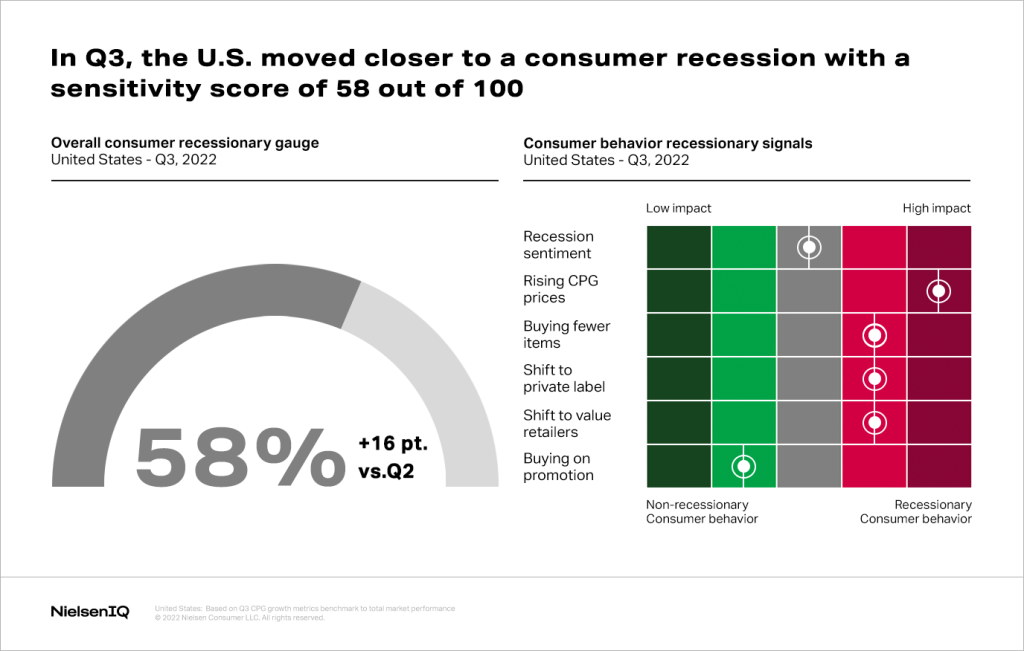

NielsenIQ’s latest Q3 release of our consumer recession scorecard shows that the U.S. is moving closer to consumer recession with a score of 58%—an increase of 16 points from Q2.

67% of Americans think we are currently in a recession, up from 53% in Q2. Importantly, 52% of consumers surveyed think the pending recession will last well beyond the next year. This could point to consumers continuing to exhibit cautious spending behavior, leaving brands and retailers to deal with many of the same issues they are facing now.

We also saw a 12% increase in prices during Q3, which is a record high for CPG. For comparison, during the 08/09 recession, prices were up by 5%.

Here’s some good news: monthly increases have stabilized. After seeing a rate of +12.0% in August and only +12.1% in September, it’s possible we may have reached the peak.

The Impact

Rising CPG prices account for an additional +$705 per household in the last year.

Canada remains close to a consumer recession

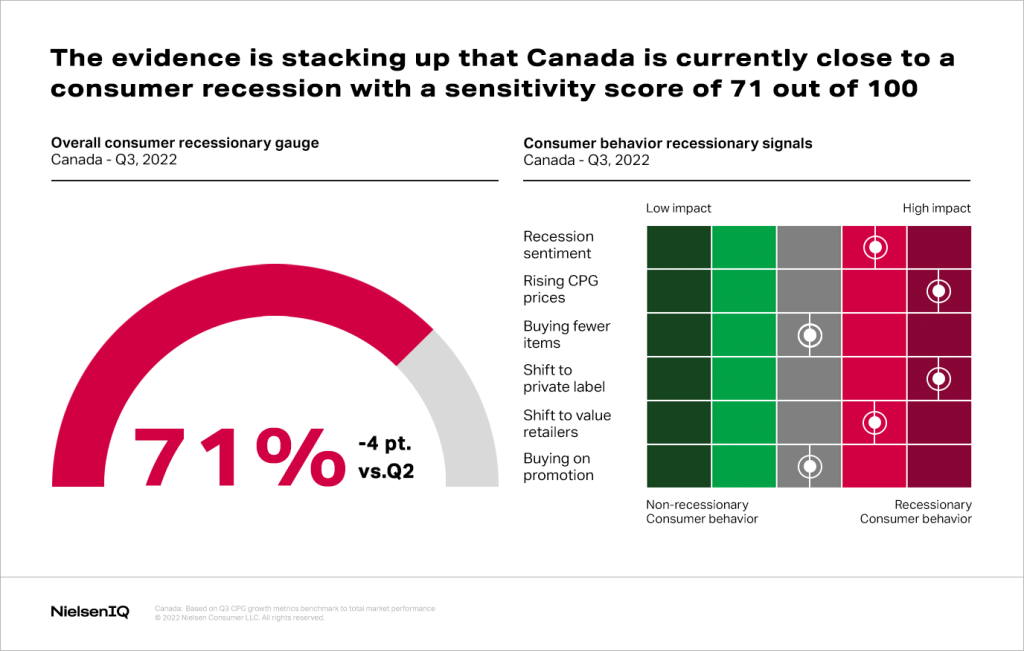

Meanwhile, in Canada, the country remains perilously close to a consumer recession.

Though the overall consumer recession score did drop from 75% to 71%, this is not necessarily a sign that trends are reversing.

Consider the following:

- 61% of Canadians feel Canada is already in a recession, an increase of +7 points versus the previous quarter

- CPG dollar sales increased significantly, fueled exclusively by higher prices, reaching 10% record inflation in Q3

- Private label sales continue to outperform national brand sales as consumers seek lower prices

In response to high prices and the switch to private-label goods, some retailers in Canada have announced that they have capped prices of their private-label goods until January of next year. Unfortunately for consumers, these prices are capped at what is currently an all-time high, but any relief from future increases is still a benefit.

Private label is at an all-time high

Private Label, which on average provides 14% savings versus other brands, has set a new report share, now accounting for 19% of CPG sales in the U.S.

We have seen that as prices rise, so does the growth of private-label goods, which reported an increase of +13% in September. With more consumers shifting their spending habits, brands will need to differentiate and continue to innovate in order to win back the consumer wallet.

Not everyone is impacted similarly

It is important to keep in mind that inflationary pressures do not affect everyone the same.

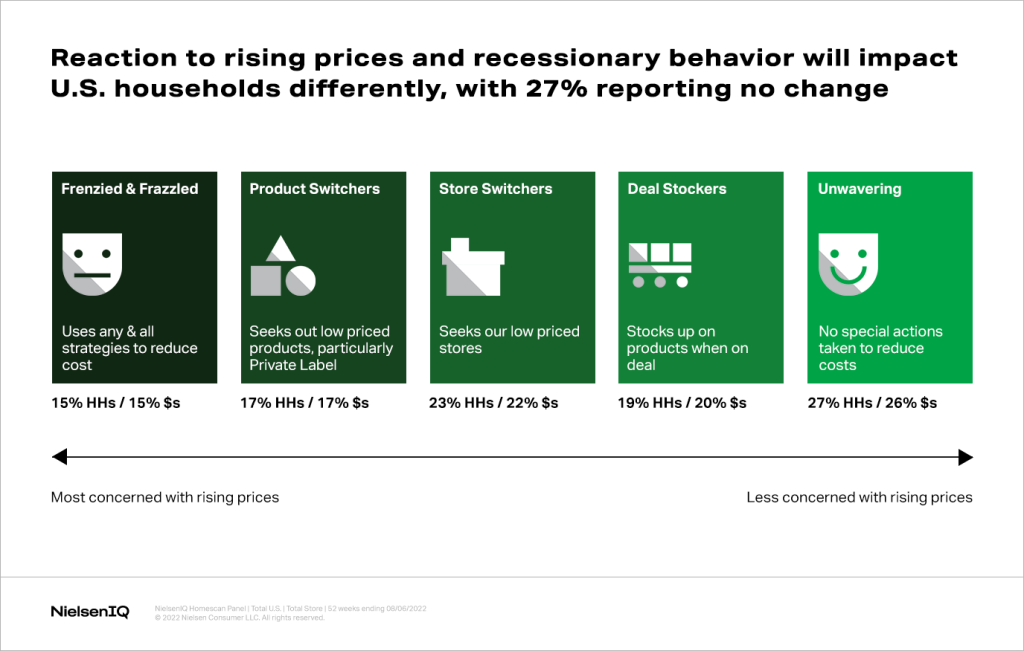

To better quantify the impact inflation is having on consumers, NielsenIQ survey data facilitated the creation of five U.S. consumer segments based off their spending habits.

As the chart notes above, 27% of consumers, the ` segment, are not changing any of their spending behavior due to inflation. These individuals shop at the same stores and make all the same purchases they did before inflation.

The remaining 73% of consumers represented by these remaining four segments are looking to save, they just have different approaches.

Deal Stockers will stock up on products when they are on promotion, which is probably not happening to their liking as the industry has cut back on promotions by 4%. Even when promotions are offered, prices have also jumped by +4% with the average discount of 12% versus 15% a year ago. As this trend continues, consumers can expect to pay a bit more for that item on sale and find it less often. The lesson? When you see the deal, take advantage of it.

Store Switchers will eschew their typical shopping habits, instead searching out the lowest priced retailer. In September, value-based retailers’ sales jumped +11%, capturing 41.6% of CPG sales.

Product Switchers will pivot away from their traditional favorite brands, instead oftentimes focusing on the previously mentioned private label goods.

And finally, the Frenzied and Frazzled segment is the most affected by inflation and will use any means—switching stores, products, buying private label, couponing, etc.—to save money.

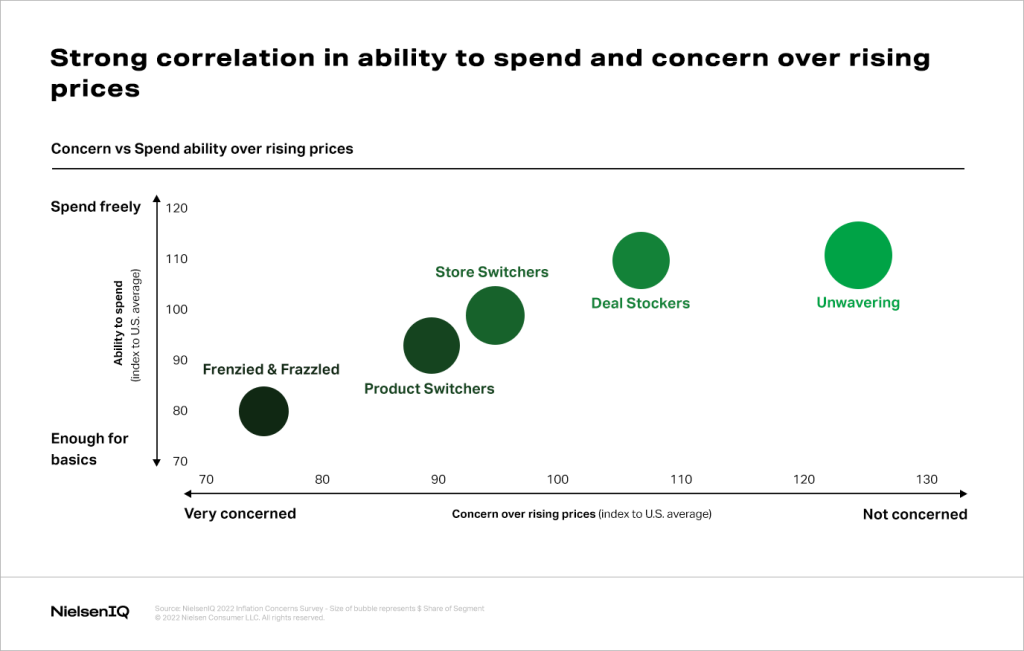

The chart below shows the correlation between the ability to spend and concern over rising prices.

Consumer recession and the holiday season

One direct way we could see inflation impact the holiday season in the U.S. and Canada is on the holiday dining table.

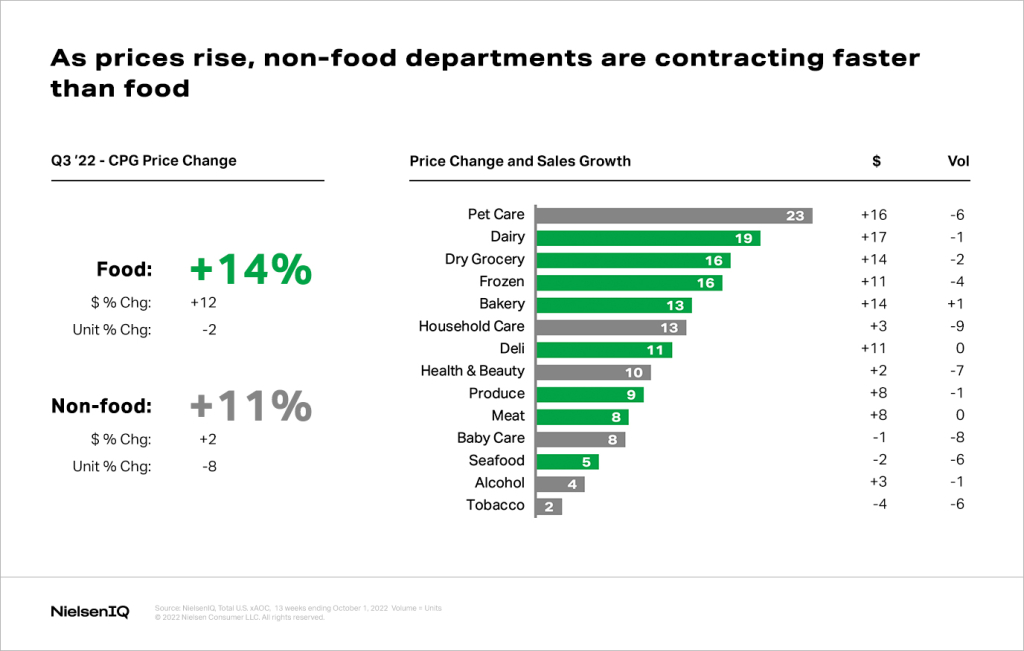

Inflation is hitting all areas of the grocery store, primarily driven by the food department. Q3 saw the following increases in the U.S.:

Food inflation continues to outpace non-food, though there is much less of a drop-off in unit sales. Again, food is an essential we cannot skimp on.

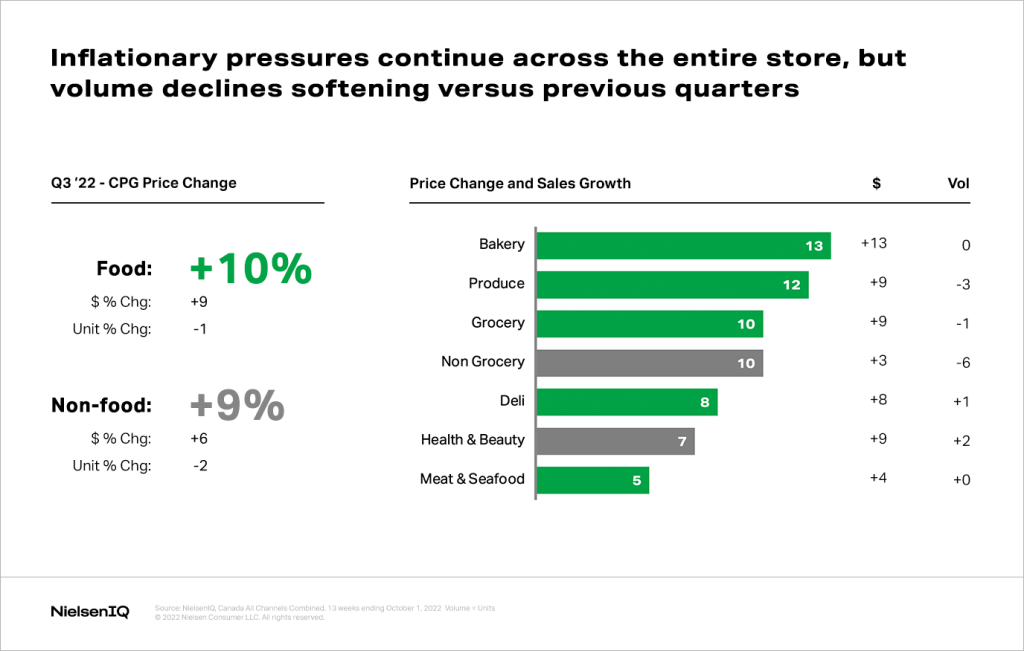

The difference is less stark in Canada but still notable:

Where we could see this impacting holiday shopping is people focusing on cheaper alternatives—chicken instead of turkey for American Thanksgiving or just a turkey breast, for example. The increase in Bakery in both countries will impact everything from desserts to items like rolls.

Consumption continues to decline

CPG sales growth continues to be fueled by rising prices as consumption declines. Consumers may be spending more, but they are putting fewer items in their shopping basket. September reported a 9% lift in dollar sales, whereas unit consumption dropped -3%.

Declining consumption is a concern as consumers focus their spending on essentials like food. We can expect ongoing pressure on non-food sales as consumers cut back on discretionary spending and focus on essentials.

With Canadian and American consumers both believing the recession will last longer than 12 months, retailers and manufacturers should brace for impact.

![Understanding your audience: The power of segmentation in retail [podcast]](https://nielseniq.com/wp-content/uploads/sites/4/2025/07/Podcast-Understanding_your_audience-The_power_of_segmentation_in_retail-mirrored.jpg?w=1024)