Consistent top concern: Physical health

Recent years have witnessed a remarkable surge in the demand for over-the-counter medicines among Filipino consumers. Notably, the COVID-19 pandemic intensified this trend, with consumers turning to self-medication and preventive care. OTC mineral and vitamin supplements, which are viewed as essential for bolstering immunity, became a staple.

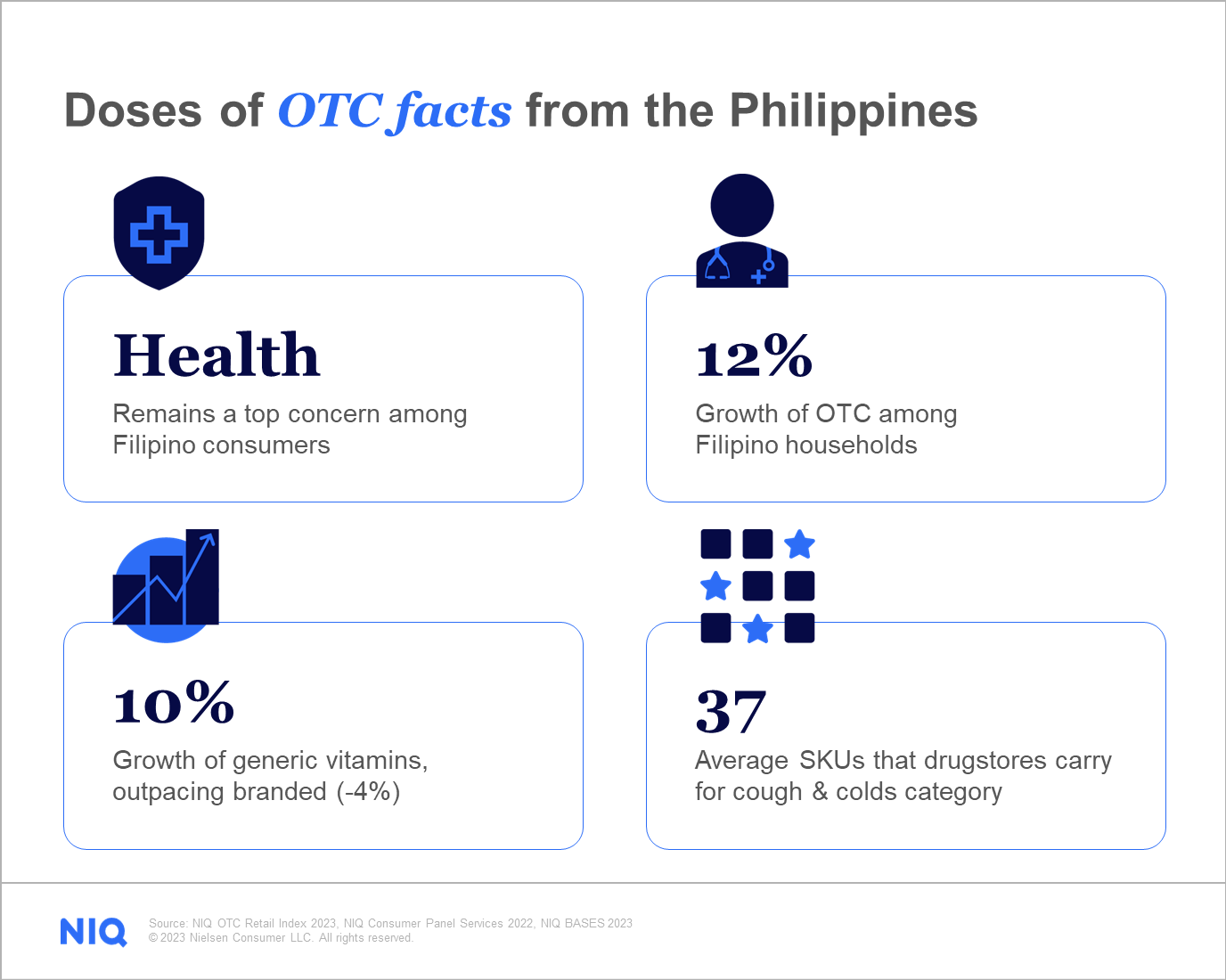

While consumers have now moved on to new concerns, such as rising prices and the cost of living, physical health continues to be a top priority among Filipinos. OTC products empower consumers to address their daily healthcare needs, aligning with the growing trend of self-medication.

Affordable solutions in prudent times

In a climate of economic caution due to a prolonged period of inflation, OTC medicines have emerged as a pocket-friendly choice for Filipino consumers seeking to manage their health without incurring exorbitant costs. The pursuit for affordable medicines is more obvious upon further analysis of retail sales data in the second quarter of 2023, where the NielsenIQ OTC Retail Index reveals a significant 10% growth in generic OTC brands, while branded alternatives experience a 4% decline compared to the first quarter of the year.

The surge in demand

The upswing in demand for OTC medicine mirrors the commitment of Filipino consumers to their physical well-being. OTC items have soared by 12% among Filipino households, with vitamins leading the way with a remarkable 40% growth in 2022. This surge has reshaped the retail landscape, as OTC products now command a significant portion, accounting for half of the combined sales of fast-moving consumer goods (FMCG) and OTC items in the country’s drugstores.

Key retail channels and consumer dynamics

Unquestionably, drugstores and pharmacies have taken the lead in the Philippines as distribution channels of OTC medicines. These retail channels play a pivotal role in making OTC medications accessible throughout the archipelago.

Approximately 40% of drugstore shoppers arrive with a clear understanding of the OTC product they’re looking for, emphasizing the importance of efficient store layouts. Surprisingly, 60% of shoppers are willing to switch from one store to another in search of their preferred OTC brand, underscoring the significance of ensuring product availability.

Competing in the growing OTC industry

As the OTC medicine industry continues to flourish, manufacturers and retailers need to harness a deep understanding of consumer behavior and the power of comprehensive retail data. Acting as a strategic compass, retail data empowers manufacturers and retailers to evaluate product performance, stay informed about market trends, analyze competitive landscapes and pricing strategies, and identify emerging market segments within the OTC category for strategic adjustments.

Grow your business with comprehensive OTC retail data

Unleash the power of trusted NIQ data to help you identify opportunities, make better strategic decisions, and drive growth within the OTC medicine industry. Book a meeting with us to learn more.