After strong momentum during Covid, online sales continue to grow

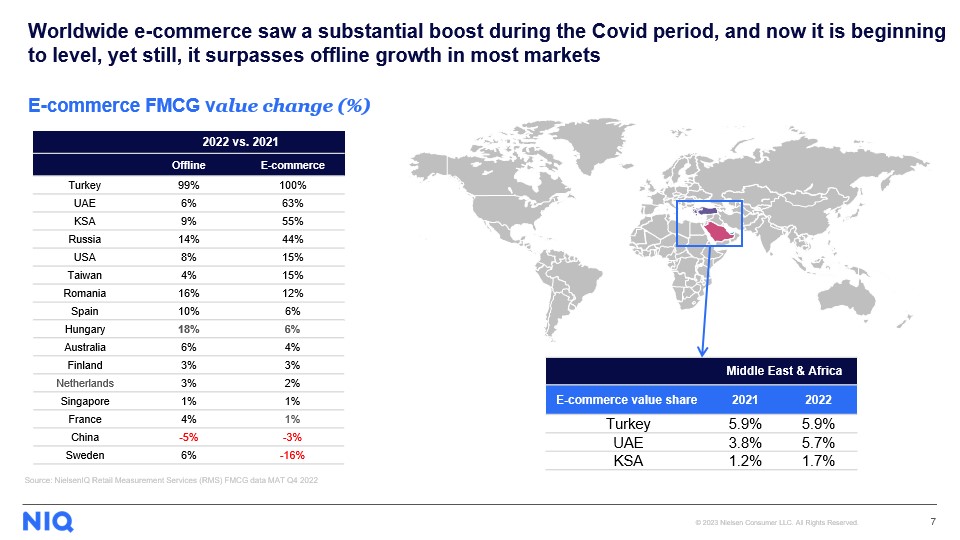

Şekerel Erdoğan pointed out that FMCG online sales continued to grow with some normalization in 2022 after gaining strong momentum during COVID-19 in 2020 and 2021. Continuing, Şekerel Erdoğan said, “Comparing FMCG e-commerce sales with offline sales, we see that e-commerce growth is still ahead in many markets. However, we see that the growth gap of previous years has narrowed and that the growth of e-commerce has lagged behind in some developed markets such as China and France. This shows us that e-commerce growth is normalizing around the world.”

The Middle East: Leader in growth performance

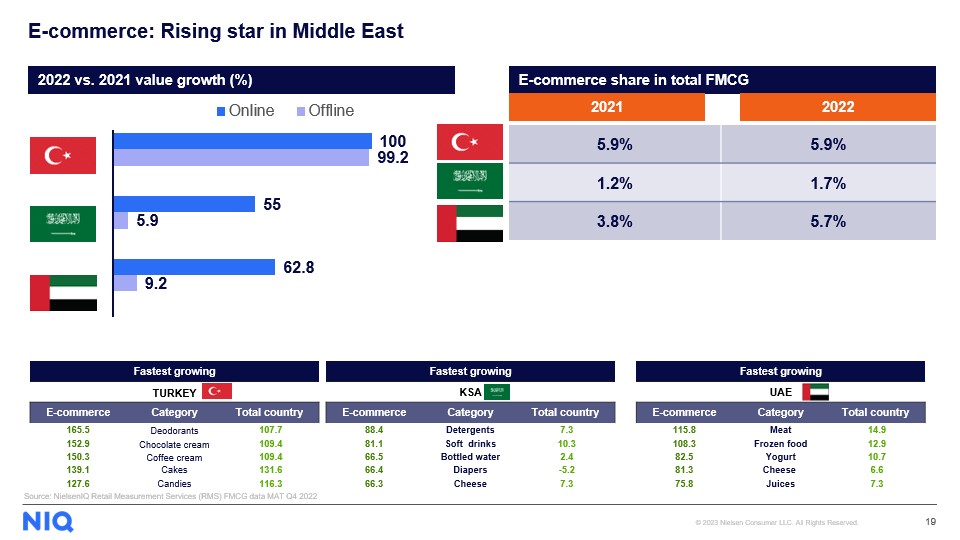

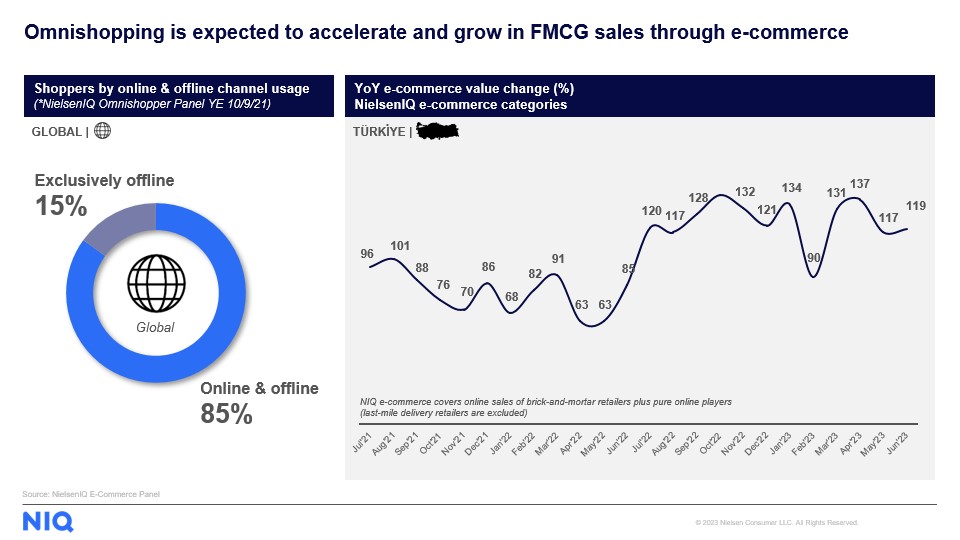

Turan Konu, NielsenIQ Retailer Services of the Middle East and Africa E-Commerce Director, noted that Turkey and the Middle East markets stand out in growth. Konu said, “E-Commerce’s accelerated growth in recent years in Turkey is maintained in 2022, as well. When we look at the United Arab Emirates (UAE) and Saudi Arabian (KSA) markets, which are still developing in terms of e-commerce, we see a very strong growth performance compared to offline. These 3 markets stand out globally. For those countries, the food categories stand out among the most growing groups in e-commerce, which means that the shoppers are gaining more and more omnichannel habits.”

Price advantage, product variety, and time-saving

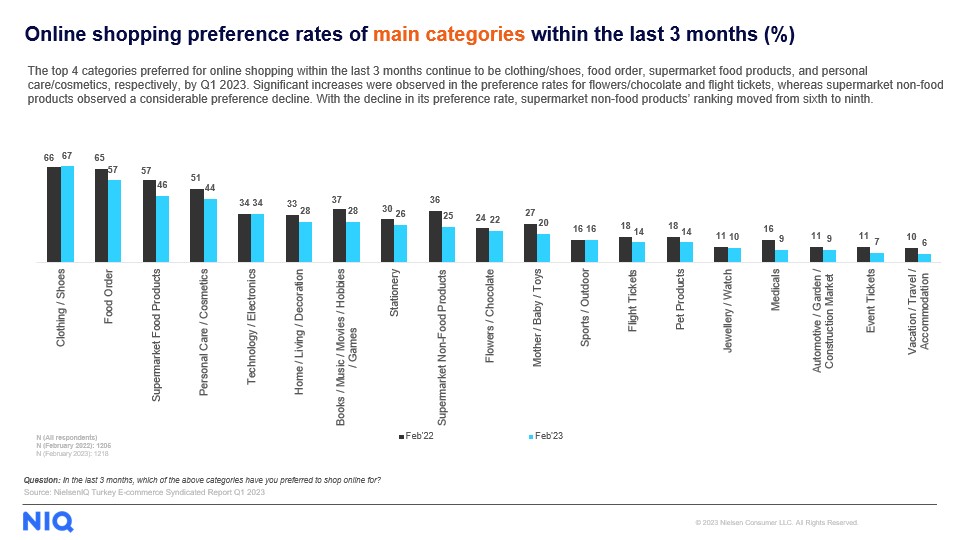

Şekerel Erdoğan emphasized that Turkish online shoppers tend to shop online mainly with the motivations of price advantage, product variety, and time-saving. She also pointed out that more than a third of online shoppers order from the categories of supermarket food products, food ordering, clothing/shoes, and personal care/cosmetics.

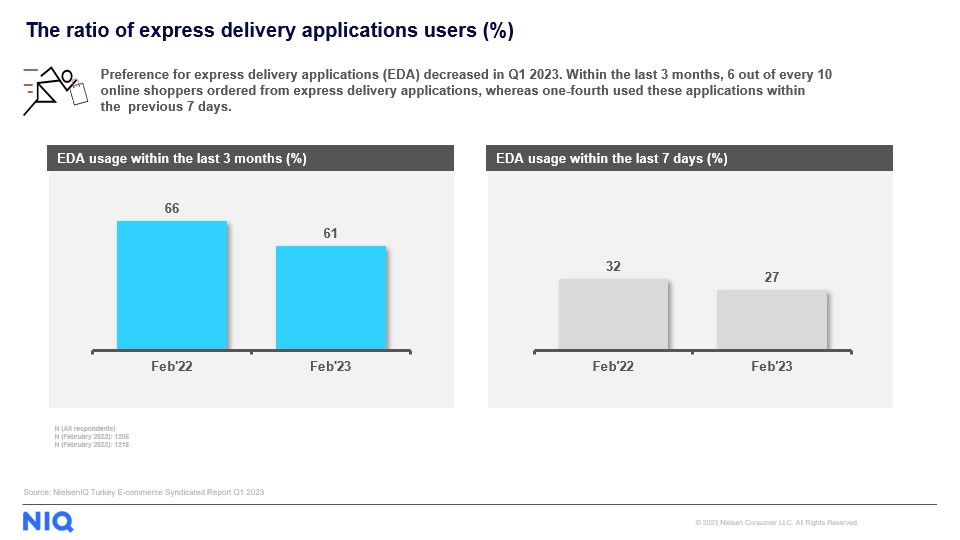

Continuing with the same study’s results, Şekerel Erdoğan also noted that there was a decrease in the use of fast delivery applications compared to the previous year.

FMCG’s e-commerce performance in Turkey

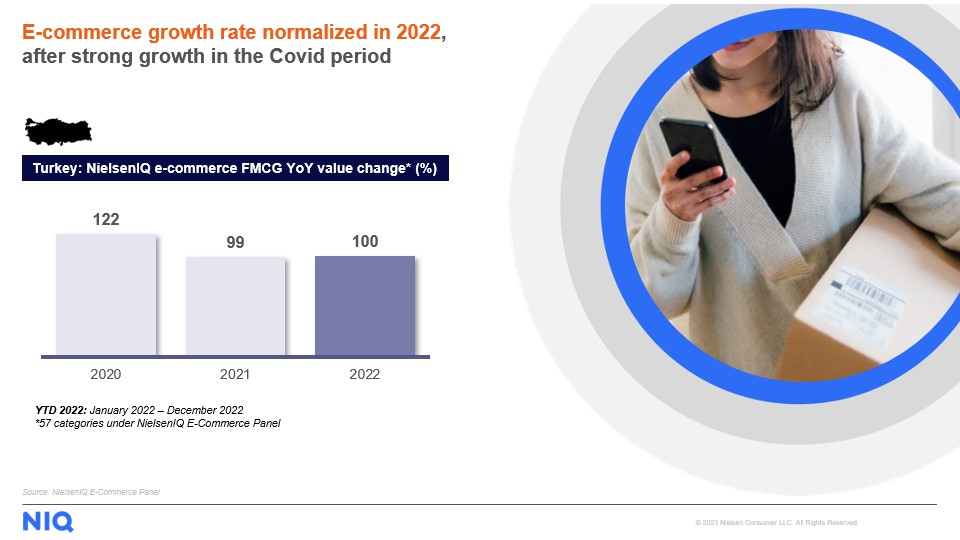

Evaluating the online performance of FMCG products in Turkey, Yankı Yalçın, NielsenIQ Turkey Client Services and E-Commerce Director, shared that e-commerce increased its weight in the total FMCG by recording strong growth throughout the world during the pandemic period and that this rate normalized in 2022, which is called the New Normal period.

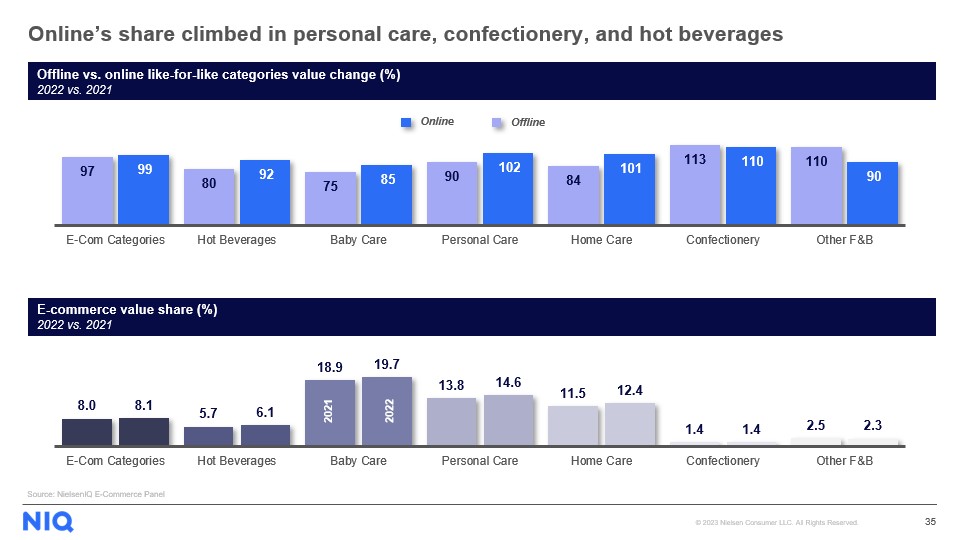

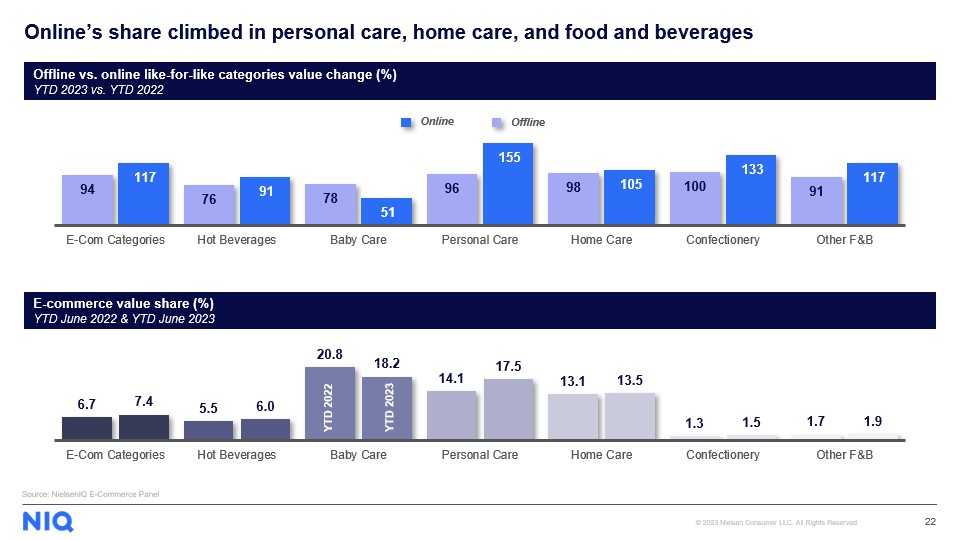

Yalçın underlined that the food, especially the confectionery group, came to the fore in both online and offline growth performance. Yalçın said, “When we look at the groups where online has higher performance, the leading groups are especially hot beverages, baby care products, personal care, and home care.”

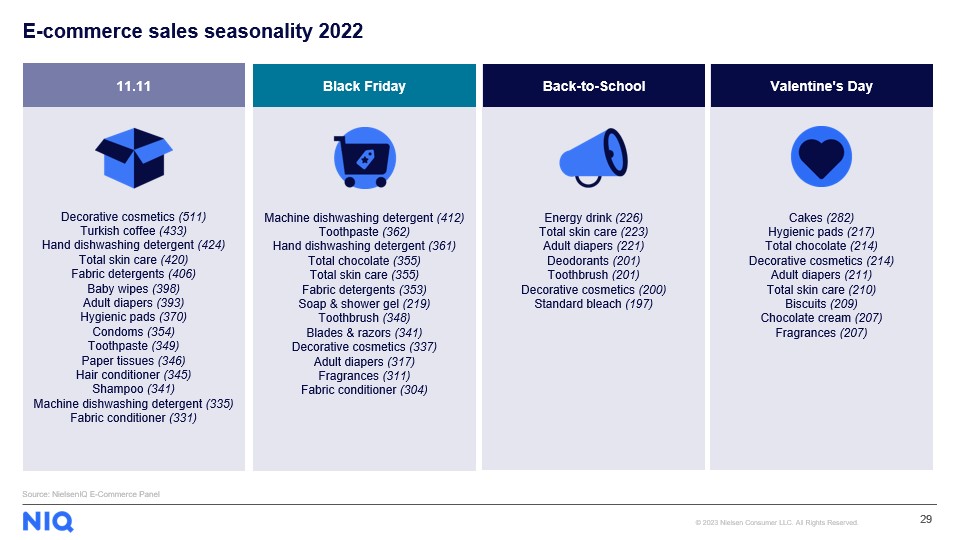

Seasonality is critical in e-commerce

Stating that e-commerce achieved a 100% turnover growth in 2022 despite its strong base in 2021, Şekerel Erdoğan noted the importance of increasing omnichannel shopping habits in this performance. Sharing the global study results, Şekerel Erdoğan noted that 85% of shoppers worldwide prefer omnichannel shopping, which is growing daily in Turkey.

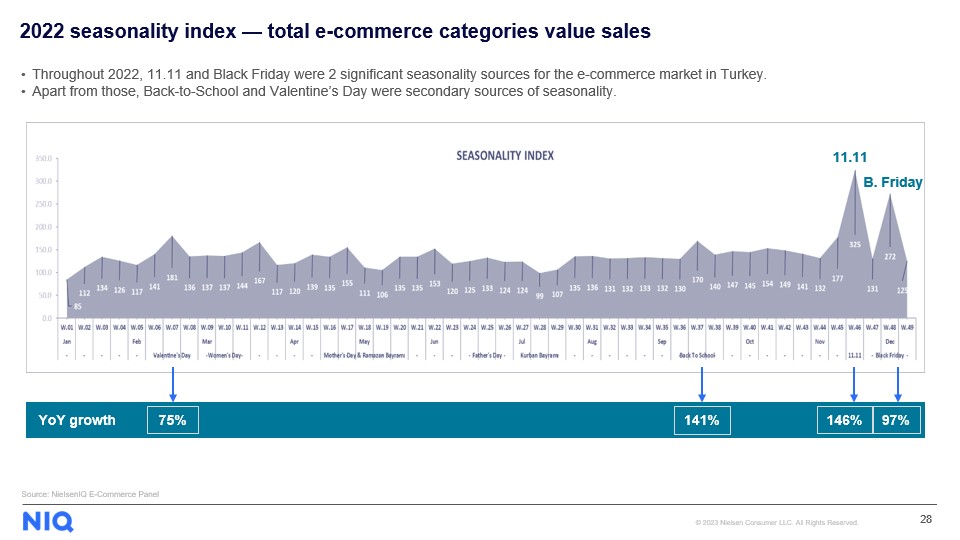

Emphasizing that Turkey’s FMCG e-commerce growth has gained momentum, especially in recent months, Şekerel Erdoğan pointed out that according to the results of the NielsenIQ Turkey E-Commerce Panel, e-commerce sales accelerated, especially during the seasonal and retail holidays of Valentine’s Day, Back-to-School, 11.11, and Black Friday. She mentioned that correctly understanding these occasions is critical for retailers and manufacturers.

Noting that each period has different category dynamics, Şekerel Erdoğan shared that the top 5 best-selling categories in 11.11, where the most substantial seasonality was experienced, were decorative cosmetics, Turkish coffee, hand dishwashing detergents, skin care products, and fabric detergents.

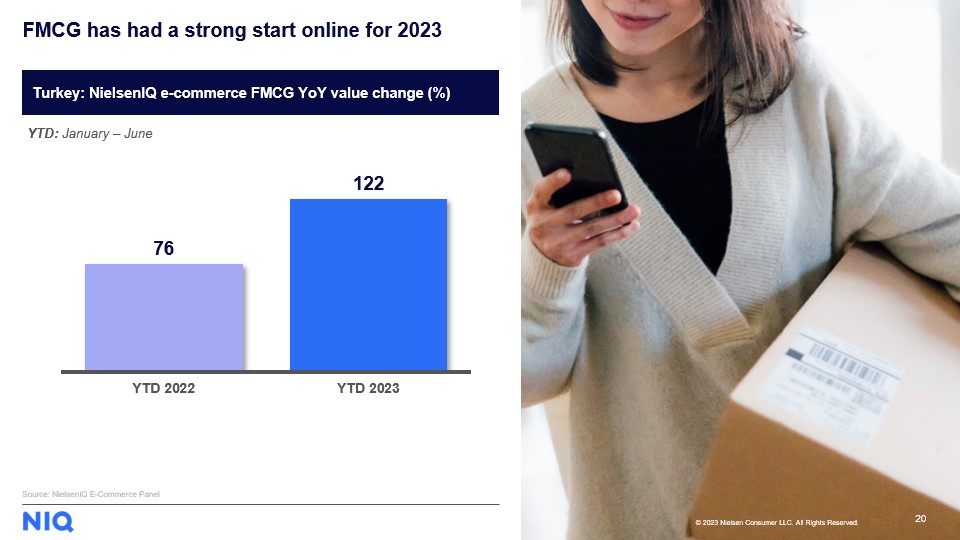

E-commerce made a strong start in 2023

Yalçın, who shared the 2023 first-half results of e-commerce in Turkey, mentioned that the strong performance seen in 2022 continues in 2023, and the value sales grew by 122% compared to the previous year.

Looking at the components of this strong growth in the first quarter of 2023, Yalçın emphasized that online growth surpassed offline, especially in personal care, home care, and food and beverages groups, and the overall online share in total FMCG increased.

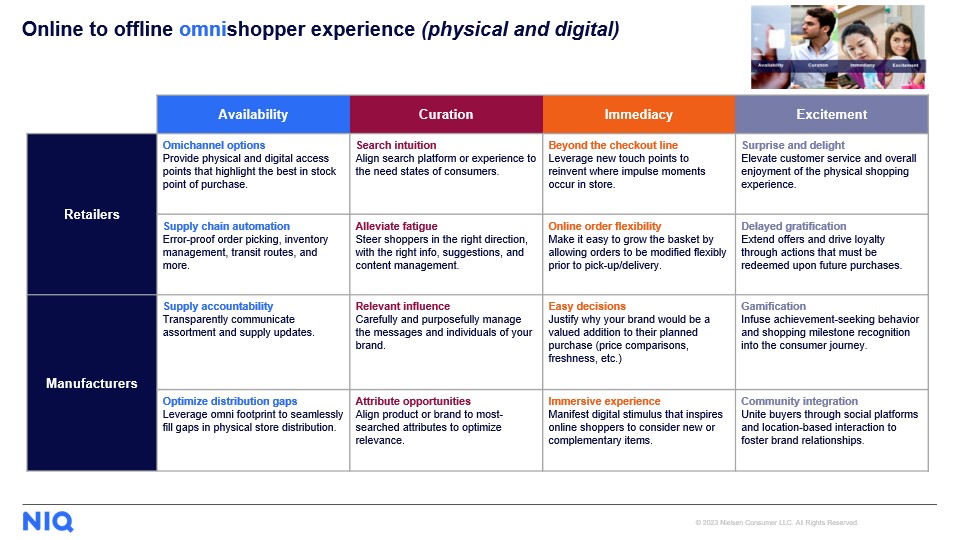

Four dimensions of the omnichannel shopper experience

Şekerel Erdoğan shared that from a global perspective, manufacturers and retailers have space to improve the online shopper experience further. Şekerel Erdoğan added, “We observe 4 main axes to explore: availability, curation, immediacy, and excitement.”

Stating that availability is essential in terms of shoppers’ desire to reach products physically and digitally without any problems, Şekerel Erdoğan shared that retailers need to guarantee an error-free delivery process through supply chain automation.

Pointing to curation as a developing topic of the online shopping experience, Şekerel Erdoğan said, “Retailers should improve the online product search process compatible with searching platforms, and should guide the shopper to the right product through recommendation and content management. Manufacturers, on the other side, must carefully and purposefully manage their brand messages; they should align their brand value propositions with the most searched product attributes.”

Generate shopper loyalty with excitement

Emphasizing the importance of creating new contact points between retailers and shoppers under the title of immediacy, Şekerel Erdoğan said, “Manufacturers should correctly position the value proposition that their brands will add to the basket and create a digital stimulus to support impulse buying.”

Excitement is one of the most prominent and impactful tools, which offers many opportunities for the ideal shopper experience. “Retailers can ensure shopping loyalty with their advanced customer service experience. Through gamification, manufacturers can ignite shoppers’ desire for fun and earning, which leads to regular shopping and loyalty. Manufacturers can also unite shoppers on social platforms and encourage them to share their brand experiences, on which the campaigns might be built,” she said.

Power your e-commerce strategy

Get in touch with us for accurate data and actionable insights.