Status of online sales in the first quarter of 2023

A slight increase in sales

Spending online increased by 6% in Q1 2023 compared to Q1 2022.

The electronics category is the only one to show a decline at the beginning of the year. Purchases in all other categories are up, with a breakthrough in the DIY & Gardening, and Sports & Car categories.

In France, 3/4 of online shoppers from 2022 have already made an online purchase in Q1 2023

Of all e-shoppers in 2022, 76% have already made at least one online purchase in Q1 2023. 24% have not yet made an online purchase; and 4% of shoppers are new entrants to the market, showing that e-commerce is still attracting new customers.

Returning customer rates vary by category – the FMCG category has the most loyal customers, with a 62% returning customer rate.

On-Demand delivery: lasting trend or just another fad?

Although the returning customer rate in e-commerce is very good (75%), on-demand customers seem to have disappeared…

If we look at the four main players in the sector, i.e. Gopuff, Gorillas, Flink and Getir, we can see that only 28% of their customers placed a quick commerce order online in the first quarter of 2023.

Where have their buyers gone?

→ 14% of them have not purchased any FMCG online

→ 58%, more than half of them, have jumped ship and swam to the competition, continuing their FMCG purchases elsewhere. They turned to other, more traditional retailers offering click-and-collect, or to players like Uber Eats or Deliveroo.

TikTok Shop: the 2023 flagship trend in the UK

TikTok redefines the expectations of beauty consumers

TikTok is the platform on which all kinds of tutorials have emerged: cleaning limescale from your bathroom with baking paper, making curtained fringes, or mastering contouring like Kim Kardashian – with TikTok, you can do it all.

But it’s the beauty sector that benefits the most from the platform: always on the lookout for new beauty tips, TikTok users like to experiment with new products, new techniques, discovering new beauty tricks. The GRWM (“Get Ready With Me”) content category has truly taken the platform by storm.

Before, social networks were the playground of brands. They used to promote their products to encourage users to buy. With Tiktok, the roles have changed. Users are taking back control. They create their own make-up, share it, make millions of views – and the brands are inspired to develop new products, new collections.

These are challenges that force the beauty industry to adapt.

What is the impact of TikTok Shop on UK e-commerce?

TikTok launched its online shop in the UK a few months ago – a country with 23 million monthly active users.

Over the last 12 months, out of the 8 best-selling products on the platform, 6 are beauty products. This figure is justified by the type of buyers on the platform: 71% of them are in fact female buyers.

The penetration rate by generation shows an over-representation of Generation Z. Around 60% of female buyers are from Generation Z, 29% from Generation Y and 10% from Generation X.

Generally speaking, 48% of the TikTok customers are from Gen Z, 34% from Gen Y and 15% from Gen X.

TikTok makes stereotypes hard to break

Looking at the categories most shopped on Tiktok, women prefer beauty products (29%) and clothes (17%) – while men opt first for electronic products (16%), with beauty only coming second (12%).

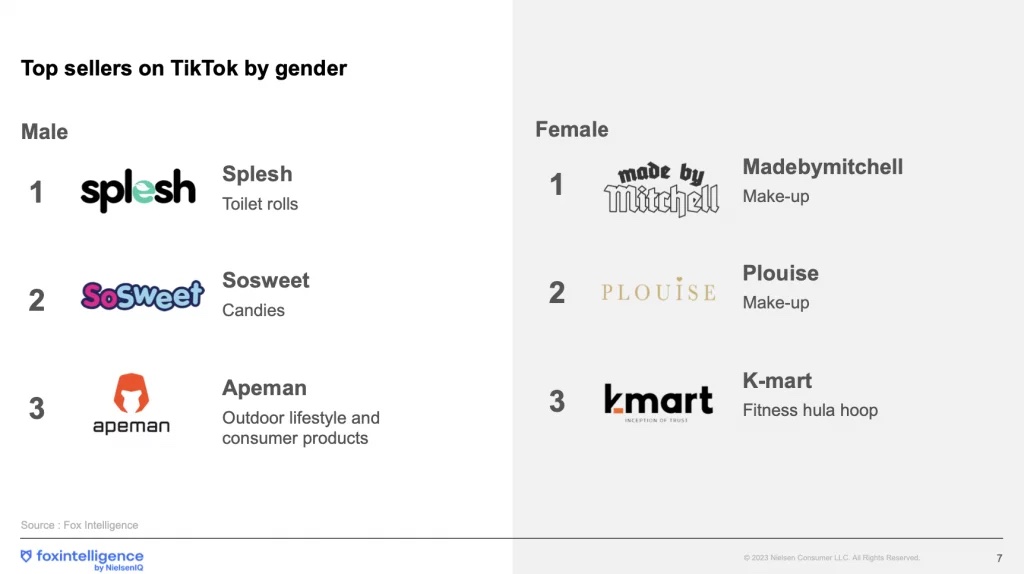

In terms of top selling products, men buy toilet paper and women buy make-up 🤷🏻♀️

TikTok: an opportunity for beauty brands

Buyers on TikTok spend more than the average on the category: €327 compared to €234 over the last 12 months. They also buy more often.

In total, they spend 17% of their beauty budget on Tiktok. A channel that comes in second place, just behind Amazon (23%).

In France, many brands are interested in this sales channel – needless to say, there’s a huge anticipation for its possible arrival in the country.