Ultra-Fast Fashion, Real-Time Fashion, Second-hand: More and More for Shein

Shein: the fast fashion brand to which we owe the concept of ‘ultra-fast fashion’. They deliver entire collections in record times: 6850 new items for Zara in 2022 compared to 4400 for H&M… and 315,000 for Shein. The brand launches in 2 days what H&M offers over several months. An aggressive business policy that promotes interchangeable and disposable fashion.

Shein, Bershka, PrettyLittleThing, Boohoo: these brands release new products online daily. Mesmerized with the endless flow of novelties, buyers are shoved to the brands’ boutiques/websites much more regularly than with so-called classic brands that only release new collections a couple times a year.

Thanks to Shein, after fast fashion and ultra-fast fashion, we’re now talking about real-time fashion: unparalleled responsiveness at ever-lower prices.

The controversial ultra-fast fashion brand has more than one trick up its sleeve: they’re launching their own second-hand platform, Shein exchange. Only available in the US for now, it gives customers the ability to order brand-new and preloved in one place, without the need for a third-party platform.

As posed by Shein CSR Manager (…): ‘At Shein, we believe that it’s our responsibility to build an ethical fashion future for everyone, while accelerating the search for solutions to reduce textile waste.’

As Zara and H&M Make a Major Strategic Shift, Shein Rules the Ultra-Fast Fashion Market

Pillars of the ultra-fast fashion, Zara and H&M have been left behind with the arrival of the Chinese giant on the market. To differentiate themselves from their huge competitor – and continue to attract shoppers, both brands have made a strategic shift.

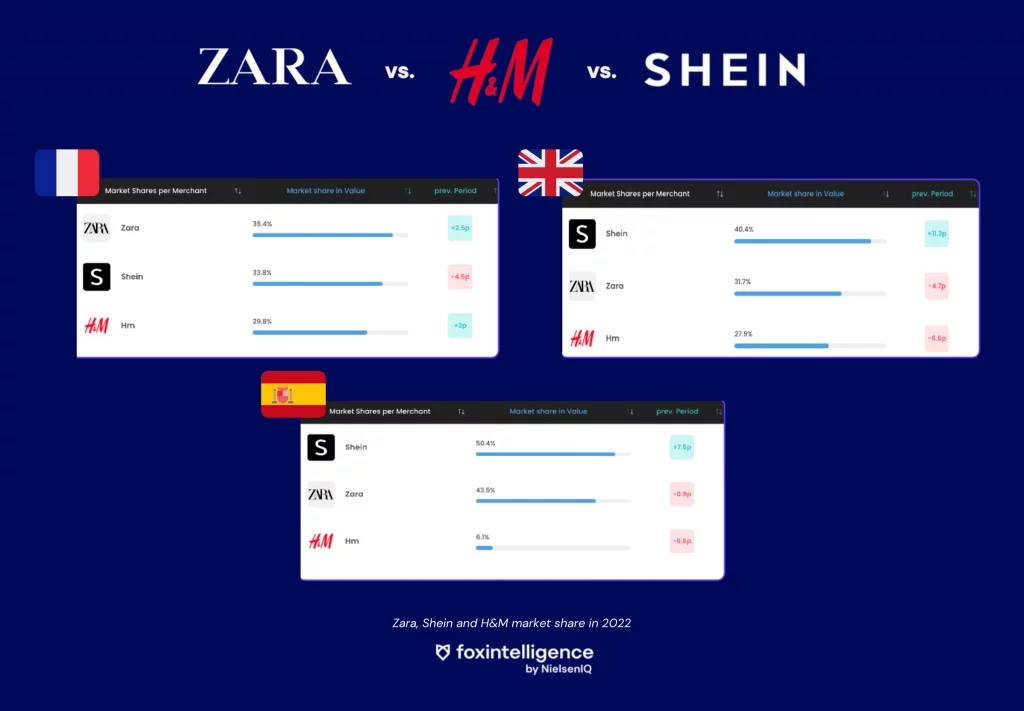

Focus on the Market Shares of the 3 Main Players in the Ultra-Fast Fashion Market in 2022

In France, Shein weighs 1/3 of the ultra-fast fashion market in value (33.8%). Zara weighs 36.4% and H&M 29.8%.

If figures seem balanced between the 3 giants of the industry, Shein is noticeably losing momentum: the brand lost 4.5pts in market shares in 2022 vs. 2021 – meanwhile, its two rivals are seeing an increase in market shares.

The trend is opposite in the UK and Spain. In Great Britain, Shein’s sales represent 40% of market shares. On the Spanish side, the Chinese group reaps more than half of the sales in value. In both countries, Shein’s market shares increased from 2021 to 2022, by 11.3pts in the UK and 7.5pts in Spain.

As for Zara and H&M, their market shares are receding. We can see that H&M is ranking 3rd in Spain, well behind its competitors, with a meagre 6.1% in market share – as a direct outcome of the health crisis, the brand closed down 30 stores in Spain in 2021 (out of 156 in the country).

Thus, Shein growth is accelerating in Spain and the UK, while the French are slowly disengaging from the brand.

Zara: A Move Upmarket

Zara’s positioning has evolved: with a bold price increase and partnerships with renowned haute couture players, the brand moves upmarket. The Spanish store chain has also revised its return policy. Customers are now charged for product returns that were originally free. For the brand, it’s a way to limit its environmental impact and motivate e-buyers to shop more consciously – and to move away from its ultra-fast fashion branding.

H&M: Second-hand, Repairs, Rentals and Recycling

H&M has chosen a different shift. On the programme:

- Drastically reducing its carbon footprint

- The acquisition and integration into its website of a second-hand platform

- Clothing recycling

- Clothing rental (only in a few major cities for now)

- H&M Take Care: the opening of their first store offering repair and maintenance service

How to Run Away From Fast Fashion When Purchasing Power Drops

Shein gets it, the brand particularly appeals to Gen Z. Their winning recipe: lower than low prices, ultra-fast delivery, more and more references and at the top of the trends – with, icing on the cake, the opportunity of renewing an entire wardrobe for less than €150.

Thanks to this winning combination, the brand continues to rise, despite the consumerist model it promotes. It’s become a Gen Z favourite – the same Generation Z identified with their commitments to ecology.

An ambivalence that shows the difficulty of remaining true to one’s convictions for the youngest consumers. Yet, there are alternatives: second-hand, online or in thrift stores. But, as vintage clothing becomes more and more desirable, prices shoot up. On Vinted, preloved Zara pieces remain more expensive than Shein’s newest products.

Consequently, inflation, with the resulting decline in purchasing power offers a business opportunity for ultra-fast fashion.

Temu, the addictive shopping app: likely to be a fierce competitor for Shein

In 2022, Shein was the most downloaded free app in the USA – ahead of TikTok and Instagram. In the beginning of 2023, Temu overtook the brand.

Temu is a ‘shopatainment’ platform. At the intersection of Shein and Wish, it’s the online version of a shopping mall where we wander aimlessly. The app provides an endless scroll of suggested items to buy. It mainly displays clothes, but also kitchen utensils, car accessories and other random articles, sometimes for just a few euro cents.

Betting on gamification, Temu features a mini-game through which users can win products. Or you can earn credits if you share your purchases on social networks. Temu pushes the envelope much further than Shein.

What’s Next?

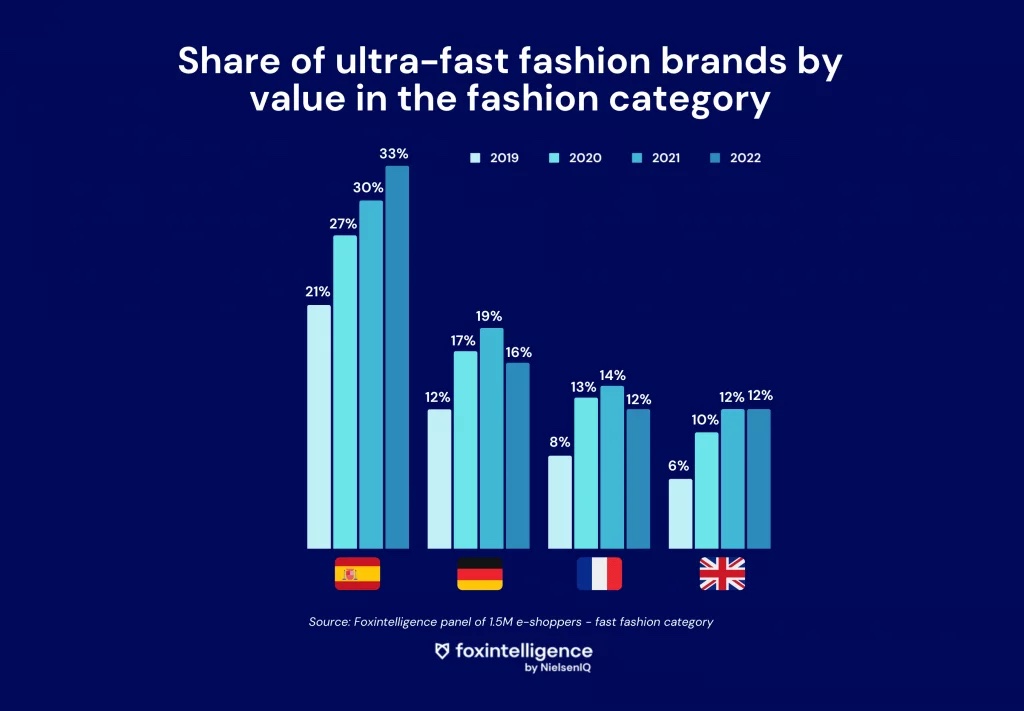

- Ultra-fast fashion is gaining ground in Spain. The market penetration rate is growing increasingly: from 21% in 2019 to 33% in 2022. Spain, birthplace of the Inditex Group (which includes Zara, Bershka, Oysho, Massimo Dutti, Pull & Bear and Stradivarius), where ultra-fast fashion now weighs more than a third of the fashion market.

- In Germany, the UK and France, ultra-fast fashion is losing steam.

- In Germany and in France, the weight in value of ultra-fast fashion brands is sliding downwards. After a 3 years increase in the penetration rate back-to-back, the trend was reversed in 2022.

- In Germany, the market penetration rate decreased from 19 to 16% between 2021 and 2022. In France, from 14 to 12%. In the UK, the figures are at a standstill, with a stable penetration rate of 12%.

- Though there’s seemingly still a long road ahead, we can hope that 2023 will be the year of change, with:

- environmental labelling (which provides consumers with information on the environmental footprint of products and services they consume)

- the introduction of a bonus system for the more sustainable brands

- a growing consumer awareness

- the rise of new consumption habits (second-hand, reconditioned, upcycling).

Shein’s online sales evolution

Although in the US, Shein is still an almighty mastodon, we can hope for a growing awareness on the European side. A strong indication of it being the downward trend in Shein’s market shares in the last quarter of 2022 in Europe – including Spain.