The “new” market plummets

The last few years have been marked by a very sharp rise in purchases during the health crisis – and then by a steep fall, linked to the economic environment we now find ourselves in.

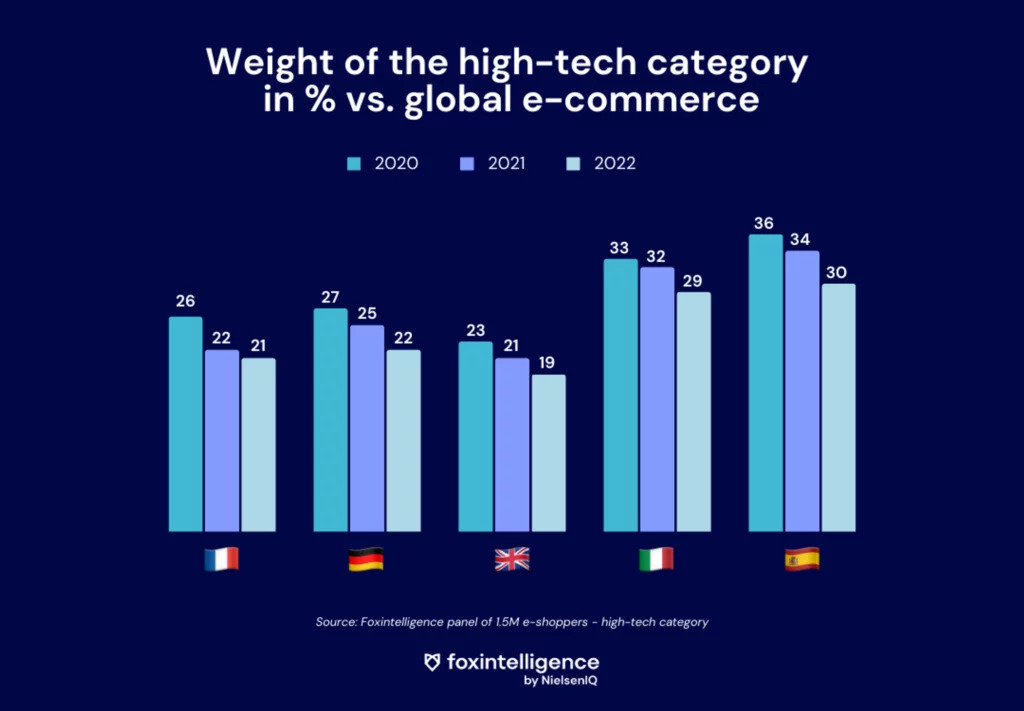

In France, between 2020 and 2022, the high-tech category lost 5 points: it now accounts for only 21% of e-shoppers’ budgets. The downward trend is true for the five European countries, where the category is losing between 4 and 6 points. The biggest decline is seen in Spain: in 2022, products in the category will account for 30% of the household budget – compared to 36% two years earlier. Despite this, Spain remains the country where high-tech purchases account for the largest share of household budgets.

In terms of value, the Germans have the highest expenditure in 2022.

Average amount spent per person per country on the high-tech category in 2022:

- Germany: €579

- France: €553

- Italy: €504

- UK: €459

- Spain: €456

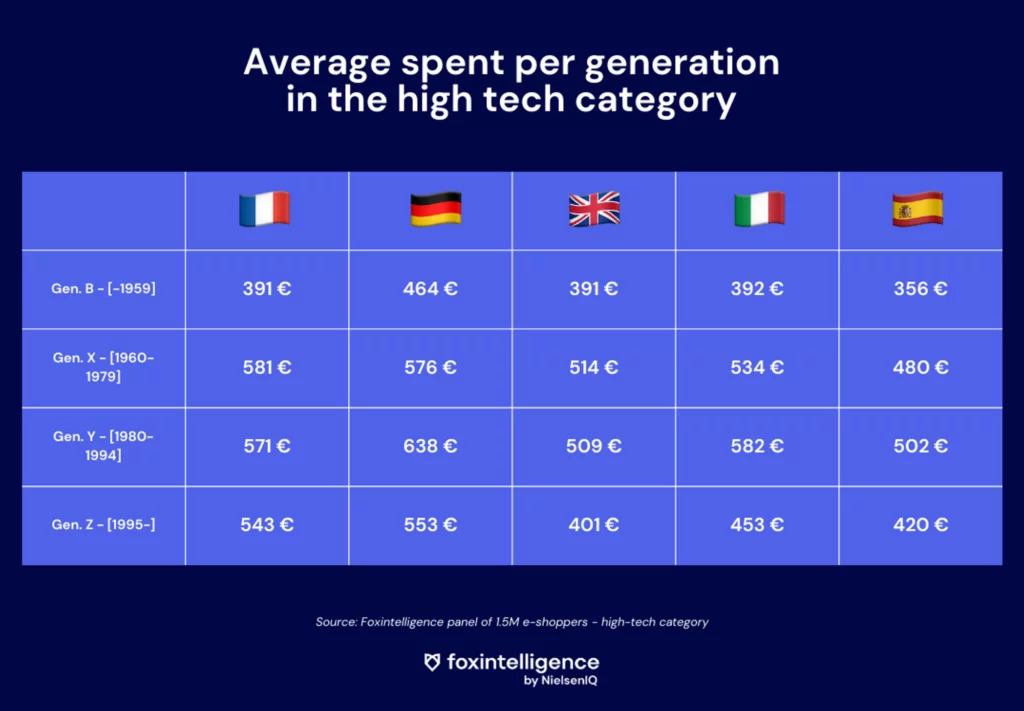

Is buying high-tech equipment online a generational issue?

In terms of generations, Gen B (born before 1959) spends the least online on high-tech products in all five countries analysed. Generation Z comes second, again in all countries.

Generations X and Y spend the most online on high-tech equipment.

In all five countries, online sales are driven by laptops and smartphones, which are the biggest spending items.

What does that mean for the second-hand market?

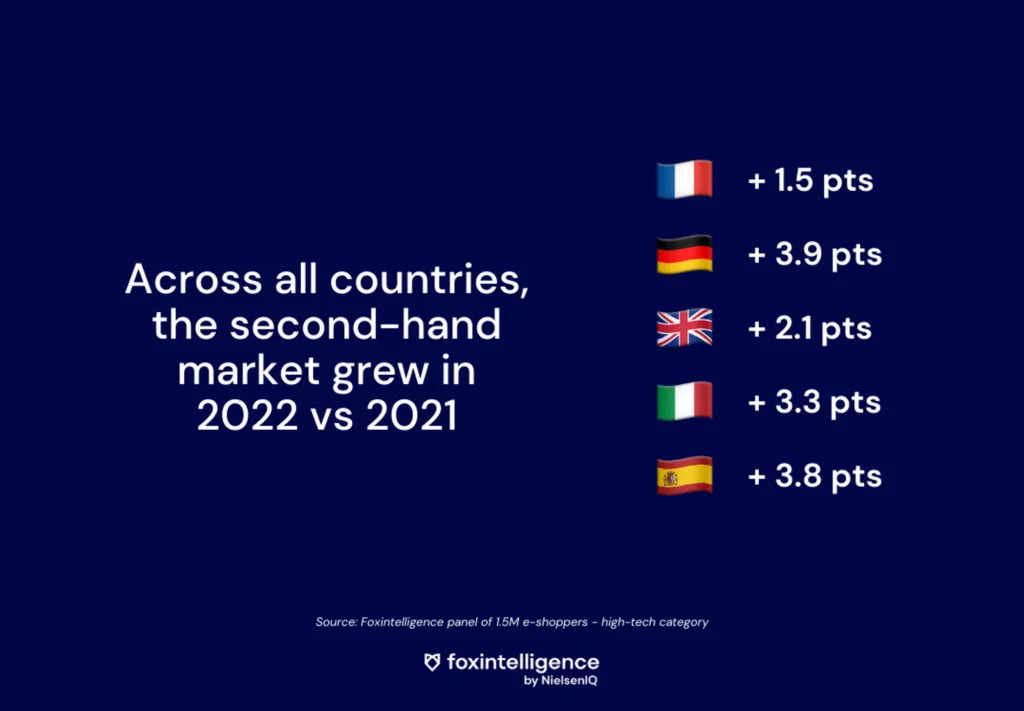

Low inventories, declining purchasing power and rising prices have also had an impact on the second-hand market.

In contrast to the “new” market, the second-hand market is growing exponentially.

Second-hand goods have become commonplace – especially thanks to reconditioned high-tech products. The trend was already gaining momentum, but is now growing even more during this period of inflation. Far from being an alternative, buying second-hand high-tech products is a first choice, a new way of consuming. While the economic aspect is often the primary motivation for buyers, the desire to consume more responsibly also weighs in on their decision.

France making strides in the sales of refurbished smartphones

Refurbished and second-hand products accounted for 13% of sales in the high-tech category in France in 2022 with smartphones accounting for 29% of that. This means that in France, almost one third of smartphones sold online are second-hand products.

One of the main reasons for this is that smartphone prices are reaching record highs and are driving consumers to find cheaper options.

How are brands responding to this evolution?

The second-hand market is gaining ground while the “new” market is losing ground. The brands in the high tech sector must adapt to this impending market reality.

The Fnac Darty group is moving into the repair of high-tech and household appliance products. In-store, areas reserved for second-hand products are being set up for consumers. On top of that, Fnac is marking its territory in the travel retail sector. The company has more than 35 pocket-sized shops in stations and airports.

As another example, YesYes (a marketplace for refurbished products) is setting up corners in Casino group supermarkets. Although it is very easy to buy refurbished products online, most of the market players are exactly that: pure players, purely online. To understand the new expectations of consumers and to distinguish itself from its competitors, YesYes goes to meet its customers in person and removes the obstacles to purchase. High-tech products at discounted prices, with local service and reassurance as well.

And finally, Dyson is diversifying and investing in the beauty sector. On the agenda: twenty or so products on the electro-beauty market in the years to come. Moreover, in the brand’s Paris flagship store, there is the Dyson Beauty Lab – a hair salon where only Dyson appliances are used. This screams diversification strategy, as well as new growth opportunities for the brand.