Zara, Shein & H&M: a close-up on the online fast fashion market

Shein invents ultra fast fashion

Shein coined the term “ultra-fast fashion.” And with good reason: in 48 hours, the brand offers more new products than H&M does in several months. An aggressive practice that encourages disposable culture.

Shein takes the top spot in fast fashion, with Zara and H&M shifting strategies

In 2022, Shein captured 33.8% of the ultra fast fashion market by value in France. Zara 36.4% and H&M 29.8%.

In France, Shein’s market share declined in 2022 vs. 2021 – while those of its competitors increased. The opposite trend can be observed in the UK and Spain:

- In the UK, Shein accounted for 40% of the market share (+11.3 pts vs. 2021)

- On the Hispanic side, Shein accounted for over 50% of sales in the ultra-fast fashion market (+7.5 pts vs. 2021)

Zara opts to shift upmarket

Higher prices, partnerships with the great names of haute couture – Zara is moving upmarket and trying to turn its back on its image as a fast-fashion brand.

H&M bets on CSR

H&M is taking a somewhat different turn: emphasizing second-hand, recycling and garment rental – as well as reducing its carbon footprint and promoting its H&M “Take Care” program (garment repair and care services).

What is the weight of ultra-fast fashion in the fashion category?

In Spain, ultra-fast fashion is gaining ground. 21% in 2019, 33% in 2022: the market penetration rate is rising steadily.

But in the UK, France and Germany, the market is not doing so well. Figures are stagnating in the UK, while in France and Germany, the penetration rate fell in 2022.

- Can we really turn our backs on fast fashion despite declining purchasing power?

- Is it possible to compete with Shein?

Is second-hand the future of the fashion industry?

At a time when everyone knows about Vinted, can we still consider that second-hand is only for the younger generation? What are buyers’ real motivations for turning to second-hand? And how should retailers position themselves to meet these new needs? Let’s dive in.

Second-hand, a booming market

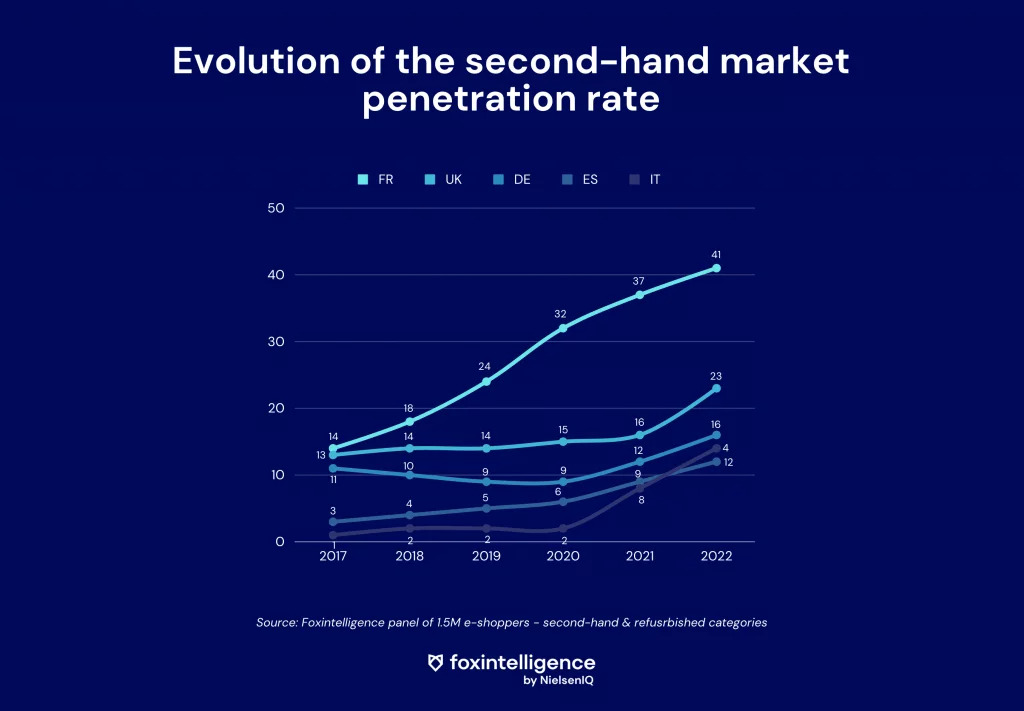

The penetration rate of the second-hand market has been growing steadily over the past 5 years. In France, it tripled from 14 % in 2017 to 41 % in 2022.

The underlying motivations of e-shoppers who choose second-hand products

There are many reasons, but it’s the need to save money that comes out on top. The advantage for shoppers is twofold: to treat themselves at a low price, and to earn money by selling clothes they no longer use. Second-hand is the perfect answer to declining purchasing power.

Shoppers’ second motivation is militant – buying clothes that have already had a first life is a way of protesting against fast fashion, over-consumption and over-production.

Spend less, buy better: it’s a no-brainer for the second-hand market.

For retailers, second-hand is no longer an option

Participating in the circular economy has become a purchasing criterion. Used, second-hand, reconditioned: more and more consumers are considering products that have had a first life – before turning to new.

For retailers, this represents an opportunity for growth. Kiabi for example has opted for product take-back by opening its second-hand platform. Customers can return clothes they no longer wear, in exchange for vouchers.

It has become essential for retailers and marketplaces to take these new needs into account.

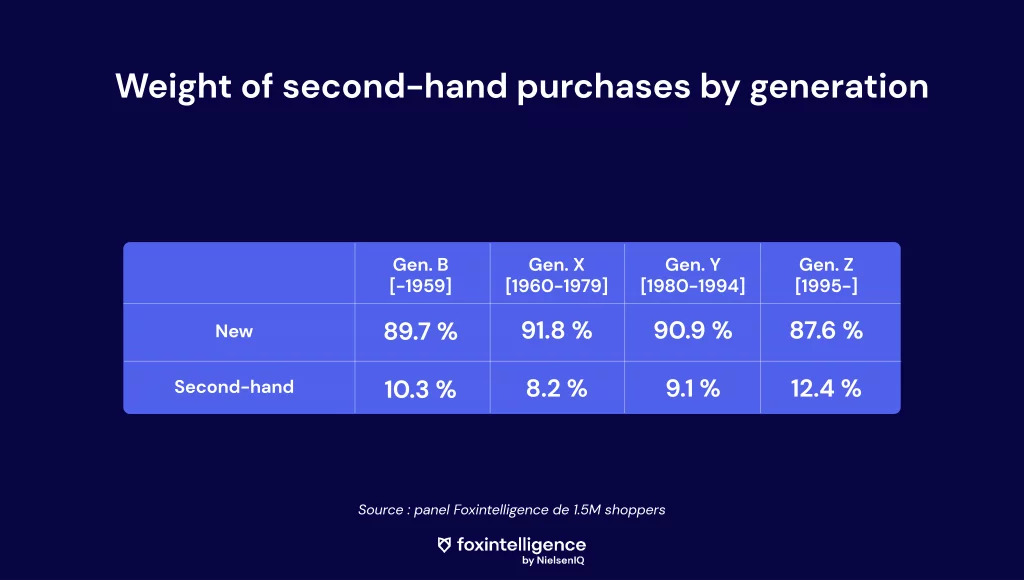

- Is the second-hand market still just for the younger generations?

- How often do people buy second-hand and new products?

Sézane, the successful DNVB that took the retail world by storm

Sézane is France’s leading online fashion brand. It has experienced (and continues to experience) exponential growth: in 10 years, it has shaken up the retail market and rewritten the fashion rules.

The typical Sézane customer

Straight to the point: they are Parisians – 42 % of the brand’s online market share is generated in the Paris region.

They also buy from Zara, and are fans of Vinted

Sézane acquired 59 % of new online customers, but lost 51 % of their base between 2021 and 2022. The lost customers spent 19 % of their fashion budget at Vinted, and the brands they buy most from are Zara (6.4 %) and H&M (4.6 %).

Their average spend on the Sézane website was €431 in 2022

Generations Z and Boomers spent the least at Sézane. Gen X and Y are the brand’s core target, with average spending of €499 and €481 respectively.

A strong preference for second-hand goods

Second-hand accounted for 3 % of Sézane purchases in 2018. By 2022, the figure had risen to 9.5 %, reflecting the reality of the market for many merchants. Second-hand has become a business opportunity for brands, which are increasingly integrating it as a strategic pillar for their growth.

From a generational point of view, as we saw above, Boomers and Gen Z spent the least on the brand’s website – yet they are the ones who spend the most on second-hand Sézane clothes!

Sézane owes its success to its well-established business model

Masterful storytelling & an ultra-committed community:

- The brand was created on the principle of micro-collections, intended for privileged subscribers to the brand’s newsletter.

- The designer is the brand’s muse, and its storytelling is a masterclass: Sézane is Morgane Sézalory, its designer – a founder who inspires and unites a community of loyal shoppers.

- The Sézanettes, the brand’s aficionados, have a Facebook group of 66,000 members – and on Instagram, the hashtag #sézanette brings together 135,000 publications of Sézane looks posted by shoppers.

Thought-out offers & sold-out collections in a matter of hours: Sézane is the definition of FOMO

- The site features an “Essentials” category – timeless basics that are available all year round -and in parallel, limited-edition capsule collections to boost the brand’s desirability

- A judiciously accessible price point, halfway between fast fashion and luxury

- In the physical boutique, customers enjoy a personal journey – from herbal teas to creaky wooden floors, the brand has created a new kind of shopping experience

Key Points

- The penetration rate of ultra-fast fashion fell in France and Germany in 2022 – but remained stable in the UK

- To break away from their image as fast fashion brands, H&M and Zara are making strategic shifts

- Second-hand is a major business challenge for retailers and marketplaces – the market penetration rate has tripled over the last 5 years in France

- For Sézane, the generations who spent the least on the brand’s website are those who spent the most on second-hand clothes