Traditionally considered a budget friendly option, private label growth has skyrocketed over the past few years and is leading the way for innovation across categories and on the digital shelf. Now, 53% of retailers expect private label to be their number one growth driver in 2024 (NIQ x Advantage Manufacturer and Retailer Outlook Survey).

Private label no longer simply provides shoppers with competitive price points, it is now starting to win-out on quality, cost, and shopper experience.

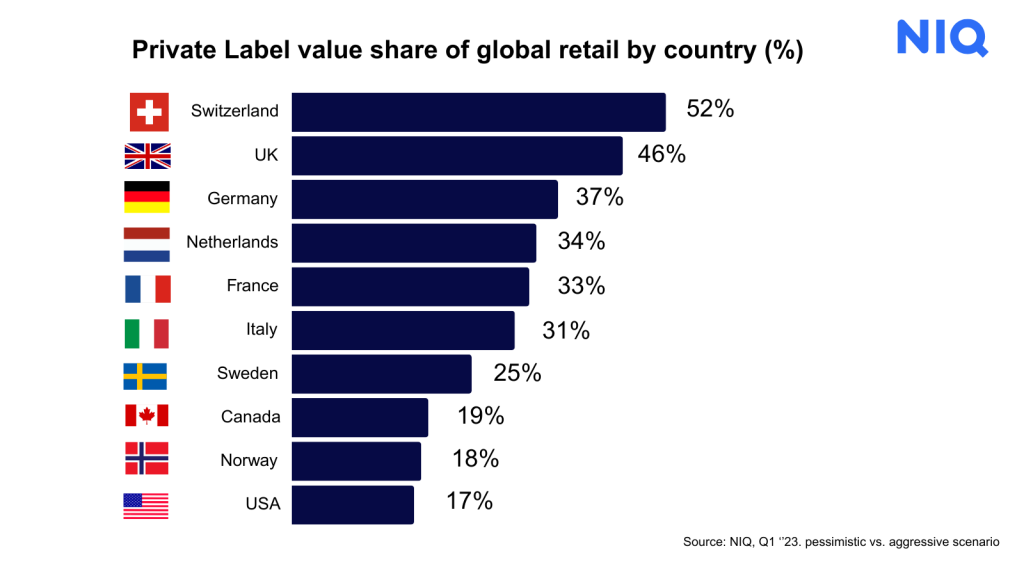

In 2023, private label accounted for 19.4% of total FMCG value sales globally, a number that increases to 26% in when singling out Western Europe. In fact, Western Europe is leading the forefront of the growth of private label in market share, totalling 36%.

In a year when 36% of shoppers are worse off than before, 77% of which are affected by the increased cost of living, price is now the key driver for many shoppers, creating space for private label to flourish (NIQ Global Consumer Outlook 2024). Retailers are responding fast, with innovative new products, engaging redesigns and investments in content strategy that are quickly converting shoppers across the omnichannel.

In fact, NIQ Brandbank has seen a 30% increase in spend across private label over the past year, with retailers investing in strong omnichannel strategies to win across the digital shelf (NIQ Brandbank internal analysis 2022 vs 2023) .

In the Battle between branded and own label, who is really going to come out on top?

Strategy changes and altered perceptions

Part of the accelerated growth for private label sales has been an overall shift in perception. Originally chosen an alternative for shoppers seeking products unaffected by supply chain issues during the pandemic, retailers have successfully continued to retain shopper trust and loyalty in the years following.

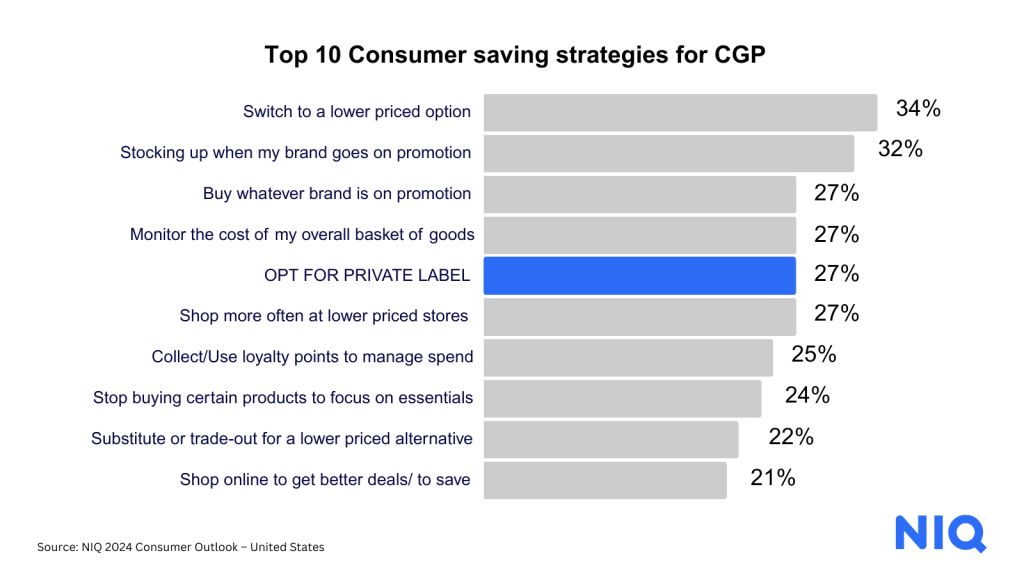

Growing inflation has caused the brand-switching to continue, and it looks like private label growth is only trending upward. Opting for private label is now a key saving measure for shoppers in 2024, with 27% of shoppers indicating that switching to private label is important to their cost-saving strategy.

Retailers have worked hard to invest into their private label strategies and shift the perception beyond basic value-for-money options. This has included introducing wider ranges of products while brands scale-back, rebranding packaging and lines and messaging to appeal to a wider range of shoppers and investment in strong omnichannel experiences that can compete with big name brands.

How are retailers responding?

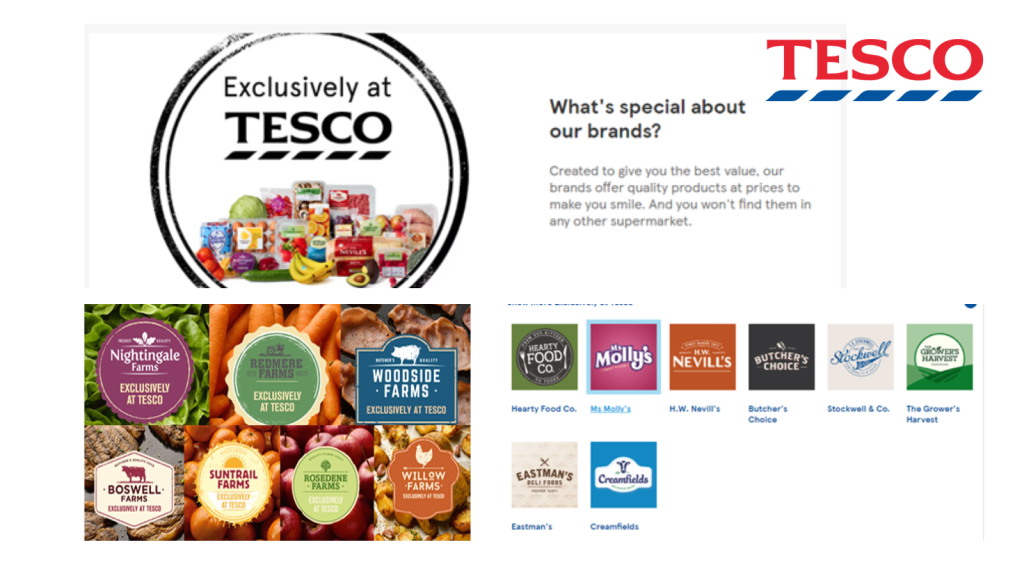

UK retailer Tesco is known for being the low-cost full-line supermarket in the UK. Recently reporting their results for 2023/24, Tesco reported ranking 1st for being the cheapest full-line grocer for 16 consecutive months.

Part of Tesco’s success is down to its extensive private label range offering which has won shopper loyalty across the omnichannel. Tesco reports that it has been ‘Investing in product quality and innovation, launching over 1,000 new products and improving c.2,700 existing lines.’

In the past, private label was more cleanly divided simply between Tesco Everday Value or Tesco Value for the retailer’s budget-friendly offering, and Tesco Finest for the premium own-brand lines, with a middle-ground simply branded with ‘Tesco.’ In recent years however, the retailer has overhauled its offering to align with discount competitors like Aldi and Lidl. Tesco already price-matches over 4000 products to Aldi, marketing Tesco as the solution for shoppers needing to shop around for the best price, arguing that shoppers now only need to shop at one destination to find the best deals.

Tesco’s budget-friendly private label range now includes, Creamfields, Eastman’s Stockwell & Co, Ms Molly’s and more. These products are now marketed with ‘exclusive to Tesco’ and might not appear to be a private label product upon first glance. Each private label brand has its own logo, branding and packaging designs that are unique to the category they belong to, mimicking the branded lines they compete with.

Tesco still offers a large mid-price range of ‘Tesco’ labelled products that simply feature the ‘Tesco’ name, including ‘Tesco Free From,’ and Tesco Organic. Furthermore, Tesco Finest still leads the premium private label line for the retailer, a popular line amongst shoppers. By spreading their private label offering across three value points, Tesco can offer a private label product option for all budgets and all shopping occasions, diversifying the audience and appealing to a variety of needs.

It’s not just Tesco, in 2023, Sainsbury’s underwent a similar private label restructure to remove their value range ‘Sainsbury’s Basics’ to introduce ‘Stamford Street,’ a banner that encompasses the stores entire value range, to help shoppers locate their budget options easily across categories. The Stamford Street rebrand does see an elevation of the previous stripped back white and orange packaging for the ‘Sainsbury’s Basics’ line.

While some retailers have invested in creating ranges that mimic brands, UK retailer Asda took the bold decision to rebrand one of their own brand ranges to make the budget friendly option as obvious as possible to a shopper.

Asda’s Just Essential range features bright yellow packaging, a move designed to help shoppers identify budget friendly products clearly whilst shopping in-store and online. While the move proved controversial in the media, the range introduced over 170 budget friendly products at the peak of the cost-of-living crisis, making it the biggest budget friendly range to exist in the UK.

Whichever method retailers are pursuing for their private label ranges, those ranges are rapidly expanding across categories to encapsulate the entire store.

Options for every occasion

Juxtaposing the retailer’s bold Just Essentials range, Asda has also been working hard at the other end of the scale to market its premium ranges, by comparing their quality to luxury retailers like Harrods and Harvey Nichols. This demonstrates the willingness to change perceptions at both end of the budget scale, strengthening the private label perception across the store.

Premium vs Budget-Friendly

Private label doesn’t just mean cheap. In fact, According to IGD, in the UK, 4.7% of all private label is considered value tier, whilst premium tier private label products account for 8.4% of total private label share. Retailers compete with brands not only over price, but also quality, and it is clear that the majority of investment is channelled into these premium ranges.

As shoppers reprioritise their spending during the cost-of-living crisis, premium private label ranges have proved a lucrative alternative to dining out. NIQ survey data demonstrates a decline in shopper spend outside of the home in 2024, with 42% of shoppers planning to spend less in out-of-home dining and eating, whilst 52% plan to spend the same amount on their in-home entertainment. (NIQ Consumer Outlook 2024, compared to metrics from 2023)

UK premium retailer M&S is widely regarded as the leader in at-home dining experiences with it’s highly popular Dine-In meal deals offers, as is responding well to this shift in shopper spending habits. As an almost exclusively private label retailer, M&S focuses on quality, ranging both budget friendly and premium lines across all categories.

With M&S Dine-In deals, shoppers can cook a variety of ready-made restaurant style meals at home, including multiple courses and drinks for set prices with a variety of options for different diets and needs.

M&S offers a range of these Dine In year-round, elevating them throughout the year to align with seasonal events, for example Valentine’s Day. In 2024 shoppers could choose from a variety of private label starters, mains, sides, deserts, and drinks to build a dine-in meal for 2 for £25. In recent years M&S has expanded their dine-in meals to incorporate more vegan and gluten-free options to widen their appeal to more shoppers. These competitive price-points offer shoppers a premium feeling without the out-of-home cost, proving popular among UK shoppers.

Investment in the omnichannel experience

More than one in five (22%) of shoppers now plan an in-store shopping trip combined with a prior online order.

Shoppers are also increasingly utilising mobile shopping sites to research products whilst shopping in store with 70% (Google/Purchased Data) of shoppers using a mobile device before or during an instore shop to research products.

Optimising product pages increases their likelihood of returning in shopper searches. This means optimising data by ensuring all attributes are captured and communicated, and optimising imagery with mobile-ready images to help shoppers clearly identify products from a digital shelf view.

The potential of the product page is something that remains largely untapped, however it seems retailers are starting to tap into the potential with larger investments in online presence.

NIQ Brandbank has witnessed a 30% increase on private label spend in the UK and Ireland due to range growth over the past year. This has been down to a combination of new products, packaging redesign and product description page updates that have all worked to improve the shopper experience for private label products.

Asda Just Essentials x NIQ Brandbank Case Study

An example of investment in private label is Asda’s Just Essentials launch in 2023, which utilised NIQ Brandbank’s CGI Omnishopper Create solution to create high quality, consistent product imagery for use across the product launch. Images were created at speed utilising NIQ Brandbank’s CGI technology and were used in marketing campaigns as well as across the Asda website.

By utilising CGI, not only was the quality of the product images consistent across the omnichannel, they were available to use upstream in the product launch, enabling Asda to release the line on time to start helping shoppers save money at a critical point of the cost of living crisis.

What’s next for private label?

We expect private label share to grow as we approach 2030, with NIQ data indicating continued growth and investment around the world. But what is next for Private label?

Key Growth Drivers:

- Accelerated omnichannel growth

Successful strategies are those that picture the end-to-end shopper experience from discovery to purchase across multiple channels both in-store and online. Retailers are starting to accelerate their omnichannel presence via investments in the private label experience on the digital shelf.

- Increased retail investment

Whether retailers look to make their private label ranges obvious like Asda, or mimic brands like discount leaders Aldi and Lidl, both require investment and energy. As brands scale back their ranges amid surging supply-chain costs, room is left for private label to attempt branded-dominated categories like Baby, Beers Wines and Spirits and more.

- Large retailer market consolidation favouring private label investment

For many retailers as we’ve seen, private label is the future. We are already starting to see increased investments in research and development of products across new categories, investment in quality and innovation, and investment in marketing and awareness of private label ranges. We can expect both the innovation of new products across the store, and the revision and redesign of existing lines to meet and exceed shopper expectations.

- Increased adoption across growing shopper segments

Private label is starting to appeal across generations, attracting growing segments like millennial and Gen Z shoppers. Alongside a wide range of generational shopper segments private label is poised to grow across price-preferences. Retailers must ensure that they continue to grow across the value-based, mid-value and premium categories in tandem to meet a variety of shopper needs and purposes.

What can brands do to compete?

It’s no secret. Private labels are starting act more like brands. However, brand equity is still a leading purchase driver for many shoppers, especially for those household name-brands. With a predicted rise in private label growth globally over the next decade, brands cannot rest on their branding and names alone, and must leverage a consistent omnichannel strategy to remain completive on the digital shelf.

Our advice to brands:

- Stay connected to shopper values like sustainability and health and monitor growing trends in these areas.

- Invest in your omnichannel strategy to make sure it is competitive, high quality, and most importantly consistent.

- Create strong innovative new products and lines that entice and excite shoppers and match trends or even establishes new trends.

- Make sure products are available at the point of purchase by monitoring your sales trends and keeping on top of your Out-Of-Stock rates, particularly when items are part of a sale or an appealing offer.

- Creating an engaging end-to-end shopper experience from discover to purchase by utilising marketing, advertising and additional product content from other areas of the product journey to enrich the point of purchase.

Who is coming out on top?

In the competition for shopper loyalty in the UK, private label continues to surge in popularity and market share. However, hope is not lost for brands. Each approach offers distinct advantages and appeals to different segments of the market.

This means ensuring that product data is complete, up-to-date and goes beyond the pack and that product imagery is clear, consistent, and enticing.

It can vary from category to category, but those that come out on top are those that have winning omnichannel strategies. As consumer preferences continue to evolve and market dynamics shift, both retailers and manufacturers must adapt their strategies to strike a delicate balance between price competitiveness and brand differentiation, ensuring continued relevance and resonance with consumers in an ever-changing landscape.

To get started on your journey to creating best-in-class omnichannel product content, please explore the range of solutions and services available from NIQ Brandbank

Sources:

NIQ x Advantage Manufacturer and Retailer Outlook Survey, October 2023

Private label market share data from Nielsen Q2 2022

Google/Purchased, U.S., “How Brand Experiences Inspire Consumer Action,” U.S. smartphone owners 18+=2,010, brand experiences=17,726, April 2017.

Tesco, Preliminary Results 2023/24, (Preliminary Results 2023/24 (tescoplc.com))