Changing outlooks and attitudes

Two words describe 2024’s retail environment: transition and change. The easing of monthly global CPG inflation growth was the year’s biggest macroeconomic news, having slowed to 1.7% by mid-year.

NIQ’s Mid-Year Consumer Outlook, which examined global consumer sentiment and behavior in this volatile environment, revealed sparks of optimism in the form of a slight decline (-2%) in global consumers who felt they were worse off financially than they were six months prior and a slight increase (+2%) in those who said they were better off.

At the same time, the cumulative effects of inflation meant that, on average, consumers were spending more for less volume. Discount tiers continued to drive sales as well—a sign that consumers remained focused on price and affordability. Consumers have shifted from cautious to intentional consumption and remain vigilant, yet optimistic in their purchase behavior.

The question lingering for retailers and manufacturers as Cyber Monday approached was this: Which consumer would show up at the point of sale: the more cautious—or more optimistic—one?

To answer these questions, we did the following:

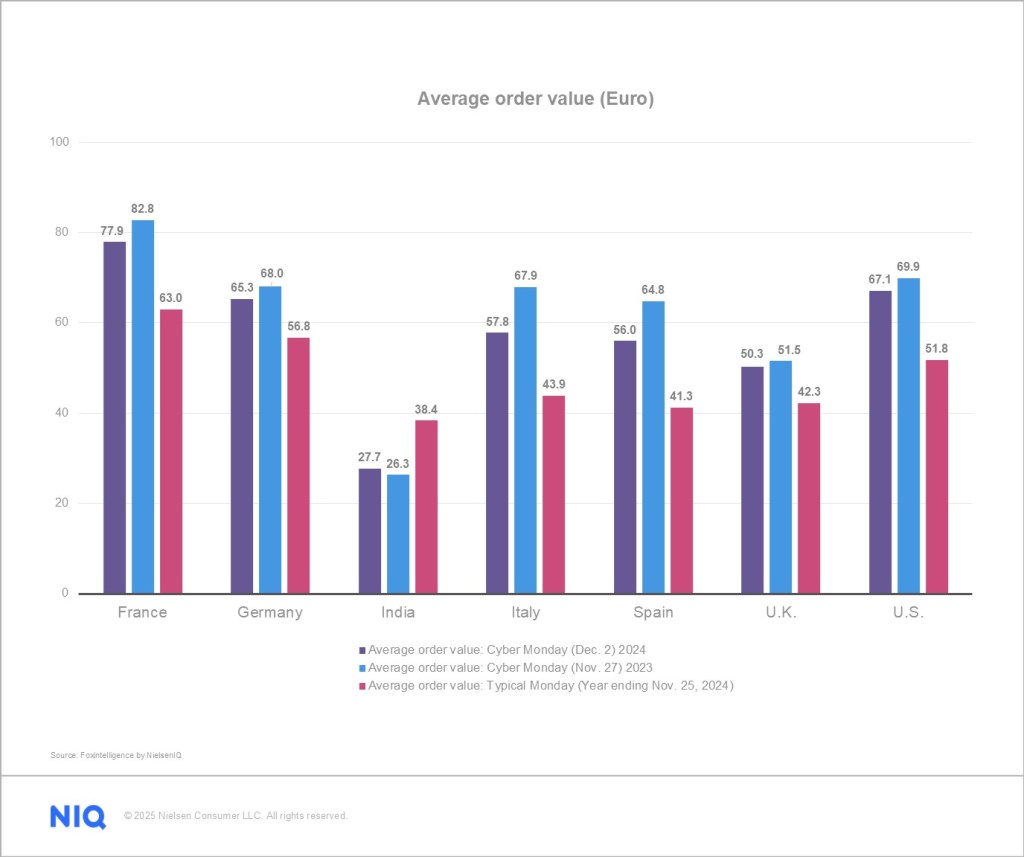

- We examined the average order by value (in Euro) and the average number of items per order in the United States; in five Western European countries with a high affinity for the holiday (France, Germany, Italy, Spain, and the United Kingdom); and in India, a country representing fast-growing Asian e-commerce markets where Cyber Monday isn’t closely tied to a major gift-giving holiday.

- We compared these values to Cyber Monday 2023, which provides insight into how consumers’ Cyber Monday shopping behaviors may be evolving.

- We compared these values to the “typical” Monday over the prior 52 weeks, which gives us a baseline for how Cyber Mondays, in general, differ from an ordinary shopping day.

Here’s what we learned.

A mixed bag when it comes to order value and volume

With the exception of India, the average order’s value fell compared with Cyber Monday 2023. Meanwhile, the average number of items ordered fell in five of the seven countries. (The exceptions: France and India.)

In the U.S., for example, average order value on Cyber Monday 2024 fell a modest 4%. The average number of items in an order, meanwhile, was unchanged. The National Retail Federation (NRF) reported the number of Cyber Monday online shoppers dropped from 73.1 million in 2023 to 64.4 million in 2024.

According to the National Retail Federation, Cyber Monday remains the second most popular online shopping day of the year in the U.S.

When compared with regular Monday shopping trends, Cyber Monday orders typically had higher values and included fewer items. The decline versus last year in Cyber Monday average order value was modest in some countries (-2.4% in the U.K.) but steeper in others (-14.9% in Italy).

Contributing to the drop this year was a late calendar date—U.S. Thanksgiving was celebrated on the fourth rather than third Thursday of November—and ever-earlier “pre-holiday” sales. Specifically, Black Friday falling on November 29 pushed Cyber Monday to December 2, narrowing the window between the shopping holidays and Christmas—and thus generating more interest in early sales. Amazon began its Black Friday sales on November 21, but some retailers started even earlier, creating a longer sales period.

NIQ’s analysis of Black Friday Week 2024 demonstrated that sales in the weeks leading up to Black Friday grew even more than sales during Black Friday Week itself. Retailers also offered deeper discounts this year and offered them earlier—even in the first week of November.

Another contributing factor: Some retailers extended Cyber Monday sales across more than one day. Amazon started its Cyber Monday event on Saturday, November 30 this year. Target, Walmart, and Best Buy all started Cyber Monday on Sunday—a day early. Macy’s extended some of its Cyber Monday deals into Tuesday, Dec. 3, as did other retailers.

Which categories were king on Cyber Monday?

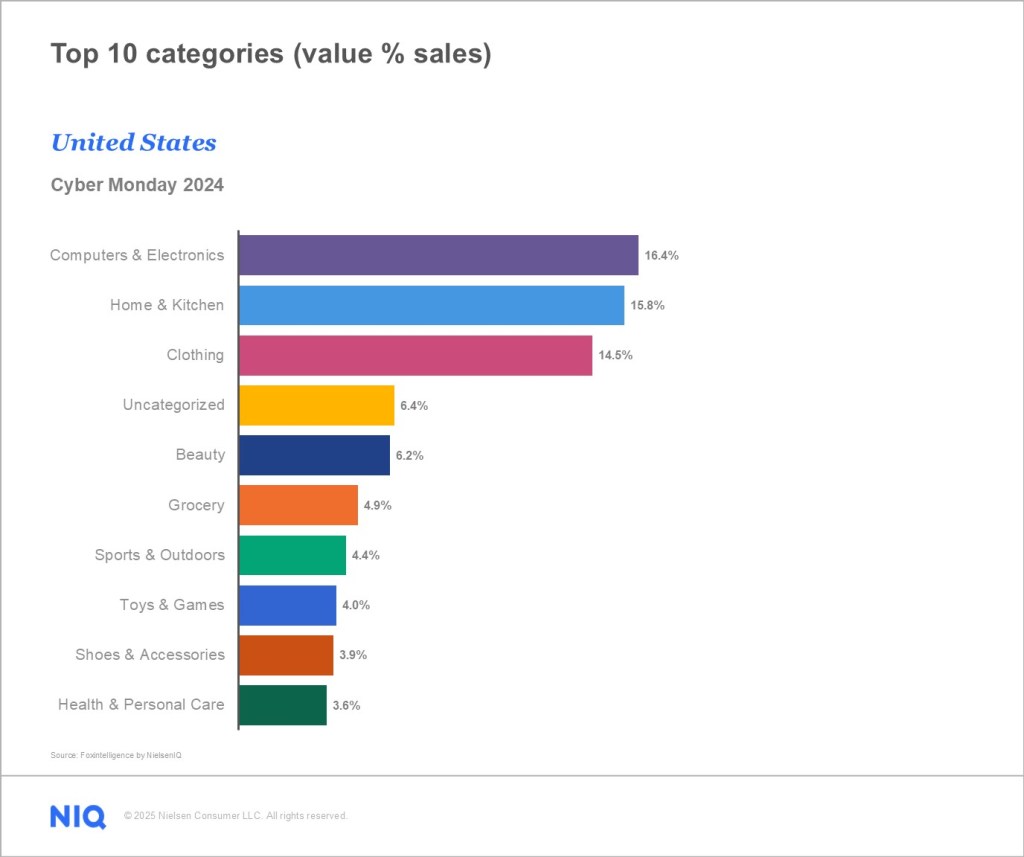

Striking similarities existed among all the countries we analyzed in terms of which categories dominated Cyber Monday. In fact, the same seven categories appear in the top 10 of all countries reviewed (albeit in different orders):

- Computers & Electronics

- Home & Kitchen

- Clothing

- Grocery

- Beauty

- Shoes & Accessories

- DIY & Tools

Let’s now dig into the nuances of the seven countries we analyzed.

Cyber Monday in the United States

Cyber Monday originated in the U.S. in 2005 as an e-commerce counterpart to the larger in-store shopping sales event of Black Friday. The tech-centric theme of Cyber Monday remains its strength, and it’s still a day for larger online sales than Black Friday—especially for electronics and appliances as gifts.

Not surprisingly, then, Cyber Monday 2024 boosted Computers & Electronics sales in the U.S. above levels for the average Monday. The value share of Computers & Electronics reached 16.4% (compared with10.6% for the typical Monday)—a 54.7% jump.

The value share of Sports & Outdoors goods, meanwhile, increased to 4.4% (compared with 3.5% for the average Monday)—a gain of 25.7%. The Beauty category also lifted by double digits, accounting for 6.2% value share (compared with 5.4% for the average Monday)—a lift of 14.8%.

When comparing Cyber Monday 2024 to 2023, four of the top 10 categories increased their value share over last year:

- Grocery: +13.9%

- Health & Personal Care: +9%

- Computers & Electronics: +5.1%

- Sports & Outdoors: +4.8%

Examining online sales by merchant type, brick-and-mortar (or “bricks and clicks”) retailers have a higher value share in the U.S. (17.0%) than in India or any of the European markets reviewed. U.S. brick-and-mortar retailers account for 25.8% in volume share of sales. Only in France (48.4%) and the U.K. (27%) are brick-and-mortar volume shares higher. Major brick-and-mortar players in the U.S. include well-established, large retail chains such as Walmart, Kroger, Costco, Home Depot, and Walgreens.

Key takeaways: Brands can expect earlier advertising and promotions from competitors, as well as a stretching of Cyber Monday over several days. This may attract shoppers before and after Monday itself (regardless of the date it falls on). Over time, this may diminish results recorded on the Monday sale day, but brands may capture more sales overall from pre- and post-Cyber Monday sales.

Cyber Monday in Western Europe

As is the case in the U.S., Cyber Monday in Western Europe is considered a significant e-commerce event. But Cyber Monday 2024 results reveal a mixed picture in the countries we analyzed. While the average value of orders fell in each country, Cyber Monday remains a day for noteworthy lifts in key categories. Compared with regular Monday shopping patterns, Cyber Monday orders typically had higher values and included fewer items.

This year, Consumer Electronics accounted for 20% to 28.2% share of value across the Western European countries analyzed. Compared to the average Monday (for the 52 weeks prior), the category’s value share increased on Cyber Monday in each country, with the percentage increase in share ranging from 10% (Spain) to 32% (France and U.K.).

Comparing Cyber Monday 2024 with Cyber Monday 2023, the Home & Kitchen category moved up from third to second in value share rankings in Germany, Italy, and Spain, overtaking Clothing in each of these countries. While Home & Kitchen’s average value share across all five countries was 11.5% on Cyber Monday 2023, it moved up 3.6 share points to 15.1%—a 31% increase—on Cyber Monday 2024.

This trend is consistent with NIQ’s analysis of 2024 Black Friday Week sales in Europe, Turkey, and Brazil. Small Domestic Appliances (i.e., “Home & Kitchen”) experienced the biggest gains in value share compared with the average week for items such as air fryers (+240%) and vacuum cleaners (+185%), which includes smart vacuums.

The Toys & Games category also increased its year-over-year value share on Cyber Monday in all Western European countries reviewed. It also broke into the top five rankings in both France and Germany (compared with Cyber Monday 2023). Toys & Games accounted for an average 3.8% of value share last Cyber Monday but grew to 4.6% this year—a 20% increase—in all Western European countries.

Key takeaways: Cyber Monday now competes with a wide range of e-commerce channels, early sales, and steeper discounting. Retailers and brands trying to attract Cyber Monday consumers need to recognize the much more competitive landscape and the growing effect of “pre-holiday” sales.

Cyber Monday in India

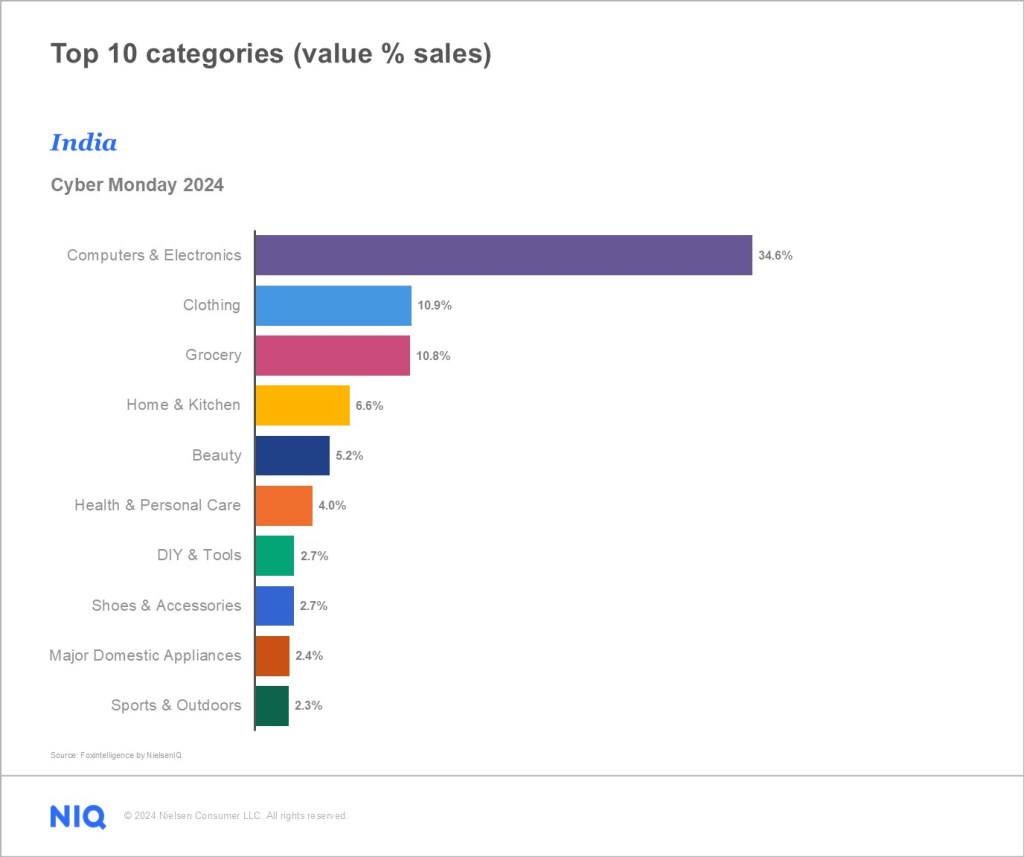

Although Cyber Monday is not perceived as a major cultural gift-giving holiday in India (or in many other Asian countries), we included India in this analysis due to its size and rapidly maturing e-commerce economy. Notably, the seven categories that appear in the top 10 of the Western European countries we analyzed appear in India’s top 10 as well.

This Cyber Monday, the average order value in India was significantly lower (down more than 25%) than an average Monday. This is in stark contrast to the Western European countries analyzed, where average order values were higher across every country.

Meanwhile, year-over-year Cyber Monday engagement was on the rise. The average order value in India grew by 5.3% in 2024, and the average number of items increased from 1.7 items to 2.4 items—a 41% lift.

Cyber Monday in India may have more in common with other “pure play” e-commerce merchant events, such as Prime Day.

The Computers & Electronics category led Cyber Monday sales in India, accounting for 34.6% of value share. (By comparison, the average Cyber Monday share for Computers & Electronics purchases in the Western European markets we analyzed was 24.5%).

What’s more, the Computers & Electronics category’s Cyber Monday value share rose by 2.5 points over last year, representing a 7.8% lift. Other categories with a year-over-year lift this year include Health & Personal Care (+48%) and DIY & Tools (+35%).

In India, pure-play online retailers—including Amazon India, Flipkart, and Snapdeal—were dominant on Cyber Monday, accounting for 82.6% of the value share of sales and 62.4% of the volume. Notably, these generalist online merchants increased their already impressive Cyber Monday value share by 7.2 points versus last year.

Generational trends among shoppers in India during Prime Day 2024 are echoed in 2024 Cyber Monday data, with Millennial (born 1981–1996) and Gen Z (born 1997–2012) shoppers dominating all sales (value share) at 45.4% and 45.8%, respectively. Also noteworthy: India’s Millennial and Gen Z consumers hold more of the sales share than in any of the Western European countries reviewed.

Key takeaways: Cyber Monday doesn’t have the same cultural or economic significance in India that it has in Western Europe—and if early indicators hold, in the U.S. as well. Rather than being tied to culturally significant gift-giving holidays, Cyber Monday is a secular shopping event where promotions and discounts drive interest.

In Western Europe and the U.S., the gift-giving season serves to pull consumers into sales. In India, retailers and brands struggle to push consumers toward deals and discounts.

The road ahead

What does this mean for retailers and manufacturers heading into 2025?

While they may be fine with consumer purchases being spread out more evenly across days during the holiday shopping season, offering similar deals across many days undermines the uniqueness of Cyber Monday—and can contribute to consumers’ skepticism that the deals retailers and manufacturers offer are “special” at all.

In the United States specifically, a longer selling season to promote Cyber Monday deals and extended sale days may be good news for brands, giving them a longer time to match to the right consumer. It does, however, make an already frenetic and competitive season of sales even more so. Brands wanting to lean into Cyber Monday will need to make well-informed decisions based on detailed knowledge of competitors, effective advertising, and profitable pricing in key product categories.

In Western Europe, retailers and manufacturers must strategically plan for a longer selling season and deeper discounting as consumers continue to seek value. In this competitive landscape, sellers need to guard against reducing net profits in favor of volume. Finely tuned pricing strategies and informed product mixes focusing on growing categories can still win new consumers.

In India, Cyber Monday’s average order value is well below the average Monday—a sign its traction among consumers is low. Nonetheless, year-over-year growth in a few categories shows that organic growth is possible. Retailers and manufacturers that are good at selling through pure-play online retailers and those that target Millennials and Gen Z may still do well.

Looking for more insights tied to seasonal shopping occasions throughout the year? Check out our Total Commerce hub.

Discover how our suite of Omnichannel Performance solutions can help you track and optimize your sales performance everywhere consumers shop.