Retailers vs Marketplaces: Battle of Business Models

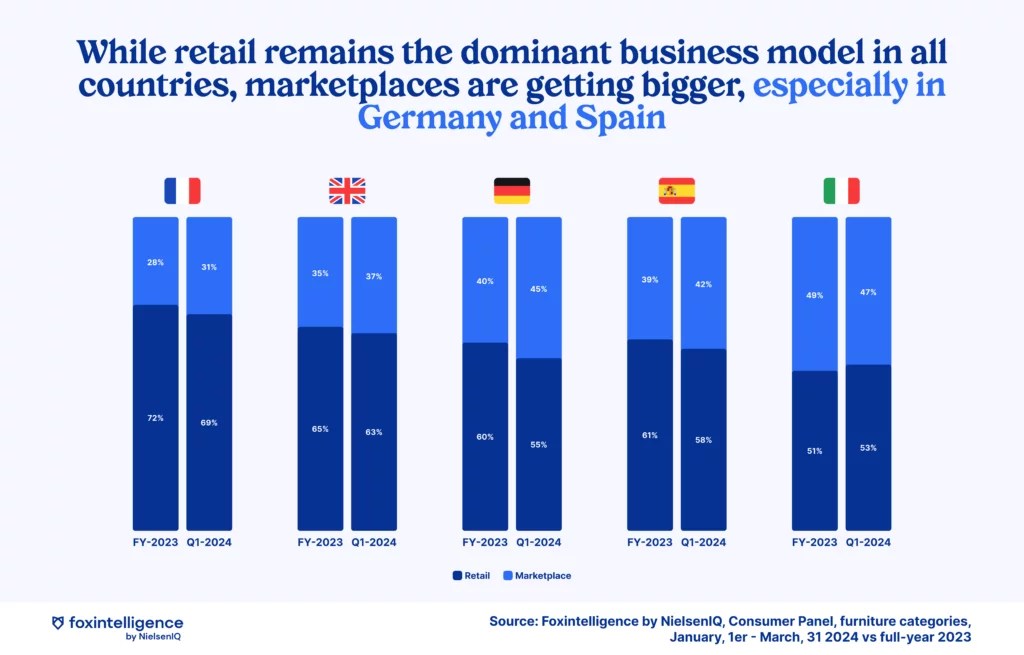

While retail remains the primary business model, marketplaces are gaining traction in Germany and Spain.

In France, the marketplace presence is the weakest, accounting for only 31% of sales, compared to over 40% in Germany and Spain. Except for Italy, marketplaces are growing in all analyzed countries.

Since the pandemic, the landscape has shifted: traditional sector players had to rethink their strategies to adapt to new consumption modes. For example, Maisons du Monde launched its marketplace in 2022.

To counter the rise of marketplaces, traditionally suburban retailers are adopting new proximity concepts in city centers. In recent years, we have seen the emergence of many Ikea City, But Cosy, But City, and Castorama with several Casto stores.

Although furniture purchases are still heavily favored in physical stores, eCommerce is gaining ground year after year.

Direct Sales vs. DtoC

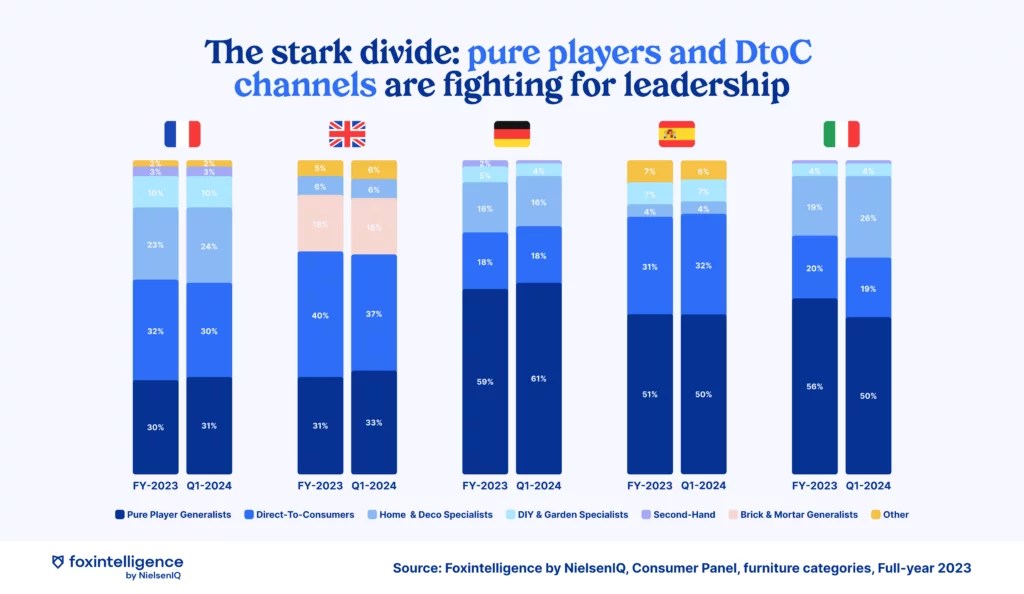

While pure players account for “only” 30% of sales in France and the UK, this figure exceeds 50% in Germany, Italy, and Spain.

After experiencing significant growth during the pandemic, pure players specializing in furniture sales faced a much less favorable context afterward. This situation mainly results from the return to normal physical commerce activity, combined with the rise of omnichannel strategies adopted by traditional sector players during the pandemic (developing online sales, launching new marketplaces).

There is a minimal presence of second-hand furniture in France, Germany, and Italy. In France, Ikea offers “Second Life Spaces” where second-hand furniture can be purchased at reduced prices. The brand also offers product take-back for store credits.

Amazon and Ikea Leave Little Room for Local Retailers

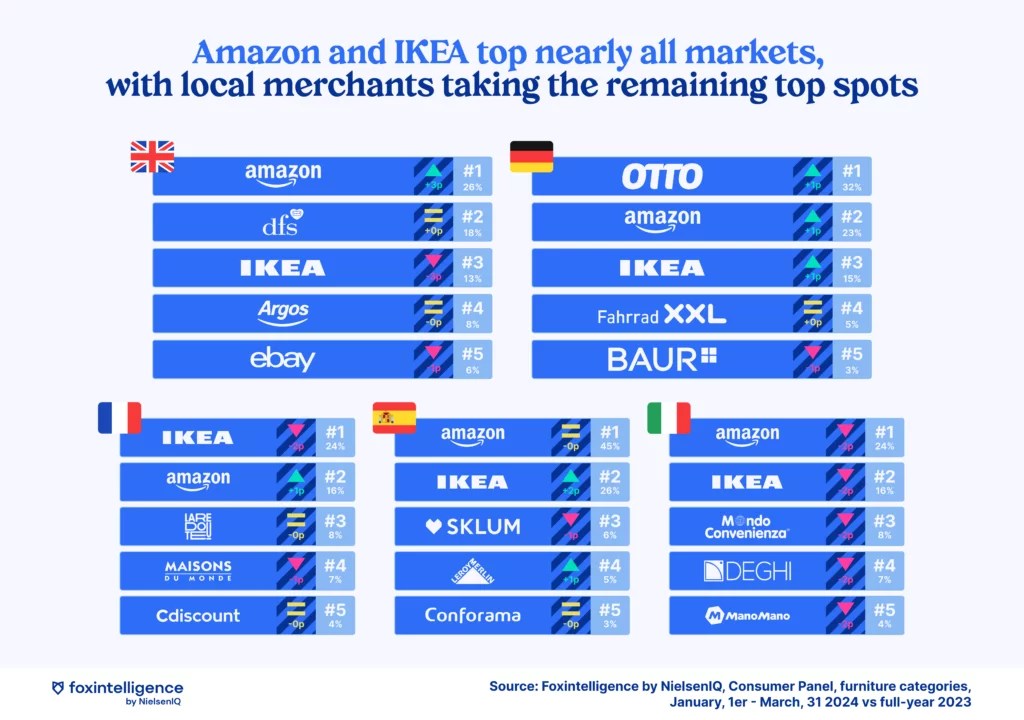

Except in Germany, where Otto takes the top spot, Ikea and Amazon lead the top retailers in the UK, France, Italy, and Spain.

In France, La Redoute, Maisons du Monde, and Cdiscount are also in the top 5.

Furniture Market in 2024: Consumer Trends

Personalization

Product personalization is a significant trend in the furniture market. With online configurators, buyers can now customize and visualize their furniture in their homes before purchasing. From adjusting the dimensions of a sofa to choosing finishes, the options are almost endless, allowing consumers to create bespoke furniture. This adds value in terms of differentiation, increased customer satisfaction, and boosted sales.

Delivery Options

Logistical advancements have enabled numerous innovations in delivery methods. Now, customers can choose the day and time of delivery, sometimes even modifying choices until the day before delivery. The idea is to make life easier for online shoppers.

Some companies also offer furniture assembly services or easy return solutions, making online furniture purchases less intimidating for consumers.

These trends not only illustrate the evolving consumer preferences but also the continuous innovation of retailers aiming to meet these demands effectively.