Executive Summary

Consumer Technology and Durables (T&D) businesses are operating in a challenging macro-economic, and category-specific environment. While there are positive indications to consider, budget planning for 2024 will be challenging – with potential gaps between top-down ambitions, and bottom-up planning.

Through our data, insights, and expertise, gfkconsult supports T&D leaders in their upcoming budget planning process by highlighting incremental growth spaces / opportunities and offering strategic sparring. In this article, we outline how gfkconsult can enable you to bridge the gap and facilitate more resilient, sustainable budget planning for 2024.

Market circumstances for budget planning 2024

The global economy continues to face a challenging path to recovery, marked by a complex and uncertain landscape shaped by prolonged, overlapping crises. These include global financial turbulence, high inflation and the cost-of-living crisis, the continued war in Ukraine, and the lingering effects of the past COVID-19 pandemic. For manufacturers, their omnichannel strategy, dented supply chain, and increasingly high inventories present immediate challenges. To outpace the market in 2024, senior business leaders in Consumer Technology and Durables (T&D) will need to shape proactive, resilient, and well-balanced plans that maximize every available growth opportunity. Here’s what you need to know.

Corporate leaders are no strangers to creating growth-minded budget plans in challenging market conditions. However, the current global landscape provides an unparalleled challenge as multiple disruptions converge, impacting business on a massive scale.

Key trends at a glance

- The global economic outlook is muted, with weak economic growth and high inflation expected by chief economists. Meanwhile, GfK analysis shows that a growing middle class offers brands growth opportunities in LATAM, and META consumers are willing to spend more — not less — on trusted brands. Meanwhile, APAC enjoys favorable GDP predictions of 4.8% as of April 2023.

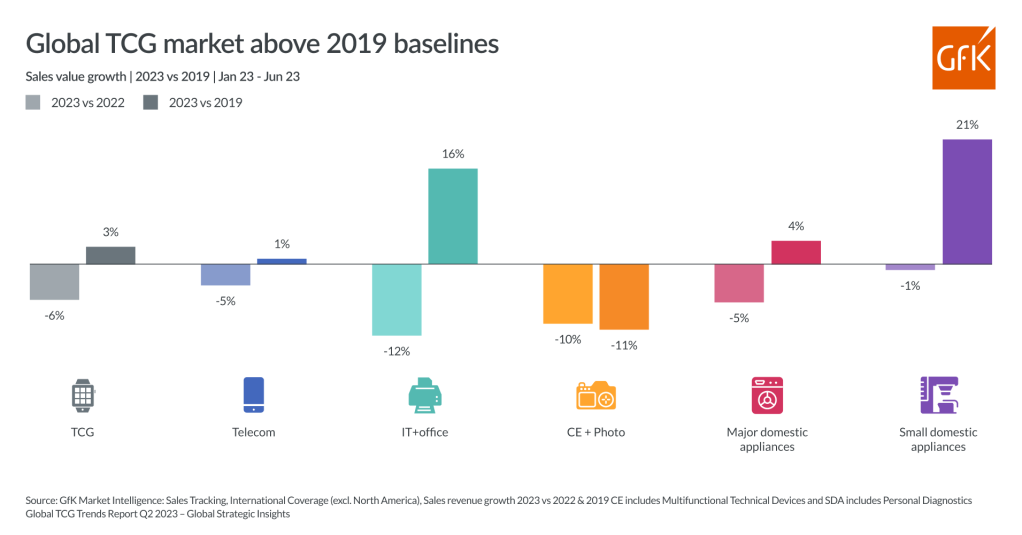

- The Technical Consumer Goods (TCG) market remains slightly up compared to 2019 in revenue terms, thanks to the ‘IT/Office’ and ‘Small Domestic Appliances’ (SDA) categories. ‘CE & Photo’ category remains weak compared to others.

- In 2022, 25% of global TCG sales value was earned during six promotional events over 14 weeks. Regional and global promotional trends continue to evolve to match changes in consumer and business circumstances, but ultimately the cost-of-living crisis and a gloomy sentiment will cement promotional sales of some kind as a popular option amongst consumers.

- By 2030 50% of consumers will be classed as eco-active, representing a TCG market segment worth more than US$700 billion. This makes the shaping of budgets and strategy around sustainable practices and product portfolios a question of How, not If or When.

Sources: GfK Global TCG Trends Report Q2 2023 – Global Strategic Insights; World Economic Forum Chief Economists Outlook 2023; GfK Market Intelligence: Sales Tracking Retailer Market, International Coverage; gfkconsult Regional Outlook 2023: LATAM; gfkconsult Regional Outlook 2023: META; gfkconsult Regional Outlook 2023: APAC; WCWD 2020 EU-10; GfK Market Intelligence:Sales tracking (GfK estimation).

The 2024 economic outlook is not all muted and enterprising brands can still find growth where socio-economic challenges hitting one region have opened opportunities in another. There’s no denying that global brands will continue to face radical challenges to finding growth in 2024, but there are pockets of opportunity to be found for the bold who can budget smartly, bide their time, and consider these challenges from various points of view.

Implications for budget planning 2024

Based on the volatile and demanding market conditions in 2022 and 2023 most country heads will be conservative in their budget planning in 2024. Global HQs however will have to show a convincing growth strategy, outpacing the overall market dynamics. Thus, the key challenge in the 2024 budget planning cycle lies in bridging this gap between conservative bottom-up planning and top-down ambition to create a sustainable budget for 2024.

Often the budget gap between bottom-up planning and top-down HQ ambition ends in a powerplay — where budget targets are forced through with limited buy-in or conviction by the executing entity. This “solves” the problem in the planning phase, but the gap rematerializes, in most cases, with the first forecast update.

To truly overcome the expected budget planning gap, in-depth market, consumer, and brand analysis is needed to identify incremental growth spaces and opportunities which will generate incremental revenue potential with the equivalent investment. This enables an aligned and ambitious 2024 budget. However, identifying these incremental growth opportunities (which are sometimes hidden) requires a deep and well-rounded category expertise, and objective distance from your day-to-day business. This is where gfkconsult can support you best.

“At GfK we’ve seen that companies who take the trouble to base their budget planning on trusted data that’s expertly interpreted outperform their competitors who rely on in-house insights only. Whilst internal teams are specialists in brand, product, and target groups, external consultants bring valuable holistic, and deeply localized insights and analytics experience to strategic budget planning.”

Paul Mitchell, Chairman, Global Market Intelligence Lead gfkconsult

Resilient but ambitious budget planning with gfkconsult

While 2024 will be a challenging year, the good news is that brands who tap into data-backed, localized and expert-led insights that are rooted in their business goals can overcome these challenges to find success. But the planning starts now, and it must be founded on smart budgeting decisions.

So, how can gfkconsult support and enable your budgeting process? Through our commercial target planning consulting service, we support you in four dimensions:

- Overall review of your business landscape — This includes a SWOT analysis of your brand’s position in markets of interest, to support decisions around prioritization.

- Analysis of key macroeconomic trends impacting prioritized markets — These clarify and define the overall setting for market-specific budget planning.

- Market, consumer, or brand deep-dives — An overall category forecast for the upcoming year and identification of incremental growth spaces and opportunities.

- Performance review vs key competitors — A high-level overview of your market competition, affecting new market dynamics and consumer choices.

Your benefit? Direct access to in-depth category expertise that gives you relevant market, consumer, and brand insights that showcase untapped growth potential and strategic sparring on how to optimize and align your budget planning for 2024.

Our approach to commercial target planning is centered around our client’s specific needs. The aim? To optimize their budget by following a proven, successful three-step process taking on average four to six weeks:

- Define what relevant budget planning support means to their business, for example in terms of focus categories, countries or KPIs

- Review relevant data and insights, showcasing growth opportunities and risks based on real, first-party data

- Support internal budget negotiations and discussions by delivering a gfkconsult dashboard that makes all relevant KPIs available at a glance.

See this in action: request a case study example

Our Target Planning Consulting service is based on GfK’s unparalleled T&D data assets — covering all relevant market, brand and consumer dimensions — interpreted through the lens of expert analysis and personalized to your business needs. This allows you to spot untapped growth potential, leverage overall category predictions, and uncover what’s most likely to influence next year’s brand performance.

Ready to jointly strategize budget and target planning? Make your 2024 planning sustainable, resilient, and ambitious.

About gfkconsult

At GfK, our strategic business consulting team draws on GfK’s pool of data insights and AI-powered analytics to enable senior business leaders to craft winning market, brand, and consumer strategies. Get in touch and see how we can help identify opportunities, solve business challenges, and rapidly deliver measurable impact.

Let’s strategize your big idea, today!