Who are Gen Z: Key Characteristics of Gen Z Consumers

Understanding the unique characteristics of Gen Z consumers is pivotal for retailers and CPG manufacturers aiming to capture their attention and loyalty. This generation is distinct in many ways, driven by their upbringing in a digital era and shaped by significant social and economic events. Gen Z is racially diverse, non-Western, and has a strong sense of identity linked to social causes.1 Gen Z consumers prioritize authenticity, sustainability, and social impact, making these factors essential considerations for any brand hoping to connect with them. Additionally, their proficiency with technology and preference for seamless, omnichannel experiences set them apart from older generations, necessitating innovative approaches in both product offerings and marketing strategies.

Some key characteristics of the Gen Z consumer include:

- Digital Native: Gen Z has never known a life without immediate, open access to information through technology, which makes it the first truly “digitally native” consumer cohort.

- Value-Driven: Gen Z demands a higher emphasis on authenticity, social responsibility, and brand values than the generations before.

- Preference for Personalization: With a stronger sense of self, Gen has a higher demand for tailored experiences and products.

Gen Z’s Impact on Retail Channels

53%

of gen Zers say they have used “buy” buttons on social media networks.

Gen Z’s preference for seamless, omnichannel shopping experiences is reshaping retail channels in significant ways. This generation values convenience and flexibility, driving retailers to integrate their online and offline operations more effectively. Click-and-collect services, where customers can order online and pick up in-store, have become increasingly popular among Gen Z shoppers. Additionally, retailers are investing in technologies that allow for a more cohesive shopping experience, such as mobile apps that enable in-store navigation, product scanning, and easy access to online reviews and inventory checks.

The rise of social media as a powerful retail channel is another testament to Gen Z’s influence. Platforms like Instagram, TikTok, and Snapchat are not just for social interactions; they are thriving marketplaces where Gen Z discovers, researches, and purchases products. Retailers and CPG manufacturers are leveraging influencer partnerships and shoppable posts to reach this tech-savvy generation directly within their preferred digital environments. Social commerce, which combines social media with e-commerce functionalities, is becoming a crucial strategy for brands looking to engage with Gen Z consumers and drive sales.

One interesting insight is that although Gen Z consumers often begin their shopping journey online and are heavily influenced by social media, their share of in-store mass merchandise dollars surpasses that of any previous generation. In fact, their combined in-store mass merchandise and grocery purchases account for nearly 50% of their total spending.2 This highlights the continued importance of brick-and-mortar shopping and positions Gen Z as the most authentic “omni” shopping generation to date.

What Influences Gen Z’s Purchasing Decisions

Gen Z’s purchasing decisions are heavily influenced by their values and the desire for authenticity. This generation prioritizes brands that align with their ethical and social principles. Environmental sustainability, social justice, and corporate transparency are critical factors that Gen Z considers when making purchases. They are more likely to support brands that demonstrate a genuine commitment to these causes, as evidenced by practices such as sustainable sourcing, eco-friendly packaging, and corporate social responsibility initiatives. Retailers and CPG manufacturers need to understand that for Gen Z, buying a product is not just a transaction but a statement of their personal values and beliefs.

Social media also plays a pivotal role in shaping Gen Z’s purchasing behavior. Platforms like Instagram, TikTok, and YouTube are where this generation discovers new products, seeks out reviews, and engages with influencers who impact their buying decisions. Influencer marketing, in particular, is a powerful tool, as Gen Z consumers trust the recommendations of influencers they follow more than traditional advertisements. The visual and interactive nature of social media allows Gen Z to engage with brands on a deeper level, creating opportunities for storytelling and authentic engagement that drive purchase intent.

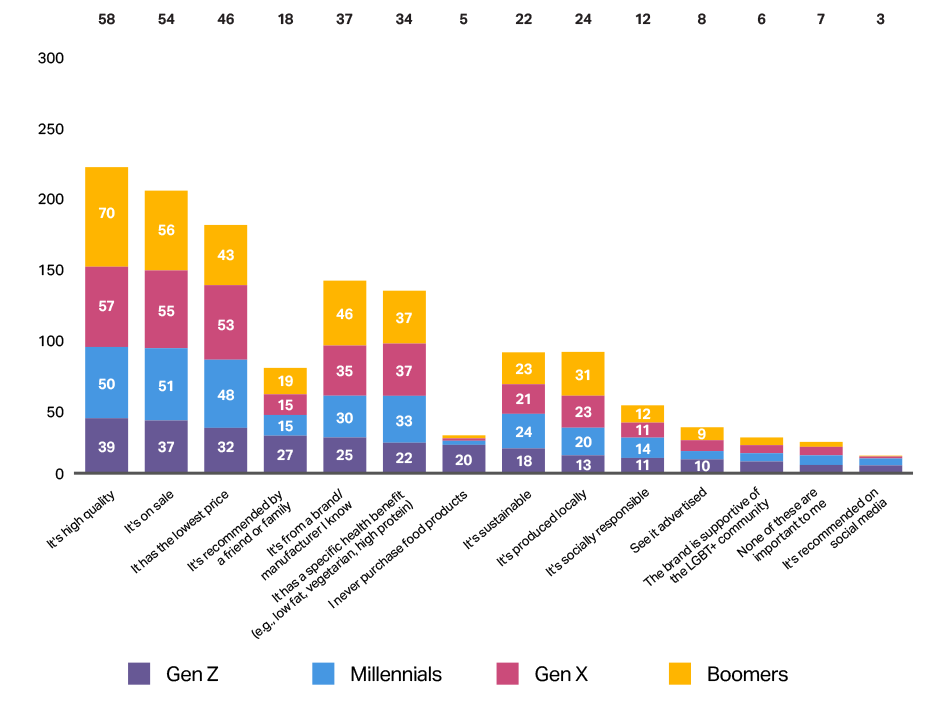

Price sensitivity combined with a desire for high-quality and unique products further influences Gen Z’s shopping habits. While they are willing to pay a premium for items that meet their standards of quality and ethics, they are also savvy shoppers who hunt for the best deals and value for money. In fact, 32% claim they are motivated to buy the lowest price product and 37% actively seek out sales.3 This generation appreciates transparency in pricing and is adept at using technology to compare products and prices before making a purchase. Retailers and CPG manufacturers must balance quality, price, and ethical considerations to appeal to Gen Z, offering products that not only meet their high standards but also provide tangible value.

SPEND Z

Gen Z Changes Everything

Gen Z’s reign is upon us—NIQ’s latest report has everything you need to know to get their attention.

Gen Z Shopping Preferences and Trends

Gen Z shoppers are redefining the retail landscape with their distinct preferences and trends.

Purchase drivers by generation

Source: NIQ US Gen Z survey, Aug 2022, Q9

One of the most notable trends is their strong preference for omnichannel shopping experiences. This generation seamlessly blends online and offline shopping, often researching products online before making an in-store purchase or vice versa. They value the convenience of e-commerce but also appreciate the tactile experience of physical stores. Retailers and CPG manufacturers need to create cohesive, cross-channel experiences that cater to this behavior, ensuring that both their online and offline presences are engaging, efficient, and aligned with Gen Z’s expectations.

Personalization is another critical factor in Gen Z’s shopping preferences. This generation expects brands to offer tailored experiences that reflect their individual tastes and preferences. They are drawn to retailers who use data-driven insights to personalize marketing messages, product recommendations, and shopping experiences. From customized emails to AI-driven product suggestions, personalization helps retailers build stronger connections with Gen Z consumers. CPG manufacturers can also leverage this trend by creating products that cater to specific niches and preferences, thereby enhancing their appeal to this discerning demographic.

Sustainability and ethical consumption are also at the forefront of Gen Z’s shopping trends. This generation is acutely aware of environmental and social issues and seeks out brands that demonstrate a commitment to sustainability. Gen Z consumers are more likely to purchase from companies that prioritize eco-friendly practices, such as using sustainable materials, reducing carbon footprints, and supporting fair trade initiatives. They also prefer brands that are transparent about their supply chains and production processes. Retailers and CPG manufacturers who embrace sustainability not only attract Gen Z consumers but also build brand loyalty and trust in this increasingly conscious consumer market. In fact, clean label products are out-performing other products with an 8% increase in the last year.4

Challenges and Opportunities for Retailers

Navigating the evolving landscape shaped by Gen Z consumers presents a unique set of challenges and opportunities for retailers and CPG manufacturers alike. This digitally native and socially conscious generation demands innovation, authenticity, and sustainability, pushing brands to adapt swiftly to their preferences. While meeting these expectations can be daunting, it also offers unprecedented opportunities for growth and differentiation. Retailers and manufacturers who can effectively understand and cater to Gen Z’s distinct behaviors and values are well-positioned to thrive in this dynamic market, capturing the loyalty of a generation that is set to become a dominant force in retail.

Challenges

Retailers and CPG manufacturers face some challenges when trying to connect with Gen Z consumers. One significant hurdle is the generation’s high expectations for digital experiences. Gen Z is accustomed to seamless, fast, and intuitive online interactions, meaning any lag in website performance, lack of mobile optimization, or difficulty in navigating e-commerce platforms can quickly deter them. Additionally, their preference for personalized shopping experiences requires advanced data analytics and technology investments to track and anticipate their needs accurately.

Another challenge is the demand for authenticity and transparency. Gen Z is particularly adept at detecting insincerity and is less forgiving of brands that fail to live up to their promises. This generation values ethical practices, sustainability, and social responsibility, scrutinizing brands for their impact on society and the environment. Retailers and manufacturers must ensure their operations, marketing strategies, and product offerings align with these values, which often requires significant changes in sourcing, production, and communication practices. Meeting these standards is crucial, yet it can be resource-intensive and complex to implement effectively.

Opportunities

Opportunities abound for retailers and CPG manufacturers who strategically leverage marketing channels to cater to the omnishopping behavior of Gen Z consumers. Gen Z’s seamless integration of online and offline shopping requires brands to provide a cohesive experience across all touchpoints. This means optimizing both e-commerce platforms and physical stores, ensuring that promotions, branding, and product availability are consistent and interconnected. Social media, in particular, plays a crucial role in influencing Gen Z’s purchasing decisions, making it imperative for brands to maintain a strong presence on platforms like Instagram, TikTok, and YouTube. In fact, Gen Z ranks online reviews from other shoppers as the most important factor when shopping.5 By engaging with Gen Z through these channels, retailers can create interactive and personalized shopping experiences that drive both online and in-store traffic.

Private label brands present a significant opportunity to capture the loyalty of Gen Z consumers who are looking for value without compromising on quality. Gen Z is increasingly recognizing the quality and uniqueness of private label products, which were once perceived as lower-cost alternatives to name brands. An astounding 67% of Gen Z feels private label products are just as good as national brands.6 By investing in the innovation and differentiation of private-label offerings, retailers can meet the demands of this cost-conscious yet quality-seeking generation. Additionally, aligning private label products with Gen Z’s values, such as sustainability and health, can further solidify their appeal. Highlighting attributes like organic ingredients, eco-friendly packaging, and ethical sourcing in private-label lines can attract Gen Z consumers who prioritize these factors in their purchasing decisions.

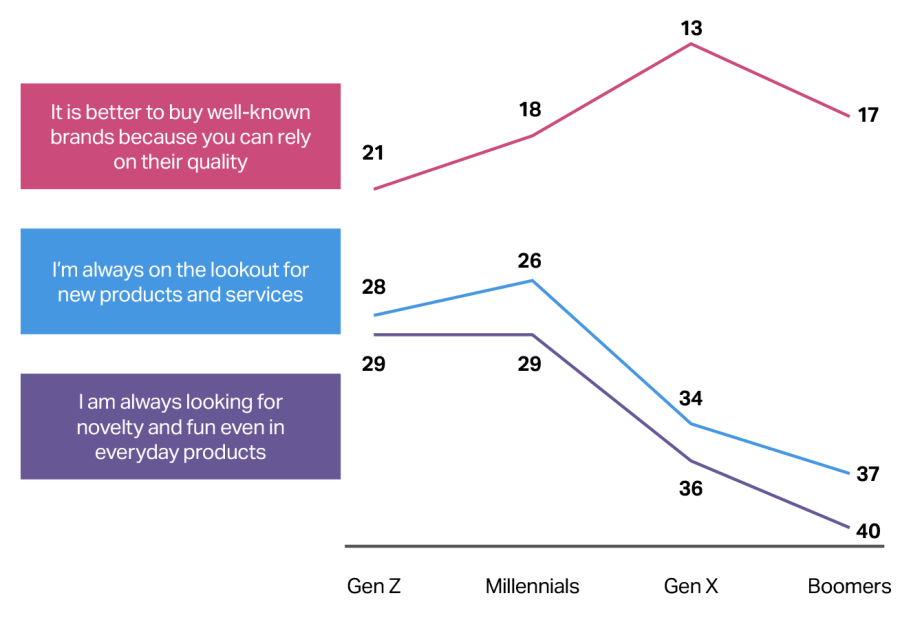

Understanding the purchase patterns of Gen Z compared to other generations is essential for retailers and CPG manufacturers looking to capitalize on this market. Gen Z’s preference for an omnichannel shopping experience, driven by technology and social media, contrasts with the more linear shopping journeys of older generations. Retailers must analyze and adapt to these patterns, ensuring that they provide a seamless, integrated shopping experience that resonates with Gen Z. Additionally, retailers should consider how Gen Z’s values and preferences differ from those of Millennials, Gen X, and Boomers. For example, Gen Z is more prone to brand exploration, and they look for novelty and fun in everyday products.7 By tailoring strategies to address these unique purchasing behaviors, retailers can better meet the needs of Gen Z while maintaining appeal across all generations.

Rank of attitudes by generation

Source: GfK Consumer Life Global 2023, E1/J1/M1 (global = 18 countries): *based on a list of 43 attitudinal statements

Adapt to Gen Z Shopping Habits with Accurate Data and Insights

Retailers and CPG manufacturers must recognize that Gen Z’s shopping habits are distinctly different from those of previous generations. Understanding and adapting to Gen Z’s unique consumer behaviors is imperative to thrive in today’s dynamic market.

This generation’s digital savviness, demand for authenticity, and focus on sustainability are reshaping the retail landscape in profound ways. By embracing technology, creating personalized experiences, and demonstrating a genuine commitment to social and environmental causes, brands can effectively engage with Gen Z and build lasting relationships. While challenges exist, the opportunities for innovation and growth are vast. By staying attuned to the evolving preferences and values of Gen Z, retailers and manufacturers can position themselves for success and drive the future of retail forward.

Ready to learn more about how Gen Z is using their spending power to change the face of retail?

Sources:

1 NIQ Spend Z Report

2 NIQ Omnishopper, Total FMCG Depts= Food, Baby Care, Health & Beauty Care, Household Care, Pet Care, Gen Merch; 52 weeks ending January 27, 2024

3 NIQ US Gen Z survey, Aug 2022, Q9

4 NIQ Report – Wellness trends influencing consumers in 2024

5 World Data Lab, Generations Forecasts

6 NIQ Consumer Survey, PLMA Consumer Research report

7 GfK Consumer Life Global 2023, E1/J1/M1 (global = 18 countries): *based on a list of 43 attitudinal statements