A definition of the digital shelf

The digital shelf is the online environment a product appears in. It’s the online counterpart to a shelf in a physical store.

Since a shopper can’t pick up a product and inspect it, a number of functionalities have evolved around enhancing the customer experience on the digital shelf, and there is a growing depth of information that can be gathered around shopper behavior too. The digital shelf is a critical part of a CPG’s activity today and as all things digital, it’s constantly evolving.

Here follow the essential aspects of the digital shelf.

Tracking these KPIs while staying current on other market forces like new tech, assortment and trends will put you in a good position to manage your digital shelf as the shift to online CPG shopping continues and increasing numbers of shoppers turn to it.

Out of stock rates

OOS rates are the first item in our list because it’s a foundational KPI.

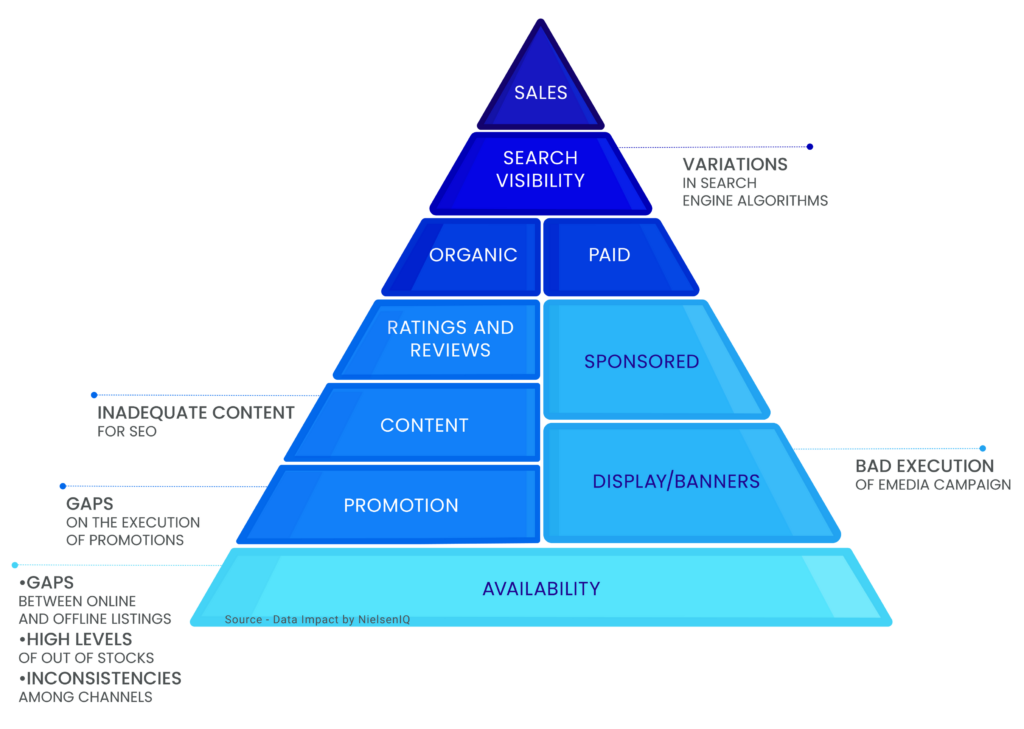

The distribution and availability of a product are essential, because without them, a product can have no presence on the digital shelf and consequently no conversions can occur.

With reliable OOS tracking rates in hand, a manufacturer can prevent costly gaps or discrepancies in distribution, and react to high rates quickly. They can contact their supply chain team and address issues directly.

That said, taking action where OOS rates are occurring is only possible with location-based, granular data. Comprehensive data is the only way to see where exactly rates vary. The fact is, they can differ dramatically from store to store.

The pyramid below illustrates all the elements of the digital shelf. Notice that the foundation is availability/ OOS. Products must be in stock to create an online presence that propels a consumer along the shopping journey.

The hero image and other imagery

Images are another very important part of the digital shelf. Why?

It’s the primary way a shopper identifies or verifies they’ve found the product they’re looking for.

As the digital shelf evolves, so does imagery. Video is becoming more commonplace, an image carousel that features different aspects of a product is also often recommended, and the hero image is the centerpiece.

A simple packshot or photograph of a product isn’t appropriate for the digital shelf. The image needs to be optimized for online shopping so that the name of the product and other key elements are easily recognizable. In fact, it’s very important that your imagery complies with the retailer’s standards, and those standards do differ. Simplicity is the rule of thumb for online product imagery. Optimizing the image for discoverability is the goal.

As much as possible, the same hero image should be used across all digital platforms. This creates consistency for the consumer, which is a very desirable part of the omnishopper experience.

Price and promotions

Here again, location-based data collection is necessary. Without it, there is no possibility of seeing where a price violation occurs, and therefore no way to correct it. Sample-based data monitoring is unreliable.

Another drawback to sample-based data collection is that the average price metric will not be accurate. A sample of stores will not yield the same average as collecting data from every single estore a product is available at.

Tracking competitor’s pricing is essential too. Competitor intelligence is needed to understand market forces and understand if trends are category-wide or not. Data collection on every SKU in a category is the only way to ensure accuracy and actionability.

Product detail page

Retailer specifications for the product detail page (PDP) vary. It’s important to ensure a product complies with all of each retailer’s specifications so that a product has the best presence possible and the highest likelihood of converting.

The PDP entails several things–ratings and reviews, product information, product description–in a nutshell, all product-related content.

Manufacturers should have a DAM tool (digital asset management) that will cross-reference their product information with retailer’s requirements. This way, any images, text or content that is non-compliant will be flagged.

An aspect of the PDP that deserves mention is the inclusion of keywords in product titles and descriptions. Ensuring the right keywords are used in the right place is particularly important because of their direct impact on search and, often, sales.

Search

Sometimes search is included in PDP, but because it has such a huge impact on conversion rates, it deserves special attention and is it’s own KPI.

Appearing amongst the first results in search is an absolute need. Products that appear outside of the top 10 or on page 2 and beyond have a very low click through rate (CTR) The first three products often get as much as 80% of clicks on major retailer’s search engines.

Does your product description contain the optimal number of keywords, images, bullet points, the correct product description length, etc. (again, per retailer) that will allow consumers to find your product instantly through search?

Ratings and reviews

Ratings and reviews are increasingly consequential.

Today, brands need to not only monitor ratings and reviews constantly, they need to respond to negative comments within the day–ideally within minutes. In the current digital environment, ratings and reviews are a trusted source of information for shoppers, and they have a significant impact on conversion rates.

Establishing a meaningful connection with consumers should be the goal of every brand, and ratings and reviews provide the perfect environment for this. The longer negative reviews go unanswered, the more damage it can do to a brand. Engaging and nurturing consumers is more important than ever in today’s engagement economy.

Ratings and reviews hold other areas of potential for brands too, like identifying emerging consumer trends, new product ideas and product improvements.

Eretail media

Eretail media is advertising on a retailer’s site. Banners are the most common kind of emedia. This feature of the digital shelf is perhaps the most talked-about aspect in the CPG world today. Why? Because online advertising is undergoing a transformational shift.

Retailers are becoming media companies. With the end of third party cookies coming in 2023, personalization and hyper-targeted marketing are going to become the go-to source of advertising and ad revenue. No-one is better placed to cultivate this treasure trove of data and personalized advertising than retailers. They have the identity and the shopping history of their customers, who are loyal, repeat shoppers. The growing databases and insights into consumer behavior these retailers/ media companies own are becoming very valuable because their site serves as a lucrative advertising platform to advertisers.

Data analytics

The fusion of online and physical shopping into the omnichannel is creating increasing complexity. Shoppers may first browse on a retailer site, then consult Amazon, then visit a store before making a purchase. There are many variations on that journey. This presents a well known challenge to CPGs. With the omnipresence of mobile, the pandemic, and the progress retailers have made in their online offerings, consumer behavior is changing at a seemingly constant pace.

As CPGs make the ongoing shift to ecommerce, it’s evident that legacy data systems and a siloed way of working are inadequate for the omnichannel reality.

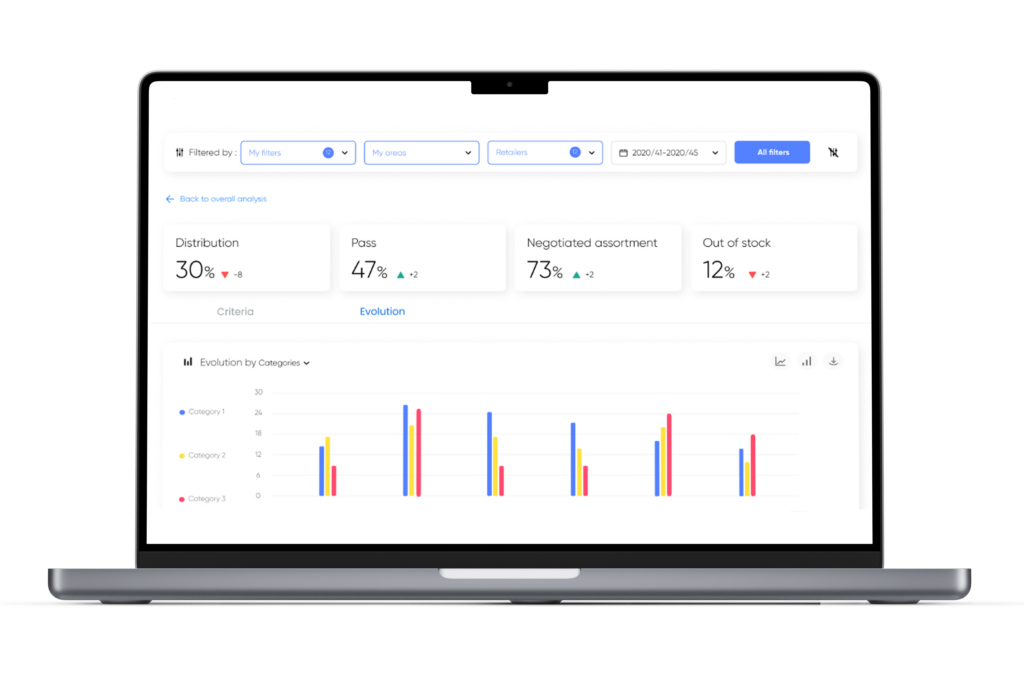

CPGs are undergoing a lot of change, reorganizing themselves and looking to solution providers that have platforms and scorecards with customized analytics that quickly and clearly give them the data, the insights, and the actionable predictions they need.

For this, a partner or network of external partners and technology players can ensure they succeed in the rapidly changing online sales environment.

Annual or semiannual shelf resets

Periodically updated promotional calendars

Monthly or quarterly reviews of brand-level marketing campaigns by a buyer

Lower order complexity – pallets of products with weekly delivery

Service levels indirectly drive physical shelf availability

Category managed by an algorithm (with some buyer influence)

Daily assortment decisions managed with test-and-learn mentality

Dynamic net revenue management decisions informed by internal and external data

Always-on marketing with ongoing reallocation of SKU-level tactics

Higher order complexity – mixed pallets, batches with multiple deliveries per week (or even daily)

Service levels directly impact customer digital shelf listing and prioritisation

Amazon’s digital shelf

Amazon has captured a huge amount of the CPG ecommerce market, particularly in the US. Among other things, their search engine criteria differ from bricks and clicks retailers, necessitating a dedicated digital shelf strategy.

Sales performance history features significantly in Amazon’s algorithm, as does keyword and text matching. Visibility is key and as always, being amongst the first products listed in search results is crucial.

With its access to 3P vendors, Amazon designs search and findability to feature items customers want to purchase so discoverability is paramount.

Price points are low on AMZ, so that needs to be considered in a manufacturer’s digital shelf strategy too.

Increasingly, Amazon is using its own digital shelf like an advertising network. Manufacturers and third party vendors compete for space, visibility and the buy box through search. Atypically, availability tends not to be an issue for Amazon with its vast warehouses and extensive delivery network.

Conclusion

Every part of the digital shelf is connected, so if one of the KPIs above is not being optimized for or monitored properly, it can affect other KPIs. Remember that availability and visibility are primordial to a well-functioning digital shelf.

At Data Impact by NielsenIQ we offer the most granular and insightful look into the online CPG marketplace in the industry. Our location-based analytics and customizable platform render your KPIs in a clear way. Book a consultation with one of our experts today!