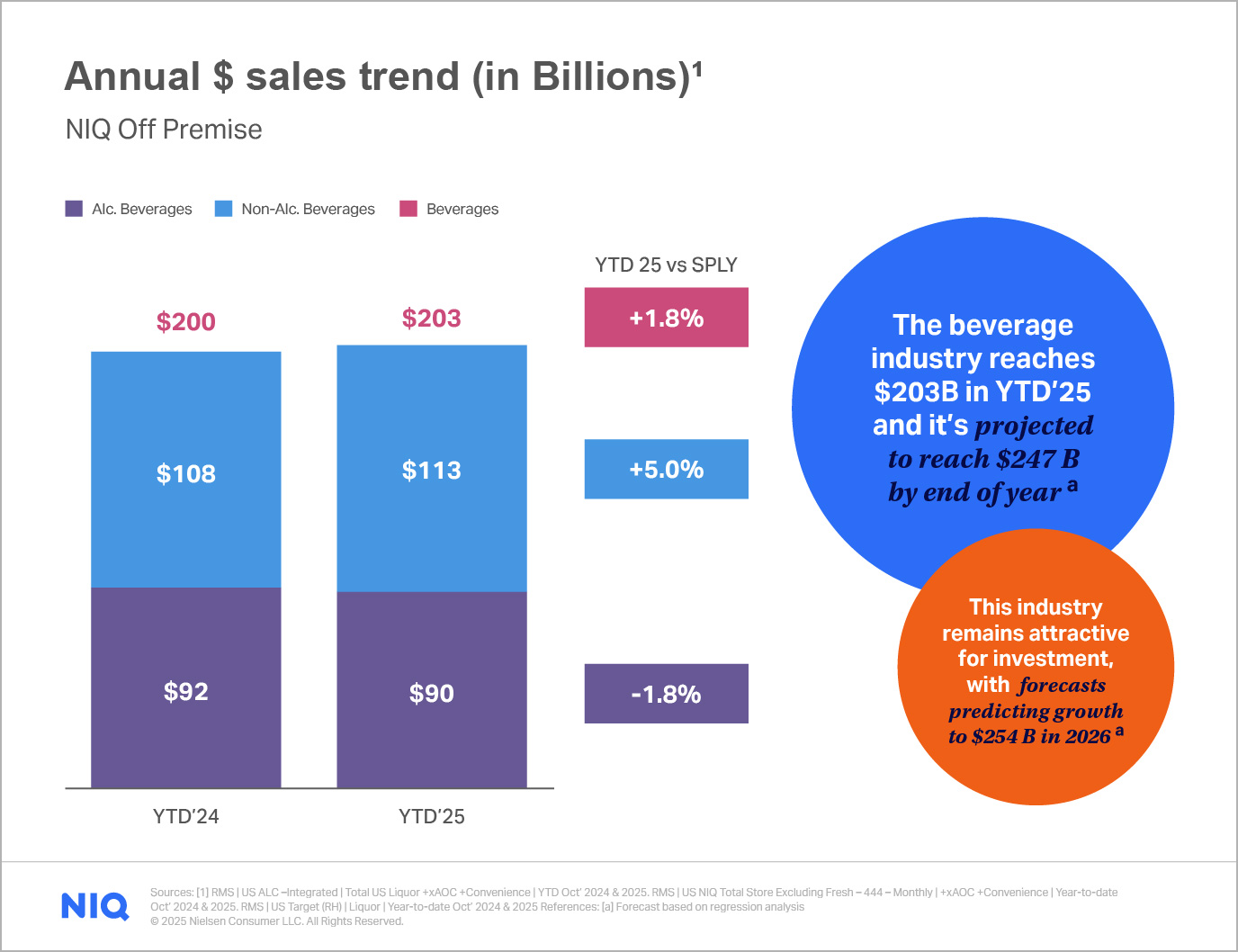

The U.S. beverage industry is entering a new era—one shaped by shifting consumer priorities, evolving channel dynamics, and a sharper focus on wellness. With total category sales projected to reach $270 billion within three years, brands and retailers have a clear mandate: adapt fast, innovate smart, and meet the moment.

From hydration to high-end spirits, the landscape is changing. Here’s what’s driving growth—and how to act.

Non-Alc Beverages Momentum: The Quiet Power Shift

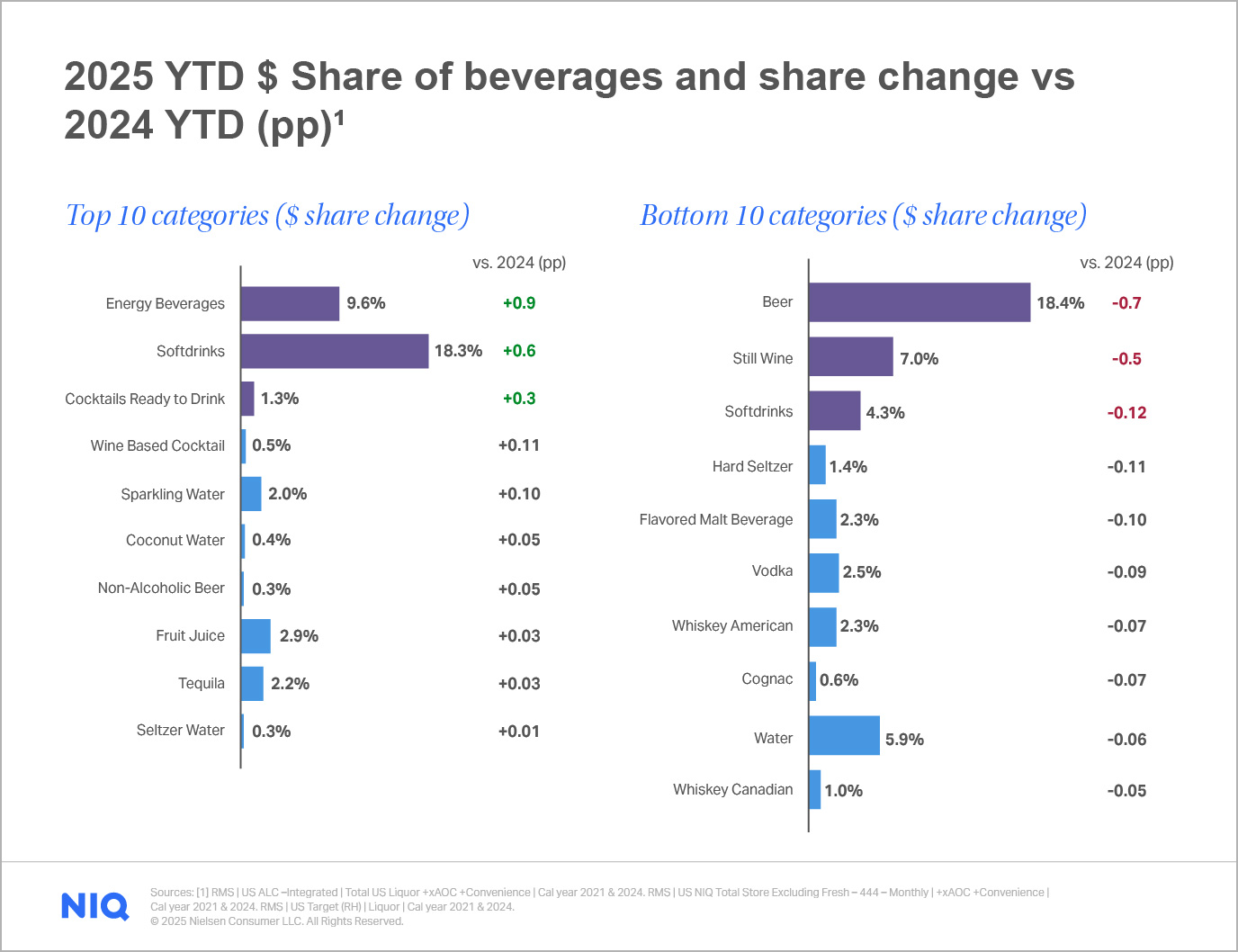

Non-alcoholic beverages are quietly overtaking their alcoholic counterparts in dollar share. Water, soft drinks, and energy beverages are gaining traction, while wine, beer, and spirits are seeing modest declines. This is a clear signal of changing consumption habits.

What it means: Manufacturers should double down on hydration and energy platforms, especially those with wellness cues. Alcohol brands can stay competitive by leaning into “Ready To” formats and flavor-forward innovations that meet legal drinking age Gen Z’s evolving expectations.

Channel Shake-Up: Convenience Wins

Consumers are migrating toward convenience and “all other” large-format outlets, leaving traditional liquor and food channels behind. These emerging channels are projected to gain up to 2.6 percentage points in share by 2027.

What it means: Winning brands will optimize for immediacy—cold placement, single-serve formats, and impulse-ready packaging. Convenience is no longer just a distribution strategy—it’s a growth engine.

Planned Purchases Dominate: Win Before the Aisle

More than 65% of beverage purchases are planned, and most shoppers arrive with a specific brand in mind. This is especially true for affluent consumers, 70% of whom pre-decide their non-alc beverages purchases.

What it means: Mental availability is non-negotiable. Brands must activate across retail media, search, and social to ensure they’re top-of-mind before the shopper hits the store. Physical availability—especially for same-day consumption—is equally critical

Gen Z (21+): The Growth Flywheel

Legal drinking age Gen Z consumers are fueling over half of non-alc beverages growth and more than 60% of alcohol growth. They’re impulsive in non-alc beverages (17% of spend is unplanned) but more deliberate in alcohol, where credibility and wellness matter.

What it means: Build two tracks: one for impulse-driven hydration and energy (think sparkling juice, kombucha, coconut water), and one for considered alcohol formats with better-for-you claims and smaller pack sizes.

Affluent Shoppers: Premium Still Wins

Households earning $100K+ are driving over 80% of non-alc beverages growth and 100% of alcohol growth. They over-index in categories like sparkling water, spirits, and wine—and, at high rates, they have a preselected brand in mind.

What it means: Premium cues—origin, sustainability, craft—should be front and center. Assortment depth and storytelling matter more than price alone. Target affluent geo-clusters with tailored marketing campaigns.

Multicultural Momentum: Buyer-Led Growth

Multicultural segments are expanding at 1.4x the rate of the total market, with 82% of their growth coming from new buyers. They over-index in categories like aloe drinks, probiotic beverages, sparkling juice, and kombucha.

What it means: Flavor localization, culturally relevant formats, and targeted marketing are key. These segments are reshaping category norms.

Innovation: Fewer Items, Bigger Impact

Innovation contributed $10.5B in sales of total beverages last year, despite a nearly 8% drop in item count. Non-alc beverages and “Ready To” formats are leading the charge, while traditional alcohol categories under-index.

What it means: Be selective. Focus on wellness-forward line extensions and flavor innovations that meet consumer expectations. In alcohol, pair format + flavor + claim to recover innovation productivity.

Wellness Attributes: Trial Accelerators

Attributes like recyclable packaging (+321%), organic certification (+109%), and reduced calories (+31%) are driving rapid growth in innovation sales. These attributes are moving beyond niche and into mainstream expectations.

What it means: Make wellness claims visible and verifiable. Use badges like USDA Organic and concise benefit language to boost conversion, especially in pre-shop environments.

Pricing & Penetration: The Demand Equation

Sales growth is being driven by buyer expansion (46%) and increased dollars per occasion (54%). Occasions per buyer are soft, so penetration and pricing are the levers that matter.

What it means: Recruit new buyers with targeted campaigns and design price/pack strategies that sustain higher baskets without relying on frequency.

Flavor Exploration: Shorter Cycles, Bigger Bets

Flavor extensions are taking center stage, but their life cycles are shortening. Consumers want novelty—but they also want relevance.

What it means: Keep flavor sprints tight and data-backed. Use shifting analysis to track competitive wins and losses, and prioritize formats that allow fast rotation

Final Word: Adapt to Thrive

The beverage industry is growing—but not evenly. Success will come to brands that understand the occasions that consumers are seeking, as well as, the new math of demand, the nuance of channel migration, and the power of wellness-led innovation.

Next step: Speak to an NIQ expert to explore how your brand can win in this shifting landscape. From flavor strategy to channel activation, we’ll help you turn insight into impact.

Ready to turn insights into impact?

NIQ’s Total Beverages Syndicated Study goes beyond topline trends to uncover the drivers behind growth—across categories, channels, and consumer segments. From strategic assortment planning to innovation roadmaps, we’ll help you make data-driven decisions that win in a dynamic market. Connect with your NIQ representative to learn more or explore customized solutions tailored to your brand.