The latest Daily Drinks Tracker shows average sales in managed venues in the week to 15 November were 3.1% ahead of the same week in 2024. The following seven days to 29 November brought fractional growth of 0.1%.

These numbers follow two weeks of similar growth in the first half of November. While increases in each of the four weeks of November were below the UK’s current rate of inflation, they do offer grounds for cautious optimism for a much-needed burst of spending in December.

The Tracker shows year-on-year growth on nine of the 14 days in the second half of November. It peaked at +11.3% on Tuesday 18 November, when important international football matches involving Scotland and Wales brought fans out to pubs and bars. There was another inflation-beating rise of 5.8% on Saturday 22 November, which saw the opening of some Christmas markets and retail campaigns. However, wetter weather over the following weekend dampened comparisons on Friday 28 (up 0.2%) and Saturday 29 November (down 2.9%).

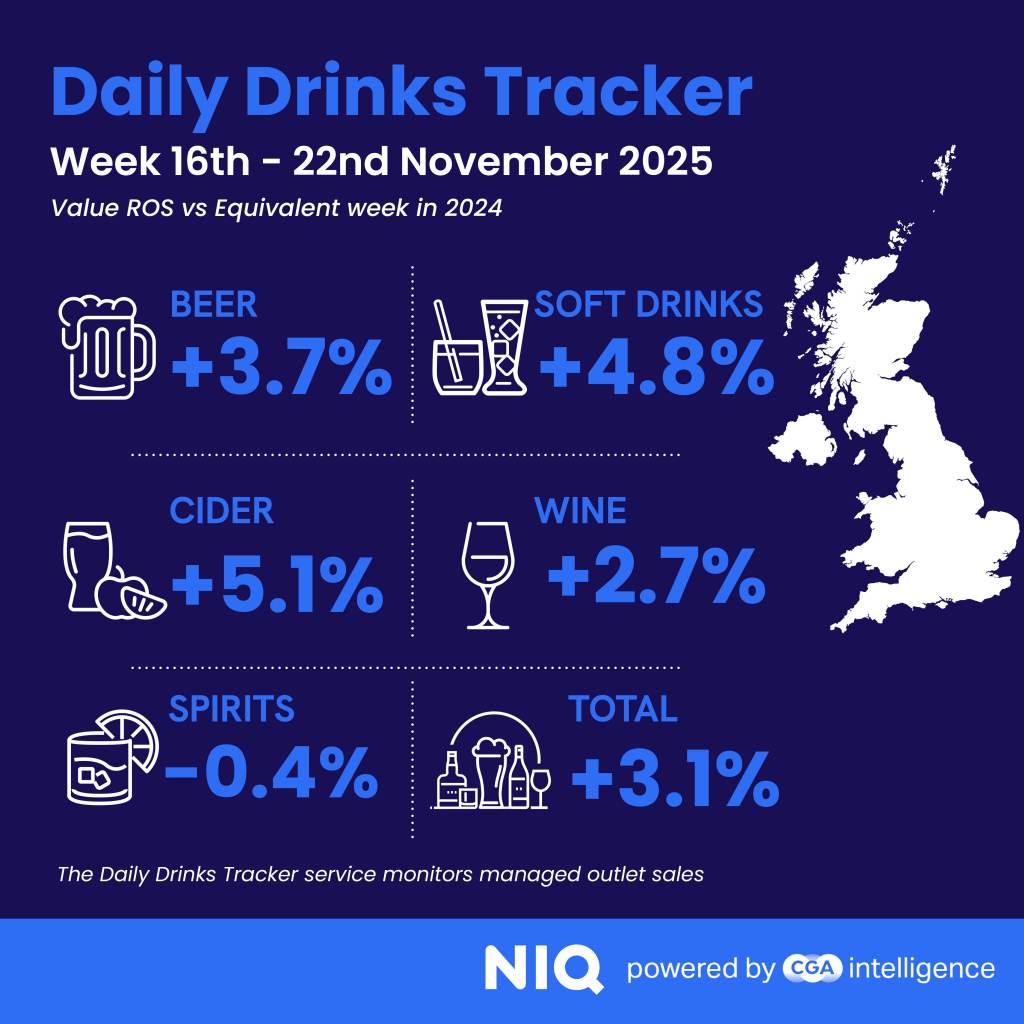

Long Alcoholic Drinks (LAD) have outpaced other categories for most of 2025, and that trend looks set to continue into Christmas trading. Beer sales rose by 3.7% and 1.6% in the last two weeks of November, and cider was further ahead with growth of 5.1% and 2.5%. Soft drinks also had another positive fortnight, rising 4.8% and 1.6%.

Some of LAD’s growth has been at the expense of the spirits category, where sales were behind year-on-year by 0.4% and 4.6% in the two weeks. Wine had an up-and-down fortnight, with growth of 2.7% followed by a dip of 1.1% in the last week of November.

Rachel Weller, CGA by NIQ’s commercial lead, UK & Ireland, said: “Operators and suppliers had to fight hard for growth in November, and the month ended with disappointing news from the Chancellor’s Budget, which will do little to ease their huge burden of costs. But while volumes are clearly down, there are signs that some consumers are making an early start to their Christmas shopping and drinking occasions. Whether this modest momentum continues into December remains to be seen, and with millions of consumers very conscious of costs, venues will have to deliver top-value experiences to bring them out of home in the crucial final weeks of 2025.”

The Daily Drinks Tracker provides analysis of sales at managed licensed premises across Britain and is part of NIQ powered by CGA’s suite of research services delivering in-depth data on category, supplier and brand rate of sale performance.

Unlock essential On-Premise insights

Contact us to unlock On-Premise insights. Understand the trends, views, and opportunities to win across this crucial channel.