Across Asia, new demand pockets are opening up, particularly in countries with strong demographic momentum and shifting retail behavior. Vietnam is one such opportunity. With over 100 million people, a rising middle class, and a retail sector in rapid transformation, the opportunity is real. It combines manufacturing advantages with a fast-growing consumer market that’s increasingly urban, digitally connected, and open to new product formats. For companies exploring international expansion whether manufacturers, brand owners, or commercial leaders, who want to understand how to navigate Vietnam’s evolving landscape is key to unlocking sustainable growth.

At NIQ, we help brands decode Vietnam’s evolving market structure, understand what drives consumer behavior, and build go-to-market strategies that are resilient, data-backed, and built for long-term growth.

Vietnam’s growth and consumer demographics

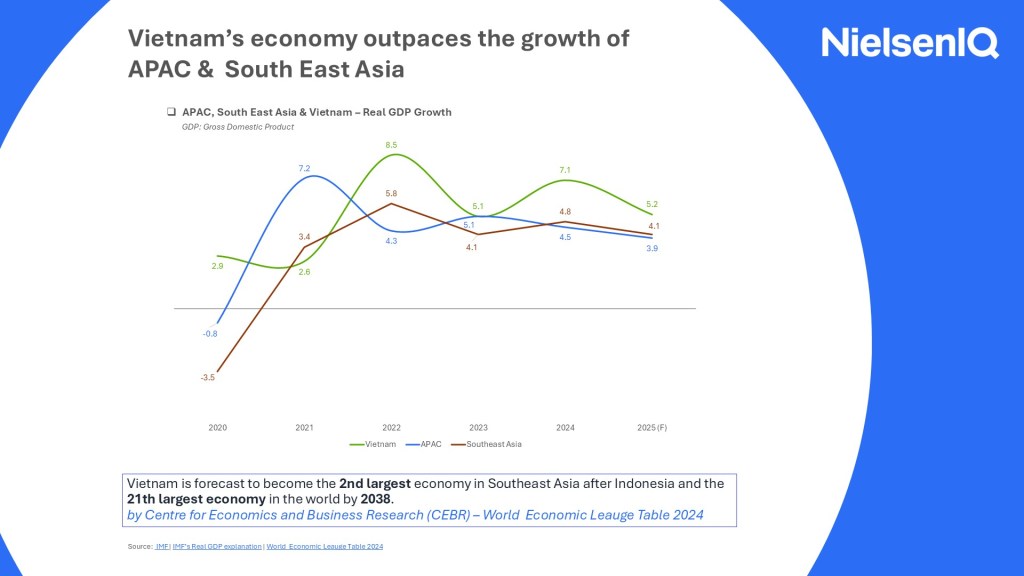

Vietnam continues to demonstrate strong economic momentum, supported by robust growth in services and industrial sectors, and a young, digitally connected population. The country’s population is not only young (65% are of working age) but also increasingly urban and digitally connected. Foreign direct investment continues to rise, with Singapore, South Korea, Japan, China leading the charge, and by 2038, Vietnam is projected to become the second-largest economy in Southeast Asia.

But growth alone doesn’t guarantee success. What matters is knowing how to navigate the market’s complexity, especially when consumer expectations, retail formats, and regional behaviors vary so widely.

Retail market structure: Traditional foundations, Modern acceleration

Vietnam’s retail landscape is in transition. Traditional Trade still dominates in terms of store count, especially in rural and semi-urban areas. But Modern Trade is gaining ground fast, particularly in urban centers where convenience and lifestyle are driving purchase decisions.

What’s interesting is how consumers use these channels. Traditional Trade remains strong for categories like beer, cigarettes, and beverages – products often bought on impulse or for social occasions. Meanwhile, Modern Trade is where consumers go for essentials: milk, staple foods, personal care. These are the categories where trust, hygiene, and convenience matter most.

Brands that succeed here don’t just pick a channel – they tailor their strategy to the product, the shopper, and the moment of purchase.

One country, many markets

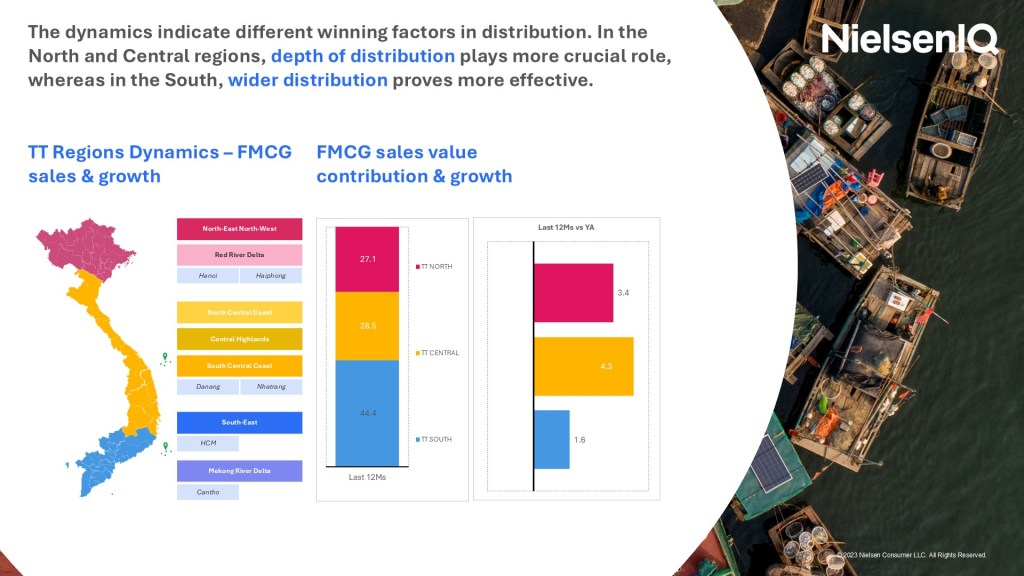

Success in Vietnam isn’t about entering one market; it’s about mastering three distinct consumer mindsets. In the North, consumers are loyal, traditional, and family-oriented. They prefer big packs, premium-looking products, and are heavily influenced by cultural rituals, especially during Tet, when some products see sales surge by over 90% compared to pre-Tet periods.

In the Central region, price sensitivity is high. Local brands dominate, and weather extremes shape shopping habits. The South, by contrast, is fast-paced and convenience-driven. Consumers here are more open to new experiences, and Modern Trade plays a much bigger role.

Understanding these regional dynamics is critical. A one-size-fits-all approach won’t work. Brands need to localize not just their messaging, but their distribution, pricing, and product formats.

Consumer behavior: Value-Oriented, Selectively Premium

Vietnamese consumers have proven financially resilient, even in the face of inflation. Our NIQ research shows they feel more optimistic about their economic situation than most peers across the region. But confidence doesn’t mean indiscriminate spending.

Vietnam’s FMCG market is becoming more polarized. Some consumers are trading down, especially in categories like home care and cigarettes. But others are trading up, particularly in milk-based products.

Premiumization is a clear trend. Consumers are willing to pay more for products that offer health benefits, convenience, or a better experience. Top motivators for premium spend: 64% want experiences that bring restaurant quality home, 62% prioritize convenient, user-friendly formats.

Even subtle cultural influences, like the popularity of Korean-style products, can give brands an edge when executed authentically.

Data usage is the differentiator

In a market this dynamic, guesswork is expensive. That’s why more brands are turning to always-on analytics to guide their decisions. At NIQ, we help you:

- Understand the true structure of the market and where your category fits.

- Identify high-performing “golden stores” that drive disproportionate sales.

- Track shifts in consumer demographics and price sensitivity.

- Optimize your promotions, pack sizes, and pricing strategies with precision.

Whether you’re launching a new product or scaling an existing one, the right data turns uncertainty into opportunity.

If you’re planning to expand into Vietnam or want to sharpen your current strategy let’s talk. We’ll help you understand the market, your consumer, and the path to sustainable growth.

Let’s talk about your Vietnam strategy

Vietnam is growing. But growth without insight is risk. At NIQ, we help you move from market entry to market leadership with the data, tools, and local expertise to make every decision count.