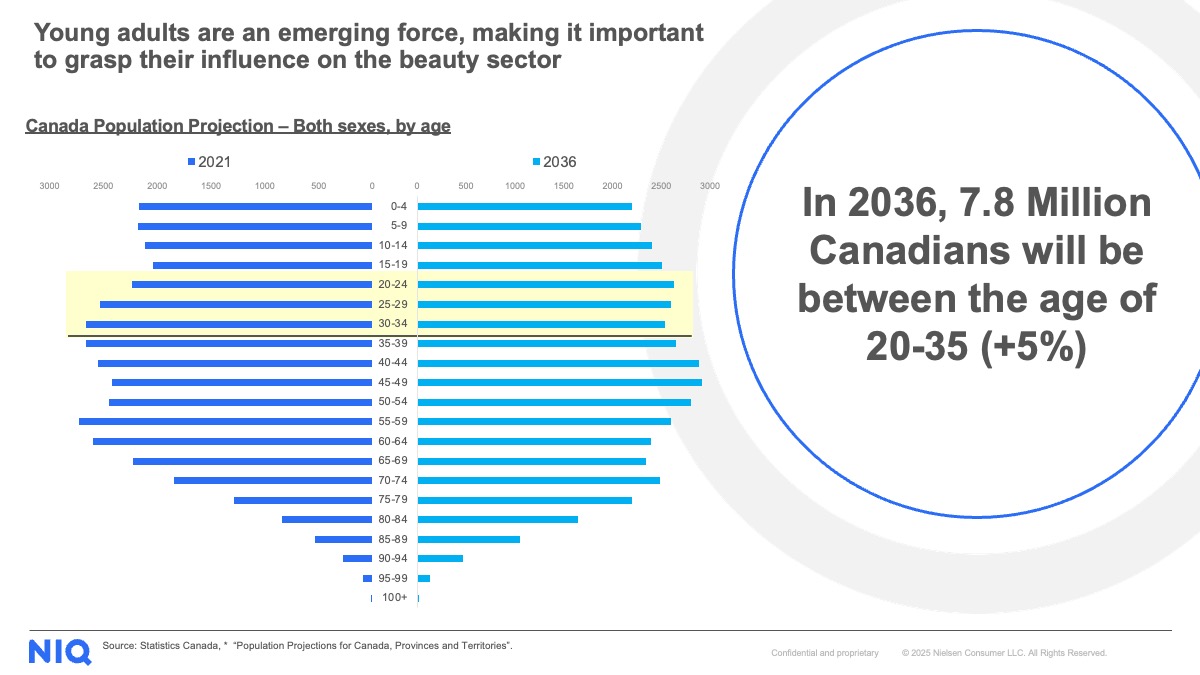

The Demographic Powerhouse

By 2036, Canada will be home to 7.8 million young adults aged 20–35, a 5% increase from today. This isn’t just a population stat—it’s a wake-up call for beauty brands. Young adults are not only growing in number, but they’re also reshaping the beauty landscape with their preferences, spending habits, and channel choices.

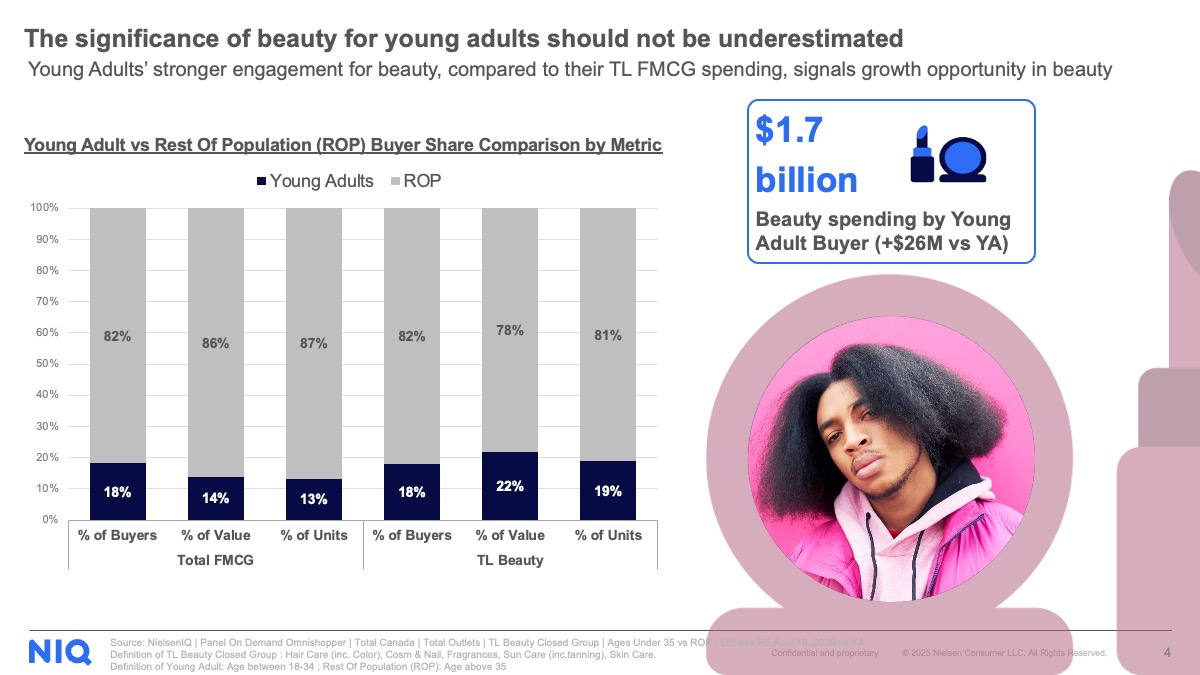

Beauty is Where They Splurge

Young adults are spending $1.7 billion on beauty annually, with a $26 million increase year-over-year. That’s not just impressive—it’s strategic. Compared to their spending on total FMCG, beauty is where they over-index. While they make up 18% of buyers, they punch above their weight in value and unit share in categories like fragrance, skin care, and cosmetics.

This signals a clear opportunity: beauty isn’t just a category for young adults—it’s a priority.

Skin Care is the New Self-Care

Among all beauty categories, skin care is surging. With 90% penetration and $235 per buyer, it’s the top category for young adults. They’re not just buying moisturizers—they’re investing in long-term skin health and natural beauty. This trend reflects a deeper shift: beauty is becoming wellness.

For brands, this means innovation in skin care isn’t optional—it’s essential.

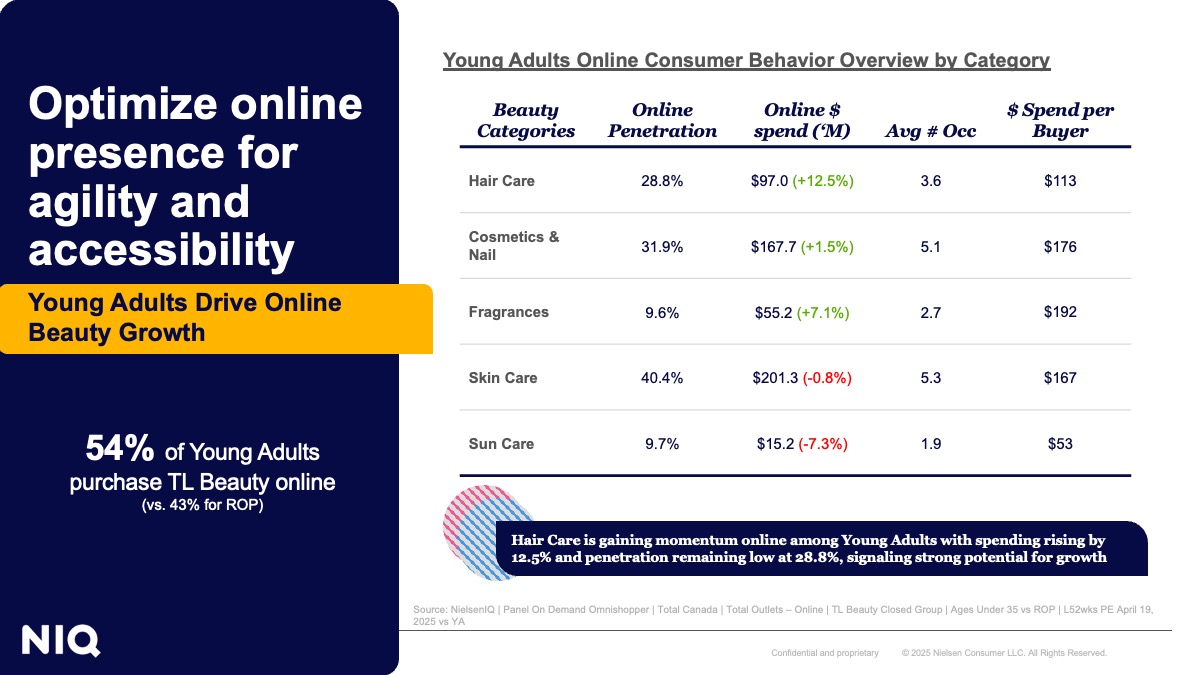

Digital-First, Always

Canadian young adults are driving the online beauty boom. Over 54% of them purchase beauty products online, compared to 43% of the rest of the population. Their online spend is rising across categories, especially in hair care (+12.5%) and fragrance (+7.1%).

They’re not just browsing—they’re buying. And they expect agility, accessibility, and authenticity. Brands must optimize their e-commerce presence, streamline mobile experiences, and offer seamless omnichannel journeys.

Beyond the Beauty Aisle

While beauty and drug stores remain key channels, young adults are exploring mass merchandisers, Amazon, warehouse clubs, and even dollar stores. These channels are growing fast, with dollar stores seeing a 24.9% increase in value and 22.7% in units.

This shift reflects their desire for convenience, affordability, and discovery. Brands must meet them where they are—not just where they’ve been.

Fragrance Finds Its Moment

Fragrance is having a renaissance among young adults. With $164 per buyer and $50 per trip, it’s a high-value category that’s gaining traction. This signals a shift toward personal expression and premium experiences.

For manufacturers, this is a chance to elevate fragrance offerings—think bold scents, sustainable packaging, and storytelling that resonates.

The Young Adult Beauty Strategy

Young adults are not just consumers—they’re trendsetters. Their influence shapes product development, marketing strategies, and retail innovation. To win with this group, brands must:

- Innovate in skin care and fragrance

- Diversify distribution across emerging channels

- Invest in digital-first strategies

- Track and respond to evolving preferences

Final Thought: Don’t Just Follow—Lead

Young adults are redefining beauty in Canada. They’re informed, intentional, and influential. Brands that understand their behavior, anticipate their needs, and engage them authentically will not only grow—they’ll lead.