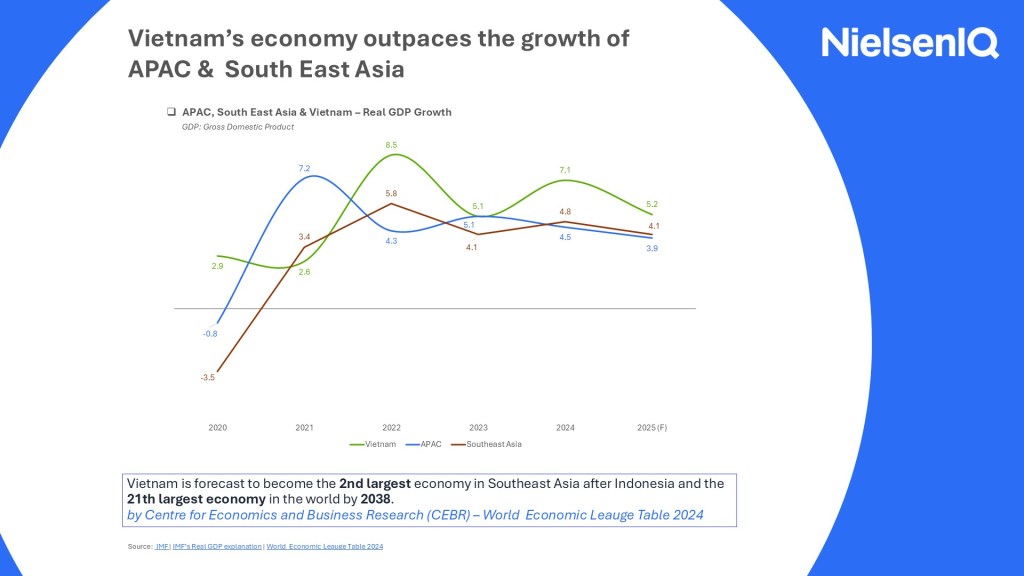

The APAC Turnaround: From Price-Led to Volume-Led Growth

For a time, growth in the FMCG sector across APAC was largely driven by price increases. But now, the market is signaling a return to volume-driven strategies. Brands can no longer rely solely on pricing to boost value—especially in a climate where consumer demand, affordability, and competition are all intensifying. To stay competitive, businesses must balance price adjustments with strategies that drive volume and retain market share.

Consumers Are Clear: Food Prices Are Top of Mind

Across APAC—from Thailand to Japan—consumers overwhelmingly cite food prices as their number one concern. Even as inflation cools slightly, the pressure remains high, and shoppers are adapting. They’re switching brands, hunting for deals, adjusting pack sizes, and shopping across multiple retailers to stretch their budgets.

This behavior underscores a crucial message: pricing power lies in understanding consumer elasticity.

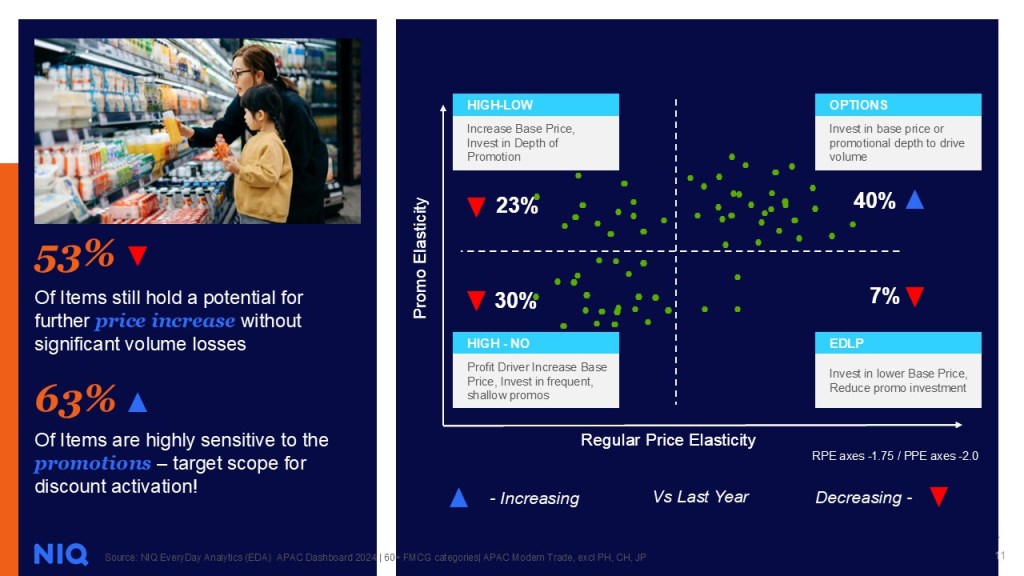

Rethinking RGM: One Size No Longer Fits All

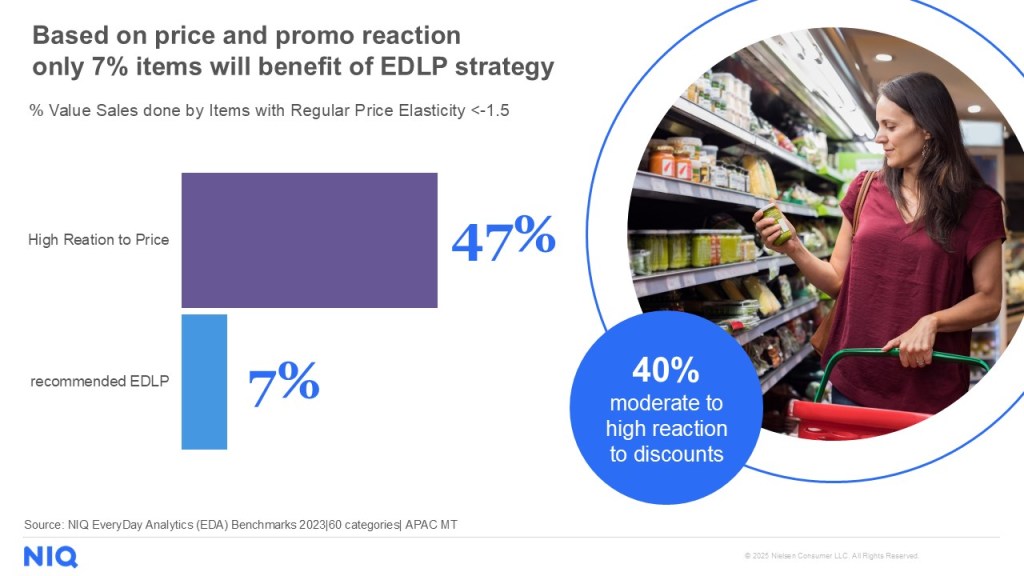

NIQ’s data shows that:

- 53% of items still have room for price increases without major volume losses.

- 63% of items are highly sensitive to promotions and should be the focus for discount activation.

- Only 7% of items truly benefit from an EDLP (Everyday Low Pricing) strategy.

This means brands must move beyond blanket approaches and segment their portfolio based on pricing elasticity and promo response.

Promotions: Necessary, but Not Always Efficient

A staggering 68% of consumers actively seek out promotions, yet NIQ reveals a $4.45 billion opportunity to reduce inefficiencies in promotional spending across APAC modern trade.

Shockingly, 15% of sales come from overpromoted items, while 20% of promo-sensitive products are underpromoted. The takeaway? Reallocate promotional efforts strategically to avoid waste and drive genuine incrementality.

Price-Pack Architecture: Give Shoppers What They Want

With shoppers under pressure, brands must offer the right price-pack combinations. Whether it’s introducing smaller affordable packs, offering economy sizes, or even careful downsizing, brands must align format with shopper expectations. Downsizing, for example, has 40% less elasticity impact than direct price increases—if used cautiously.

Three key strategies stood out:

- Downsizing: Maintain margins while minimizing perceived price hikes.

- Pack Restructuring: Offer better value via size variations.

- Line Extensions: Introduce affordable variants to broaden appeal and offset tariff impacts.

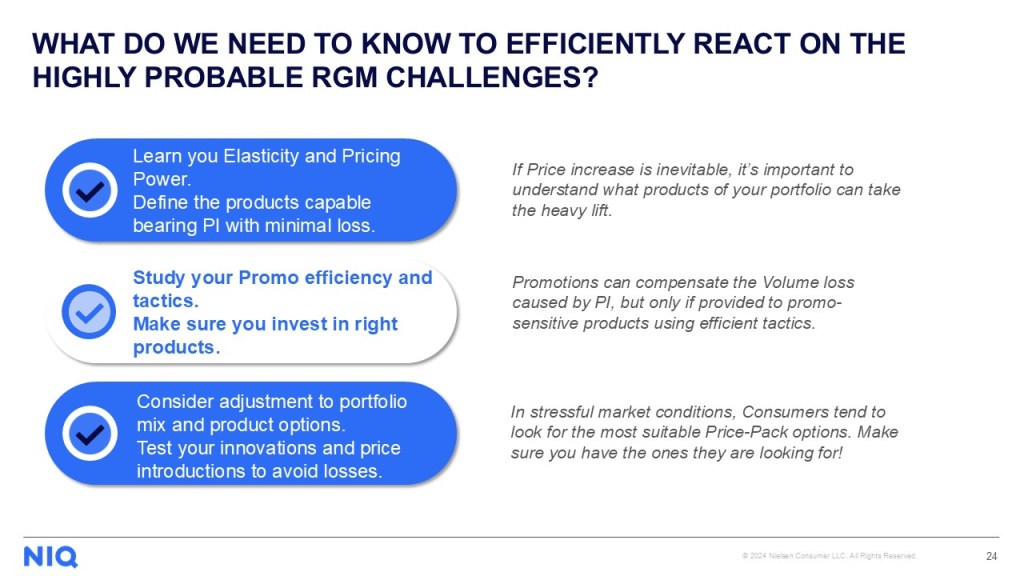

What Should Manufacturers Be Asking?

- Which SKUs can absorb price increases with minimal volume loss?

- Are my promotions driving volume or wasting spend?

- Should I adjust my pack architecture to retain shoppers?

- Is my assortment optimized for current market realities?

The answers lie in data-driven elasticity insights and continuous testing of pricing and promotional tactics.

The NIQ Advantage: From Insight to Execution

Talk to our Experts

APAC is growing. But growth without insight is risk. At NIQ, we help you move from market entry to market leadership with the data, tools, and local expertise to make every decision count.