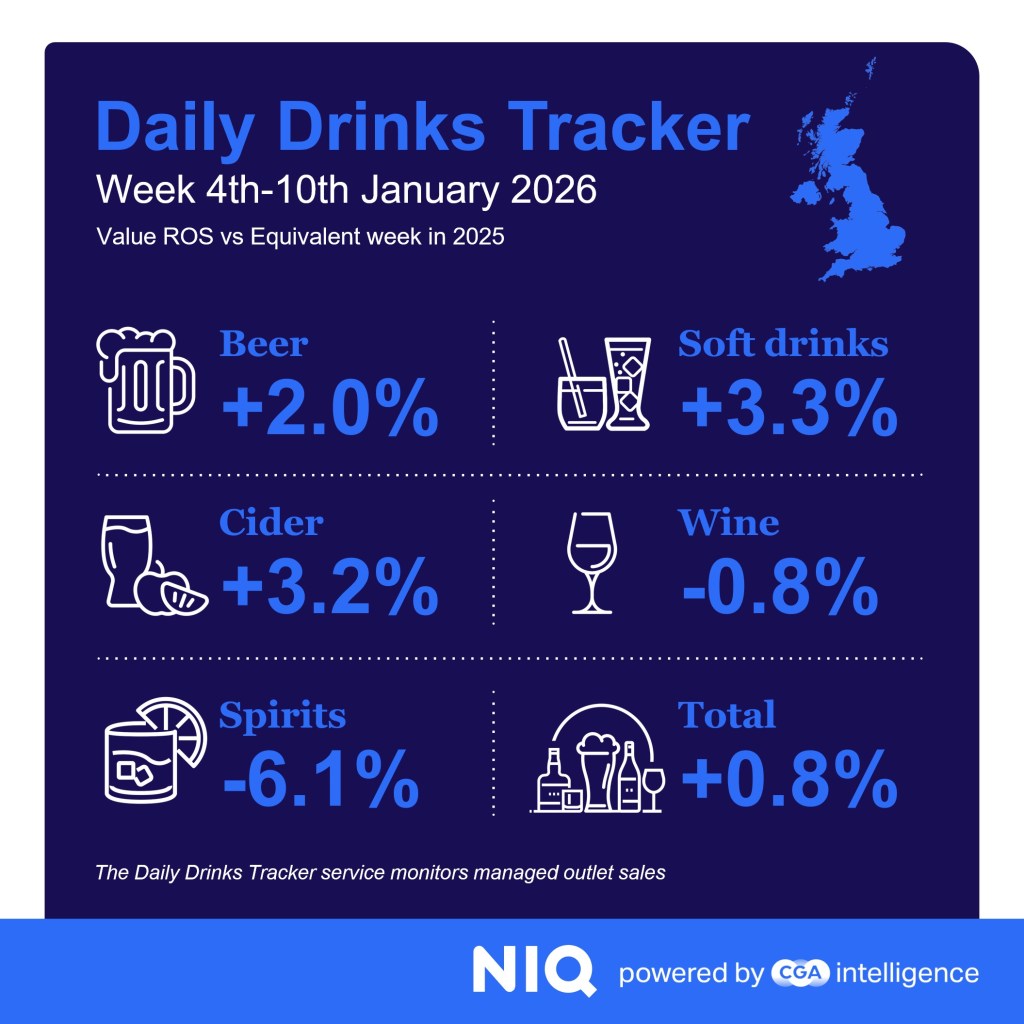

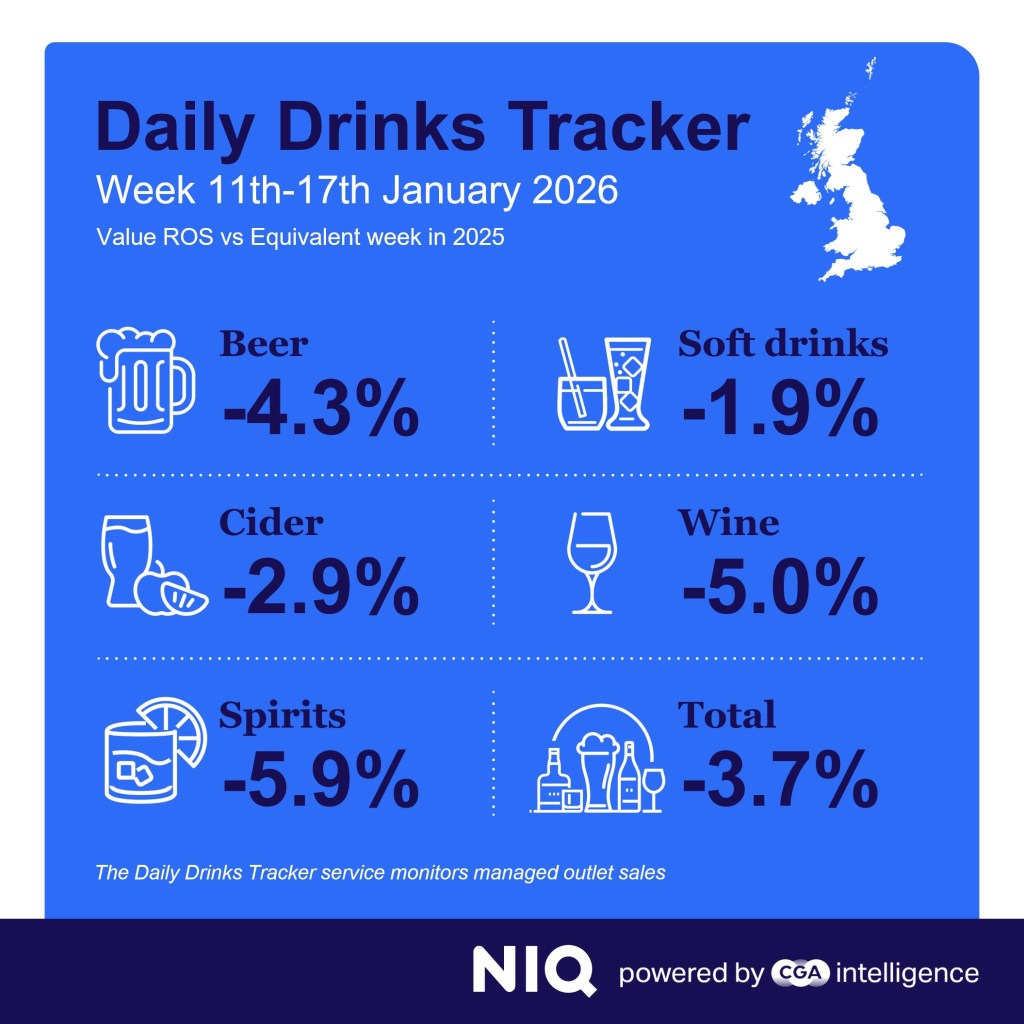

Average sales in managed venues in the week to Saturday 17 January were 3.7% down from the same week in 2025. This follows fractional growth of only 0.8% in the previous seven days to Saturday 10 January.

The slowdown in the first fortnight of the year comes after strong Christmas trading, including double-digit growth in the final week of 2025. After spending heavily over the festive season, many consumers will have been watching their money more closely in January, especially in the days before monthly wages arrive. Some people have also been reducing their On-premise visits after making resolutions to avoid alcohol in Dry January. On top of that, venues in parts of Britain were affected by cold, wet and snowy weather for extended periods of mid-January.

The Daily Drinks Tracker shows year-on-year trading was negative on nine of the 14 days to 17 January, though there were encouraging pockets of growth. Soft drinks were boosted by Dry January, with sales up by 3.3% in the week to 10 January, and down by only 1.9% in the following seven days.

Other categories struggled for growth, with beer up by 2.0% and down by 4.3% over the two weeks—though some no and low alcohol brands will have benefited from consumers moving away from full-strength beers. Cider sales (up 3.2% and down 2.9%) followed a similar pattern.

Wine sales (down by 0.8% and 5.0% over the two weeks) were impacted by tighter spending, while spirits (down by 6.0% and 5.9%) experienced the most challenging fortnight of the five major categories.

Rachel Weller, CGA by NIQ’s commercial lead, UK & Ireland, said: “January is always a tough month for the On-premise, and some pubs, bars and suppliers will be feeling a hangover after a strong end to 2025. The combination of tight spending and poor weather has made for tough conditions, though solid sales patterns for soft drinks show millions of people remain eager to drink out, even when they’re participating in Dry January.”

The Daily Drinks Tracker provides analysis of sales at managed licensed premises across Britain and is part of NIQ powered by CGA’s suite of research services delivering in-depth data on category, supplier and brand rate of sale performance.

Unlock essential On-Premise insights

Discover more about brand rate of sales performance and access the latest intelligence on drinks Understand the trends and opportunities to win across this crucial channel.