Population Mobility Reshapes Three New Consumption Paradigms

In the 22 days leading up to the 2025 Chinese New Year, cross-regional travel reached 5.5 billion trips, an 8% year on year increase.

Meanwhile, consumers’ planned spending for 2026 rose 11% compared with last year.

Meanwhile, New reunion patterns have given rise to three emerging consumption paradigms:

- New Experiences breathe life into traditional New Year customs, with intangible cultural heritage becoming a hot trend.

- New Consumption shifts from “value for money” to emotional value and self-expression, driving demand for refresh-and-upgrade categories.

- New Reunion Models break traditional patterns, as young people bring parents on “destination New Year trips,” boosting demand for readymade New Year dishes and cultural tourism activities.

As reunion scenarios diversify, so do consumption behaviours. Those who grasp the shifting needs driven by population flows will be best positioned to seize upcoming opportunities.

In the Era of “Scenario-Based and Omnichannel,” Perceived Value Becomes the Core Growth Driver

In 2025, total omnichannel sales during the Spring Festival period grew 8.7% year-over-year, demonstrating robust purchasing power. Consumers stock up online through live-stream flash sales while also visiting offline New Year markets for immersive experiences, requiring retailers to strengthen scenario-based offerings and omnichannel integration.

Category strategies diverge:

- For food categories, front-loaded stocking is essential as demand begins ramping up six weeks before the holiday, ensuring full availability and fast replenishment is critical.

- For non-food categories, scenario expansion is key design assortments around gifting, home refresh, and stock-up occasions to create strong product to scenario linkages.

In 2025, offline average prices across categories were 13.8% higher than normal periods but 2.4% lower year-on-year, reflecting increasingly rational consumer behaviour. Alcohol, snacks, and beverages achieved both price and volume growth via gifting-driven demand and social scenarios. High-end skincare performed strongly through holiday exclusives and experiential marketing. Meanwhile, pet food and staples like grains and oils adopted a “large pack + slight price cut” strategy to drive volume.

The Spring Festival premium window is no longer about simply being expensive; it’s about making consumers feel the product is worth the price.

Return-to-Hometown Travel and Holiday Tourism Redraws China’s Consumption Map

During the 2025 Spring Festival, returning travellers transformed county-level markets from “supplementary” to “primary” consumption hubs. Local supermarkets and grocery stores became top destinations for New Year’s goods and gift shopping. On-demand retail added further momentum, with orders rising 42% year-on-year, and pop-up stores became top destinations for New Year’s goods and gift shopping.

Meanwhile, reverse travel and short-distance tourism boosted lower-tier cities, where the fusion of tourism, retail, and dining flourished. Small-town New Year celebrations and cultural heritage experiences revitalized the holiday atmosphere. Time-honored brands gained youth appeal through collaborations and scenario innovation, while supermarkets used cultural events to increase foot traffic.

Returning locals invigorate hometown economies; incoming tourists energize county-level commerce. For retailers, delivering the right products into county markets is no longer optional, it is the new baseline.

Booming “Refresh” Consumption and Upgraded Gifting Drive New Growth

Two themes dominated 2025 Spring Festival spending: home refresh and gifting.

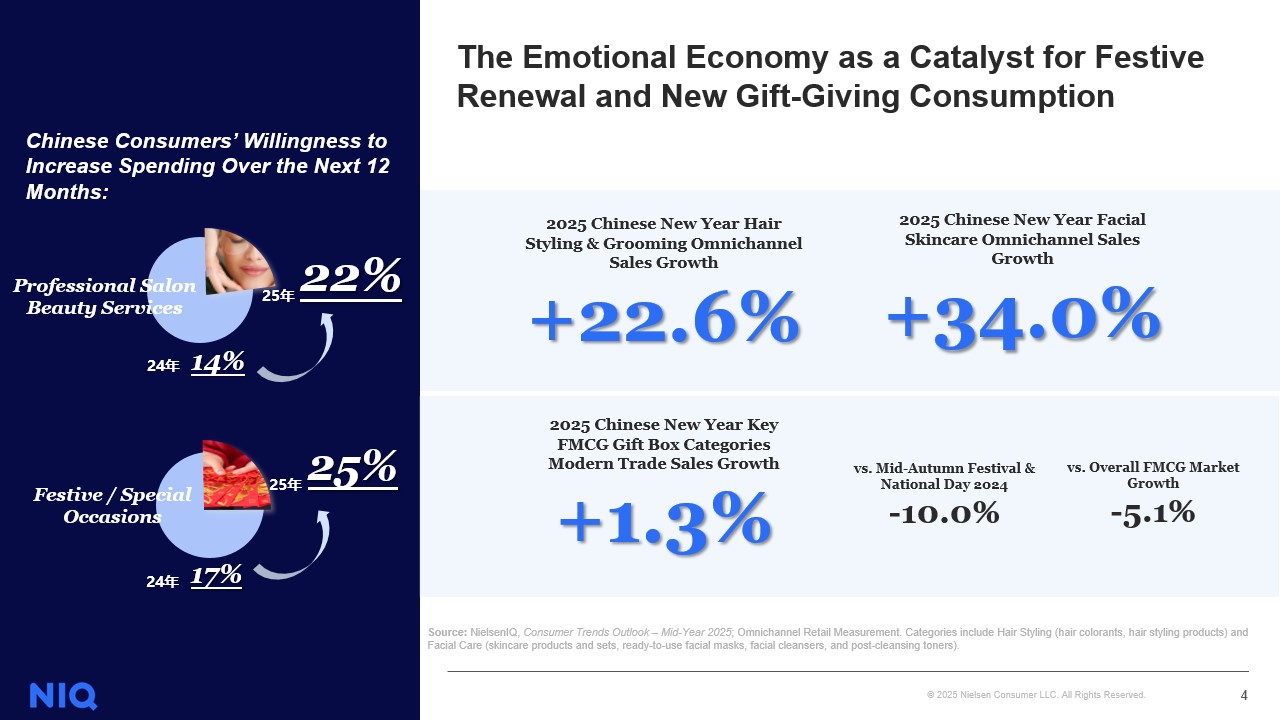

NielsenIQ reports that one in four consumers was willing to increase spending on beauty services and festive gifting. Beauty and personal care categories achieved double-digit growth across channels. On Douyin, hair and manicure group-buy orders rose 1.5×, while Little Red Book searches for “New Year photoshoot” nearly doubled.

Gift boxes performed strongly:

- Health-related gift boxes emphasized large packs and value-for-money, meeting the need for premium yet affordable gifting.

- Candy and chocolate gift boxes leveraged playful packaging and emotional storytelling.

- Health and functional products such as herbal-nutrition gift boxes and ready-to-drink wellness beverages saw rapid growth.

Retailers should focus on delivering festive experiences that are useful, beautiful, fragrant, and fun to meet rising gift-giving expectations.

From Convenient Ready-Made to Quality Home-Made: Experience and Health Lead the New Year Dining Table

Spring Festival dining in 2025 reflected a blend of traditional flavors, modern convenience, and health upgrades.

Ready-made New Year dishes continued strong growth valued for convenience, flavor variety, and rising expectations for quality. However, the sector’s growth demands a stronger emphasis on food safety and quality assurance.

Hotpot became highly interactive, and semi-ready emerged as a favourite New Year’s Eve meal. Enhancing regional broth flavors, fresh pre-prepped ingredients, and premium meats helped retailers meet consumers’ dual needs for quality and social-sharing readiness.

For home chefs, priorities centered on food safety, premium ingredients, and the joy of cooking. Key growth items included upgraded staples, high end seafood, nourishing meats, seasonal vegetables, and premium fruits.

The competition on the dining table has shifted from simply selling products to delivering complete, high quality family feast solutions.

From “Transaction” to “Life Experience”: How Retailers Can Win the 2026 Spring Festival

The Spring Festival market is clearly shifting from transactional consumption to lifestyle-driven consumption. To prepare for 2026, retailers should:

- Begin stocking six weeks before the holiday

- Focus on ritual-based products and value-for-money gift sets as core growth engines

- Capture opportunities created by return-home flows and tourism-driven lower-tier markets

- Shift from selling products to creating scenarios and experiences

Only by delivering fresh, immersive, and meaningful festive experiences can retailers truly gallop ahead into the new year and win the Spring Festival market.

Drive Demand During Key Shopping Moments

Boost visibility and sales by tapping into seasonal and commercial occasions.

Visit our Seasonal Shopping Insights hub for category-specific strategies.

Empower your retail strategy

NielsenIQ combines comprehensive, accurate, omnichannel data with cutting-edge technology to provide retailers and brands with a one-stop solution to help them win in the future retail market