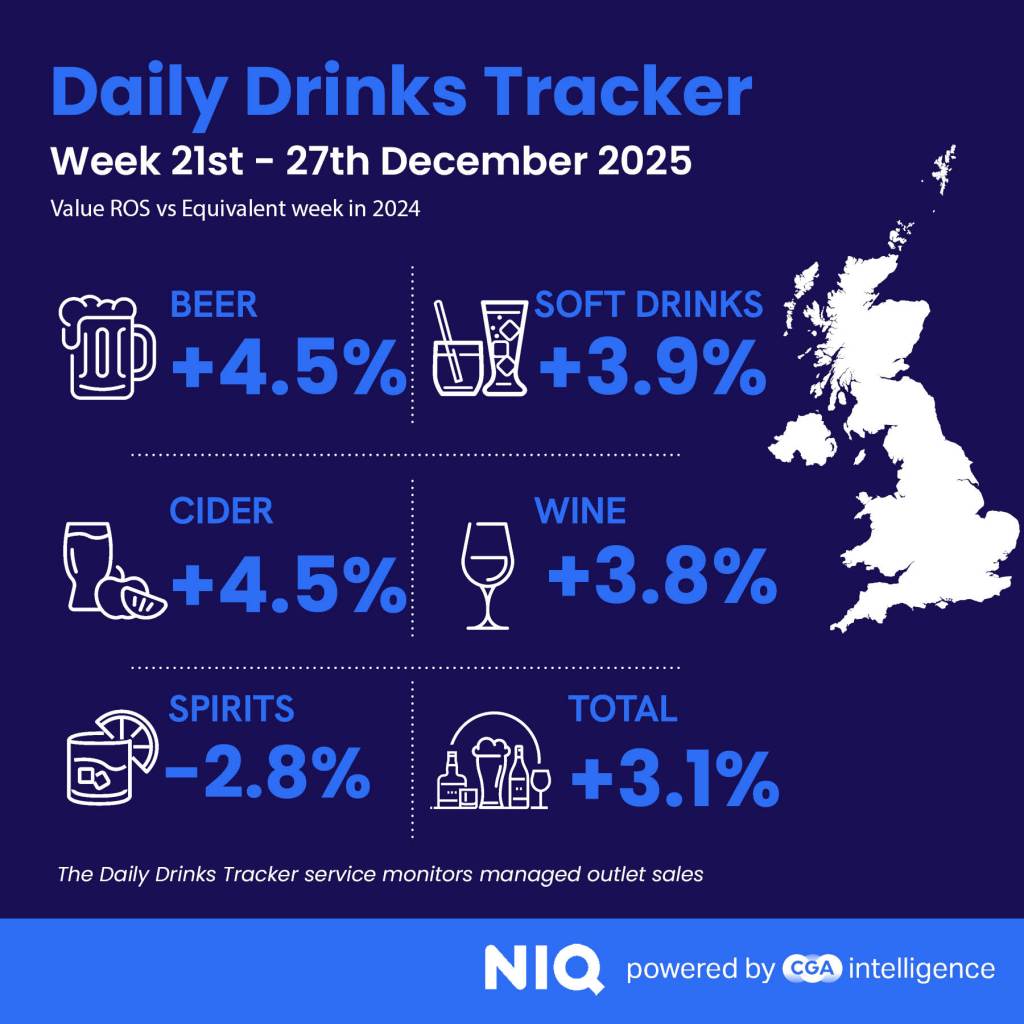

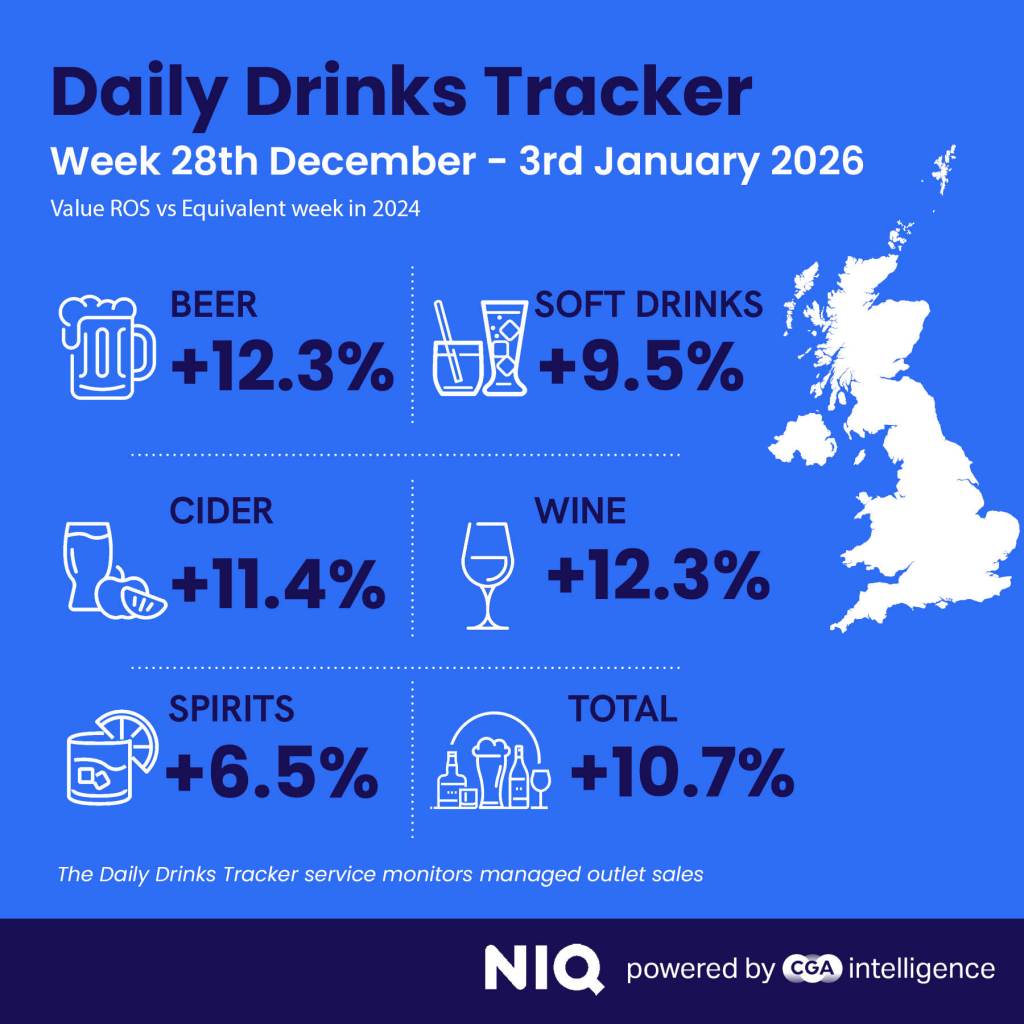

Average sales in managed venues in the week to Saturday 27 December rose 3.1% from the same period in 2024—roughly in line with Britain’s rate of inflation. Like-for-likes then soared by 10.7% in the following week to Saturday 3 January as consumers went out to celebrate New Year’s Eve in the On Premise.

The excellent final week of 2025 took the Daily Drinks Tracker to its second highest point of the whole year. It also means that year-on-year comparisons have been positive every week since late October, raising hopes that 2026 might provide stronger growth for the sector.

It was a particularly good week for the spirits category, which achieved a year-on-year increase of 6.5%—comfortably its best performance of the year. While many spirits purchases centred on New Year’s celebrations, it is a positive sign for the category as 2026 begins.

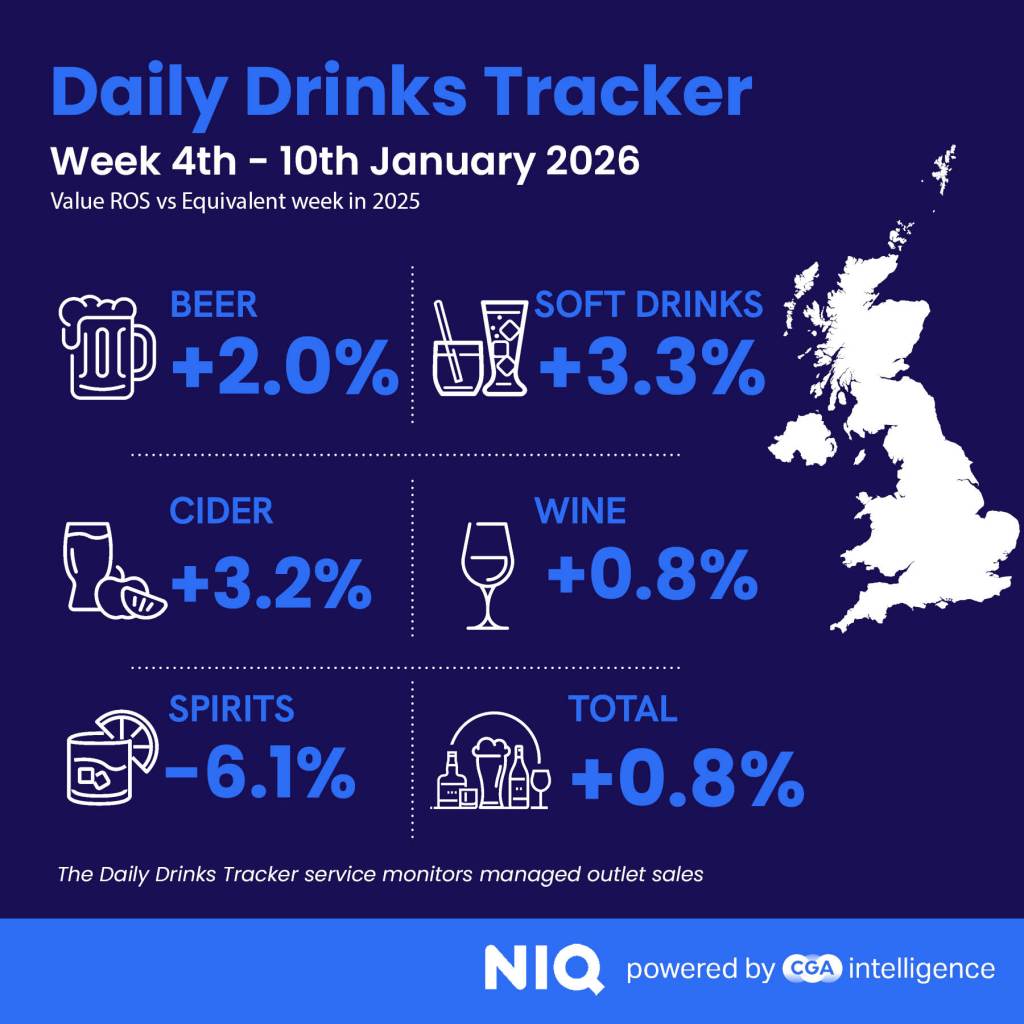

After the final burst of growth in 2025, the Daily Drinks Tracker shows trading flattened again in early January. Average sales rose by only 0.8% in the week to Saturday 10 January, as consumers returned to work and tightened their spending after Christmas. Spirits (down 6.1%) were back in negative territory, but beer (up 2.0%) and cider (up 3.2%) held up well. With millions of people embarking on ‘Dry January’, soft drinks (up 3.3%) performed best of all.

Rachel Weller, CGA by NIQ’s commercial lead, UK & Ireland, said: “After a challenging year for drinks sales it was very encouraging to see operators and suppliers achieve real-terms growth in the final fortnight. It’s obvious that consumers are as keen as ever to celebrate big occasions like Christmas and New Year’s Eve by drinking out with families and friends and enjoying the special experiences that only pubs and bars are able to provide. With Dry January starting and the costs of doing business still rising, there’s no escaping the fact that trading conditions remain difficult. But ten straight weeks of growth in the Daily Drinks Tracker does mean that the On Premise can be cautiously hopeful that people are gradually starting to relax their spending.”

The Daily Drinks Tracker provides analysis of sales at managed licensed premises across Britain and is part of NIQ powered by CGA’s suite of research services delivering in-depth data on category, supplier and brand rate of sale performance.

Unlock essential On-Premise insights

Discover more about brand rate of sales performance and access the latest intelligence on drinks Understand the trends and opportunities to win across this crucial channel.