How seriously should manufacturers of small appliances take social media as a channel for communicating with consumers? According to our Social Media Intelligence (SMI) analysis focusing on power blenders, German consumers are very willing to share their experiences, views and advice with others this way. We listened to online conversations to understand how people research the category and their view on the relative positioning of different brands. What we uncovered makes for interesting reading for manufacturers who can use this information when planning their communication tactics and strategies.

Who’s talking about power blenders on social media?

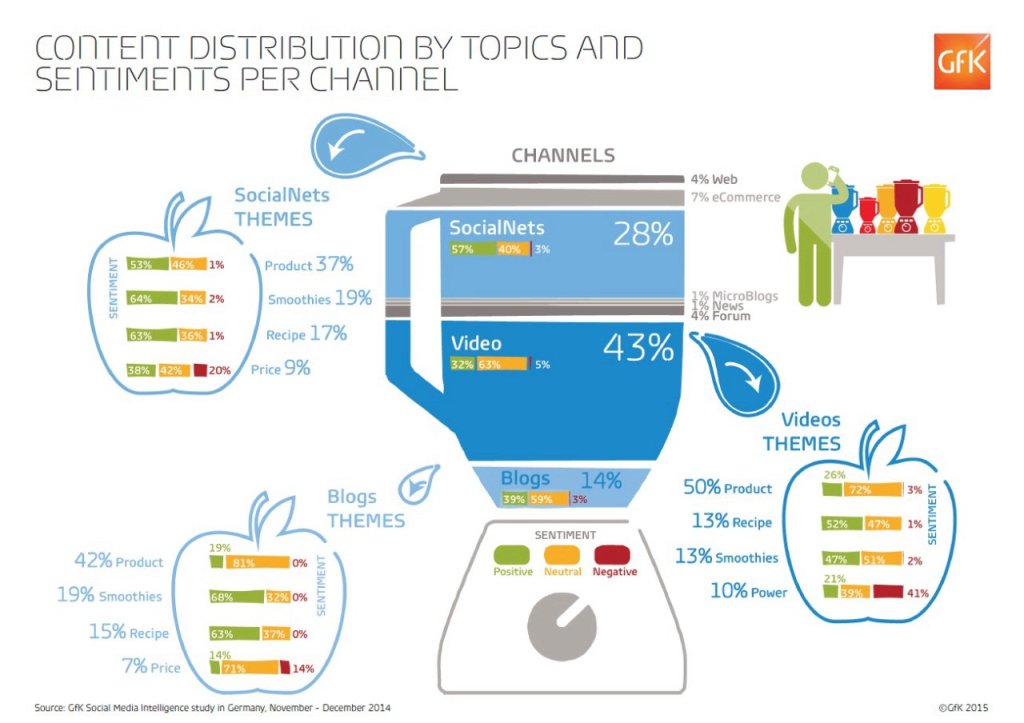

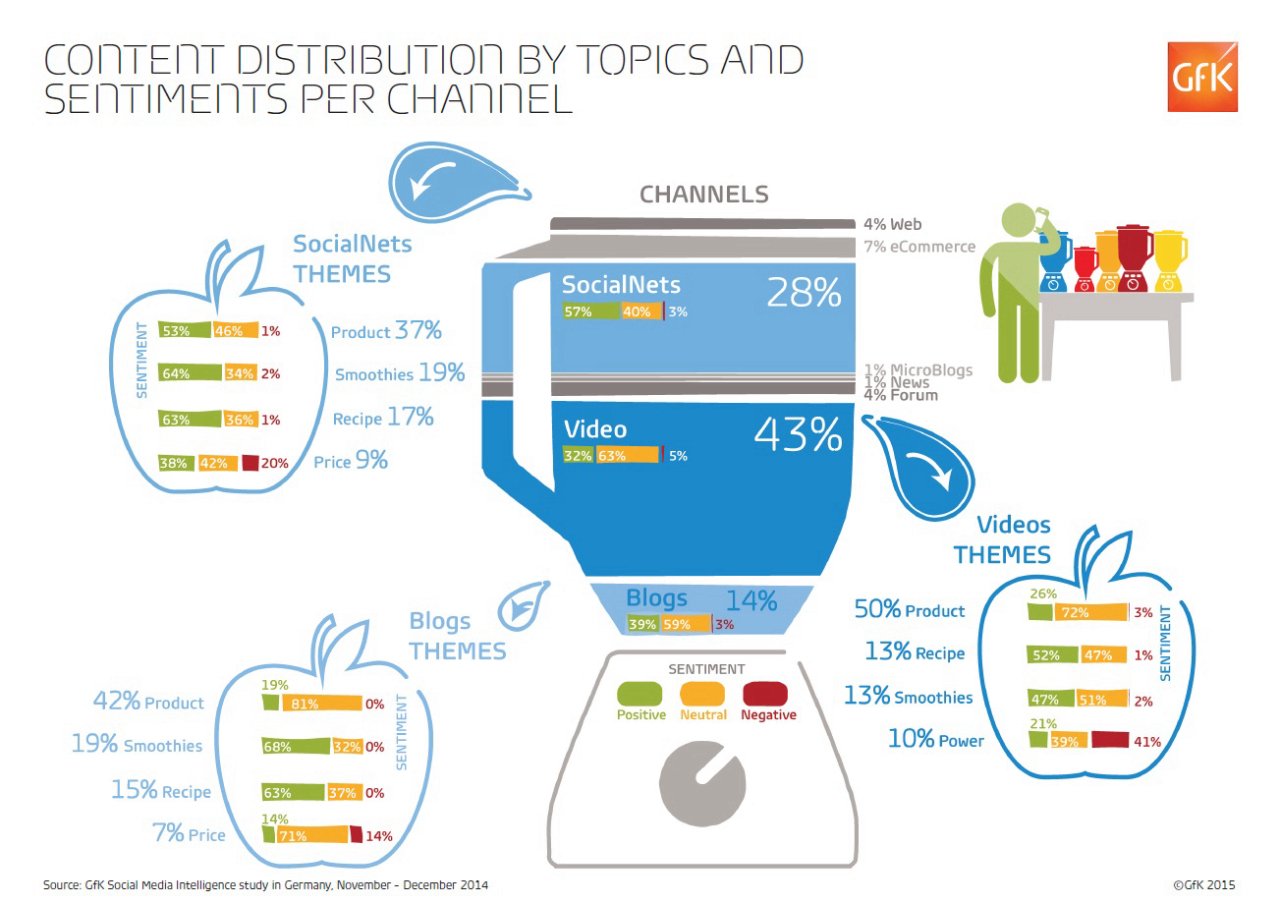

SMI allows us to listen to conversations right across the web. In this study we looked at a range of channels, from social networks to blogs, ecommerce sites to microblogs, news sites and forums. SMI also allows us to code the content by creator/originator: a user (consumer) or non-user (a brand or someone employed by the brand). In this study we saw that users created most content around health and nutrition (75% users, 25% non-users), the performance of the power blenders (76% users, 24% non-users) and price (73% users, 27% non-users). Our approach codes the sentiment of conversations too, allowing us to assess which discussions are positive and which, if any, are negative in tone. Brands can use this vital information to inform their marketing and product strategies.

Most talked about

So what are German consumers saying about power blenders on social media? At 41%, the most talked about subject matter is product comparisons, a trend we see right across the small appliances category. Next, in both second and third place, are lifestyle benefits associated with health and diet. At 13%, price comes lower down in fourth place, followed by performance at 8% in fifth.

Conversations around health and nutrition are the most positive. 71% of discussions about health, 60% about smoothies, and 55% about recipes and food preparation are positive. These topics are also closely linked to specific brands, where Vitamix, Bianco and Omniblend are named as the top three brands. Overall, the majority (62%) of brand mentions are positive. A very small number – only 1.3% – are negative comments. This suggests that manufacturers and marketers should focus on health and nutrition benefits when communicating about power blenders on social media.

Video plays a central role

Another interesting finding is the dominance of video amongst the posts about power blenders on social media channels. 43% of content is shared this way, with YouTube the broadcast channel of choice, followed by Facebook. This content again focuses on the topics that most interest consumers, namely sharing recipes and health tips. Although brand-led marketing messages often focus on the technical aspects, performance and price of power blenders, it’s clear that these messages are less appealing to consumers. If manufacturers want to maximize this channel, one option would be a brand-owned video channel where consumers are encouraged to post their own content alongside information published by the brand. This is something we believe would resonate with this target group.

In summary

It’s encouraging to see consumers taking to social media to share their tips for using and recipes involving power blenders. This positive use of social media can certainly be put to good use by manufacturers. By listening to these online conversations they can better understand how people are using their products, and they can use this insight to inform marketing messages and product development.

To find out more about SMI contact Christian Waldheim and christian.waldheim@gfk.com.