I recently found myself at a ‘Women in Payments’ conference as part of Card Forum in Chicago earlier this April. I’ll admit, I had no intention of going to the women’s sessions, but I was lured by the offer of free breakfast. However, I am very thankful that my stomach made my decisions instead – I came to a mobile payments epiphany.

Despite the fact that I spend the majority of my time conducting consumer research, including innovation and product development, and providing thought leadership for the payments industry, this simple concept eluded me because I am simply not a woman.

I lacked perspective

Mobile payments and mobile wallets do not address the needs of women and we are missing a huge opportunity.

According to our FutureBuy Study, when we look at the shopping behaviors of men and women in the US, women out-shop men in every category but one – automobiles. Men beat women in automobile shopping by 1%.

Women also buy more electronics, mobile phones, home improvement items, lawn and garden supplies, household supplies, beauty and personal care products, packaged food and beverages, toys, home appliances, clothing and fashion items, healthcare items, financial services and meals at restaurants.

Women shop more online and in-store. According to the Federal Reserve’s recent Consumers and Mobile Financial Services Report, women use mobile payments at a higher rate than men, 30.3% vs. 26.4% in 2014.

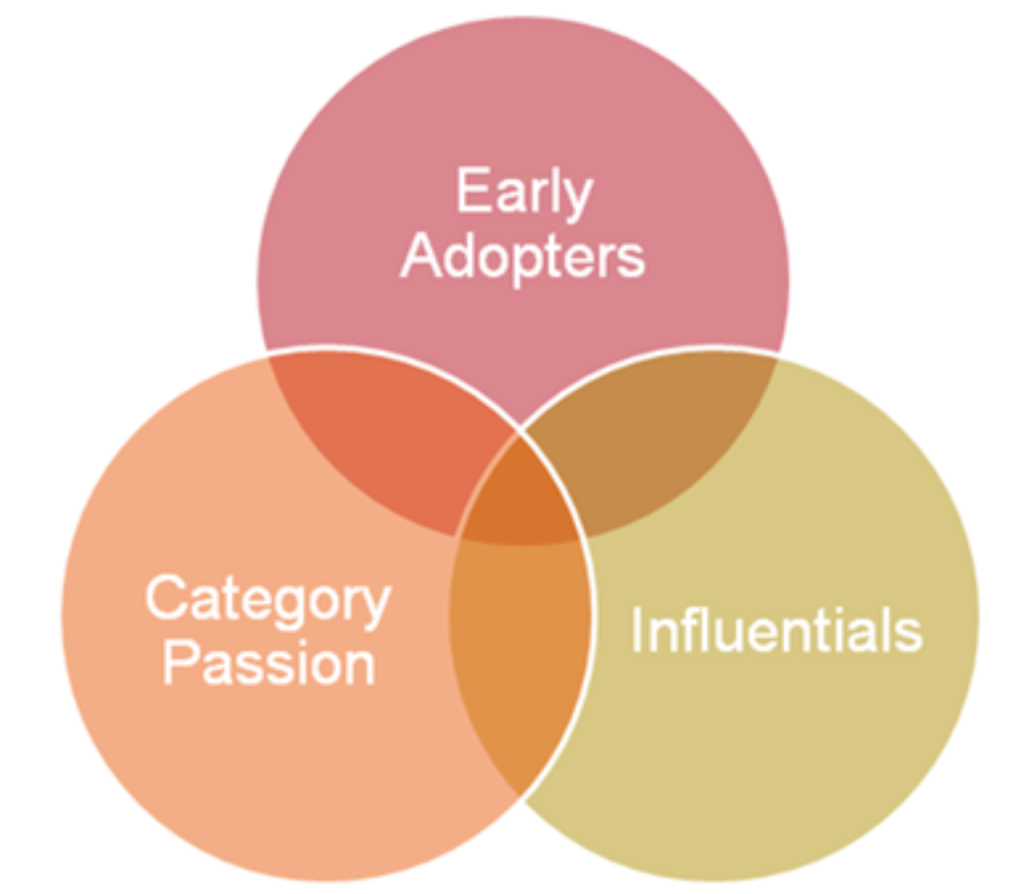

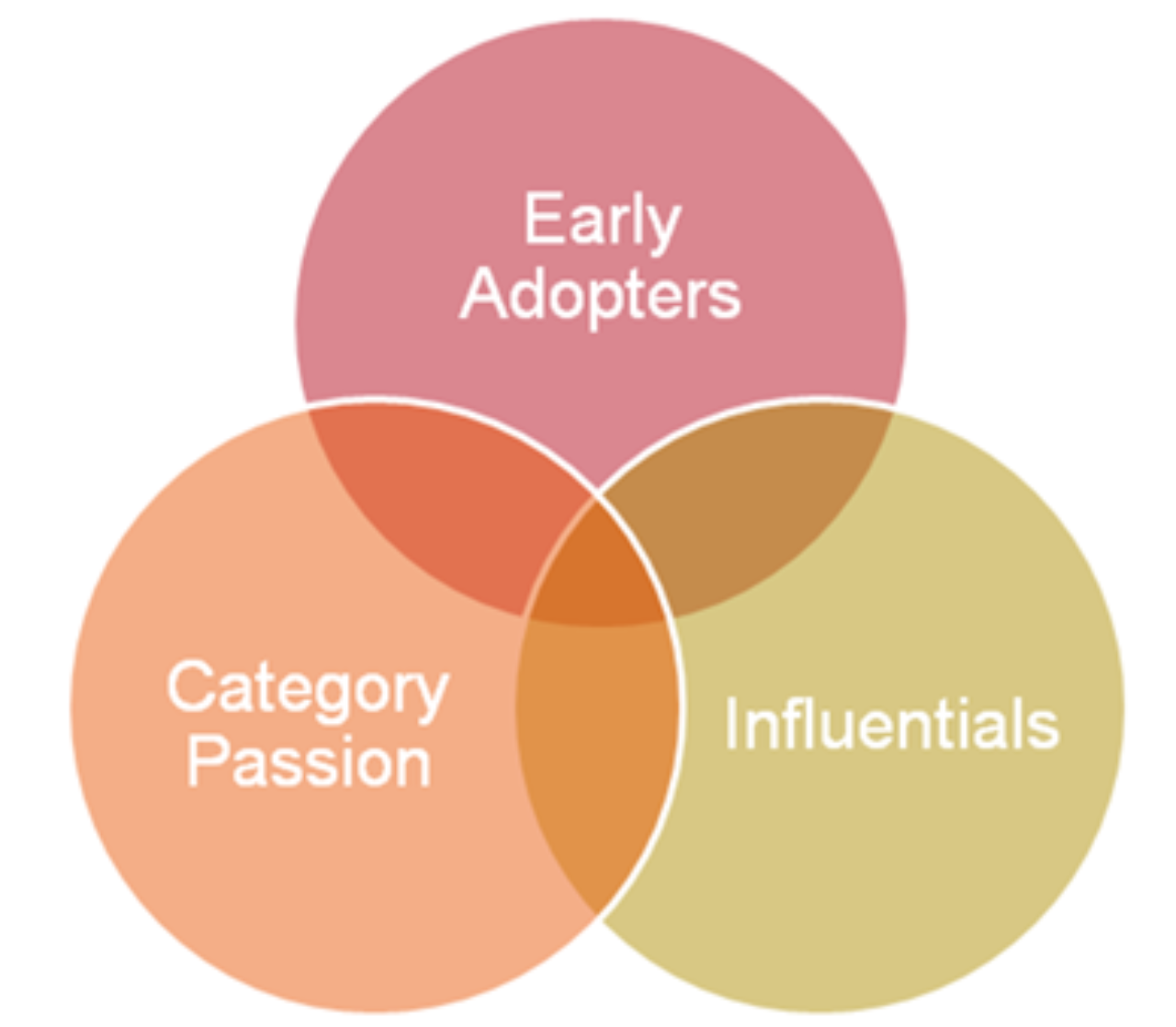

In addition, a third of US Leading Edge Consumers are women. Leading Edge Consumers (LECs) are more than just early adopters or heavy users – LECs are the movers and the shakers, the Influentials ahead of trends, influencing others on adoption. They are the category fans and fanatics and this group of pioneers helps us predict the future direction of the majority and point to tomorrow’s opportunities and many are women.

Physical vs. Electronic Wallets

The Mobile Payments industry talks about the holy grail of one day being able to leave your wallet at home. But women have completely different relationships with their physical wallets than men. Men do not like to carrying wallets, like George Costanza a la Seinfeld, but most women carry a purse, some out of necessity and others to be fashionable. Regardless, a fashionable or functional purse can easily hold a wallet. Therefore women’s relationships with their wallet and its items (rewards cards, coupons, debit and credit cards, etc.) are not as adversarial. We should factor this into how we design mobile payments for women.

If you have read any of my other articles, (The F-word and mobile payments 2.0, EMV and the impact on user experience) you know that I cannot wait for the evolution of Mobile Payments 2.0, which includes value added services outside of security that will drive usage: loyalty and rewards programs, personalized offers, location based offers, benefits and a positioning that resonates with consumers. All of these features will increase loyalty, the number of purchases and move us closer to mobile payments ubiquity across point of sale and other less formal purchase channels.

What was surprising to me was that even at the Innovation and Future or Mobile Payments Sessions at Card Forum, many speakers and panelists were still touting Starbucks as the best example of Mobile Payments 2.0. Starbucks doesn’t release data on customers who use their mobile payments, only the fact that mobile payments make up a third of all purchases. The trend remains that whenever I’m in line at a Starbucks, I always see more women than men.

Aside from Starbucks, there is no question that mobile payments apps lack a strong consumer value proposition and the evolution to Payments 2.0 is going to take some time.

As we think about what Payments 2.0 should look like, shouldn’t we focus on the consumers who shop the most and use mobile payments the most when we are designing the value added services that will drive usage. Value added services that shoppers, women, would actually use; discounts on the items they buy the most, location based offers, shopping list functionality, points to use towards future purchases, etc.?

Is the secret to Starbucks’ success due to their mobile payments app resonating with women?

For more information please contact Tim Spenny at tim.spenny@gfk.com.