The new EU energy label system is hitting the home appliances markets now – changing the scale back to A-G and getting rid of A+(+)(+) ratings. But more importantly, the concept of energy efficiency has a very different position in consumers’ minds in 2021 compared to 2010, when the previous EU label was introduced.

Energy efficiency: A step on the path to sustainability

Saving energy at home is still the most common contribution to sustainability globally: 72% of consumers claim to do so. But what was previously driven primarily by the wish to save money by saving resources, has developed into a much stronger concept of sustainability for the sake of the planet.

The new energy label comes at a time when the multi-faceted effects of global warming is on people’s minds, and the role energy efficiency plays in that. As an example, 19% of Germans cited global warming as a top concern in 2010, while in 2020 this percentage almost doubled to 37%!

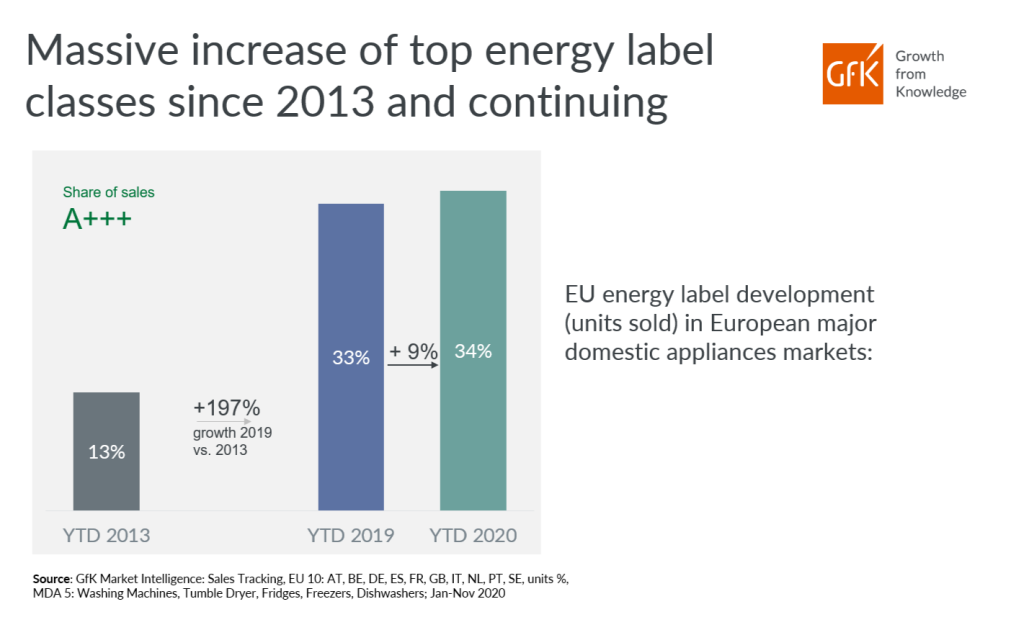

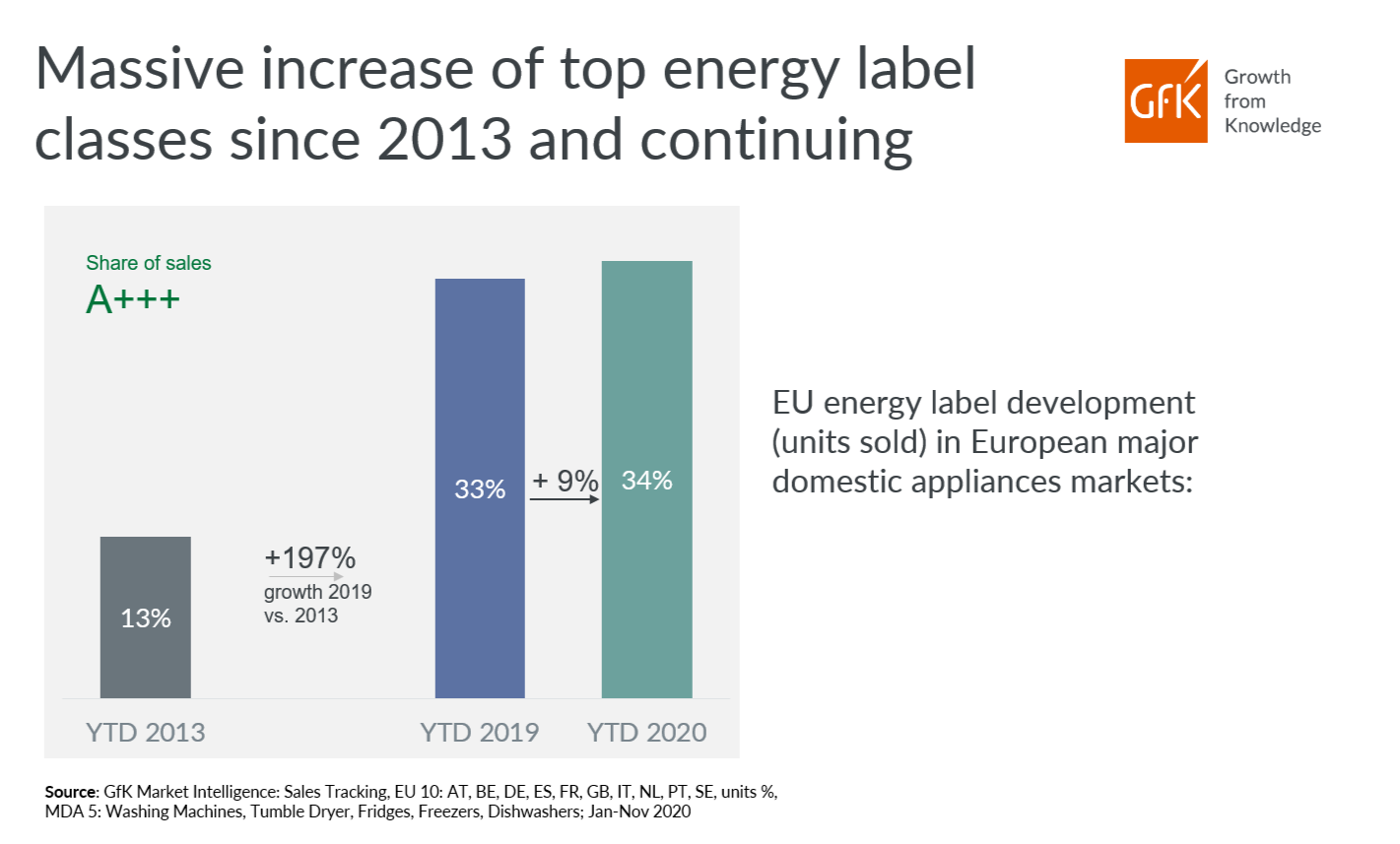

But surely, the “old” EU energy label was a huge success story in motivating people to purchase more innovative energy saving products? The share of home appliances sold with the best rating (A+++) almost tripled in the past 8 years with an impressive growth rate (CAGR) of 13% year over year (see chart below).

Home appliances markets already acted in 2020

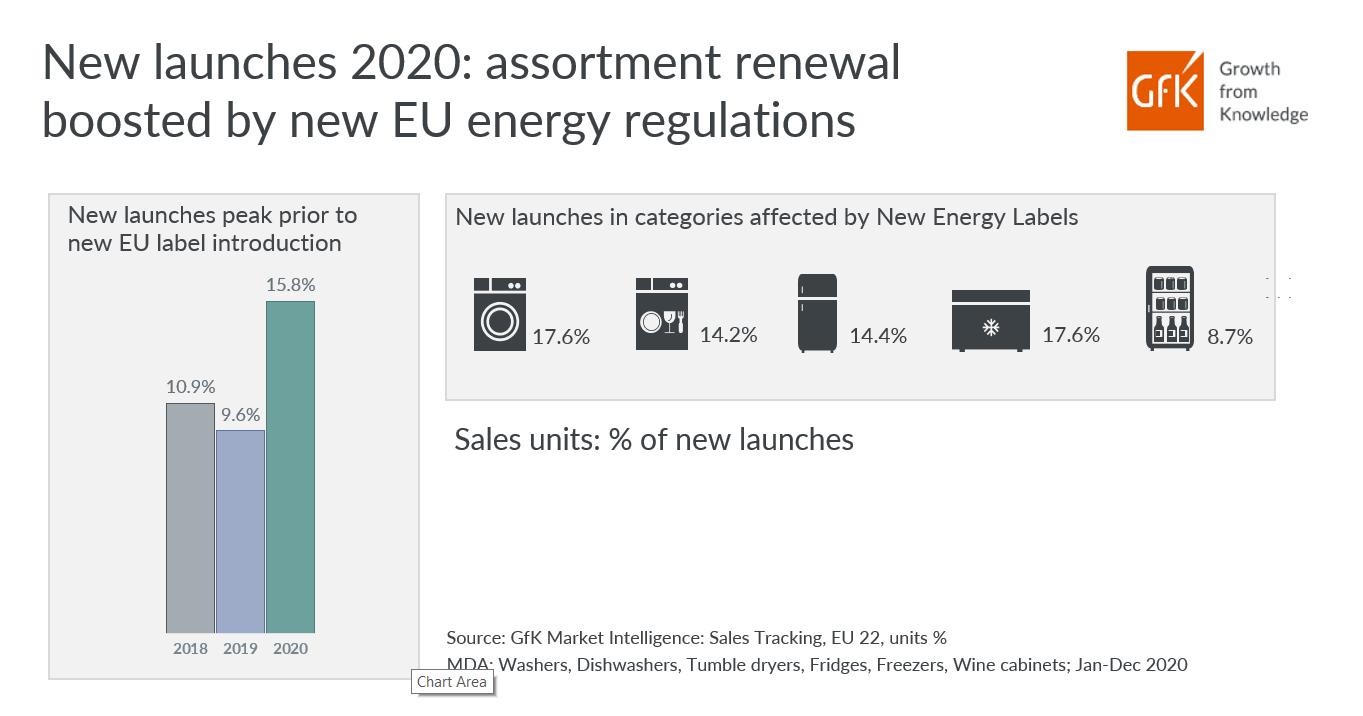

A lot has happened in preparation for the new EU energy label – as seen most clearly in the strong elevation of launch activity in 2020. In 2019, the new models launched accounted for less than 10% of all appliances sold, but, in 2020, this jumped to 16% – a clear indication that new assortment is being rotated in, in order to comply to new regulation in 2021.

This is particularly true for washing machines, as the new EU energy label testing methods are mandatory to use the new eco 40-60°C program that did not exist before – and machines without such a program cannot be sold from March 2021 onwards. This elevated the share of newly launched washing machines to almost 18% in 2020.

How are brands preparing for the new EU energy label?

Would we expect differences in how much different brands are able to prepare themselves? This is a particular relevant question, as the competitive landscape may look very different from March 2021 onwards, with regards to the energy rating bands. Being less prepared may result in a loss of customers for certain manufacturers. We already know that consumers care about sustainability and brands that don’t address those environmental demands could be in jeopardy.

If we compare the top European brands to brands from Asia, the local European brands are showing more launch activity last year: Select top European brands exceed 20% of sales from the newly launched products in 2020, while, for selected Asian brands, this was less than 12%.

This could turn out as an advantage for local European brands moving forward into 2021, as their newly launched and compliant products are ready to sell in the markets. But this is not the only relevant factor. Much more interesting will be what label rating the brands’ new ranges achieve and how they are selling. Will the currently leading brands in energy efficiency remain at the top? Or will newcomers take the chance to differentiate via new innovative energy-saving features?

We are watching the sales data for the first indicators on these questions, and will shortly share our views on what these tell us about the impacts of the new label.

Data in this blog is from the following reports: GfK Market Intelligence: Sales Tracking, GfK Consumer Life 2020