Globally, 88% of consumers say “seasonal discounts trigger me to make more online purchases”, but is price discounting the best strategy in 2022? Results from the 2021 Black Friday season suggest “premiumization” or upselling is tapping into consumers’ desire for value for money (as opposed to ‘cheap’) and a continuing focus on improving the ‘at home’ experience.

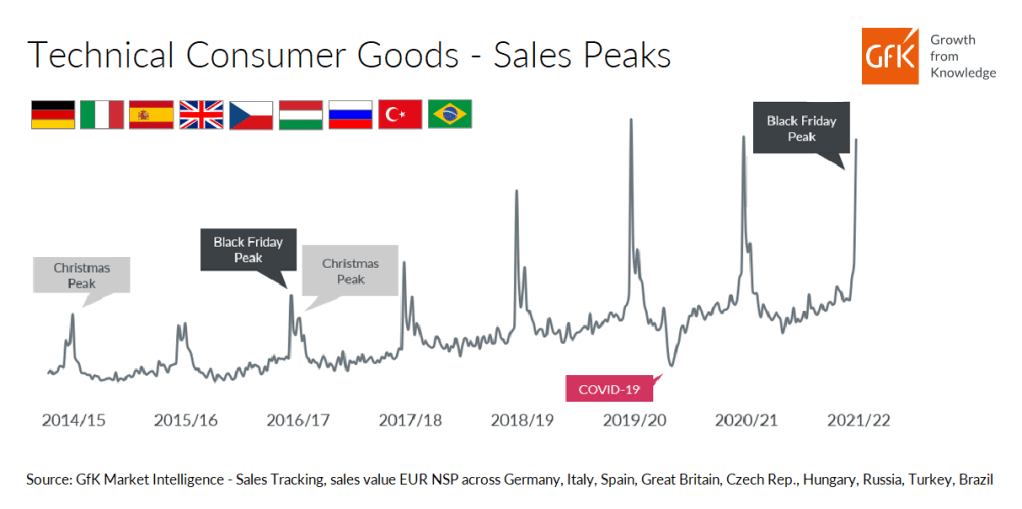

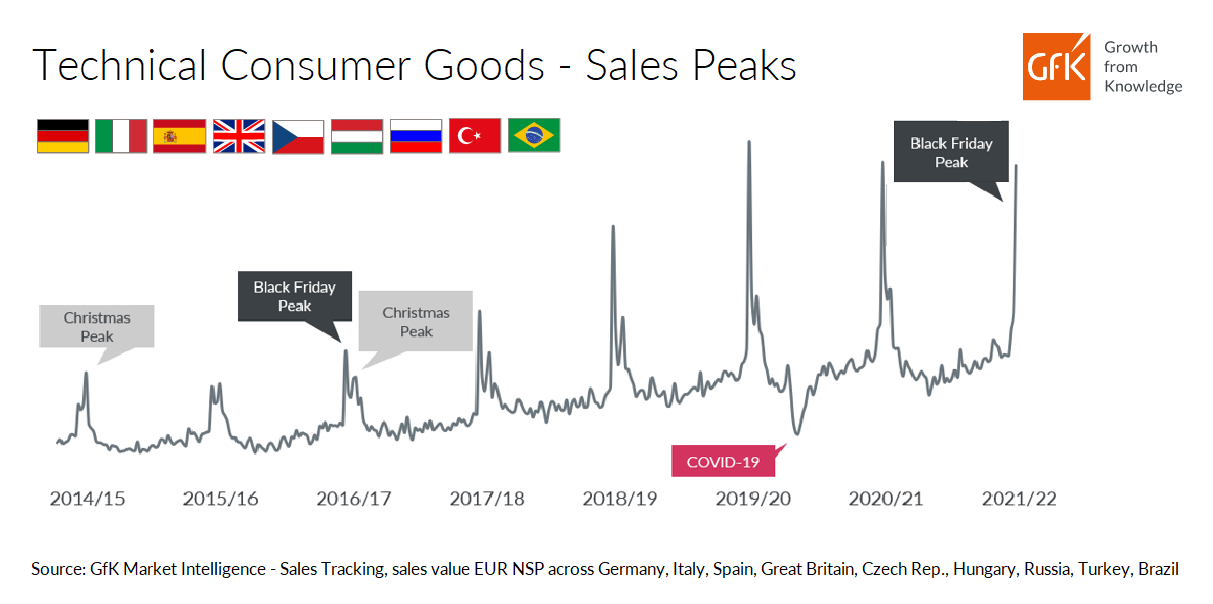

One of the most consistent drivers bringing a surge of shoppers to retailers year after year is seasonal promotion. For the last six years, Black Friday peak sales for Consumer Technology and Durables (T&D) have regularly outstripped Christmas peak sales. For 2021, Black Friday season (weeks 45 – 47) even managed to add +1% value growth compared to 2020, despite the challenge of 2020 being a strong-performing period itself. It is not all good news, however. Last year was the second year in a row of reducing growth for Black Friday week (week 47) compared to the average week – potentially giving us an early sign of consumer saturation with seasonal promotions and the opportunity to attract their spending more evenly across the year.

While Black Friday season remains an important promotion peak for retailers outside China, relying on seasonal promotions that focus on attractive discounts can be a double-edged sword for manufacturers and retailers who also need to secure margins and aim to avoid a ‘war of prices’.

One answer is to build a strategy that focuses on upselling with either temperate discounting or offers such as extended warranties or free installation, etc. This combination taps into some of the core attitudes to life that consumers globally say are most important to them and influence the way they live and the choices they make. In particular, consumers believe that “the most important thing about a brand is that it offers good value for money.” This is a different mindset to being motivated purely by a low price band and, in 2021, consumers ranked it 3rd out of 41 attitudes to life that GfK tracks across 18 core countries worldwide. This is down just one rank from 2nd place in 2020, having been beaten by “my home is a private retreat where I can relax and get away from it all” and “brands and companies have to be environmentally responsible these days” – making this a key motivator.

The importance of stressing value for money in any offer is underlined by the fact that consumers’ belief that ‘it is important to indulge or pamper myself on a regular basis’ has dropped from 18th in 2019 to 24th in 2021. The drop suggests that shoppers are reacting to the increasing cost of living and difficult economic times and becoming more cautious about what they are willing to spend their money on.

Consumers trending towards quality over quantity

As explored in detail in our State of Technology & Durables Report 2021 (download free here), last year saw an increase in consumers selecting high-end manufacturers known for quality and smart design. The reasons for this are numerous, including elements such as extra disposable income due to reduction in spending on areas such as leisure travel and commuting, an appreciation of the importance of Consumer Tech and Durables in people’s new home-centric lifestyles, but also an appreciation of getting quality for one’s money.

These factors have meant that premium brands – those with a price index of above 150, calculated by country and product group – accounted for nearly a quarter of last year’s T&D sales globally. This trend for premium goods was spread pretty evenly across the year, rather than being confined to seasonal events (the 7 months Jan–Jul 2021 saw 43% year on year value growth) and was particularly high in APAC and LATAM with 53% value growth for premium goods in both regions, compared to just 16% (APAC) and 30% (LATAM) for more budget-friendly goods.

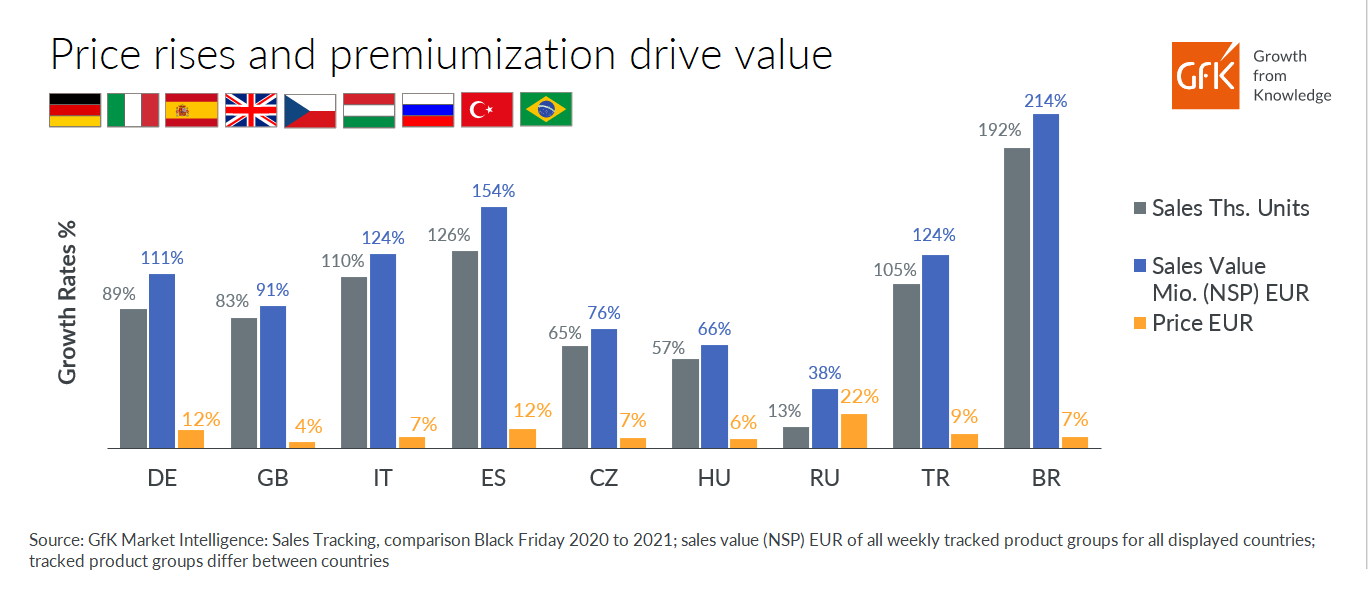

Analysis of the 2021 Black Friday performance bears out this increasing consumer attraction for premium products, with the growth in sales value for consumer T&D goods across a number of key countries being pushed up by higher prices of goods bought, more than the number of items sold.

This turned out to be a lifeline for manufacturers and retailers, given the decreasing growth for Black Friday week sales compared to an average week – seen in both 2020 and 2021 across a number of countries. The long-term picture is that shoppers are turning to quality over quantity – and brands able to tailor their 2022 strategy to cater to this mindset could benefit from the increased margins that higher-end goods offer.

“This shift from discounting to premiumization can be a game-changer for Tech and Durables companies who uncover what motivates consumers in specific markets”, says Louisa Link, GfK’s commercial account director in North America. “The retail environment in this category is ripe for innovation. Consumers are showing us they want value for their money – especially in key essential categories.”

Outlook on premiumization in 2022

Consumer pressure on businesses to keep prices down will never subside – but this is unlikely to stop the rising costs of operations and raw material being passed on to shoppers. As brands look to justify higher prices, this may well drive a supply-side move towards premiumization that will run alongside the demand-side consumer preferences. Add this to the fact that premium products generally carry higher margins, and the attraction of a focus on premiumization as a strategy for 2022 is clear.

Of course, a major threat to the continued consumer attraction towards premium products is the high inflation across many markets. If the rising price of daily living starts to balance out the savings from reduced commuting costs and restricted overseas travel etc, the trend towards premiumization may suffer a hit for a large portion of the global population. However, the opportunity remains for manufacturers and retailers to focus this strategy on consumer groups that have a greater tolerance for inflationary spikes, compared to those with less disposable income. It’s therefore vital for brands to grasp the detailed makeup and weight of relevant consumer groups and plan their strategy accordingly.

“Our analysis across markets suggests people are ready to make a conscious effort to save their funds so they can afford to invest in premium brands. The focus on enhancing the home environment for both work and entertainment will continue, although with signs of saturation in certain product groups. People don’t just want products to do what they are supposed to do, they want to get that strong feeling of value gained. That means upgrading to appliances and products for the home that are well designed, beautifully crafted, and seamless to use – and offered with a package that the consumer sees as value for money. That does not necessarily mean price alone; enhanced value can also come through offers such as extended warranties, free delivery or installation, or customization options,” says GfK Chief Marketing Officer Gonzalo Garcia Villanueva.

The critical factor for success lies in the fact that, while premiumization offers the potential to drive revenue growth for manufacturers and retailers, rolling out a premiumization strategy in France is different than rolling one out in Poland. Every market has its own nuances and differences in what will trigger shoppers within different product groups. To stay successful, your strategy must be built on accurate, up to date and comprehensive market and consumer intelligence.