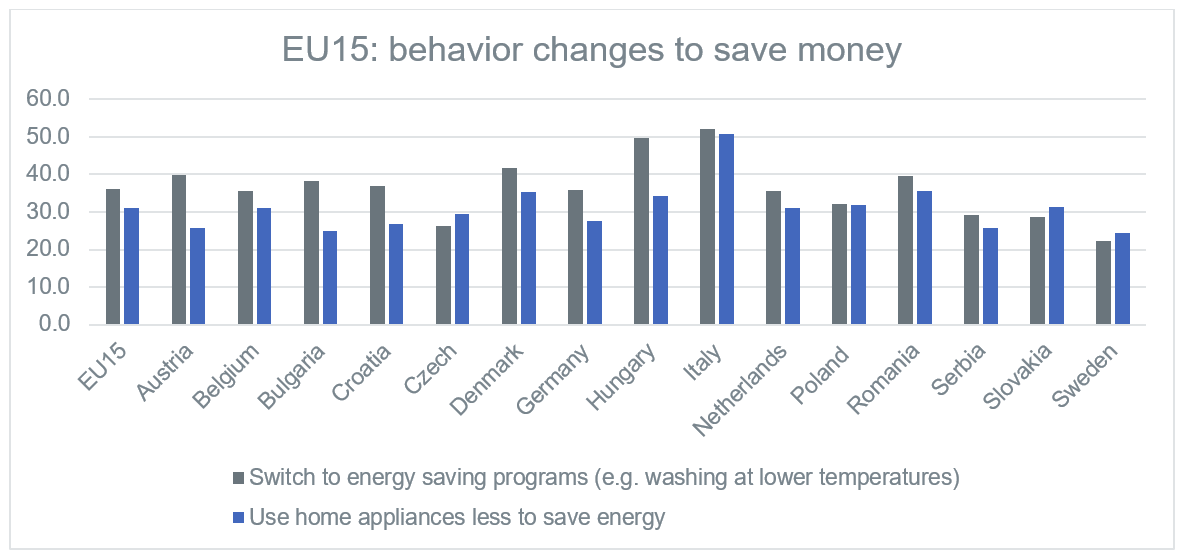

Latest research across 15* European countries shows 93% of shoppers have already changed their behavior one way or another to save money in response to the rises in inflation and cost of living. In particular, around a third are saving money by using their home appliances less (31.1%), or by switching to energy saving programs such as washing at lower temperatures (36.2%).

Italy and Denmark are two of the leading countries seeing these behaviors.

- Italy tops all 15 European countries on both counts, with over half the population saying they are switching to energy saving programs on their home appliances (52.0%) or using their home appliances less (50.7%), in order to save money.

- Denmark also makes the top three for both activities, with 41.7% using energy saving programs and 35.4% using their home appliances less.

On the other end of the scale, Sweden (where the cost of electricity, although risen, is significantly lower than countries such as Denmark, Germany and Italy) has only a fifth (22.2.%) switching to energy saving programs and a quarter (24.4%) using their appliances less often in order to save money.

Source: GfK, Behavior Change November 2022, in which 9,834 adults were interviewed across Austria, Belgium, Bulgaria, Croatia, Czech, Denmark, Germany, Hungary, Italy, Netherlands, Poland, Romania, Serbia, Slovakia, and Sweden

What does this mean for T&D and also FMCG?

For both Consumer Technology and Durables (T&D) and Fast Moving Consumer Goods (FMCG), there is great opportunity for innovative products that offer clear savings in the amount of energy used in day to day living – thereby truly meeting two of consumers’ core objectives: saving money, and being green in the slipstream.

For T&D, it’s about the product features (short cycles, reduced temperature settings, capacity etc) and energy ratings that consumers will be looking for in new models.

For FMCG, there is a critical impact for categories that are tied into intensive use of home appliances, such as cooking or washing products. To avoid being left out of the shopping basket, brands operating in such categories must focus on the consumers’ category entry point and how their product makes the perfect fit in relation to that.

For example in the category of ready-to-heat meals consumers are focusing on their need to reduce energy use to save money – so brands could profit from featuring their reduced cooking times compared to ‘standard’ or competitor solutions. Similarly, in the category of washing detergents, shoppers will be attracted by products that feature high performance even at short or lower temperature washes. Brands that can present honest promises around how their product reduces energy use in daily living will help close the deal with these shoppers.

Similarly, messaging around avoiding food waste is another core opportunity to resonate with consumers’ focus on rational shopping objectives, while achieving a positive emotional pay-off as well. Offers such as meal portioning or dynamic pricing as products get closer to expiration dates engage not only with people’s desire to save money, but also with their values around environmental and healthier living issues.

Lenneke Schils, Global Insight Director at GfK, adds,

“Consumers’ focus on cutting their daily costs presents a prime opportunity for retailers’ loyalty schemes. By turning negative connotations (the need to reduce spend) into positive ones (“Congratulations, you have saved!”), brands can foster positive-experience connections that increase loyalty.

“Given how widely the intensity of consumers’ coping trends vary in different countries, the key take-out for brands is to tailor their go-to-market strategies based on clear understanding of the precise local landscape.”