During economic downturns, consumers adjust their shopping habits. And as demand changes, retailers and brands need to understand what their key consumers will still spend money on and what they won’t. The lipstick effect is a theory of consumer spending where shoppers continue to buy smaller, premium products, despite cutting back in other areas. While the lipstick effect has been observed in previous downturns, what evidence is there it will do so again in 2023?

IT demand during the Great Financial Crisis (GFC)

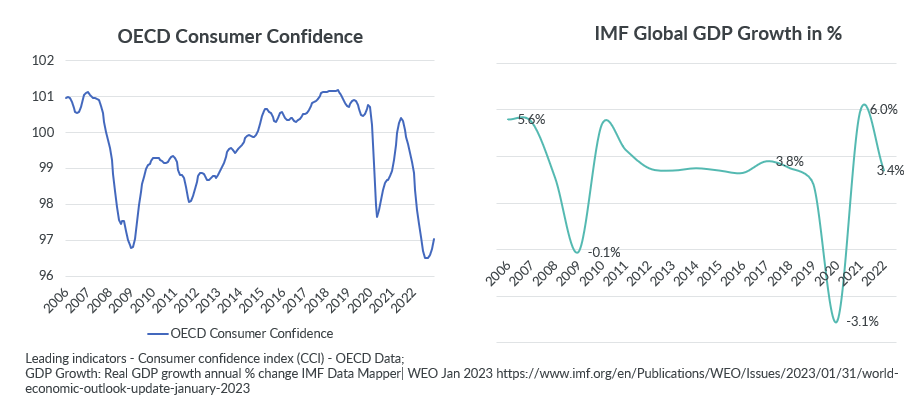

To understand how demand for different IT accessories fluctuates during downturns, let’s take a closer look at how the sector performed during the GFC. During the crisis, consumer confidence dropped to new lows, and consumers adopted a more considered approach to their spending.

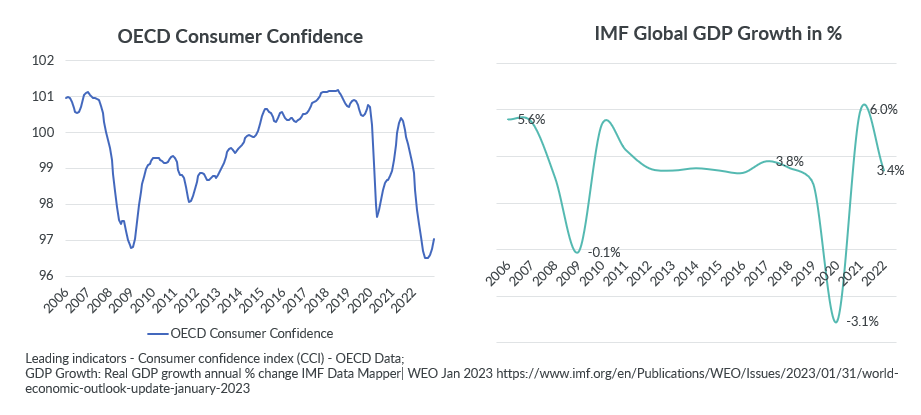

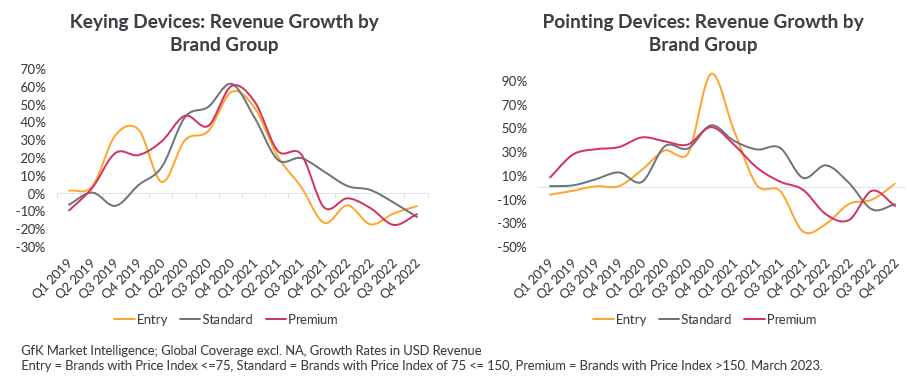

During the GFC, some segments of the IT accessories sector followed the fortunes of the rest of the economy and shrank as consumers reigned in their spending. But, despite not attracting the same revenue growth as other products, consumer spending shifted notably towards pointing and keying devices, such as mice and keyboards, during the recession. These devices continued to be among the fastest growing categories even as the economy recovered in the years after the recession.

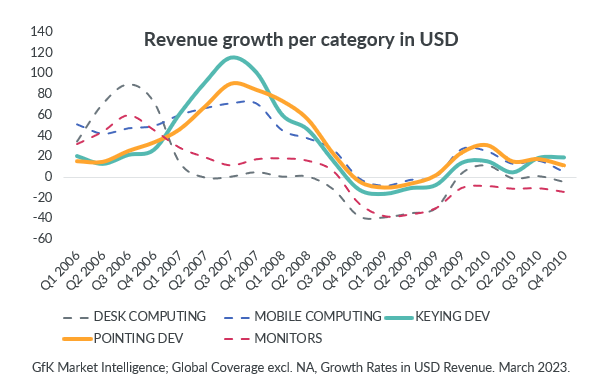

And as consumer demand shifted, premium brands were favored ahead of entry and standard-level brands. In both the pointing and keying categories, premium brands continued to see more revenue growth than other brands as the recession eased. While it may seem that consumers would prioritize more affordable products during a recession, the figures show that for some categories the opposite is true. The growth of revenues towards some premium products confirms a lipstick effect took hold in this sector during the GFC.

For IT manufacturers and retailers, this suggests there are grounds for optimism. With consumer confidence down and inflation impacting organizations and consumers today, the presence of a lipstick effect means that there may still be ways for businesses to reach their core consumers.

Changing consumer demand

But while the GFC and present economic turbulence are both impacting purchasing power, consumers have responded in different ways.

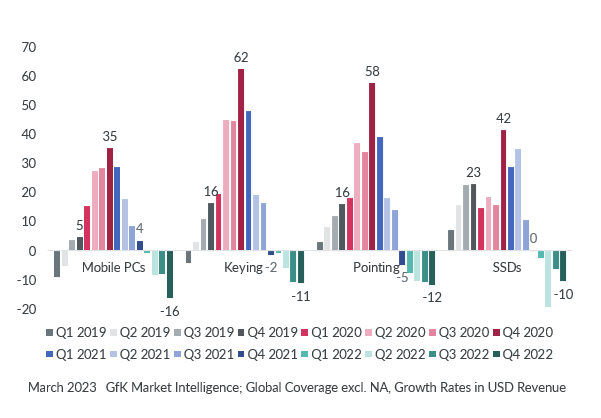

In the fourth quarter of 2020, revenue growth across all accessory categories grew significantly. Most notably, keying and pointing devices achieved 62% and 58% growth respectively.

Since then, however, supply chain disruption, shortages, and saturation in key markets have shrunk revenue growth across all categories. Whereas certain devices saw additional consumer demand during the GFC, there is no sign yet of a similar lipstick effect taking shape in the broader premium IT market today.

Equally, there is little indication that the current market environment is benefiting premium brands. In fact, in a reversal of the previous trend, consumers are choosing to buy entry-level products. This has been partly driven by stronger performance for entry-level products in emerging regions, where they performed better than they did in more developed markets.

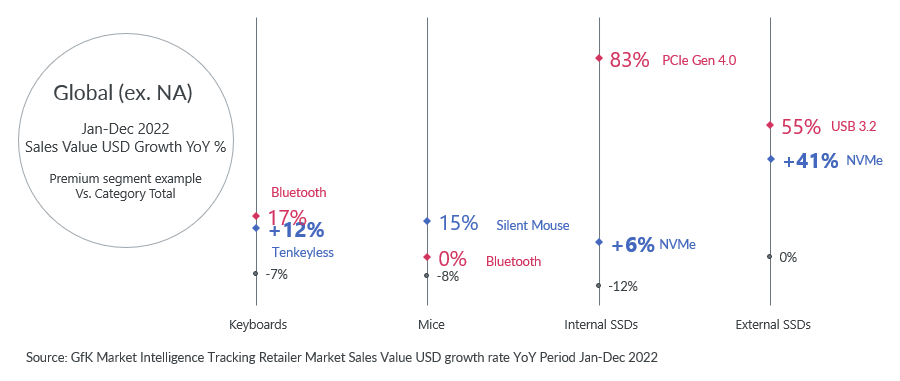

Things could be different, however, within a few highly specialized product categories. In particular, IT peripherals with premium features, such as silent mice, Bluetooth keyboards, internal SSDs supporting PCIe Gen 4.0 and external SSDs with NVMe standard are outperforming their product categories. Whether or not the growing demand for these premium products is the beginning of a new lipstick effect for premium IT products remains to be seen – but should be closely monitored by brands in 2023.

While the lipstick effect has not yet taken hold, as difficult times continue, there is potential for consumers to favor premium accessories and to hold off on replacing products by upgrading their existing devices.

Identifying opportunities in consumer shifts

With economic turbulence likely to remain for 2023, consumers are shifting their priorities. But this doesn’t necessarily mean consumers will forego premium products. During difficult periods, some shoppers continue to buy from high-end brands. And while a smaller lipstick effect may be observed within the IT accessories sector today, businesses should pay close attention to specialized products that still carry strong consumer demand.

Understand how your consumer’s habits are changing – whatever the economic picture.

Speak to gfkconsult today.

![]()