Not being able to heat your home during winter or having to ration your electricity usage is a worrying thought. For those households that are looking closely at their energy bills at the start of 2023, it can be difficult to know what action to take. While governments around the world are looking to provide various forms of assistance, brands have a big role to play. Not only are consumers buying more smart products, but brands are capturing more user and performance data. This creates the potential for brands to create real value for consumers around energy efficiency – and build brand loyalty along the way.

A long-term crisis

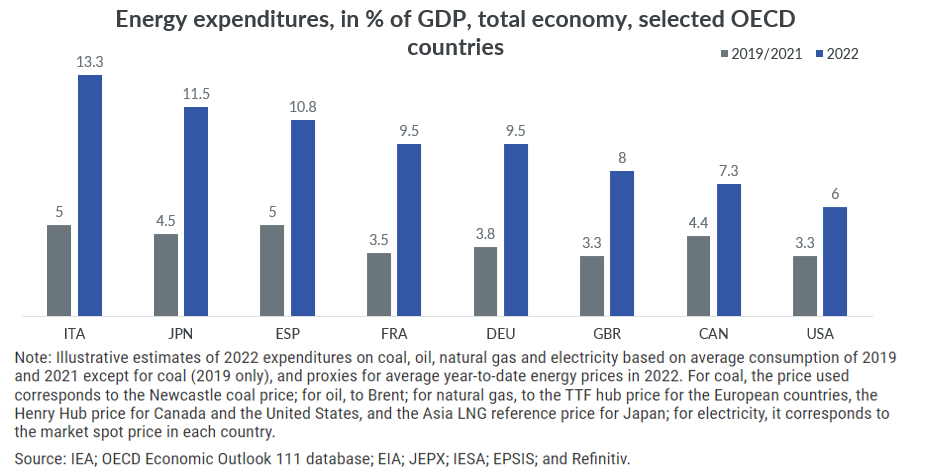

Rising energy prices were one of the dominant trends impacting the global retail market in 2022. In all OECD countries, energy expenditure as a share of GDP was well up in 2022 when compared to 2019/2021. And that picture does not look likely to change in the short term. In fact, there are some indications that the current crisis could stretch well into 2023 and 2024.

The International Energy Agency (IEA) estimates that the EU will need to find an additional 30 billion cubic meters of natural gas in 2023 to avoid shortfalls. Throughout 2022 European governments were able to take a number of steps to shore up gas supplies for the winter. This resulted in gas storage across the continent being well above the five-year average in December 2022. It is unlikely these measures will be available in 2023.

Consumers are looking for efficiency

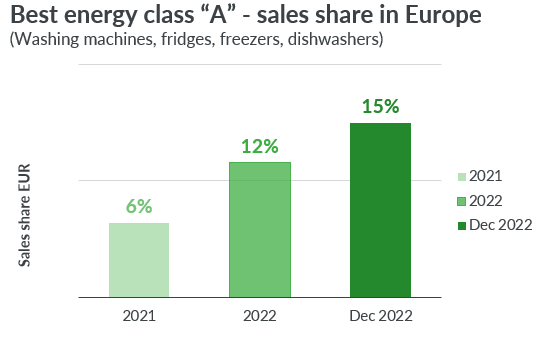

Just as the Covid-19 pandemic accelerated an already existing trend towards hybrid working, the current energy crisis could do the same for sustainability and energy efficiency. While many consumers were interested in limiting their environmental impact before, today 73% are actively looking to save energy every day. Nearly all consumers are adapting in some way, with 93% reporting a change in behavior due to high inflation and energy prices.

These behavioral changes align with the growing significance of sustainability, waste reduction and efficiency as consumer purchasing decisions. While 18% of households in the EU are actively using their oven less and 15% are limiting the use of their washing machine, many consumers still want to make sustainable and healthy purchases. Smart products that offer energy optimization benefits have also seen high growth in Europe in line with rising energy prices. Smart LED lamps saw a 29% jump between January to September 2022 compared to the same period in 2019, while smart thermostats saw a 90% increase in sales during the same period.

How brands can capitalize

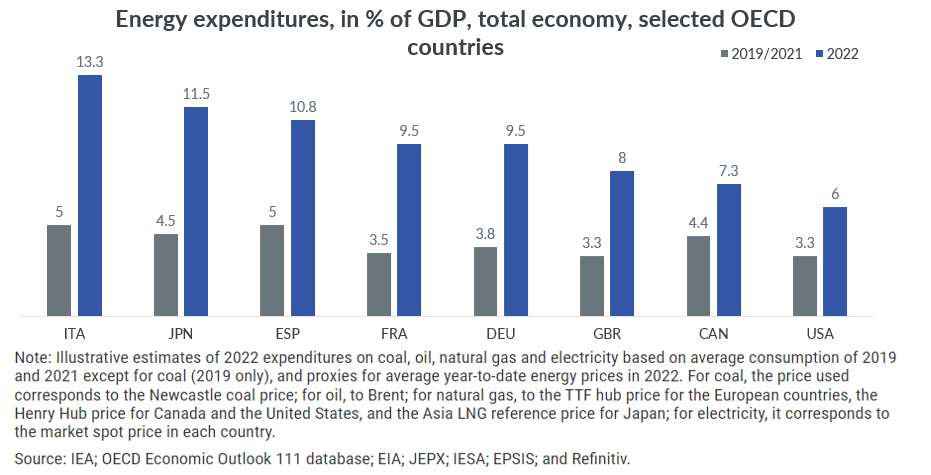

When it comes to reducing consumption and waste, energy efficiency is perhaps one of the best opportunities for technology brands. For MDA categories, for example, energy austerity is clearly pushing consumers towards buying best-in-class labeled appliances to save energy in the long run.

This creates opportunities for brands that can offer enhanced functionality or features that simplify energy efficiency or even automate it altogether. Whether it is through a product dashboard, app or even email, consumers value eco-feedback that shows them their usage and ways to cut back.

While many consumers have a desire to be more eco-friendly, they currently have very little visibility over which brands are actually eco-minded. This creates significant potential for brands to own this space, especially for newcomer brands or those that have limited brand equity today.

Energy saving in the long run: AI, repairability and upgradeability

Energy efficiency is also driving innovations across domestic appliance categories. Advances in AI can be utilized in a wide variety of ways to help consumers save energy and reduce their costs. Smart fridges, for example, can now contextualize themselves to the routines of their users – such as reducing the cooling temperature during periods when the door stays closed for hours (such as 9-5 during the working week). Certain Smart appliances now come with an AI Energy Mode that continually adjusts performance to reduce energy use.

As well as energy efficiency, brands are increasingly taking a more sustainable approach to design too. While enhancing the durability of products has been a priority for many brands, upgradeability could be the next big trend. Leading brands are looking to design new appliances with upgrading in mind – allowing both software and hardware upgrades to be easily installed by consumers. This provides the benefits of the latest innovations, without the need to purchase a new model. But brands can also build on this trend through multiple channels by offering repair instructions, videos, spare parts and similar which will further complement the picture of how users see the brands on the market. Such services also potentially open new business cases to manufacturers.

Enabling efficiency and strengthening loyalty

In the face of continued market volatility and shifting consumer behavior, brands are going to need to be innovative, agile and ready to meet consumers where they are. This will be especially valuable for something so important and universal as household energy bills. The current crisis may prove to be an accelerator for sustainability thinking too. By 2030, 50% of the global population will be eco-active and this will generate $1000 billion in FMCG sales and $700 billion in TCG sales. As brands and consumers continue to align on sustainability issues, there is huge potential for widespread value creation – for consumers, brands and the planet.

Meeting your current and future customers where they are requires accurate, reliable and up-to-date market insight – exactly what gfkonsult offers.