Although businesses and households in every corner of the globe are feeling the effects of high inflation, what that actually looks like in practice is not universal. In fact, a whole range of factors can influence the impact of inflation in different markets – from household debt and savings to GDP and consumer spending habits. For brands looking to navigate what is likely to remain a challenging operating environment for the near future, keeping track of the shifting regional picture is essential.

The global impact of inflation

Heading into 2023, the outlook for the global economy remains uncertain. In fact, global demand and consumer spending continued to decelerate, and growth slowed more than anticipated in 2022. Already in a fragile state of recovery following the unprecedented disruption of the global pandemic, 2022 saw global markets rocked by the war in Ukraine, rising energy and raw material costs as well as record inflation.

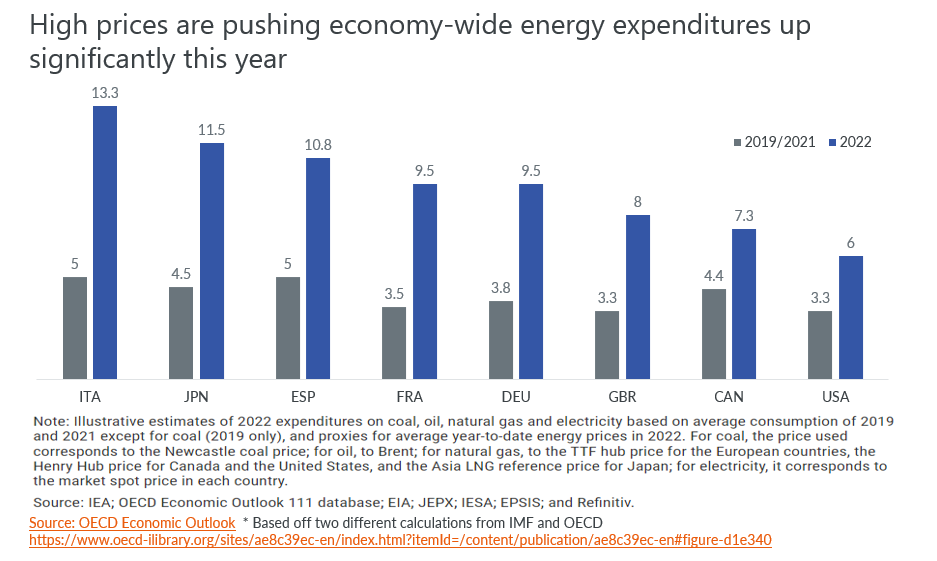

In fact, inflationary pressure is extending out beyond food and energy prices in much of the global economy. For businesses this means higher energy, transportation, materials and labor costs. For consumers it means less spending power, rising bills and, for many, the need to monitor household finances more closely. Across the Eurozone, North America and Asia, we are seeing high prices pushing energy expenditures much higher than in 2019. With monetary policies tightening around the world, headline inflation is likely to stabilize and decline over 2023 – although it could stay high for some time.

Differences between regions

The global picture contains a large amount of variance. Not only are different markets being impacted by high inflation in different ways, but individual households within those geographies too. OECD figures show that elevated inflation and continued energy prices look set to persist in the UK and Europe due to changes to monetary policy being implemented later than in the US. For emerging market economies, the picture is more complex. While inflation remains comparatively low and stable in China, countries like Brazil, Turkey, Mexico and Argentina are facing significant inflationary pressure. Despite this, growth in emerging markets and developing economies looks set to only fall from 9.9% in 2022 to 8.1% in 2023. This is compared to a drop from 7.2% in 2022 to 4.4% in 2023 for advanced economies.

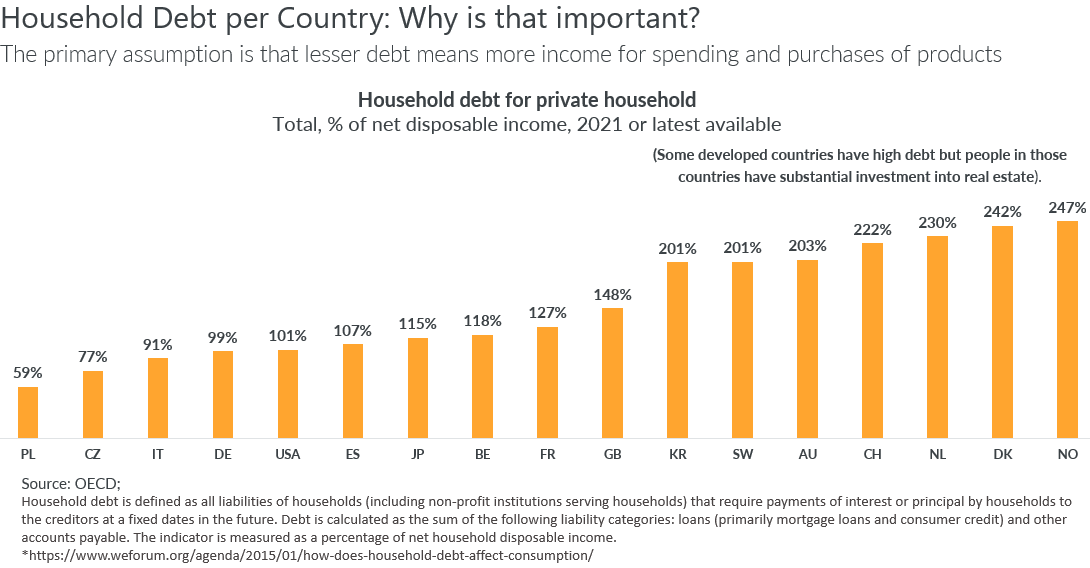

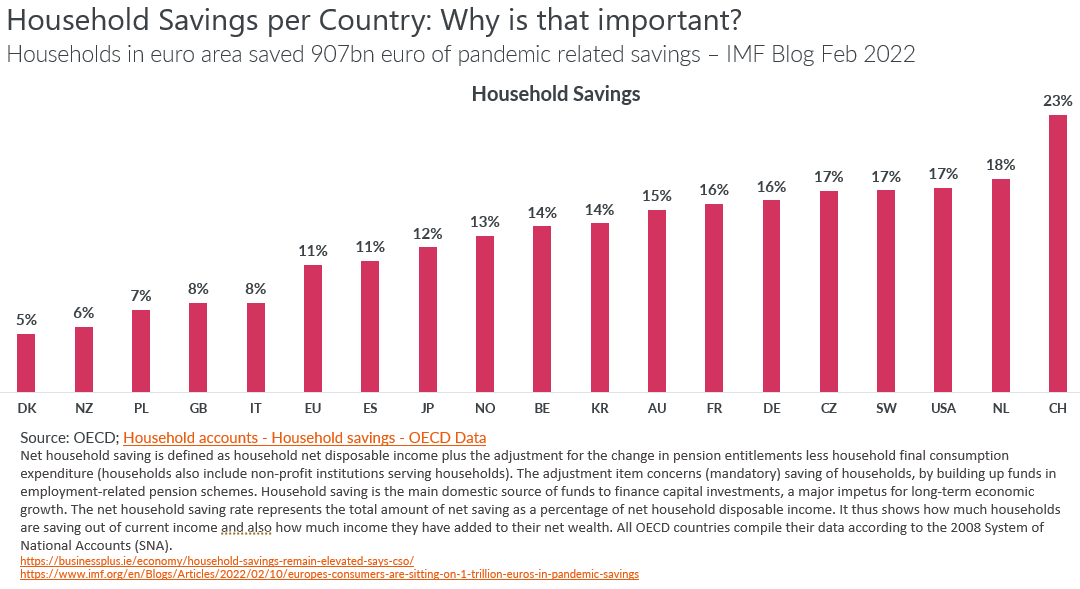

For brands looking to adapt their regional strategies, there are important differences among the financial position of consumers across different economies. Two of the most important are varying levels of household debt and savings. It would seem reasonable to assume that households with less debt are free to spend more of their income on products and services. The pandemic has also had a significant impact on savings across many countries. Before 2020 and 2021, consumer spending was broadly in line with incomes. However, the years since have seen households across the Eurozone limit spending and boost savings. And with consumer confidence still way down in the region, as well as the rest of the world, that trend could continue throughout 2023.

Despite the differences across regions, we are entering 2023 with a general global trend of low consumer spending and confidence. This doesn’t mean, however, that there are no opportunities for brands. The majority of consumers are not halting spending altogether – just becoming more selective about what they buy.

No one-size-fits-all strategy to combat inflationary pressures

For retailers, the impact of inflation is certainly going to make 2023 challenging. That doesn’t mean that continued growth is off the table, just that strategies may need to be adapted. This is certainly true for businesses that operate in multiple jurisdictions. With so much variance across regions and households, basing local strategies on consumer data and insight is mission critical.

There are a few commonalities that brands may be able to utilize. While premiumization for example is not a core growth dynamic, it is still an important buying criterion for a significant portion of consumers who want to spend their money on high quality, durable goods from trusted brands or those that simplify their lives. Brands should look to maintain good product mixes with balanced price points. Similarly, having the right products on appropriate promotions is another important way to appeal to more wary consumers.

Whatever strategies businesses choose to mitigate high inflation in 2023, it is vital they leave as little to guesswork as possible.

That’s where we come in – discover gfkconsult today.