The call is coming from inside the house

Does Bigfoot roam the forest?

What lurks beneath Loch Ness?

Do 95% of all innovations fail?

Even if you’re not an urban legends aficionado, chances are you’ve heard one of these tall tales before — on the playground, at a party, or from a friend of a friend. But if you’ve worked in the innovation space for any amount of time, you might be surprised to see a frequently cited statistic about innovation failure on the list. Despite past attempts to debunk this assertion, its pervasiveness (and seeming industry acceptance) begs the question: Are the odds really so stacked against innovation success?

To put it bluntly: An investment with a 95% failure rate makes little business sense. Would we invest millions in a basketball player who nailed only 5% of their free throws? Or a kicker who missed field goals 95% of the time? CPG innovation is a multi-billion-dollar industry. Does this mean business leaders are willingly throwing that amount of money at an endeavor with such meager odds of payoff?

Fueled by incredulity about this stat, I recently sent a group of BASES innovation experts on a quest: Leverage our data to validate the (in)accuracy of this ubiquitous failure rate. Not only did we uncover a much different and more encouraging story, we also came to an important realization: The construct of “success versus failure” is simply insufficient when it comes to innovation measurement.

From success to vitality

Many forces around us create the impression that we live in a binary world: Good or bad, left or right, success or failure. The tendency to view the world in this way is understandable: it simplifies how we perceive our interactions and make meaning of things. But it can also become problematic when there are multiple interpretations to be had — for example, in the case of innovation success and failure rates.

To illustrate: If a product is delisted after three months, does that make it a failure? What if that product is pumpkin spice cookies, intended to be a seasonal treat?

Likewise, if a new product stays on shelves through Year 2, does that mean it’s a success? Technically, yes — if your only threshold is survival. But what is the state of your innovation at the end of Year 2? Is it healthy, strong, growing? Or is it straggling, worn out, gasping for breath on a death spiral to delist?

A vital shift for innovation

It is within this framework that we propose a shift from measuring innovations by their success or failure to their vitality. For us, the term is evocative of a living, thriving entity and aligns with what we have always emphasized to our clients: Innovation is never a “launch and leave” endeavor — your product and strategy need care and tending, from concept to development to activation and beyond.

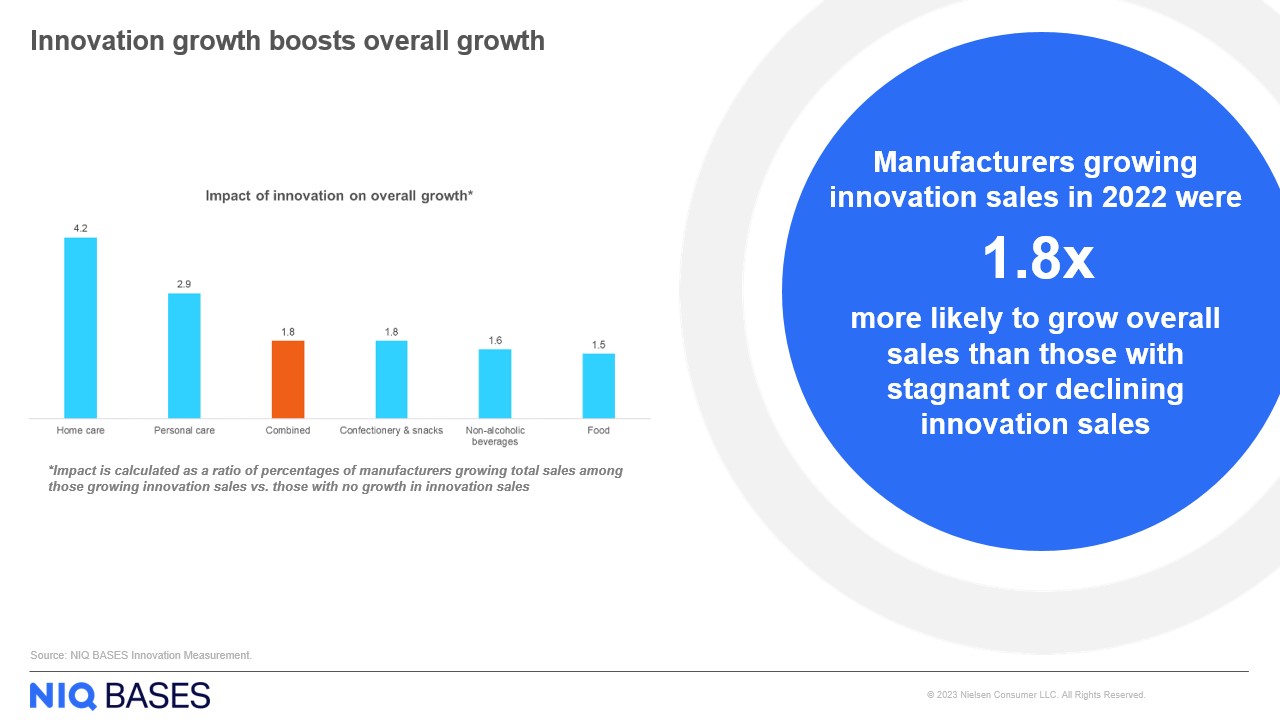

So what, then, defines vitality? It all comes down to the bottom line. Our data shows that when innovation sales grow, a company is 1.8 times more likely to grow overall sales, as compared with companies whose innovation sales are stagnant or declining.

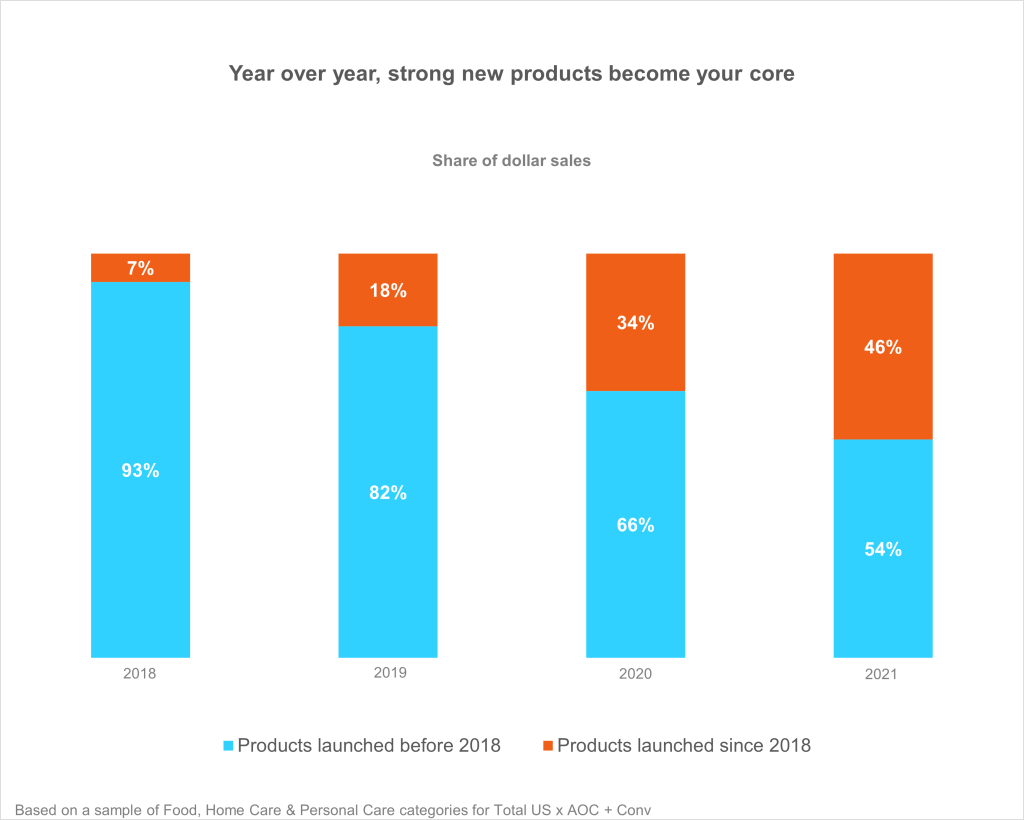

Furthermore, over time, strong new products become part of your core. Broadly speaking, if a new product not only survives Year 1 but goes on to grow sales in Year 2, it is demonstrating its vitality. And based on our findings, it’s clear that vitality is worth the pursuit.

Leveraging our Innovation Measurement platform — which deploys A.I. to narrow in on true innovations (not just new SKUs launched), pairs them with innovation-centric characteristics, and links their NIQ retail measurement data — we reviewed over 60 thousand innovations in five countries over multi-year periods. We then assessed their vitality by dividing the number of new UPCs that grew sales in Year 2 vs Year 1 by the total number of new UPCs launched during that same period.

Assuming national distribution, we found that 52% of new items that hit the shelf show vitality, growing sales in Year 2. When we lower the distribution threshold to include all new items, 33% show vitality. Both outcomes dispel the notion that innovations are destined for “failure” before they even get off the ground.

Great innovations, unrealistic expectations

So now we know the good news: Innovation vitality is more attainable than urban legend would have us believe. But why has this legend persisted to begin with? The answer may lie in whether you’re defining the right expectations for your innovation launch.

We know from neurological research that our brains are wired to make us feel good when our expectations are met (and even better when they are exceeded). The reverse is also true when delivery falls short. When goals are not grounded in solid pre-market research, great innovations can be deemed failures because they didn’t live up to unrealistic expectations. The best way to counteract this urban legend is by safeguarding on both the front-end (by setting realistic goals grounded in solid research) and the back-end (by closely managing your innovations in real-time).

Innovation vitality is worth the pursuit

Innovation vitality is not only worth pursuing, it’s also more achievable than spotting the Loch Ness monster — and critical to your bottom line. In the coming weeks, we’ll share additional data from our findings, including vitality rates by category and best practices to maximize your odds for growth. In the meantime, contact your BASES representative if you’d like a sneak preview of what’s to come.

Your guide to innovation vitality

Want a sneak preview of what’s ahead? Contact a BASES representative or register for our upcoming webinar, “The Innovator’s Guide to Vitality.”