The best deals come to those who wait

Virtually all consumers employed at least one money-saving tactic in response to the inflationary pressures of 2022, from cutting back on staples to seeking out budget brands. Close to six in 10 spent less on necessities because of rising prices while more than one in three switched to a less expensive brand. Additionally, over a quarter of consumers bought something second-hand instead of new.

Tellingly, almost half of consumers told us they had postponed the purchase of a product until it was on promotional pricing. Their response shows that a high proportion of people are prepared to resist impulse buys and risk missing out on a product if it means the chance to secure it at a lower price. We expect to see more of this wait-for-it coping strategy in 2023 as consumers continue to feel pressure to eke out their budgets.

Consumers responded to the personal touch

Personalized promotion strategies are more accessible thanks to wide-reaching online leaflets and digital loyalty schemes. They’re resonating particularly with households that are struggling to make ends meet or with buyers that need to support larger families. Both measures are helping retailers create promotion strategies that forge lasting customer relationships at a time when spending power is lower.

We saw a strong uptick last year in personalized promotions, which influenced 16% of purchase decisions in the EU. Regular use of online leaflets grew by 6% across the continent, and retailers are increasingly integrating digital promotions into their apps or using location-based services to grab attention. An example is one supermarket’s price labels, which change to the loyalty card price when it senses the smartphone of a nearby loyalty cardholder’s phone.

In Europe, personalized promotions are particularly popular in Sweden, where 31% of retailers offer them – almost twice the average of other European countries. A key factor is that nine out of 10 Swedish households have a loyalty card for grocery retailer ICA and almost eight out of 10 have a loyalty card for Coop. Both let them access promotional prices on items they often buy or personalized product suggestions.

Loyalty cards alone are not enough, however. Despite their popularity with supermarket shoppers in Sweden, 37% of Swedish consumers admitted they still shopped around in different stores last year to find the best deals. And for value-conscious Danish people, 50% of comfortable consumers and 65% of those struggling financially shop around for the best deals. It’s fair to say now is a tough time to establish brand loyalty.

World Cup football fever stole Black Friday thunder

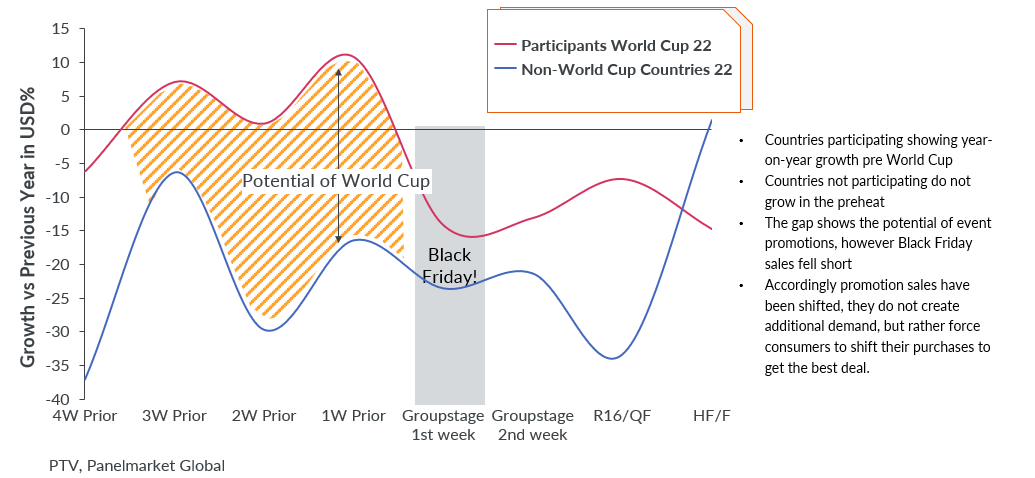

For the first time ever, the first week of the FIFA World Cup coincided with Black Friday in 2022, raising retailers’ hopes of injecting some football fever into the festive promotional events.

In the weeks building up to the tournament, participating countries did indeed see a ramp-up in sales of panel televisions (PTV) compared to the previous year and compared to non-participating countries. This was a welcome uplift for the category which had been steadily decelerating over the year. However, far from turbocharging Black Friday, the excitement around the World Cup only brought forward sales that would otherwise have happened around 24 November, leading to lackluster results on what is traditionally a crucial promotional event for retailers.

The muted activity suggests that consumers in World Cup-competing countries were enticed by tournament-related promotions not simply because of the football feelgood factor but because they were already looking online in anticipation of Black Friday deals. Once they had snapped up their festive bargains, they reined in their spending due to squeezed budgets.

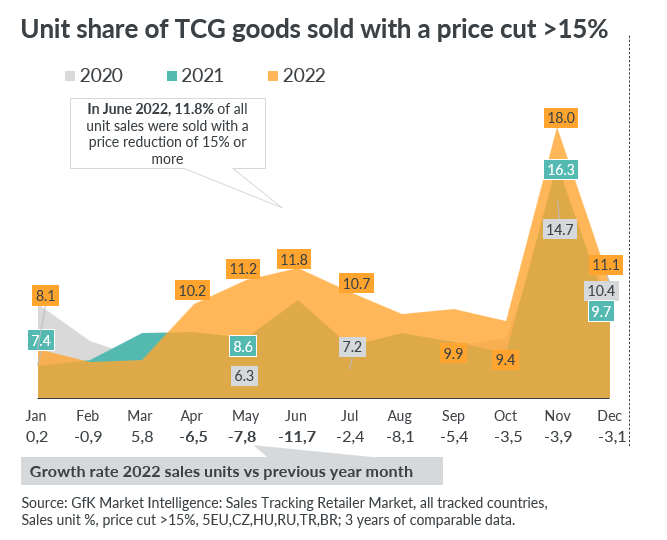

Retailers were forced to cut prices out of season

When markets slumped following Russia’s invasion of Ukraine in February 2022, price-cut promotion strategies climbed steeply. By May, about one in nine technical consumer goods (TCG) sold had been slashed in price by 15% or more compared with about one in 16 by the same time in 2020. By June, the figure was almost one in eight, a new high. And by peak shopping season, close to one in five goods sold had been discounted by at least 15%, compared with less than one in seven in 2020. Since inflation remains high and consumer budgets are squeezed, we expect to see these strong levels of promotion continue in 2023.

Promotional events resonated differently in different regions

Consumers around the world have become very familiar with the cadence of promotional events in their regions and are increasingly timing their purchases accordingly.

Cumulatively, 27% of global technical consumer goods (TCG) revenue in 2022 was made during just five promotional events: Christmas and New Year, Mother’s Day, China’s Singles Day and Black Friday/Cyber Monday.

Although these five events were concentrated in 12 weeks of the year, this is an increase on 10 weeks in 2021, showing that retailers are stretching out the promotional period and consumers are responding.

Consumer awareness of, and appetite for, the events varies by region, however, creating opportunities for retailers to create targeted, localized promotional strategies.

The sales over the Christmas and New Year period grabbed by far the most attention and wallet share in developed economies such as Western Europe and Developed Asia. The exception was China where Singles’ Day on 11 November and JD.com’s 618 event were far more important – events almost exclusively celebrated in the country, which makes Black Friday a muted affair in China.

Christmas and New Year sales mattered much less to shoppers in Latin America. Even with more evenly distributed promotional events throughout the year, Latin Americans were more tuned into Black Friday than consumers anywhere else in the world. Western Europeans have a similar appetite for the event.

Mother’s Day promotions, typically held in March or May, were a big hit in Central Europe and Commonwealth Independent States (CEE CIS) where they accounted for over 6% of the full year revenue for TCG in 2022. In Western Europe and China, by contrast, the day was little more than a blip, showing that consumers were not expecting to be bargain-hunting around this time.

In Europe, Black Friday/Cyber Monday and the Christmas sales dominate the promotions calendar, while Amazon’s Prime Day, exclusively for its Prime members, has been gaining traction since its launch in 2015. Even as inflation began skyrocketing, Prime Day in July 2022 was the biggest in Amazon’s history, with some 100,000 items sold per minute.

Meeting seasonal demand

Seasonal promotions are one of the core magnets for consumers who are considering a purchase – especially for ecommerce shoppers. Satisfying this need results in a very sustainable trend, which we can observe in GfK’s weekly long-term sales development for Technical Consumer Goods.

While in 2013 a traditional Christmas peak was clearly visible, this evolved into a double peak (Black Friday). Eventually, Black Friday overtook Christmas to become the most important promotion peak for retailers outside China.

While market players may be happy or unhappy with this situation, it’s foolish to ignore the consumers’ attitude and motivation to shop at promotional events, which they associate with attractive discounts. Instead, retailers should understand how to handle such decisive promotional events while securing margins.

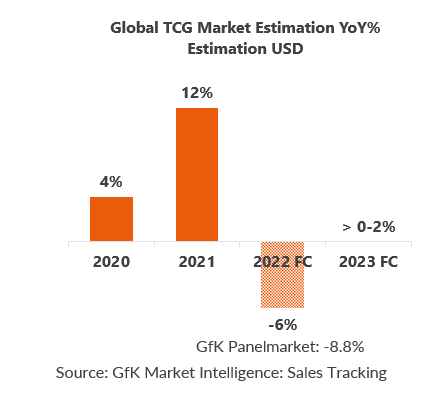

In Western Europe and Developed Asia, the slump in the TCG market is expected to continue, albeit less marked than before, with a single digit decrease year-on-year. At the same time, consumer aspirations to buy premium brands and features remains ever-present, so the polarization we have seen looks set to continue.

As in every challenging period, brands that continue to invest in innovation can expect to weather the storm better than others, gaining traction in the cohort of consumers whose discretionary income is not significantly affected. However, as inflationary pressure continues to bear down, even this affluent group will get savvier about when they make purchases, so well-timed promotions will be crucial.

The picture looks more promising in emerging regions. They’ve had historically lower baselines and did not experience the explosive growth from home-based retail trends that Covid-19 triggered in developed markets. In fact, the International Monetary Fund predicts that China and India will account for roughly half of global GDP growth in 2023. Many other emerging countries offer pockets of growth in a challenging year due to their rising middle classes and the chance to make up ground lost during the pandemic.

Promotion optimization will be essential for driving volume for retailers in 2023 as consumers continue to adapt their buying behavior. Amid growing austerity, it’s important that retailers target shoppers with promotions in ways that resonate with them.

Across the board, attractive promotions are becoming essential to satisfying both loyal customers and those who are shopping around for the best deals. Where consumers are cynical about faux discounting, retailers will need to demonstrate genuine value in promotions, leading to potentially deeper discounting.

With GfK’s Pricing and Promotion solutions, leaders in Technology Products & Durables, Retail, and FMCG can make quick, efficient pricing adjustments, run successful promotions and react to competitors’ activities.

![]()