The world is going through a reset – consumer behavior and market dynamics have not normalized post pandemic, rather they have evolved and changed. Amidst this change, smart home technology is slowly but surely going mainstream as an idea and a consumer choice, with 15% of global internet users now owning at least one smart device. Yet, even as awareness goes up and prices come down, there remains a set of consumers who are reticent.

How can brands and retailers win over these skeptics to crack the mass market? And is it possible to justify premium prices? We look at the dynamics shaping the market in 2023.

Overview of the smart home market today

Smart home products have also seen the deceleration in demand that has impacted the technical consumer goods (TCG) market at large. High inflation triggered by the outbreak of war in Ukraine last year has diminished consumer appetite that was already falling from its pandemic peak.

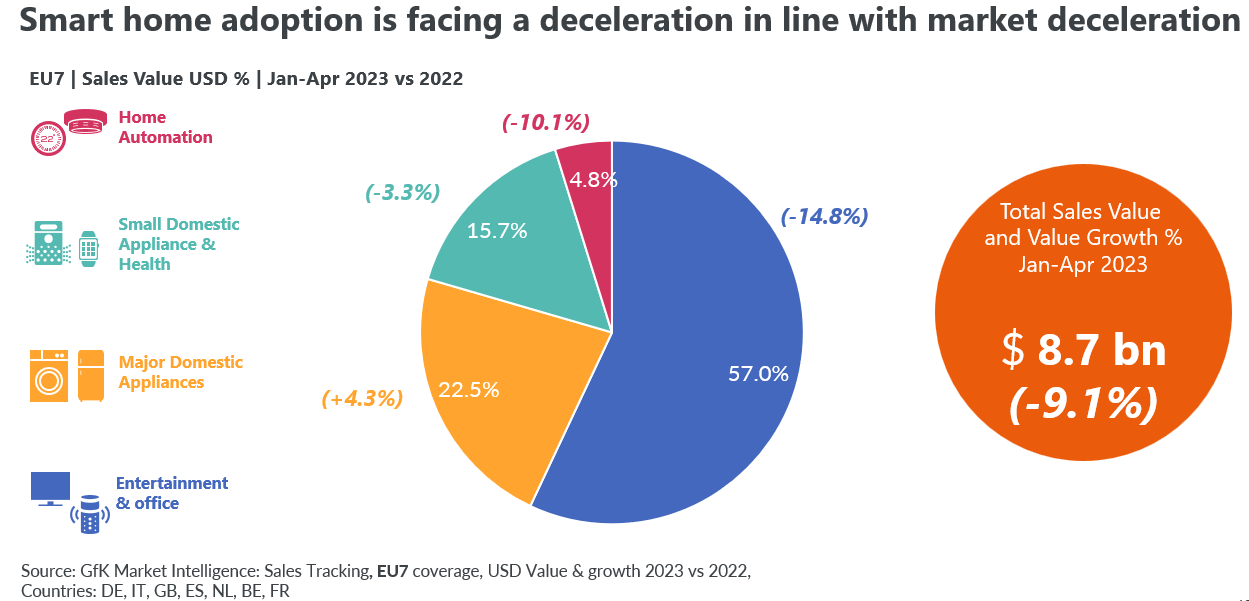

Demand for smart home goods continued to slow in Q1 2023 in line with the rest of the (TCG) market. Between January and April, sales of smart products brought in $18.3 billion across 11 major Asian-Pacific markets (China, India, Australia, Japan, Singapore, South Korea, Taiwan, Malaysia, Thailand, Vietnam and Indonesia), 11% down on the same period in 2022. And across major European markets , smart products raised $8.7 billion in Q1, down 9.1% on last year, although the major domestic appliances sector was a standout, it grew by 4.3% in the same period.

Prices of smart products in major European markets rose strongly during the pandemic in response to rocketing demand during peak sales periods in 2020 and 2021, only to drop in 2022 as cost-of-living pressures hit consumers and demand declined. One other factor that has contributed to a price decline is increased commoditization of smart products in each category. This has led to the price for innovations in smart functionality also reducing. In the year to April 2023, prices declined by 14% to hit the levels they were at immediately before the pandemic.

Despite this muted performance, TCG revenue overall is still higher than 2019 levels and smart features remain one of the best levers for premiumization if the product has a compelling use case. With the world economy showing signs of a rocky recovery, we expect to see consumer appetite pick up in late 2023, especially as smart home products play into the three themes that have driven consumer purchase decisions in recent years: performance, simplification and premiumization. However, barriers to broad-based adoption remain, and will need to be overcome if smart products are to appeal to the mass market.

Who’s buying smart home products?

The leading smart home market is the UK, where 26% of internet users aged 16 to 64 own one device. The Italians, Spanish and Chinese are also eager users – more than one in five internet users own at least one smart home device.

Awareness is high in these leading markets. Four in five consumers in the UK have some knowledge of the smart home concept, up from three in five in 2016, and more than a third feel they know a fair amount or a lot about the technology.

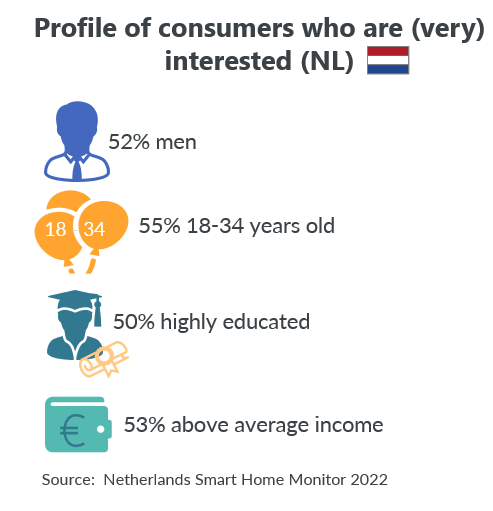

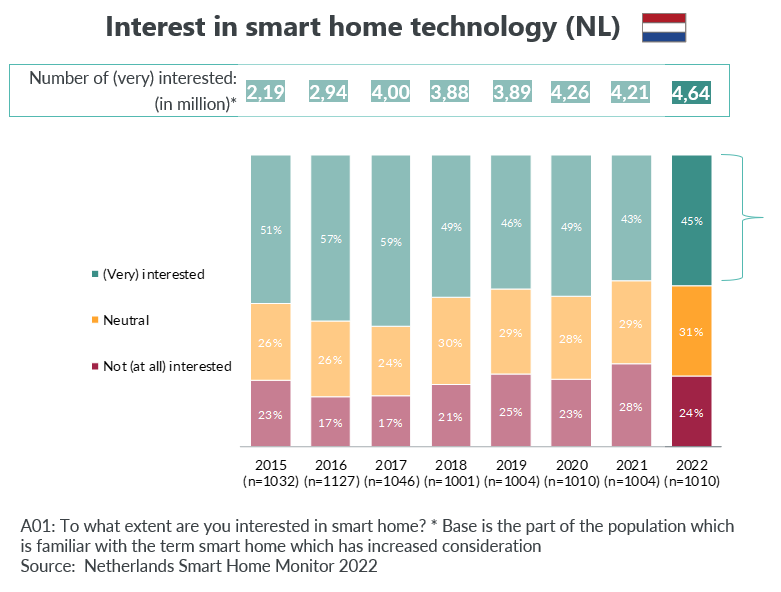

In the Netherlands, where adoption is above the global average, the number of people who are both familiar with the technology and interested in it has more than doubled in seven years to 4.6 million according to the GfK Netherlands Smart Home Monitor Study. The typical profile of a Dutch smart product enthusiast is a highly educated male aged 18-34 on an above-average income, although these characteristics account for little more than half of all people interested in smart home technology.

Who’s not buying smart home products?

At the other end of the spectrum, fewer than one in 20 internet users aged 16-64 in Thailand and Japan own a smart device, and fewer than one in 10 in Saudi Arabia, Philippines, Indonesia, Argentina and South Africa.

Given that one in five people globally says they don’t know enough about smart home technology to make a purchase, a lack of awareness, confidence and trust may explain the low adoption rates in these countries, coupled with cost barriers.

Even in leading markets, skeptics make up a significant chunk of the potential consumer base. Take the Netherlands, for example. Although awareness among a tech-savvy consumer baseabout smart products and their benefits has rocketed since 2015, resulting in a doubling of the number of people interested in smart home technology, the percentage of the total consumer base who are familiar with smart technology but not interested has stayed relatively constant over the past seven years – sitting at 24% in 2022.

What’s holding shoppers back?

The three top barriers to smart home adoption are the same as we reported last year, but consumers’ objections are slowly fading.

-

Price

Price remains the number one barrier to smart home adoption. This is true in 22 out of a global core of 25 countries, even for affluent consumers, with 43% of global consumers saying it’s their main obstacle. However, this is down three percentage points since 2020, reflecting the value depreciation of innovation that occurs over time as well as the recent drop in prices due to demand deceleration in the TCG market.

More than half of global consumers say they are not willing to pay more for a smart home product than its standard version. However, over 44% of consumers are prepared to pay a premium for a helpful product, and this has increased over time.

-

Privacy

Back in 2020, more than half of global consumers were concerned that smart home products would jeopardize their privacy and 63% feared their personal information could be used fraudulently. These fears are waning somewhat. In our latest research, 31% of consumers are concerned about the privacy implications of a smart home and one in four have safety concerns. When it comes to voice assistant speakers, however, privacy is the top concern globally, no doubt fueled by media reports about hackers breaching home security cameras and smart speakers eavesdropping on householders’ conversations to harvest user data. Hence brands need to continue to communicate around their privacy and transparency measures. Awareness and trustworthiness around privacy measures can go a long way to win over the skeptics.

-

Apathy

For a good number of consumers, the case for smart home products is still not compelling.

Apathy is a particular issue in Developed Asia, North America and Western Europe—even in the UK 42% of consumers say they don’t know enough about smart home technology to buy it. In these economies, consumers are often more skeptical about tech than in emerging markets where populations tend to be younger and more experimentatal with tech innovations.

Lack of appeal is also notable for specific products. For example, 32% of global consumers don’t see the point in smart blinds and shades.

How can brands win over the next wave of consumers?

To move beyond confident early adopters, cracking the mass market is imperative. Smart home products must focus on these five requirements of smart shoppers worldwide in 2023.

-

Useful and convenient

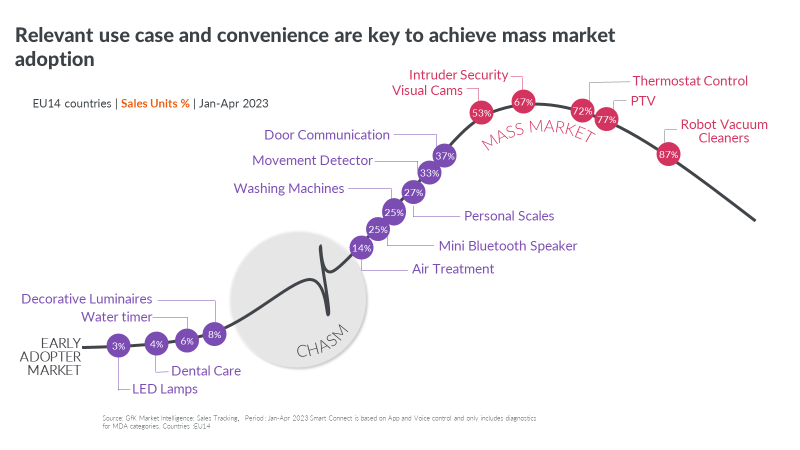

Smart home products must go beyond a gimmick. A practical use case is crucial to earning mass market adoption, and 41% of consumers are prepared to pay a premium for products that make their lives easier.

The prime example of this is smart robot vacuum cleaners which have cracked the mass market even though they cost close to four times the price of standard versions (an average of $423 compared to $116). The use case has become so strong that nearly 87% of the volume assortment is smart.

Likewise smart panel TVs, thermostat controls, intruder security and visual cams are now mass-market items while consumers are increasingly seeing the benefits of smart door communications, movement detectors and dishwashers.

Of course, a raft of convenient functions doesn’t help if consumers don’t know about them. So, brands need to promote these use cases via the device and touchpoints such as newsletters, tech magazines, vlogs/blogs, influencers or streaming channels where you can grab their attention.

Remember that geopolitical events and trends can strengthen or weaken use cases. For example, we saw a 10% spike in smart security categories after the outbreak of war in Ukraine and a big uptick in smart thermostat purchases when energy prices rose.

-

Secure and trustworthy

Although privacy concerns have reduced in the last three years, the TCG industry clearly has some way to go to build trust in connected home devices. To reassure consumers, it is vital to clearly communicate the safety and data protection features of your products.

In Japan, where smart home adoption is very low, for example, regulators have recently warned the makers of artificial intelligence (AI) chatbot ChatGPT not to collect sensitive data without people’s permission. This is just one example of a market where increased engagement and transparency is important (sometimes even mandatory) and could dramatically pay off, especially given that AI will drive the evolution of many new features, from pattern recognition and routine setting to predictive maintenance alerts.

One idea to build credibility would be to circulate an FAQ to explain how you protect their personal data and safeguard your products from cyber attacks.

-

Compatible and integrated

The prospect of compatibility problems is a major turn-off for consumers, with 18% worried that technology across different systems may not be able to communicate with each other.

Brands need to flatten the learning curve and make it as simple as possible for users to set up multiple devices and bounce back quicky from any update errors or connectivity disruptions.

Making headway in this sphere is the new communication protocol Matter, which leverages the existing technology stack such as Thread, Wi-Fi, Bluetooth, and ethernet, to allow smart devices of different brands to communicate with each other. Dozens of big brands have pledged support for the new standard, which should break down one of the most challenging barriers to mass smart home adoption. However the adoption has been quite slow since the declaration.

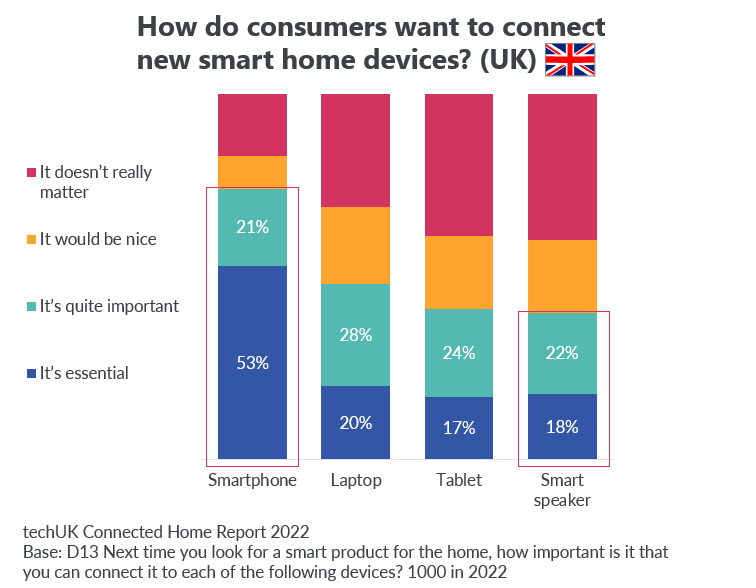

Smartphone connectivity is a clear priority for consumers, with three-quarters of users in the UK saying this is important.

- Innovative and high-performance

Smart connectivity provides a rationale for securing margins through premiumization. But with even affluent consumers wary of high prices in the volatile economic climate, brands need to work even harder to demonstrate the long-term value of owning smart home technology. As described above, this could be in the form of increased convenience, or it could be through innovative high-performance features that provide a superior experience, or save the consumer money or time in the long run, for example through energy savings.

The interplay of smart functionality and sustainability is also growing. In fact, it is becoming an enabler for the latter, especially by allowing measurability of sustainability within tech products. The definition of good product is broadening from mere performance features to sustainability features. At major consumer trade fairs like IFA and CES there is a clear trend for brands to bolster their energy efficiency credentials by helping consumers understand and optimize their energy consumption.

Meanwhile, smart robot vacuum cleaners continue to evolve, with new wet and dry suction docking stations seeing triple digit growth year-on-year from Jan-May 2023, while dry-suction only grew marginally.

Conclusion

Smart home technology has immense market growth potential where products have obvious practical benefits and superiority over standard versions.

To pull in the next wave of first-time buyers, manufacturers and retailers need to pitch their products in the affordable premium range, build trust through transparency and prove to the skeptics that it’s better to be connected.

Find out more about how consumers use smart tech in their homes with GfK’s latest smart home report.