Value of sales took a hit at the start of the year, but volume demand is up.

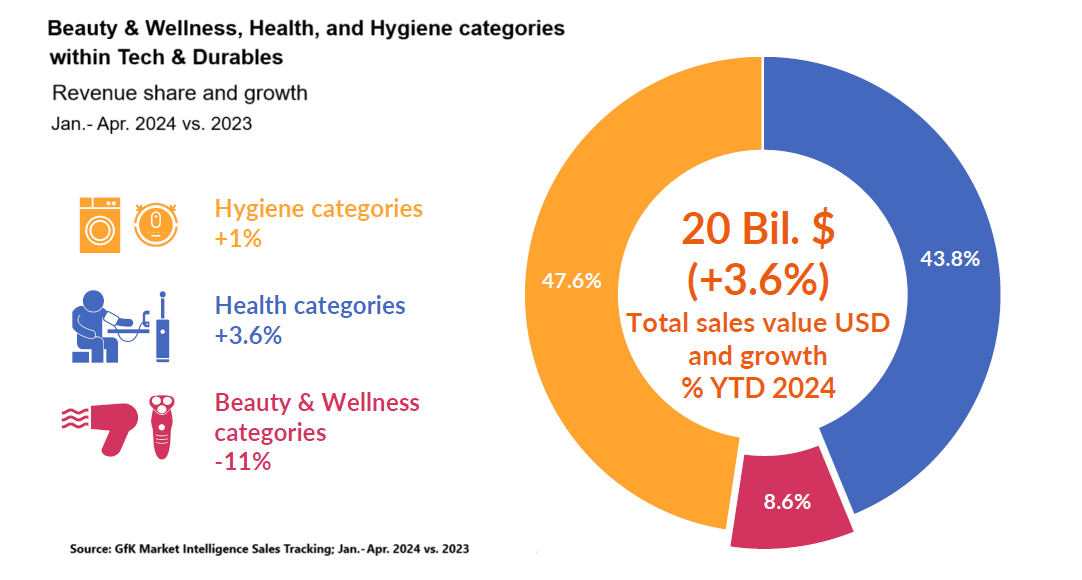

Beauty and Wellness categories within tech products—think hair dryers, hair stylers, shavers, electrical cosmetics (electrotherapy), and massage devices—performed inconsistently in the first four months of 2024. Although revenue was down 11% compared with the same period last year, sales volume trended upward. These patterns signal a recovery in consumer appetite to buy, but also a focus on affordability and lower-priced options.

Category trends

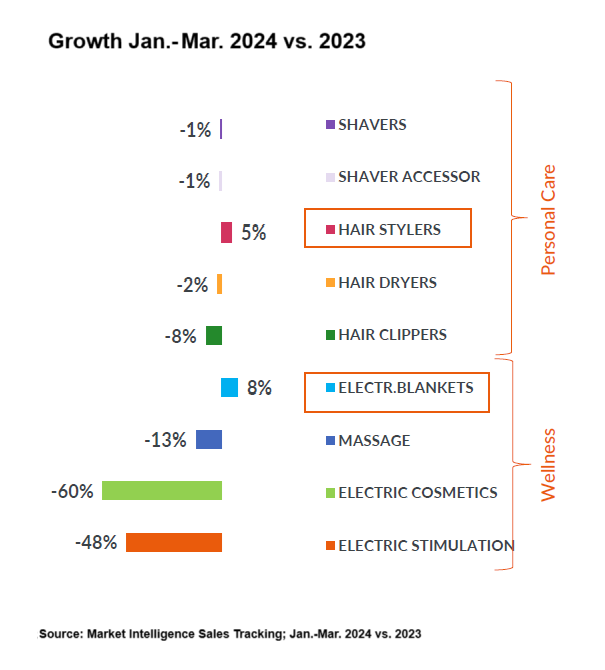

At the total category view, hair stylers and electric blankets stood out as hitting modest revenue growth in Q1. When it comes to hair stylers, consumers are looking for performance (with 35% prioritizing the number of speed/heat settings the device has) and time savings (33% prioritizing speed to style). This further illustrates consumers’ continuing focus on saving money: 32% globally are still feeling financially worse off now than they did a year ago, per NielsenIQ’s forthcoming Mid-Year Consumer Outlook report.

Sales of shavers and hair dryers remained mostly stable. But there was a significant decline in revenue for both electrical stimulation devices and electrical cosmetics, due to market saturation but also to new legislation and guidelines. This is especially true in China, a huge market for electrical cosmetics), where 2024 growth has been clearly affected by new regulations. For example, the sale and regulation of Intense Pulsed Light (IPL) devices as over-the-counter products still varies significantly by country, but more countries (including China) are now classing them as medical devices requiring registration, testing, and adherence to national standards.

Within men’ shavers (traditionally a high-movement category), there has been key growth in segments that offer multi-functionality—such as multi-grooming kits and body-groomers—or that cater to easy grooming on the go, such as electric system razors and beard trimmers. The relatively small segment of body groomers delivered a 29% increase in value, while sales of electric system razors grew 12%, beard trimmers were up 9%, and multi-grooming kits rose 7%.

Regional trends

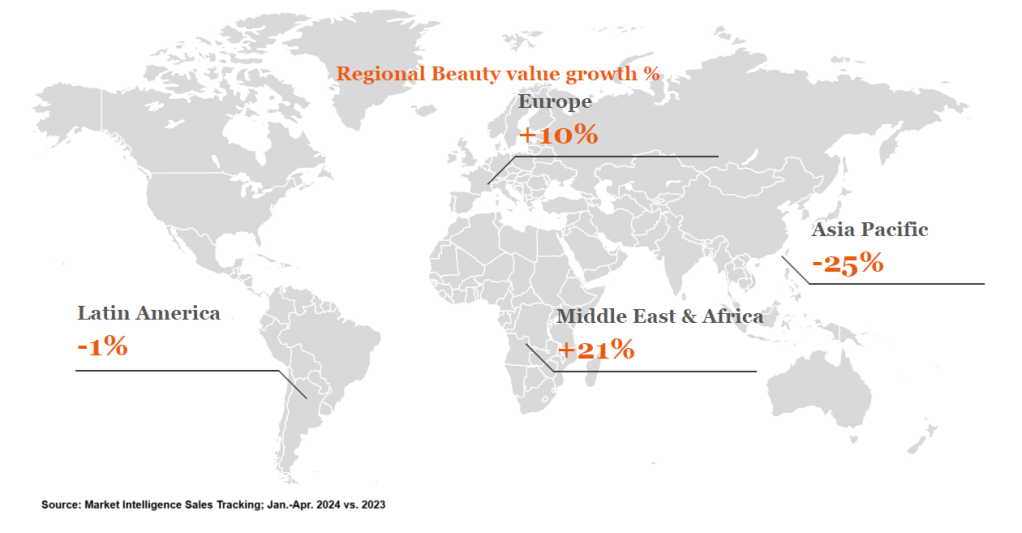

Consumer demand for electrical beauty products varied widely across regions. The Middle East & Africa and Europe saw strong upticks in year-over-year revenue, but Asia Pacific sales plummeted, driven largely by disappointing sales of electrical cosmetics and electrical stimulation products following earlier market saturation and regulatory changes.

Looking at spending intentions around personal and beauty care, consumers in India, China, and the U.S. say they are most likely to spend more this year. However, bear in mind that this includes spending on conventional beauty products, like cosmetics, as well as electronic beauty categories.

What is the profile of an electrical beauty buyer?

In a big market like the U.S., nearly two in three (62%) electrical beauty buyers are middle income. This is an aspirational, yet vulnerable, buyer group that will be affected by external factors such as cost of living. Additionally, two in five electrical beauty shoppers are replacing a faulty product—and could potentially opt for a more aspirational model. Only 27% are looking to upgrade a working product, and 17% are shopping for additional products.

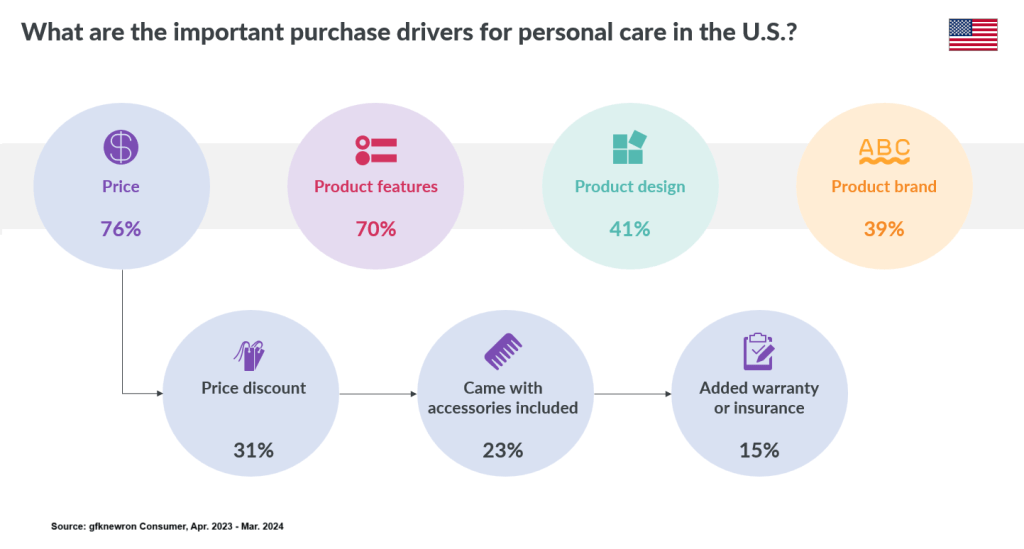

When it comes to personal care (shavers, hair dryers, and stylers), price is still the most important factor for most buyers. Price discounts are the preferred type of promotional offer, followed by bundling (accessories included). Product features come close to price in importance (70% of buyers mention it as an important factor in their decision making), while product design (41%) and brand (39%) lag behind.

Generation and channel implications

Beauty trend influencers are younger than ever, with Gen Z and even Gen Alpha representing key demographics for manufacturers and retailers to consider.

In India, Saudi Arabia, and Mexico, one-third of the population is under 20 years old, while in Brazil, China, the U.S., the U.K., and France, this age group accounts for nearly a quarter of the population. In five years, Gen Z will overtake Boomers for overall spending.

This makes channel selection even more important. Currently, around 60% (volume) of electrical products in the Personal Care and Wellness categories are purchased online. However, social e-commerce has gained share from traditional online, with platforms such as TikTok shaking up beauty e-commerce in several key markets.

Opportunities

Final thoughts

Aspirational yet discretionary

Most people’s beauty spending within Small Domestic Appliances (SDA) is aspirational, but it is also discretionary. Cost of living factors will affect these buyers; however, smaller ticket price items continue to sell.

Out-of-home focus impact

Tourism has rebounded, and consumers are again focusing on out-of-home events and socializing— and thus prioritizing their appearance. Because many electrical beauty buyers are also prioritizing affordability, they will likely complement their visits to the salon by buying devices that allow them to achieve similar results at home.

Social media impact

Social media has high relevance for SDA beauty categories, as it does for categories such as makeup and fashion. In particular, channels like TikTok are set to become increasingly important, driven by the growing influence of Gen Z and Gen Alpha as key demographics.

Top sellers and dynamics

Hair stylers are a key growth segment due to innovation and new launches. The electrical cosmetics and electrical stimulation categories also have seen new the launch of new products, but saturation from last year’s sales has affected growth this year.

Outlook

Overall, we expect to see some conventional categories return to growth by 2025, with newer areas, such as electrical cosmetics and electrical stimulation, being affected by increasing regulation across all markets.