Strong regional performance in Q1 2024 vs same period last year for Middle East, Turkey and Africa (META) and Eastern Europe. Western Europe struggled to reach positive growth.

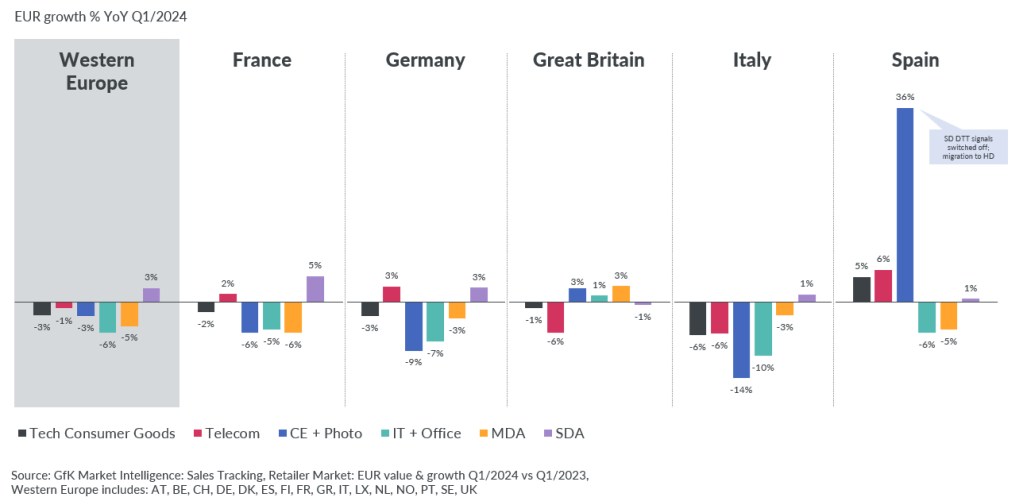

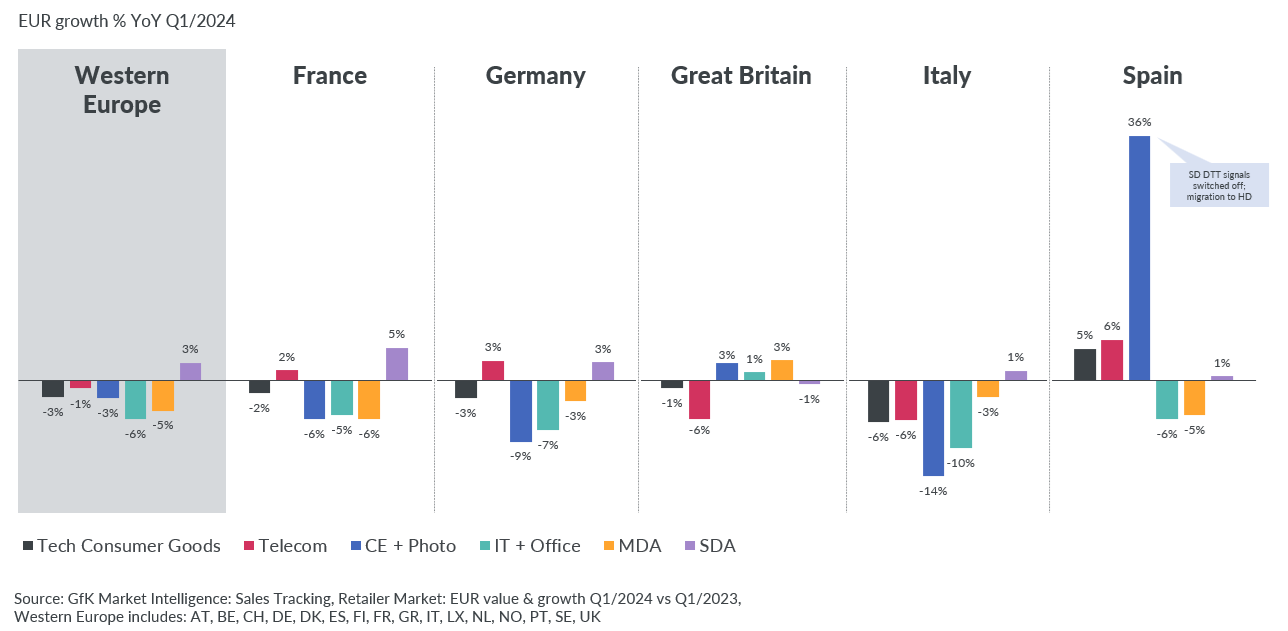

Western Europe – sales revenue Q1 2024 vs Q1 2023

- Small domestic appliances (SDA) is the only sector to see positive revenue across most countries in Western Europe.

- Spain’s high growth in Consumer Electronics (CE), driven by purchases of HD-enabled TVs, following end of SD DTT signals on 14 Feb 2024.

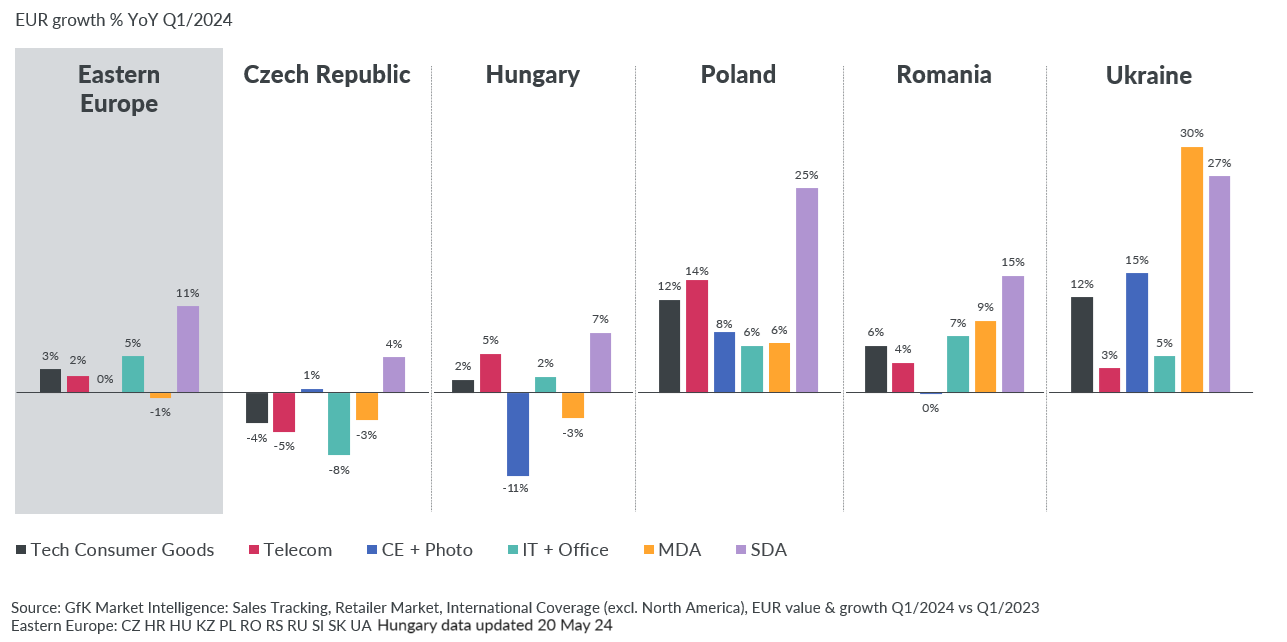

Eastern Europe – sales revenue Q1 2024 vs Q1 2023

- Eastern Europe saw good regional growth in Q1 2024, helped by a low baseline from the previous year.

- Fastest recovery seen in purchases of small domestic appliances (SDA), as well as in IT and office equipment.

- Poland, Ukraine and Romania performing most strongly within the region, with positive or stable growth across every sector.

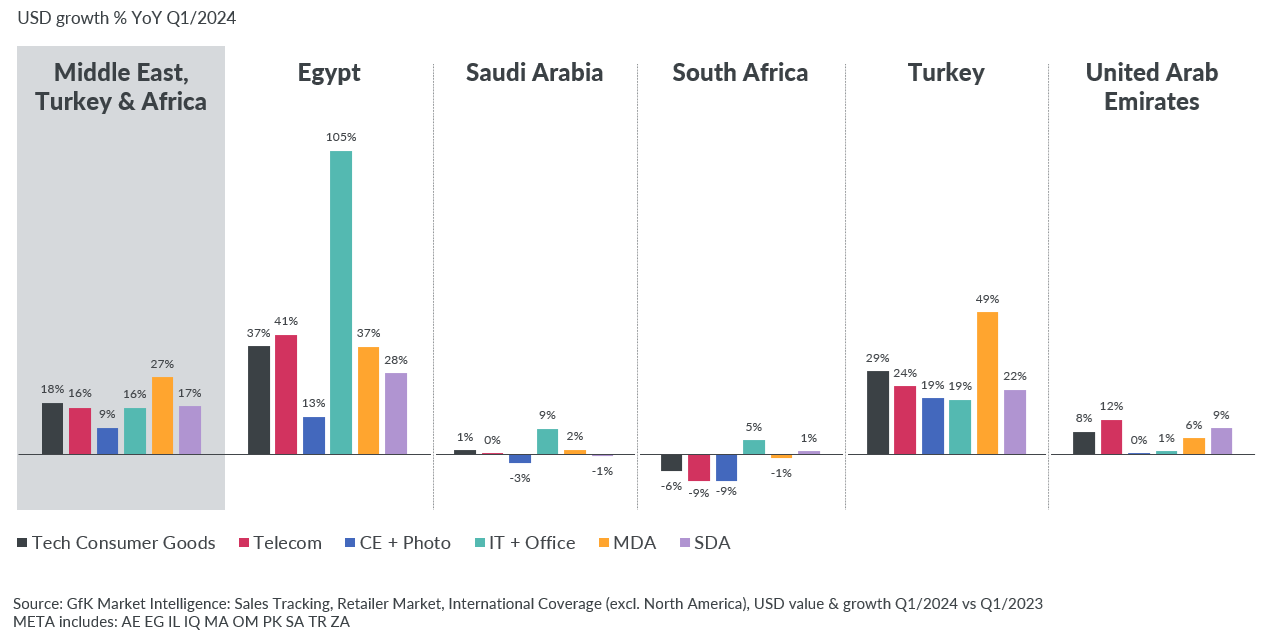

Middle East, Turkey & Africa (META) – sales revenue Q1 2024 vs Q1 2023

- T&D sales in META have been impacted by inflationary price increases.

- Geopolitical impacts also remain a risk for this region.

- Ongoing high inflation rates in Turkey and Egypt sees consumers turning cash into assets

Want to know more? Watch our experts’ videos and download our report on the trends impacting the Tech & Durable industry in 2024