Connectivity or smart features are among the best triggers to drive consumer purchases of technical consumer goods in 2025, including product premiumization.

Volume demand for smart home products continues to be subdued following the peak sales of 2020 and 2021. This is in line with the Tech & Durables (T&D) market overall, but there are signs of improvement. In the major EU7 markets, revenue from sales of smart home products in the first half of 2024 stands at $13.9 billion. That’s 6.5% higher than at the same time last year.

Compare that to the 0.6% drop in revenue for consumer T&D sales globally in that period, and it becomes clear that connectivity or smart features are among the best triggers of consumer spending in today’s consumer landscape—and for driving product premiumization.

As shown in our most recent Consumer Outlook report, consumer confidence is improving. Nearly one-third (30%) of global consumers now feel they’re in a better financial position than they were a year ago—up 2% since January. This improved sentiment is enabling a shift from cautious to intentional consumption, and a certain proportion of people are prepared to spend more on the smart version of a standard tech product, but only if the product’s use case is directly relevant to their need.

Performance, convenience, energy savings, and sustainability continue to be some of the leading themes driving consumers’ purchase decisions right now. Smart products can deliver on all of these, and consumers are showing growing interest in smart home technologies, but mass adoption hinges on overcoming barriers and strengthening use cases.

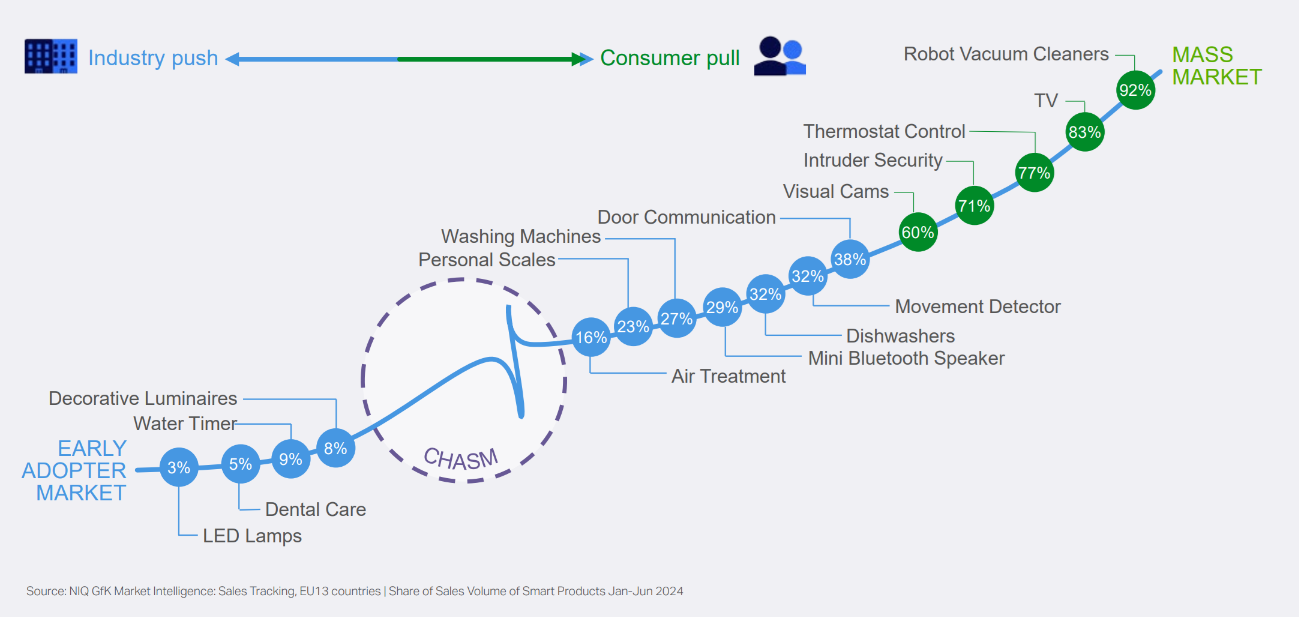

Share of sales volume taken by smart products within each category (EU13, January–June 2024)

Consumers’ barriers to buying smart home products

Overall, cost remains the top barrier to smart home product adoption among the list of 10 potential barriers that we measure—even for high-income consumers. (These barriers range from safety concerns to the lack of knowledge about smart home products.)

Privacy concerns are another core obstacle, standing at #2 for smart appliances and smart security and rising to #1 when it comes to voice assistant speakers. These fears have been fueled by media coverage of hackers breaching home security cameras and reports of voice assistant speakers gathering more information than their owners were aware of. For some consumers, the risk is just simply too high to justify the benefit.

For some products—like televisions, robot vacuum cleaners, and dishwashers—the benefits of smart functionality are quite clear to consumers in increasing performance and convenience, or reducing energy use. In certain other smart home products, the benefits still aren’t compelling enough to overcome those barriers. This is especially so in developed markets, where consumers overall are less enthusiastic and more skeptical about tech, compared to many emerging markets, where the population tends to be younger and more excited about what tech can offer.

Smart products and premiumization

Overall, only a small percentage of consumers are fully willing to pay more to get a smart variant of a product. But, for some product categories, that willingness becomes far more prevalent.

When it comes to security, lighting, energy, and health and personal care products, four in 10 consumers say they’re willing to pay slightly more to get a “smart” variant.

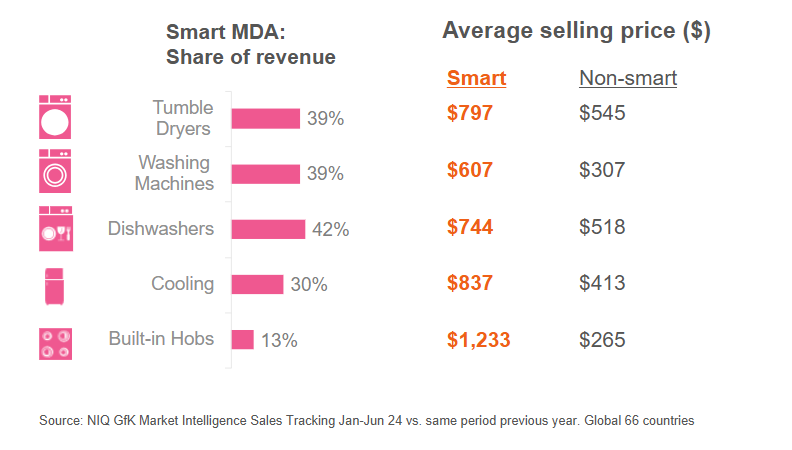

If we look at Major Domestic Appliances, 38% say they’re willing to pay a bit more for smart variants of these appliances—and this claimed intent is also seen in the actual sales results. In the first half of this year, smart variants accounted for around 40% of the sales value of all tumble dryers, washing machines, and dishwashers sold globally, with people paying around $300 more than for a non-smart version.

Major Domestic Appliances (MDA): Share of sales revenue of smart versions

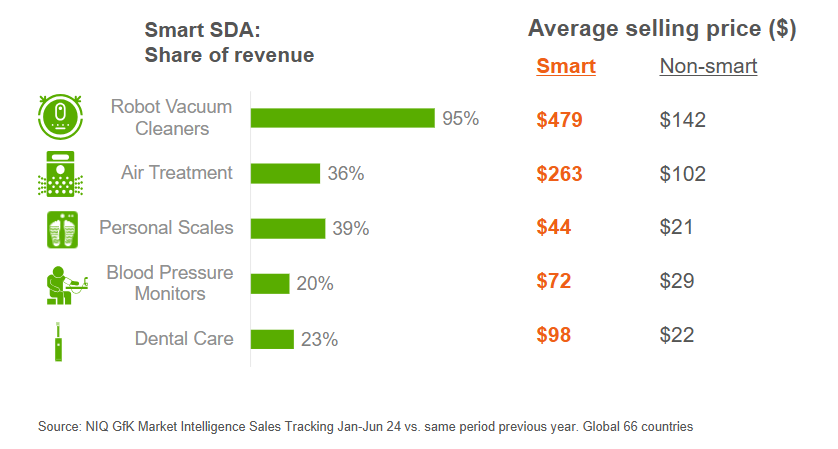

For Small Domestic Appliances, 32% say they are willing to pay a bit more for smart variants. The picture across actual sales is more varied, however, and links back to the need for a really compelling and relevant use case in order to persuade consumers of the value of investing in the higher purchase price.

Robot vacuum cleaners are the leading example of getting this right, with 95% of all items sold being smart versions that allow users the convenience of controlling them remotely and setting automatic timers, among other features. Smart variants of personal scales are also reaching mass-market status, accounting for 39% of all items sold. This is partly due to the relatively small jump in price between non-smart and smart varieties. At a difference of around $20, consumers are able to justify paying a bit more to get features such as convenient tracking and monitoring of personal measurements over time, personalized reminders, and a visual display of results.

In other product categories, such as dental care and blood pressure monitors, the data shows a different story. Here, the price jump from non-smart to smart is notably higher—and smart variants account for only around 20% of sales revenue. Shoppers in these categories aren’t convinced that the benefits offered by these smart variants justify the higher price. There is a need, therefore, for manufacturers and retailers to present use cases for the smart variants that resonate more closely with the specific needs of consumers in these areas.

Small Domestic Appliances (SDA): Share of sales revenue of smart versions

Takeaways for the 2025 smart home market

As people’s portfolio of smart products increases, a “multiplier effect” of benefits will kick in, allowing users to enjoy an increasingly seamless and integrated experience across their entire home. For instance, a smart speaker can control multiple devices like lights, locks, thermostats, and appliances through voice commands, creating a cohesive and intuitive user interface. Or a smart thermostat can adjust the temperature based on data from smart window sensors, which detect if windows are open or closed.

The interconnectivity and synergy within a fully connected smart home presents real potential for users—from more efficient-energy use and subsequent cost savings to greater convenience and time savings within the home.

Smart home products must go beyond being a novelty and be genuinely useful within the specific lifestyle and household of the user to break through the current barriers to adoption.

Smart home products must also adapt to the consumer and not vice versa. Manufacturers and retailers that offer proactive support around product setup, operation, security, and the responsible management of user data will gain the advantage of consumers’ trust.