Who is the Hispanic Beauty Consumer?

Today, there are more than 62.5M Hispanics in the US. They are the fastest-growing population in the US, having quadrupled in the past 40 years.1 With this large and diverse population comes an estimated $2.4t buying power, up 87% in the past decade.2 Understanding their values, outlooks, and behaviors is key for beauty brands to grow within this highly sought-after segment.

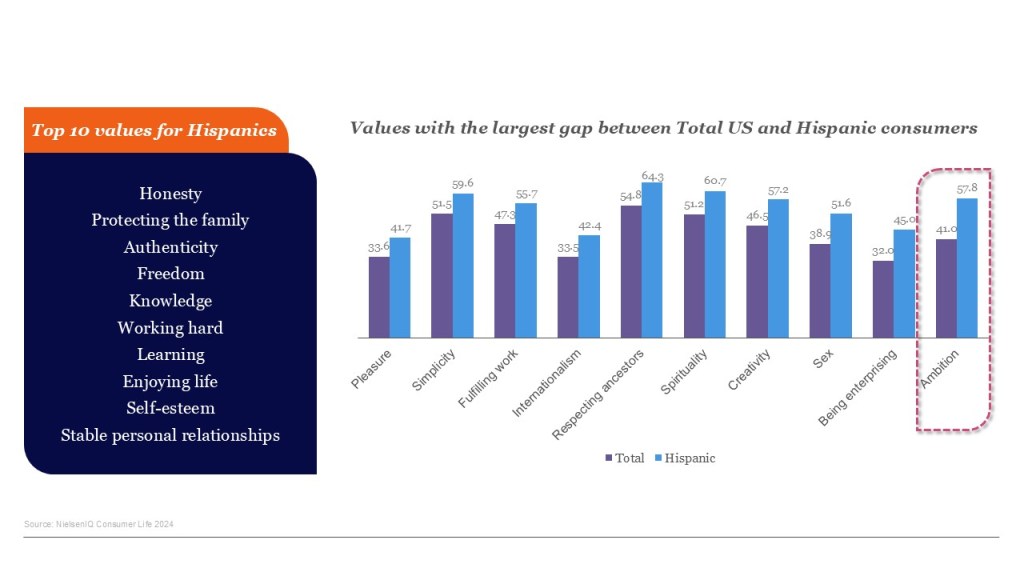

Hispanic consumers are deeply guided by a set of core values that shape their purchasing decisions and lifestyle choices. According to NIQ Consumer Life survey data, the top values for Hispanic consumers are honesty, protecting the family, and authenticity.3 Hispanics also prioritize enjoying life, self-esteem, and stable personal relationships, reflecting a balance between ambition and well-being. This positive outlook is mirrored in their optimism about the country’s future, with 40% expressing a hopeful perspective, slightly higher than the general US population.3 These values, when understood and embraced by brands, offer a powerful opportunity to connect meaningfully with Hispanic consumers.

Key Hispanic Consumer Beauty Trends

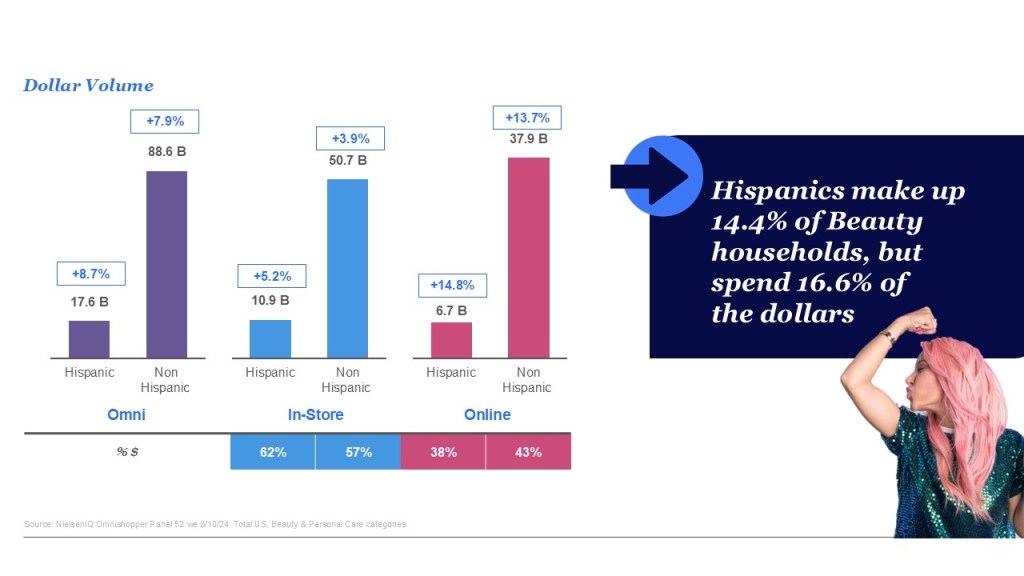

Hispanic consumers are driving significant growth in the beauty industry, with their spending outpacing that of non-Hispanics in several key areas. While Hispanics make up 14.4% of beauty households in the US, they account for an impressive 16.6% of total beauty dollars spent.4 Hispanics also shop more frequently and spend more overall on beauty than non-Hispanics across all channels.4 This demonstrates not only their strong engagement with the beauty category but also their willingness to invest in products that reflect their unique needs and preferences.

Hispanic beauty consumer spending is primarily driven by fragrance, cosmetics, and hair care. In fact, they outspend non-Hispanic consumers by an average of $39 in these categories each year.4 They also show strong growth across all beauty categories, with their highest spending focused on fragrance, hair care, and facial skincare. As these categories continue to see elevated spending, brands that offer tailored solutions for Hispanic consumers can tap into a loyal and growing segment of the beauty market.

As the Hispanic population continues to grow, their influence on the beauty market is becoming increasingly evident, presenting brands with a prime opportunity to tap into this dynamic and expanding consumer base. Understanding these trends is essential for brands looking to connect authentically with Hispanic shoppers and capture a larger share of this fast-growing market. By aligning with the cultural values, preferences, and beauty needs of Hispanic consumers, brands can foster stronger connections and build lasting loyalty in this key demographic.

What categories resonate with the beauty buyer?

Ultimately most buyers will purchase across price points and product categories. Though there are some categories that luxury buyers are more likely to purchase, and some categories that are appealing to both sides of the dual shopper:

- Fragrance and face cosmetics are categories in which shoppers often gravitate towards luxury products.

- Consumers will select the best product overall in facial skincare and haircare categories – regardless of segment.

Consider: Luxury fragrance can serve as an entry point for consumers who haven’t tapped into the luxury segment yet – especially as 41% of total fragrance sales fall under luxury. Consumers value access to unique scents and opportunities for expression. This especially rings true for younger consumers who are embracing luxury fragrance at growing rates.

How Hispanic Consumers Perform in Key Beauty Trends

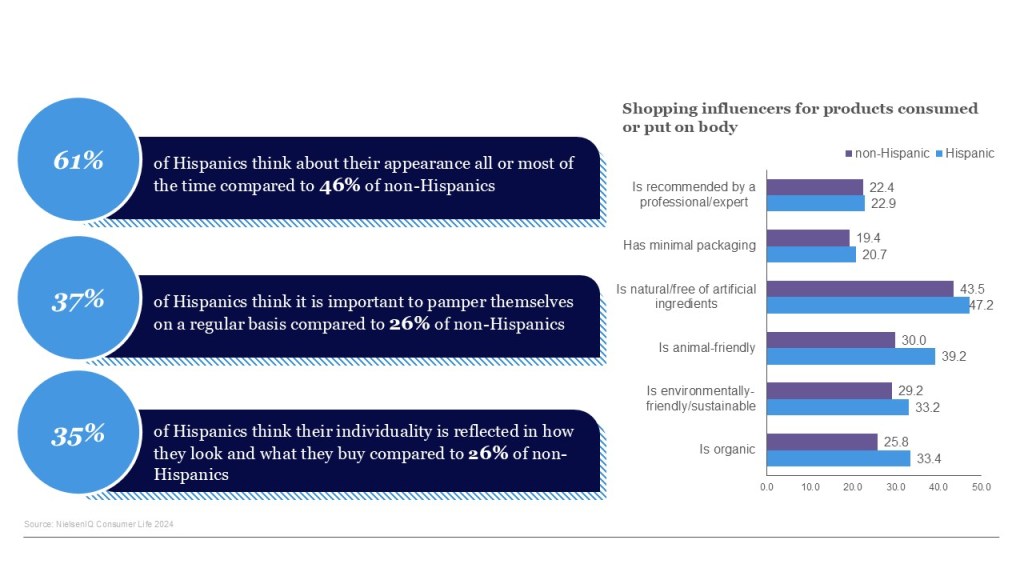

One of the biggest drivers of beauty sales is consumer focus on their appearance. Hispanic consumers place a particularly high value on their appearance, with 61% reporting that they think about their looks all or most of the time, compared to 46% of non-Hispanics.4 This heightened focus on personal grooming and beauty reflects the cultural importance of presenting oneself with pride and confidence, as appearance is often seen as a reflection of dignity and self-respect.

Sustainability and clean-label products are also becoming increasingly important to Hispanic consumers, but their influence differs compared to non-Hispanic shoppers. For instance, 33.2% of Hispanics are influenced by a product’s environmentally friendly attributes, slightly higher than the 29.2% of non-Hispanics who feel the same.4 However, when it comes to natural or artificial ingredient-free products, only 7.2% of Hispanics are swayed by this factor, compared to 43.5% of non-Hispanic consumers.4

Finally, Hispanic consumers place a strong emphasis on self-care, with 37% believing it is important to pamper themselves regularly, compared to just 26% of non-Hispanics.4 This higher value on indulgence and personal care reflects a cultural focus on well-being and the importance of taking time to invest in oneself. These gaps show that Hispanic consumers have distinct preferences and priorities when it comes to beauty, highlighting the need for brands to tailor their offerings and messaging to align with their unique values around appearance, self-care, and sustainability.

You can also check out NIQ’s Beauty Inner Circle for insights on the health and beauty vertical, our latest research, and more.

Sources:

1 – https://www.pewresearch.org/race-and-ethnicity/fact-sheet/latinos-in-the-us-fact-sheet/

2 – NIQ Report – The Hispanic Beauty Consumer

3 – NielsenIQ Consumer Life 2024

4 – NielsenIQ Omnishopper Panel 52 we 8/10/24; Total US, Beauty & Personal Care categories