Over the past 12 months, FMCG sales in Saudi Arabia and the UAE reached a combined $36.3 billion, with KSA growing +3.3% and UAE accelerating at +7.1% year-over-year. This growth is being driven not by price increases alone, but by a notable rise in consumption — a signal that consumer confidence is shifting in the region.

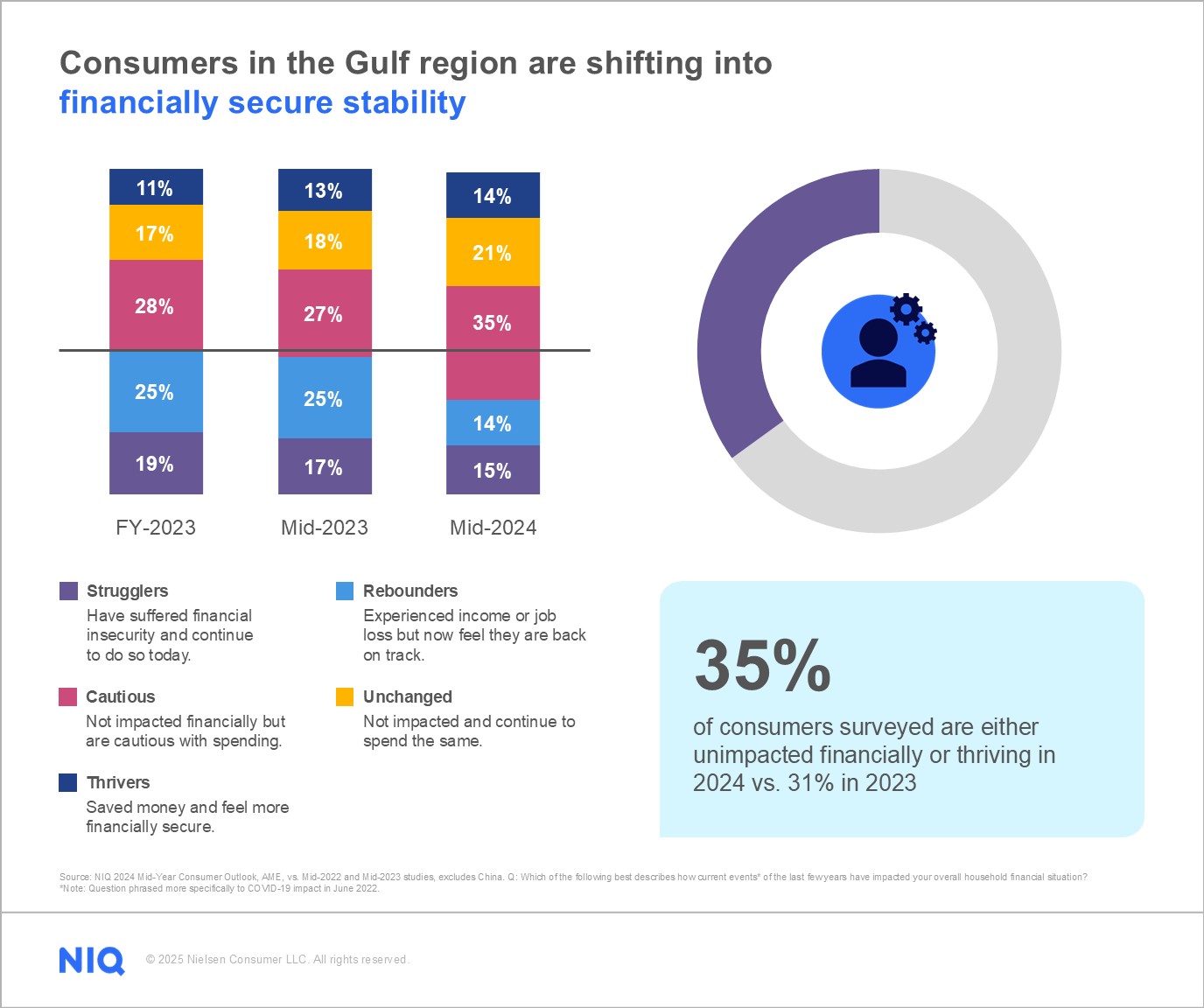

At NIQ, we’ve been closely tracking this evolution through our Economic Divide segmentation, which reveals that 35% of consumers now feel financially secure or unimpacted, up from 31% a year ago. This shift is critical: it tells us that while affordability remains a key driver, consumer expectations around value are expanding.

Promotions Still Matter – But They Must Evolve

In today’s Gulf markets, promotions remain a powerful tool. They can drive trial, boost frequency, and strengthen manufacturer–retailer relationships. But more promotions do not always mean better results. In fact, KSA saw an increase in promotional activity this year, while UAE remained relatively stable — and yet, not all promotions delivered incremental growth.

“Temporary price reductions” type of promotions accounts for 86% of deals in Saudi while in UAE this accounts for 56%. Saudi is able to generate marginally better promo efficiency compared to UAE market in general.

Consumers are now weighing multiple promotional offers, each with different value propositions — and they are choosing based on more than just price.

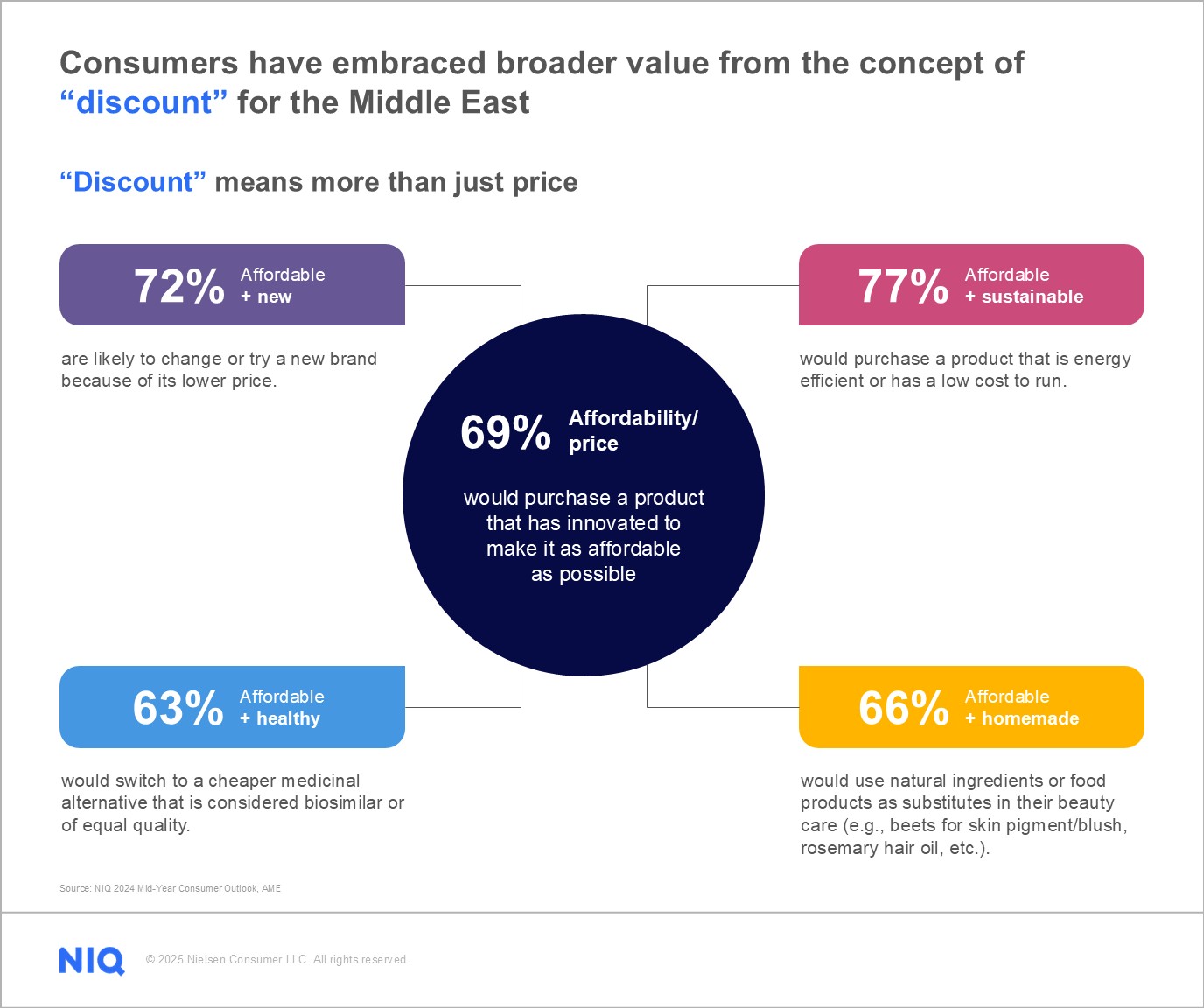

“Discount” Means More Than Just Price

Today’s shoppers in the Middle East expect hybrid value. According to NIQ’s global research:

- 72% would try a new brand if it’s affordable + new

- 63% would switch to an affordable + healthy alternative

- 66% would use homemade or natural substitutes in personal care

This evolution in value perception means that pricing and promotion strategies are more nuanced. It’s not just about offering a deal — it’s about offering the right deal, in the right format, to the right consumer.

Best Practices for Breakthrough Promotions

- Understand Price Elasticity

Not all SKUs respond the same to price changes. Leverage both baseline and promo elasticity data to drive both volume and value growth in the category. Segment Your Promotions

Align your offers with consumer values — health, homegrown, innovation — not just affordability. - Measure True Incrementality

Use weekly sales decomposition to determine the extent of base sales versus true incremental sales to ensure promotions are driving steal from competition and increasing trial and not driving subsidization. This will help steer overall promo efficiency for the portfolio and category. - Balance Retailer Relationships

Promotions have the potential to create mutual value for both manufacturers and retailers. When carefully calibrated, they strike a balance that enhances brand visibility, boosts sales, and strengthens partnerships across the supply chain. Most importantly, a well-executed strategy can deliver meaningful benefits to shoppers—through better pricing, availability, and engagement.

The Bottom Line

In the UAE and KSA, breakthrough promotions are not about doing more — they’re about doing better. With the right data, tools, and mindset, FMCG leaders can move beyond short-term volume wins and build sustainable, profitable growth.

Want to learn how your brand can lead in pricing and promotion?

Let’s talk about how NIQ’s RGM solutions can help you unlock your next growth opportunity.