The Cocktail Crowd: Young, Curious, and Ready to Spend

The cocktail and mixed drink market is thriving in the US, particularly among younger consumers. About one in three Americans aged 21 to 54 enjoy cocktails, with even higher engagement among Gen Z and late millennials. Cocktails are experiencing a wave of cultural momentum, with mixology gaining mainstream appeal and even spawning celebrity-style figures and dedicated shows on streaming platforms. This is no small feat, especially in light of the struggles faced by other alcohol categories like wine and beer, and the broader trend of declining alcohol consumption.

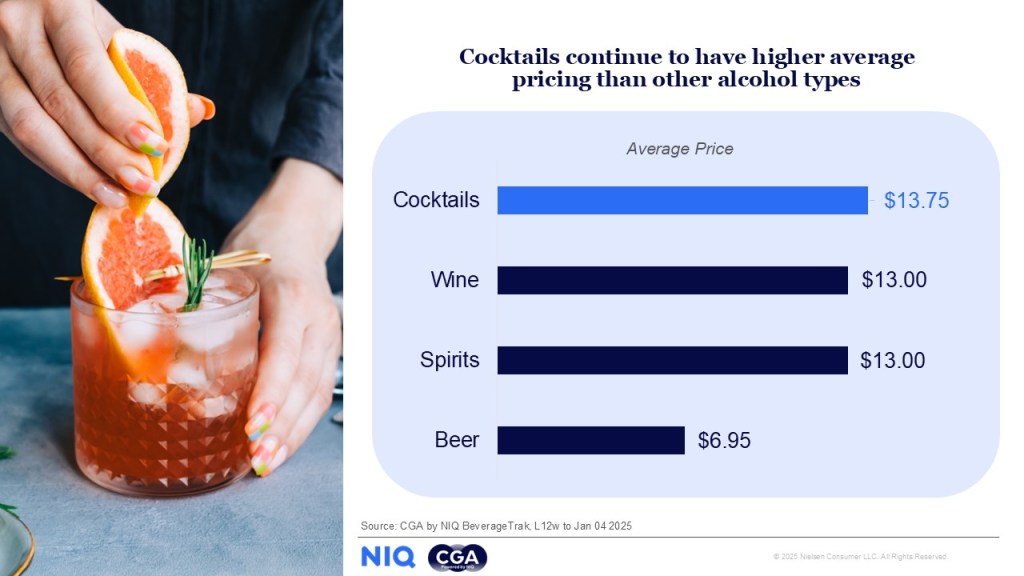

The cocktail category’s popularity translates directly into strong revenue potential for On-Premise venues. According to BeverageTrak, mixed drinks account for 34% of total spirits value in the On-Premise, generating over $14,000 in average outlet revenue over a 12-week period. Cocktails also deliver the highest revenue per serve, with an average price of $13.75. This is higher than wine, neat spirits, and nearly double that of beer, which shows just how critical this segment is for any On-Premise business. To fully capitalize on this lucrative market, however, operators and suppliers need to understand what motivates guests to choose a cocktail, which drinks they’re gravitating toward, and how they navigate the decision-making process when selecting what tipple to drink.

Taste Reigns Supreme—But It’s Not the Only Factor

Unsurprisingly, taste is the top driver of cocktail choice, with 71% of drinkers saying it’s their main consideration. But price, quality, and brand recognition also play big roles. Nearly half of consumers say quality is a deciding factor, and over a quarter are brand-sensitive. That means your menu needs to do more than list ingredients—it needs to sell the experience.

Two-thirds of cocktail drinkers check the menu before ordering, especially younger guests. That means your menu isn’t just a list—it’s a sales tool. Nearly half of cocktail drinkers say quality is a deciding factor, which they’re likely gauging based on the listed ingredients, unless they’ve tasted it before. Over a quarter are particularly brand sensitive, meaning the appeal of specific ingredient names can strongly sway their choices. For operators, this underscores the need to ensure that cocktail descriptions and ingredient lists are not only informative, but enticing. Be clear, be descriptive, and don’t be afraid to name-drop premium brands.

When guests are unsure, 72% turn to the bar staff for guidance. NIQ’s 2025 Global Bartender Report reveals that four in five (79%) bartenders say they suggest specific drinks to consumers on every shift, making them one of the biggest influences on decision-making in the On-Premise. That’s a huge opportunity for upselling—if your team is trained and confident. A knowledgeable bartender can turn a hesitant guest into a high-margin sale with just a few well-placed words.

Discover global bartender opportunities for beverage success

Powered by BarSights, this study uncovers global bartender opportunities for beverage success in the On-Premise. By leveraging the findings of this report, gain a competitive edge, enhance your product positioning, and foster stronger relationships with the bartender community.

Spirit Preferences: Tequila Takes the Crown

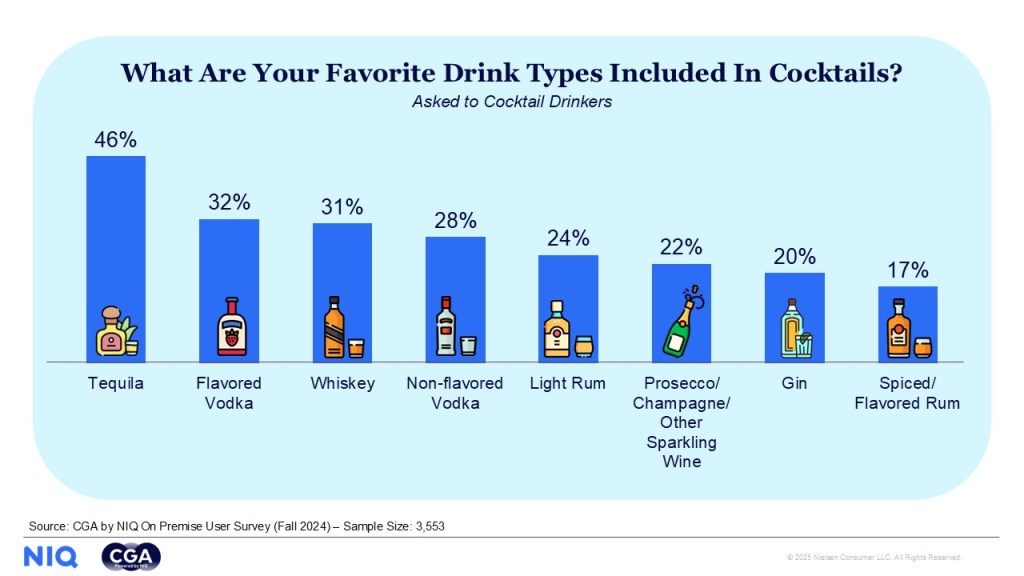

When it comes to base spirits, tequila is the undisputed leader, preferred by 46% of cocktail drinkers. Followed by flavored vodka, and whiskey, each preferred by nearly one in three. Plain vodka, light rum, sparkling wine, gin, and flavored or spiced rum follow closely behind.

These spirits should be staples on any back bar, as their popularity is also reflected in the top-performing classic cocktails. The Margarita remains the undisputed champion across all age groups, with a remarkable 55% of over-55s choosing it when drinking out. The Mimosa follows, resonating strongly with under-35s, alongside other younger crowd favorites like the Daiquiri and Piña Colada.

Profitability vs. Popularity: Know the Difference

Cocktail performance can vary significantly depending on the metric considered. While the Margarita wins on volume, it doesn’t top the charts for spend. That honor goes to the Caipirinha, which drives the highest average check value. Meanwhile, the Manhattan and Negroni command the highest prices per serve—nearly double that of a Sex on the Beach. Guests are clearly willing to pay more for a well-made classic.

And then there’s the Old Fashioned—the Swiss Army knife of cocktails. It doesn’t top any single metric, but it performs consistently well across the board. If you’re looking for a reliable, high-performing drink to anchor your menu, this is it.

Timing Is Everything – Pay attention to the clock.

Friday and Saturday are the big hitters, with Saturday leading in volume and check value. But don’t overlook the weekdays. Thursday is the most lucrative non-weekend day across most dayparts, with the Margarita and Old Fashioned performing particularly well.

Dissecting consumption times further, our data reveals that cocktail velocity increases throughout the day, peaking in the early evening. Cocktail sales peak between 6pm and 10pm, but there’s money to be made earlier in the day, too. Drinks like the Bellini and Mimosa shine between 11am and 3pm, perfect for brunch and daytime sipping. And if you’re looking to drive weekday traffic, consider pushing Juleps and Collins-style drinks—they perform better early in the week than on weekends.

Cocktail Sales Tracker

NIQ’s exclusive industry-first data-led tracker reveals sales dynamics of the cocktail market, helping suppliers to understand the evolving cocktail category and maximize brand potential.

Complimented by the On Premise Cocktail Market Report – a report unlocking the foundational insights needed to build an effective cocktail programming for the On-Premise; the Cocktail Sales Tracker enables suppliers to track all the core metrics over time and identify new opportunities from trending cocktail performance within the market.

Strategy Over Guesswork

At first glance, the cocktail category might seem unpredictable. Different drinks perform better at different times, on different days, with different audiences. But that’s actually its greatest strength. With such a wide range of flavors, formats, and price points, cocktails offer unmatched flexibility.

The key is strategy. Know your audience. Understand your peak times. Train your staff. And most importantly, use data to guide your decisions. Whether your goal is to drive volume with crowd-pleasers or maximize revenue with high-margin classics, there’s a cocktail strategy that fits.

About the author

Matthew Crompton – Vice President of Beverage Alcohol On-Premise (Americas)

With over 15 years of experience in on-premise consumer intelligence, Matt has managed and provided consultancy for some of the largest BevAl manufacturers across Europe and the Americas.

Operating at the intersection of consumer behavior, commercial performance, and market dynamics, Matt is a trusted advisor to leaders in global drinks brands and hospitality operators navigating the evolving beverage landscape.

His insights are regularly featured in industry publications, and he plays a critical role in shaping strategic decisions across North America, Latin America, and beyond. Originally from the north of England, Matt has embraced American life at every opportunity since relocating to Chicago in 2015.

Essential insights for your Cocktail strategy

Maximize your brand potential and drive sales in the cocktail space with our intelligent solutions