Winning with targeted categories

Shoppers are more actively informed than ever before, aligning their purchases with needs and values related to health, wellness, sustainability, human and animal rights, and more. In fact, 70% look for specific attributes in the products they consume.

To capitalize on this growing opportunity, CPG companies must not only develop a deep understanding of their target consumer, but also identify where they live and—just as importantly—where they already shop.

The first step is to understand who the specific attribute shopper is and what they buy. For instance, plant-based shoppers, keto-friendly buyers, sugar-conscious consumers, and sustainability shopper segments each have different needs and shop at different retailers.

Finding growth with

health-focused consumers:

A keto case study

Let’s look at the example of Brand K, a U.S.-based manufacturer looking to improve sales of its products with two key health and wellness segments: keto-friendly shoppers and plant-based shoppers. Brand K needed to answer 3 important questions:

- Which categories and brands are keto shoppers more likely to buy?

- Which stores should I focus on to efficiently target keto shoppers?

- In which regions can l find keto shoppers?

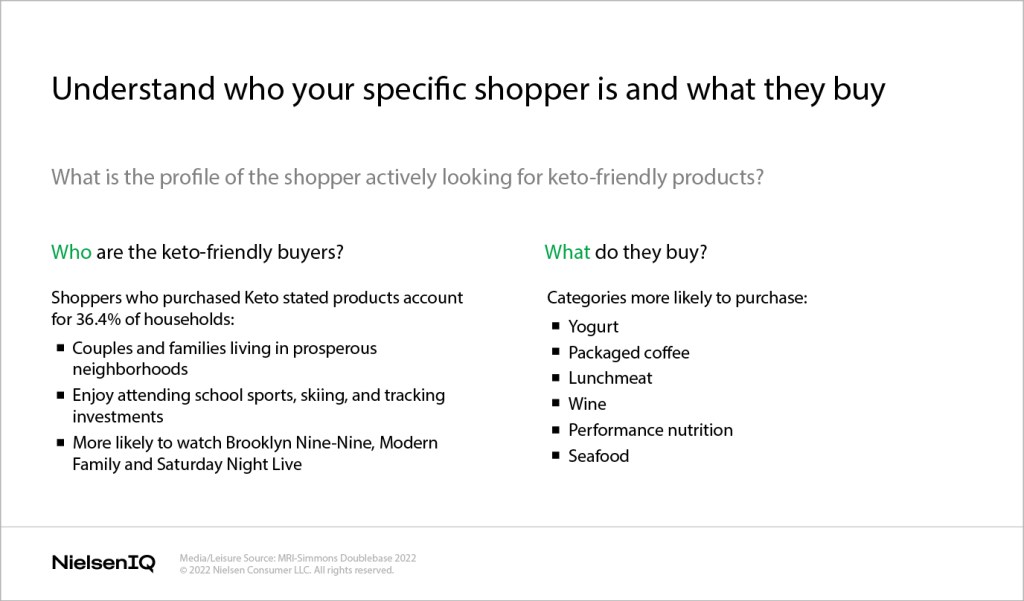

NielsenIQ’s Spectra solution, enhanced with NielsenIQ Product Insight health and wellness attributes, provided Brand K a broad picture of their keto-friendly buyers:

With a detailed shopper profile from NielsenIQ’s Spectra Total Wellness solution, Brand K could see which of its products had the highest selling potential among keto-friendly consumers.

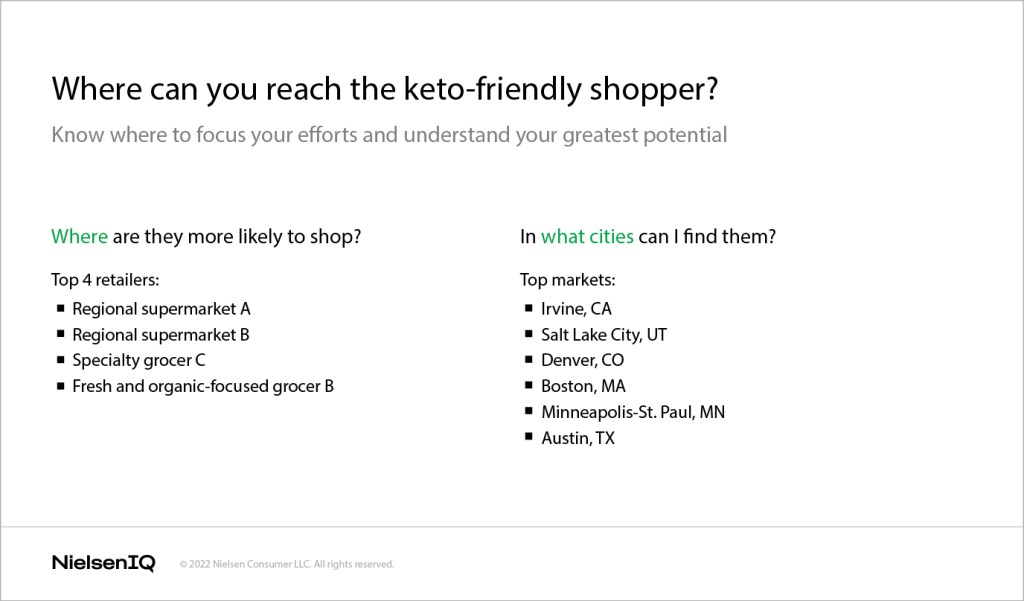

Next, Brand K leveraged this solution to identify the top cities that keto-friendly shoppers were concentrated in, the top retailers within those cities that keto-friendly consumers were more likely to shop at, and the individual locations where potential demand for keto products is high.

Brand K now understood which of its products could win big with keto buyers and had a map of where to find them. Having strong quantitative proof of market potential for its keto products was also valuable during conversations with retail partners.

Retailers: Optimizing the shelf for local consumers

A retailer with this knowledge could identify which markets and locations should carry keto-friendly products, which shouldn’t, and the optimal size and frequency of shipments.

Detailed Spectra profiles can also help retailers more accurately identify underperforming stores so the right strategic levers can be activated to improve sales.

Pinpointing plant-based buyers

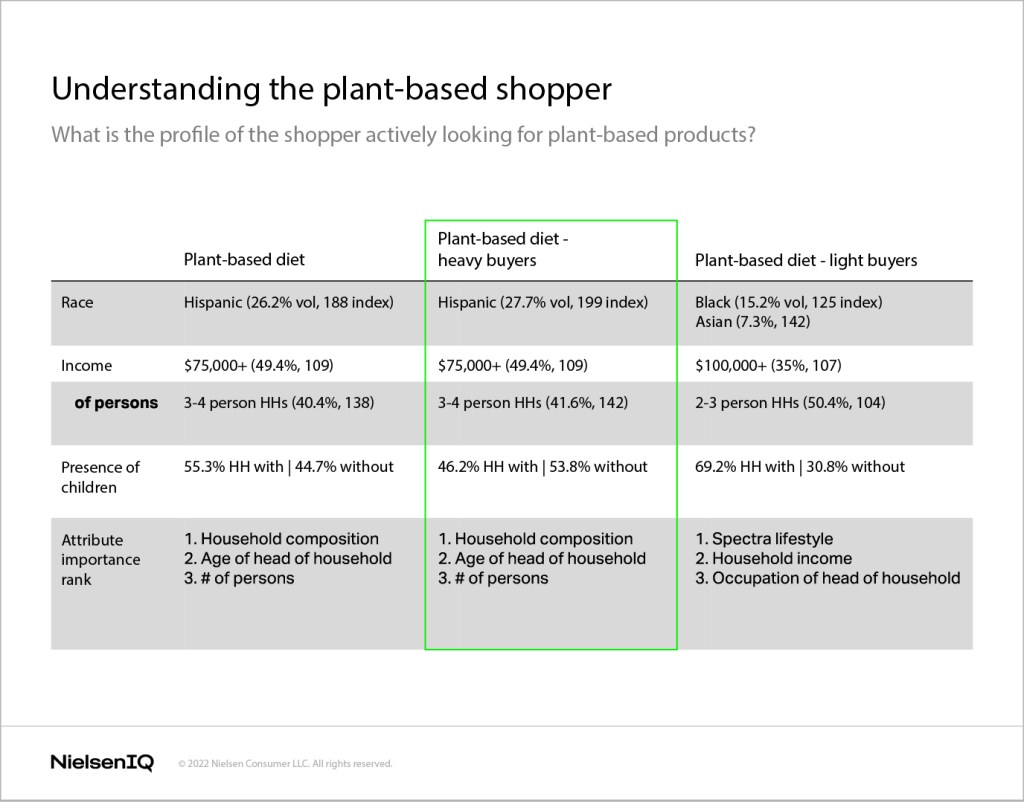

Next, Brand K investigated the profile of consumers seeking plant-based products. With insights from NIQ, the company could understand the differences between heavy, medium, and light buyers so it could choose the best-fit segment to pursue—in this case, the heavy buyers. With key insights into target consumers’ demographics, interests, and geographic hotspots, Brand K could optimize sales and marketing strategy decisions to tap into high-potential markets before competitors.

Finding the “where” of wellness

Keto-friendly and plant-based products are just two examples of in-demand attributes manufacturers and retailers can use to connect consumers with their products. CPG companies can evaluate the greatest selling potential of many other trending product attributes including carb-conscious, vegan, clean label, cruelty free, organic, fair trade, and more.

Knowing which consumers purchase specific attributes, where these consumers live in high concentrations, and which specific retailers they visit can help CPG businesses navigate an uncertain landscape with confidence.